Best Medicare Advantage Plans 2021

We researched all major Medicare insurance companies and their 2021 Medicare Advantage plan offerings, ultimately selecting the 6 best Medicare Advantage plans.

- Highest CMS star ratings in states served

- $0 deductible with every plan

- $0 monthly premium option in many plans

- Only serves 9 states

For the past 5 years, Kaiser has been ranked as the best overall Medicare Advantage plan in J.D. Power’s annual survey2. Kaiser offers numerous extra perks, such as wellness coaching, transportation to medical appointments , gym access and support groups. Kaiser wins our No. 1 spot for its top-notch customer service, extensive benefits, and user-friendly online tools.

- Nearly 2.5 million members will have no monthly premium for 20213

- National plan availability

- 3 types of Special Needs Plans offered

- Limited online resources

With 26% of all Medicare Advantage enrollees receiving their coverage through UnitedHealthcare4, it’s the largest Part C provider in the country. Because of its size, UnitedHealthcare is able to offer both rate stability and a broad range of plans for every budget and lifestyle.

- Numerous health and wellness benefits

- Mail delivery for prescription drugs with some plans

- Resources for managing chronic diseases

- Ranked #1 for customer service

- Humana Honor plan designed specifically for military veterans

- Limited pharmacy options

Consider Premiumsand Your Other Costs

To see how a Medicare Advantage Plan cherry-picks its patients, carefully review the copays in the summary of benefits for every plan you are considering. To give you an example of the types of copays you may find, here are some details of in-network services from a popular Humana Medicare Advantage Plan in Florida:

- Hospital stay$100 per day for the first 4 days

- Emergency Room – $120 copay

- Diagnostic radiologyup to $100 copay

- Lab Servicesup to $50 copay

- Outpatient x-raysup to $50 copay

- Outpatient surgery – up to $100 copay

As this non-exhaustive list of copays demonstrates, out-of-pocket costs will quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. The best candidate for Medicare Advantage is someone who’s healthy,” says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. “We see trouble when someone gets sick.”

What Do Medicare Advantage Plans Not Cover

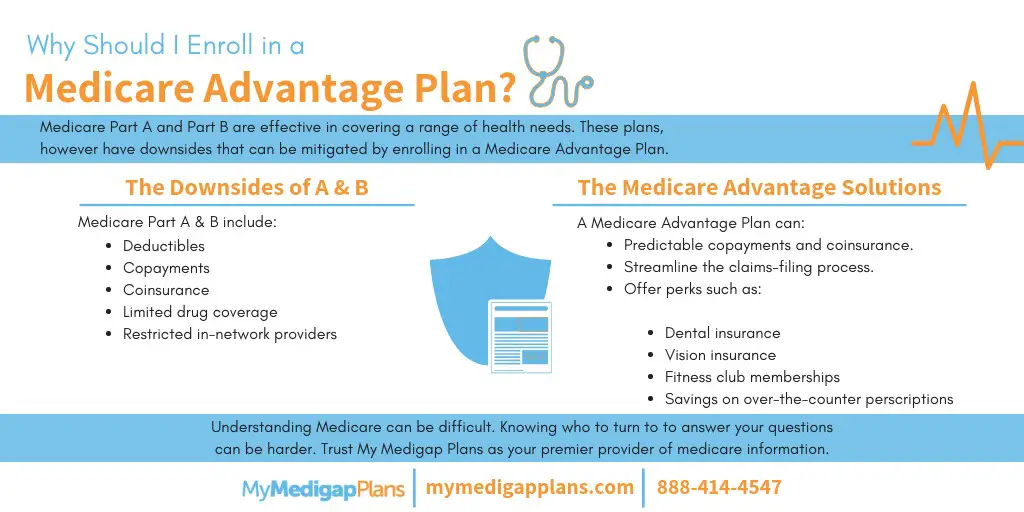

Medicare Advantage plans, at the basic level, do not cover dental or vision, but many plans offer those and other extra benefits, such as gym memberships or wellness programs. Some also offer 24-hour nurse hotlines to answer medical questions. Part of the reason Medicare Advantage plans are popular is that they are comprehensive and all-encompassing.

