If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

You Decide Which Program Is Right For You

No one has to sign up for Medicare Part D. If you have no coverage for your medicines now and do not sign up during the initial enrollment period, you may have to pay higher premiums if you enroll later. If you have drug coverage through a retiree plan, your spouses work, a union, or other program, you may keep that coverage if you wish.

If you want to keep the plan you have now, it is VERY IMPORTANT that you make sure your drug plan covers as much or more than a Medicare drug plan. If it does not, and you decide later to sign up for a Medicare drug plan, you may have to pay higher premiums. You will get a notice from your employer or union that tells you if your current drug plan covers as much or more than a Medicare drug plan.

You also may call the Senior Health Insurance Counseling Program at 800-463-2828.

Will Medicaid Pay My Medicare Premium

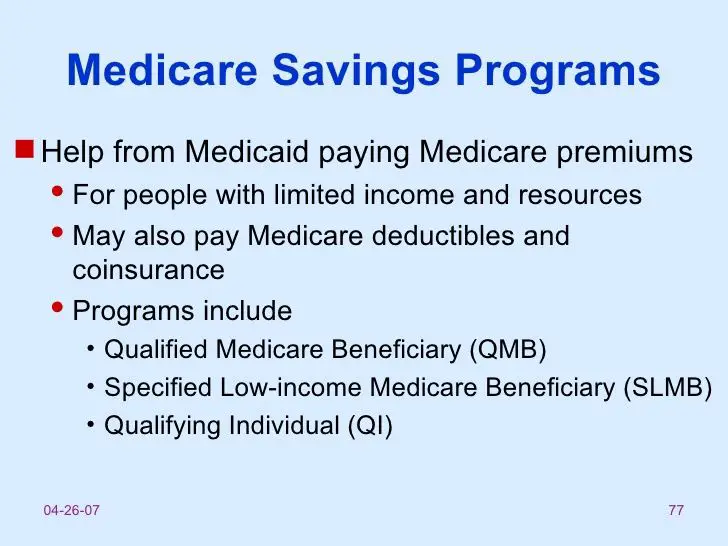

Medicaid can provide premium assistance: In many cases, if you have Medicare and Medicaid, you will automatically be enrolled in a Medicare Savings Program . MSPs pay your Medicare Part B premium, and may offer additional assistance. Note: You cannot be required to enroll in a Medicare Advantage Plan.

You May Like: How Does Medicare Plan G Work

What If Your Doctor Only Accepts Medicare And Not Medicaid

Doctors are not required to accept Medicaid payment. Why? It requires more paperwork for them, and Medicaid reimbursements can be less than other forms of insurance. What can you do?

- Remember that there are more than 70 million people on Medicaid. Therefore, many doctors are indeed treating people with Medicaid coverage.

- If you already have a doctor you like, explain to him or her that you recently received Medicaid. They may continue to see you as a patient, even if they are not accepting other new patients on Medicaid. After all, you are an established patient of theirs.

- You may have to put a little effort into finding doctors in your area who accept Medicaid payment. Try searching the physician finder websites in your area, ask your Medicaid contact person, and call individual doctors offices.

- If a doctors office says they dont accept Medicaid, ask for a referral to a practice that does accept new Medicaid patients.

Help Paying Medicare Prescription Drug Premiums

You may be able to get help with Medicare premiums for your prescription drug coverage through the Part D Low-Income Subsidy program, also called Extra Help. This program can lower your copays and coinsurance for generic drugs to no more than $3.70 each . Additionally, you could pay less for your Part D premiums and deductibles.5

In 2021, the income limits for Extra Help are up to $19,320 annually . For resources, qualifying limits are up to $14,790 .5 You are automatically eligible for LIS if you qualify for the QMB, SLMB, or QI program.4

Don’t Miss: How Much Copay For Medicare

Do You Have To Apply For An Msp During Medicare’s Annual Election Period

No. You can apply for MSP assistance anytime. As noted above, youll do this through your states Medicaid office, which accepts applications year-round.

But the marketing and outreach before and during Medicares annual election period can be a good reminder to seek help if you need it. You might decide to make a change to your coverage during the annual open enrollment period, and simultaneously check with your states Medicaid office to see if you might be eligible for an MSP or Extra Help with your drug coverage.

What Happens If I Dont Get My Medicare Bill

If your second bill remains unpaid by its due date, youll receive a delinquency notice from Medicare. At that point, youll need to send in the total overdue amount by the 25th of the following month to avoid losing coverage. All told, youll have a three-month period to pay an initial Medicare Part B bill.