Read Also: Does Medicare Cover End Of Life Care

Can I Add Drop And Change Coverage

Yes, and no.

You cant add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

Lets go through each situation and see if you can drop or add it, if there will be any penalties, and when you can do it.

Can I add Part A later?

No, this is what you start with. If you dont qualify for Part A but do later down the road, you can add it then.

Can I drop Part A later?

Yes, but you shouldnt especially because there are no monthly premiums.

Can I add Part B later?

Yes, but there is a 10 percent late enrollment fee for every 12 months you dont have Part B after you initially enroll.

Can I drop Part B later?

Yes. This may occur when a spouse or loved one finds a job that covers all the costs that Part B covers. There is no penalty to do this.

Can I change from a Medicare Original plan to a Medicare Advantage Plan after and vice versa?

Yes, you can add the Advantage Plan later, but you can only do so in the open enrollment period from October 15 to December 7. You can switch to the Original Medicare plan in the same time.

Can I change from one Medicare Advantage Plan to another?

Yes, during the aforementioned open enrollment period mentioned in the last section.

Can I disenroll from my Advantage Plan?

Yes, there is a period from January 1 to February 14 when you can disenroll.

MORE ADVICE

What Types Of Medicare Advantage Plans Are There

MA plans are available from private insurance companies that contract with Medicare to give you your Medicare Part A and Part B benefits. Some Medicare Advantage plans offer benefits beyond the Part A and Part B benefits, such as routine vision and dental care.

So before you decide which Medicare Advantage plan is best for you, you might want to learn about the different types of these plans:

- Medicare Advantage Health Maintenance Organization plans generally limit you to health-care providers within the plans network. These plans may often have lower premiums than other types of Medicare Advantage plans. You typically need to select a primary care physician for referrals and to help coordinate your care.

- Medicare Advantage Preferred Provider Organization * plans generally have provider networks, but let you get care from out-of-network doctors often with a higher coinsurance or copayment. You usually dont have to select a primary care physician, and you generally dont need referrals to see specialists.

- Medicare Advantage Health Maintenance Organization-Point of Service plans generally have provider networks, but let you get services outside the network. There may be a higher copayment or coinsurance when you go out-of-network.

- Medicare Advantage Special Needs Plans are designed around certain health conditions, such as chronic heart failure or diabetes mellitus. In most cases, you need to:

You May Like: Does Medicare Medicaid Cover Assisted Living

How Do I Pick The Best Medicare Advantage Plan For Me

Fact checkedContributing expert: Roseann Birch Reviewed by: Leron Moore –

What You Should Know

- 1Nearly 25,000,000 seniors are enrolled in Medicare Advantage plans, as of June 2020.

- 2To choose a plan, determine personal needs and look at how plans can effectively meet them.

- 3Every region of the country has access to a different array of Medicare Advantage plans.

- 4Anyone who is eligible for or already enrolled in Medicare Parts A and B is eligible for Medicare Advantage.

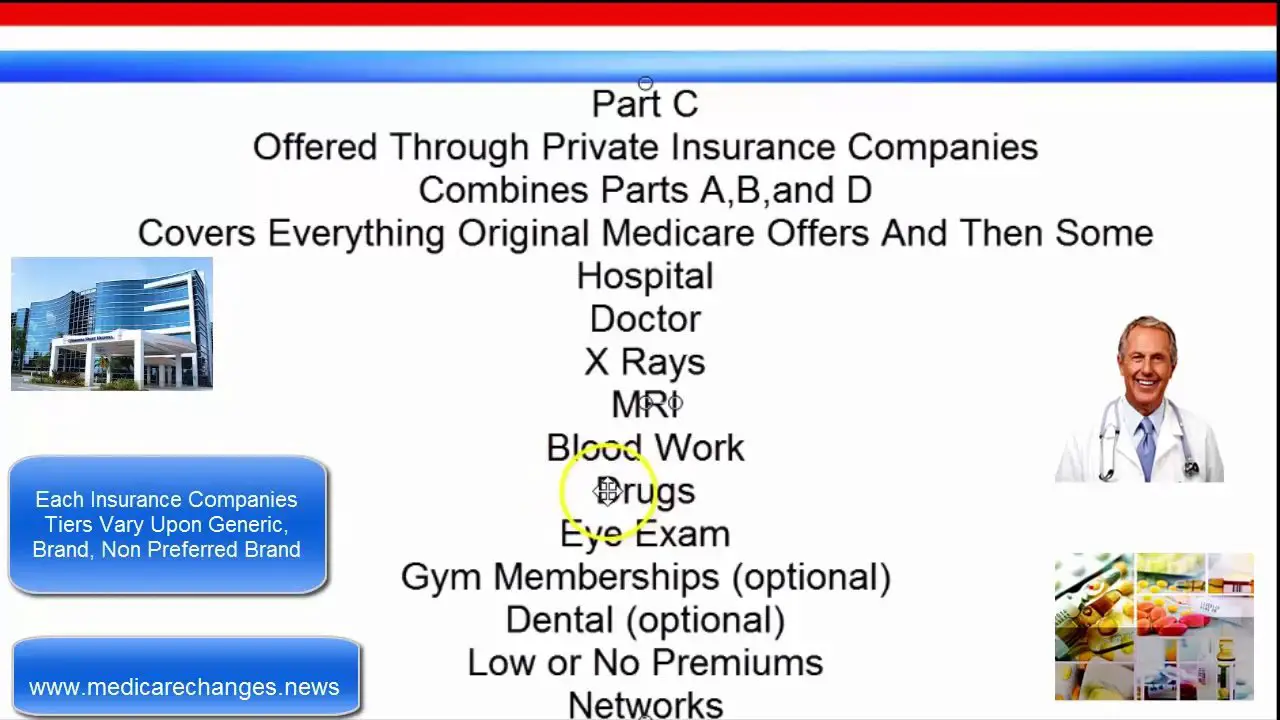

For seniors seeking options outside of Original Medicare, a Medicare Advantage plan can be an excellent alternative. Also known as Medicare Part C, a Medicare Advantage plan is purchased through a private insurer, not the government. Its a popular choice, too nearly 25,000,000 seniors are enrolled in Medicare Advantage plans, as of June 2020. With enhanced flexibility, a wide range of cost options, and numerous plan models, theres a lot to be gained by choosing Medicare Advantage over Original Medicare.

Medicare Advantage plans are required to provide, at minimum, the benefits included in Original Medicare Parts A and B, but are permitted to offer additional coverage options, as well. As such, no two Medicare Part C plans will be exactly alike. Coverage can vary significantly from one insurance provider and plan type to another, so its very important for seniors to do their homework to find the best possible plan to meet their needs.

Compare Medicare Advantage Plan Benefits

Medicare Advantage, also known as Medicare Part C, is delivered through private insurance companies under contract with Medicare. These plans must cover the same benefits available through Original Medicare, including:

- Inpatient care in a hospital, skilled nursing facility, or home health

- Medically necessary and preventive services, such as physician visits, tests, screenings, and flu shots

Insurance providers then have the flexibility to offer a combination of additional health-related benefits, such as prescription drugs, dental, vision, and hearing.

Here are common supplemental benefits available through Medicare Advantage plans and the percentage of plans offering them in 2020:

- Prescription drugs

- Support for caregivers

Don’t Miss: How Do I Join Medicare

Wondering Which Medicare Plan Is Best For Your Clients

Throughout our lives, there are many choices we must make regarding our own or our familys healthcare. There are many factors that go into which choice is best for your clients. Your clients likely have many questions like how to choose a Medicare plan or what is the best Medicare plan for me?

Today, I am sharing key insights into Medicare coverage options as well as questions for you to consider asking when it comes time to make Medicare enrollment decisions with your clients.