Don’t Miss: Does Medicare Cover In Home Help

Medicaid Part B Reimbursement Options

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.

The Need For Assistance

Anyone may need assistance as they age, whether due to dementia, illness, loss of eyesight, or simple frailty. The level of assistance and how long it will last can vary greatly. You may simply need help with meals and paying bills, or total care for a few months at the end of life, or you may need total care for many years. The unpredictability of one’s future needs makes it difficult to plan ahead.

The difficulty of planning is further exacerbated by our disjointed systems for providing care and paying for it. For most families facing a long-term care need, it’s catch as catch can as they patch together care when a family member becomes ill, frail or develops dementia.

The beauty and the challenge of the American free enterprise system is that in the absence of a coherent strategy for providing care from either the federal or state governments, a huge number of for-profit and non-profit agencies and businesses have developed to provide home care, assisted living and nursing home care. But the family must find the best fit, and that fit can change over time as the elder’s needs change and the financial, physical and emotional resources of the family are spent down.

Few older adults have sufficient income or savings to pay for such care out-of-pocket. The Center for Retirement Research study estimates that middle-income seniors can pay for around-the-clock care for about three months, on average.

Don’t Miss: Does Medicare Cover House Calls

The Solution: Medicaid Could Make Up The Medicare Difference For You

Some people think that Medicaid is welfare, but that is not true. Medicaid covers medical expenses, long-term care services, case management, and much more. Medicaid is a different program than Medicare.

Medicaid is for people whose incomes are close to the federal poverty line. Today, Medicaid provides extra help paying doctor bills, hospital bills, and prescriptions for millions of Americans aged 65 and over. If you fall into this category, then youll want to take a close look at your Medicaid eligibility.

Not Limited to Seniors

Others besides seniors can receive Medicaid benefits In all states, Medicaid provides health coverage for some low-income people, families and children, pregnant women, the elderly, and people with disabilities. In some states the program covers all low-income adults below a certain income level. People with a disability or certain medical conditions may qualify for Medicaid at any age.

Medicaid Recipients Whose Medicaid Is Handled On The Nys Of Health Marketplace And Are Newly Enrolled In Medicare And Not Yet In A Medicare Savings Program

See GIS 18 MA/001 – 2018 Medicaid Managed Care Transition for Enrollees Gaining Medicare, #4 for an explanation of this process. That directive also clarified that reimbursement of the Part B premium will be made regardless of whether the individual is still in a Medicaid managed care plan.

Note: During the COVID-19 emergency, those who have Medicaid through the NYSOH marketplace and enroll in Medicare should NOT have their cases transitioned to the LDSS. They should keep the same MAGI budgeting and automatically receive MIPP payments. See GIS 20 MA/04 or this article on COVID eligibility changes

Read Also: Does Medicare Pay For Naturopathic Doctors

Medicare Part A Premiums

Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as youre eligible for Social Security or Railroad Retirement Board benefits.

You can also get premium-free Part A coverage even if youre not ready to receive Social Security retirement benefits yet. So, if youre 65 years old and not ready to retire, you can still take advantage of Medicare coverage.

Part A does have a yearly deductible. In 2022, the deductible is $1,556. Youll need to spend this amount before your Part A coverage takes over.

Should I Enroll In Medicare If I Have Health Insurance From My Current Employer

If you are 65 or over, eligible for Medicare, and have insurance through your or your spouses current job, in most cases you should at least take Part A . For most people, Part A is free.

To decide whether to take Part B , for which everyone pays a monthly premium, you should ask your benefits manager or human resources department how your employer insurance works with Medicare and confirm this information with the Social Security Administration and Medicare. Be aware that when you qualify for Medicare, your employer insurance may start to work differently for you. You will need to figure out whether paying for both types of coverage will be useful in offsetting your health care costs.

As a first step, assess whether your employer insurance will be primary or secondary to Medicare.

In either case, you qualify for a Special Enrollment Period to enroll in Medicare without penalty after you initially qualify. You can enroll in Medicare without penalty at any time while you have group health coverage and for eight months after you lose your group health coverage or you stop working, whichever comes first.

In some cases if you have health coverage from your union or current or former employer when you become eligible for Medicare, your coverage may automatically convert into a Medicare Advantage Plan .