Medicare can be complicated so your clients must understand it as well as they can before they make an enrollment decision. They likely should plan to have a thorough discussion with a Medicare Broker who can help them understand their specific options and make better-informed choices. What follows is a breakdown of Medicare options that can help your clients prepare to have those important discussions.

How Do I Compare Plans By Medicare Star Ratings

Each year, the Centers for Medicare and Medicaid Services rates all Medicare Advantage and Medicare Part D plans using a five-star scale.2

Plans with five stars are the highest rated plans.

Plans are rated on the following criteria:

- Screening tests and vaccines

- Member experience with the plan

- Member complaints and changes in plan performance

- Customer service

- Drug safety and accuracy of drug pricing

The data used to score each plan comes from member surveys, information submitted to Medicare from clinicians and plans and Medicares regular monitoring activities.

You May Like: How To Get Medical Equipment Through Medicare

How Much Do Medicare Advantage Plans Cost

Most people who join a Medicare Advantage plan do so because there is a cost-benefit. The cost-benefit can come from Medicaid benefits, retiree benefits from an employer, or the additional benefits bundled with a plan.

There is a general misconception that Medicare Advantage plans cost less than Original Medicare. This isn’t true. In fact, studies show that an inpatient stay in the hospital is likely to cost more with a Medicare Advantage plan, not less.

For this reason, it is very important to do your homework and examine costs when you use healthcare services with a plan. Every plan publishes a summary of benefits document that details all costs. MedicareWireMedicareWire is a Medicare insurance consulting agency. We founded MedicareWire after seeing and hearing how confusing and frustrating it is to find, understand, and choose a plan. Our services are free to the consumer…. publishes the summary of benefits information on all plan pages. You can download it as a PDF document to easily compare plans.

How Do I Know If I Have The Best Plan For Me

En español | Before you choose a Medicare plan, think about your options carefully. Read through the information that is available on all the plans. Talk to your doctor and friends who have Medicare. Compare the costs, benefits, and quality of the plans you are considering. Ask yourself the following questions:

- What is most important to you in a Medicare plan cost, coverage or convenience?

- Will you have your choice of health care providers?

- Will the plan you choose meet your needs? How does the plans quality ratings compare with others in your area? With those nationally?

- How much will you have to pay for your health care and prescription drugs?

- Will you have coverage if you travel frequently or leave your hometown for long periods of time?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.You can contact Medicare directly by calling 800-MEDICARE .

Recommended Reading: Does Medicare Pay For Air Evac

Theres No Right Answer

We work with a broker in Colorado who explains that theres no one-size-fits-all when it comes to Medicare plan options. Two of her clients are siblings who live in the same town one has a zero-premium Medicare Advantage plan, while the other has Original Medicare plus a comprehensive Medigap plan and a Part D prescription plan.

The one with the Medicare Advantage plan would rather save money on premiums, and doesnt mind the higher out-of-pocket exposure and limited provider network. The other sibling, on the other hand, is willing to pay higher premiums in trade for the lower out-of-pocket costs and nationwide provider choice that comes with Original Medicare.

Ultimately, the choice between Medicare Advantage and Original Medicare with supplements is a personal one that reflects each applicants health, risk tolerance, and approach to personal finances.

And there are varying degrees of coverage within each type of plan. Medicare Advantage plans include extra benefits that arent available with Original Medicare + supplemental coverage, and some Medicare Advantage plans have out-of-pocket maximums well below the federally-allowed limit. And while some Medigap plans, like Plans C and D , cover most of an enrollees out-of-pocket costs under Original Medicare, other Medigap plans, like Plan N, for example, are less robust.

Best For Bonuses: Aarp

-

No mobile app for payments

-

Higher out-of-pocket maximums

Nearly all of the Medicare Advantage plans offered by AARP come with plenty of extras, such as dental exams, vision and eyewear coverage, foot coverage, along with Renew Active, a Medicare fitness program with a gym membership, and an online brain health program.