Read Also: Does Medicare Help Pay For Mobility Scooters

Medicare Part B Premiums

For Part B coverage, youll pay a premium each year. Most people will pay the standard premium amount. In 2022, the standard premium is $170.10. However, if you make more than the preset income limits, youll pay more for your premium.

The added premium amount is known as an income-related monthly adjustment amount . The Social Security Administration determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago.

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income.

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. Youll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

How Do I Pay My Medicare Premium Using My Medicare Account

After you make your payment, you’ll get a confirmation number. It takes about 5 business days for your checking or savings account payment to processcredit card payments process faster. Your statement will show a payment made to “CMS Medicare Insurance” for credit or debit cards, or “CMS Medicare Premiums” for checking or savings accounts.

You can also sign up for Medicare Easy Pay, and have your monthly premium automatically deducted from your checking or savings account each month. You can’t set up recurring credit card payments at this time.

| Note |

|---|

| For your payment to process correctly, log into your Medicare account. You don’t need and shouldn’t create an account at Pay.gov to pay your premiums. |

If you have questions about your payment, you can call us at 1-800-MEDICARE . TTY: 1-877-486-2048.

Recommended Reading: How To Qualify For Medicare And Medicaid

Paying For The Doctor When You Have Original Medicare

For Medicare-covered services, you must first pay the Medicare Part B annual deductible, which is $166 in 2016. After you have met your deductible, you pay a Part B coinsurance for Medicare-covered services. For doctors visits you generally pay 20 percent of the Medicare-approved amount for care you receive. This is also called a 20 percent coinsurance.

However, you may have to pay more depending on what type of doctor you see and whether your doctor takes Medicare assignment. A doctor who takes Medicare assignment agrees to accept the Medicare-approved amount as full payment. In general, there are three categories of Original Medicare doctors:

- If you see a participating doctor, you are only responsible for paying a 20 percent coinsurance for Medicare-covered services. Most doctors who treat patients with Medicare are participating doctors.

Be sure to always ask your doctor if he/she accepts Medicare before you get care.

How Medicaid And Medicare Fit Into Planning For Long

By Harry S. Margolis, Next Avenue

getty

Beginning this year, workers in Washington state must pay 58 cents of every $100 they earn into the Washington Cares Fund to help pay their long-term care costs in the future. Those with qualifying long-term care insurance can be eligible for an exemption.

Beginning in 2025, those Washington residents who have paid in for at least three out of the prior six years, or for 10 years in total, will be able to withdraw up to $36,500 to pay for their costs of care.

This is an attempt by the state of Washington to fill in a huge gap in our patchwork of a long-term care system.

California has enacted a law to bring the eligibility threshold for Medicaid, the main payer for long-term care services, from $2,000 to $130,000 in total assets beginning July 1, and to totally eliminate it by the end of 2023. New York state is considering similar legislation at this time.

These initiatives begin to solve the long-term care financing challenges facing older Americans which will multiply in coming decades as the large boomer generation starts needing care.

Also Check: Is Omnipod Covered By Medicare

Related Training & Materials

Frequently Asked Questions about Medicare Part A and B “Buy-in” : The main policy questions, & responses, submitted to CMS to date on the updated Manual for State Payment of Medicare Premiums released on September 8, 2020.

Five Key Policy Topics From the Updated Manual on State Payment of Medicare Premiums: CMS designed this webinar for state policy staff to introduce five key policy topics addressed in the updated Manual for State Payment of Medicare Premiums released on September 8, 2020.

Overview of the CMS State Buy-In File Exchange: A webinar, with associated slides, available as a resource to support states moving to daily exchange submission.

Full Benefit Vs Partial Benefit: The Different Levels Of Medicaid Help

As long as youre entitled to Medicare Part A and B, and are eligible for some form of Medicaid benefit, then youre dual-eligible. However, not all dual-eligible benefits are the same.

If you are awarded Medicaid, your benefits will fall into one of the following categories of financial assistance. Medicaid can even pay for your Medicare Part D drug plan in some circumstances. Heres a brief overview of how each program works.

Don’t Miss: Does Medicare Cover Oral Surgery Biopsy

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

If a Medicare beneficiary also qualifies for full Medicaid benefits, they may enroll in SLMB+ . SLMB+ pays for both the Medicare Part B premium and all Medicaid covered services.

Qualifying for SLMB also makes you eligible for the Medicare Part D Extra Help program, which helps pay for Medicare Part D drug costs such as premiums, copayments and coverage gaps.