In addition, AARP offers low copays for specialist visits, such as visits to an oncologist or a cardiologist, provided theyre in-network. It also offers a variety of Medicare Advantage plans and has an incredible amount of detailed educational information about Medicare and Medicare Advantage plans on its website, including the option to receive a free Medicare guide via email. However, the out-of-pocket maximums can be a bit on the high side, normally several thousand dollars.

Not only does AARP offer the ability to make your payments with your Social Security benefits, but it actually gives the option to have it automatically withdrawn from them, which gives you one less thing to worry about. The Social Security Administration will automatically deduct your Medicare Part B payment from your benefits, and AARP has the ability to do the same for your Medicare Advantage plan.

Read Also: How Much Is Medicare B Cost

How To Find The Best Medicare Part D Drug Plan

A CR analysis found huge price differences on plans within ZIP codes, sometimes even at the same pharmacies. Here are tips on how to save hundreds on your drugs each year.

When Damian Birkel, 66, fills his prescriptions each month at his local pharmacy in Winston-Salem, N.C., he has the pharmacist run more than a dozen of his meds through his Medicare drug coverage plan, called Part D, and pays cash for three more. For those, he uses GoodRx, a company that provides discount coupons.

The owner of a small consulting firm, Birkel says using the discount coupons is the only way he can afford meds not covered by his plan. In fact, the $500 he saves with the coupons is enough to cover his 2021 Part D monthly premiums. So far, he says hes fairly satisfied with the arrangement.

But now he and his wife are among the roughly 48 million Americans enrolled in a Part D plan who must decide by Dec. 7, 2021, whether to reenroll in the same plan for next year or shop for a new one.

Because much can change from year to year, its not as straightforward a decision as it might seem.

For one thing, deductibles and monthly premium charges can go up. For another, the drugs a plan coversand how well it covers themcan also be different, says Frederic Riccardi, president of the Medicare Rights Center, a nonprofit group that counsels individuals on finding Medicare plans and advocates for pro-consumer Medicare policies.

How To Choose A Medicare Advantage Plan

Choosing a Medicare Advantage plan is a personal experience that requires due diligence and an understanding of coverage needs.

Seniors in most areas of the country have access to many different plan types, which can be overwhelming. To choose a plan, they should determine personal needs and look at how plans can effectively meet them. When evaluating plans, ask the following kinds of questions to ensure all requirements can be met:

- What are my medication needs? Do I need a plan with comprehensive medication coverage, or is purchasing a separate prescription drug plan more beneficial?

- Will my current preferred doctors or specialists be covered?

- How much money can I afford to spend on premiums each month? Is a more expensive plan with minimal deductibles, coinsurance, or co-pays a better value?

- Will my travel plans affect my coverage needs?

- Do I need any plan extras, such as vision, dental, or hearing coverage?

- Am I eligible for a Special Needs Plan?

There is no one correct answer when choosing a Medicare Advantage plan. What is best for one senior isnt necessarily the right choice for another. Enrolling in a Medicare Advantage plan needs to be a personal decision based on individual health and budget requirements.

Also Check: How To Calculate Medicare Wages

Another Easy Way To Find Medicare Plans

As helpful as the Medicare.gov Plan Finder is, its not the only way to search for and compare Medicare plans in your area.

One alternative is to speak with a licensed insurance agent. An agent can discuss your health care needs and compile a list of available Medicare plans in your area.

Most importantly, an agent can help answer questions you are sure to have about costs, coverage, terms and conditions of plans and help you better understand exactly what it is you are shopping for.

Medicare Advantage Health Maintenance Organization Point Of Service Plans

An HMO POS plan is similar in many respects to the basic HMO plans, and also bears some similarities to PPO systems. Youll choose your health care providers from within an approved network, but can go out-of-network in certain circumstances. Youll choose a PCP to coordinate your care, and although you dont generally need referrals, you may need to work with your PCP to get prior authorization for some services. Unlike HMO and PPO plans, however, HMO POS plans have two separate deductibles, one for in-network services and one for services outside of the network. These need to be reached separately before your insurance kicks in.

Read Also: Can You Get Medicare If You Live Outside The Us