First Three Pints Of Blood

Medicare provides coverage for blood needed during a transfusion, but only beginning with the fourth pint. Unless the hospital provides the first three pints of blood for free, the cost of the first three pints are the responsibility of the beneficiary.

Medicare Supplement Plan G provides full coverage of the first three pints of blood.

What Part A Does Not Cover:

- $1,484 deductible when admitted for hospital stay

- Hospital inpatient days 61-90. You pay $371 per day.

- Hospital inpatient days beyond 90 days.* You pay $742 per day.

- Skilled nursing facility stay days 21-100. You pay $185.50 per day.

* You have 60 additional days to use beyond 90 days at the $742 daily rate. These are Lifetime Reserve days you can use across different Benefit Periods . There must be at least 60 days between stays to use Lifetime Reserve days.

These amounts are applied to each benefit period which is when you enter a hospital or skilled nursing facility and ends when you have not received care in those settings for 60 days in a row.

Medicare generally does not pay for Part A and B services or items outside the U.S. and U.S. territories. Medicare may, however, cover inpatient hospital care outside the U.S. under rare circumstances.

Original Medicare Vs Medicare Advantage

Medicare Advantage plans are popular because of their convenience. Most plans combine medical and prescription coverage on one card. Some offer dental and vision coverage, too. And you’re able to predict your out-of-pocket costs better than you can with Original Medicare.

When you have Original Medicare, you pay 20 percent of the cost, or 20 percent coinsurance, for most medical services covered under Part B. Medicare Advantage plans use copays more than coinsurance. Which means you pay a fixed cost. You might have a $15 copay for doctor office visits, for example.

And with Medicare Advantage plans, you have an out-of-pocket maximum. That means once you spend a certain amount of money on health care each year, your plan pays 100 percent of the cost of services it covers. Original Medicare doesn’t have this cap. So if you get really sick, you’ll end up paying a lot.

You can read even more about the difference between Original Medicare and Medicare Advantage in our Help Center.

Also Check: Can You Get Medicare If You Work Full Time

Medicare Part B Coinsurance And Copayment

Medicare Part B usually charges a coinsurance and copayments for doctor visits and other outpatient care. Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases.

After you meet your deductible, Plan G pays the 20% coinsurance or copayment costs.

High Deductible Plan G: What Are The Facts

Summary: High Deductible Plan G is a good alternative to High Deductible Medicare Supplement Plan F, which wont be available to new beneficiaries in 2021. The plan deductible is $2,370. Once the deductible is met, you get the same coverage as a regular Plan G.

Youve been doing a lot of research regarding your Medicare coverage. As you may know by now, eligibility for Plan F is being restricted 2020. With this, High Deductible Plan Fs eligibility requirements are also being restricted. If youre among the group of people who love their high deductible plan, or you were planning on switching to a high deductible plan, dont worry. You still have options. After January 1, 2020, a High Deductible Plan G option will be available to purchase to anyone whos new to Medicare.

Read Also: What Is Centers For Medicare And Medicaid Services

The Solvency Of The Medicare Hi Trust Fund

This measure involves only Part A. The trust fund is considered insolvent when available revenue plus any existing balances will not cover 100 percent of annual projected costs. According to the latest estimate by the Medicare trustees , the trust fund is expected to become insolvent in 8 years , at which time available revenue will cover around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years. This and other projections in Medicare Trustees reports are based on what its actuaries call intermediate scenario but the reports also include worst-case and best-case projections that are quite different .

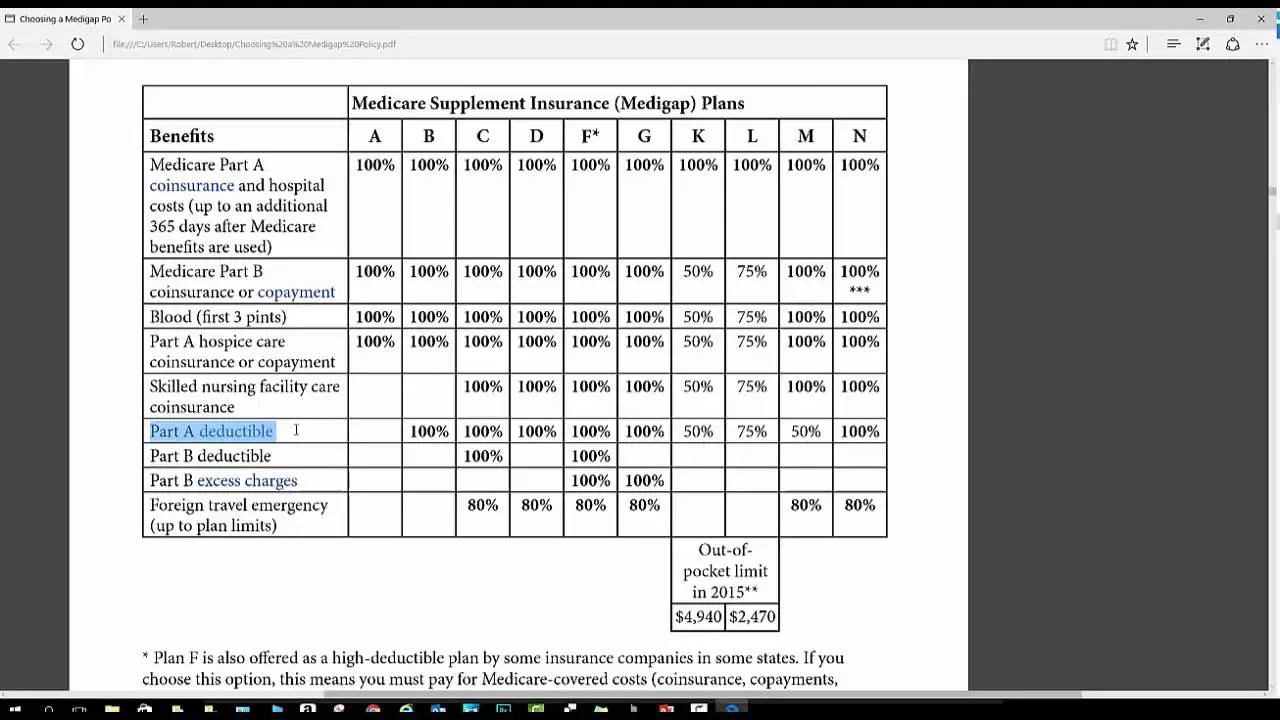

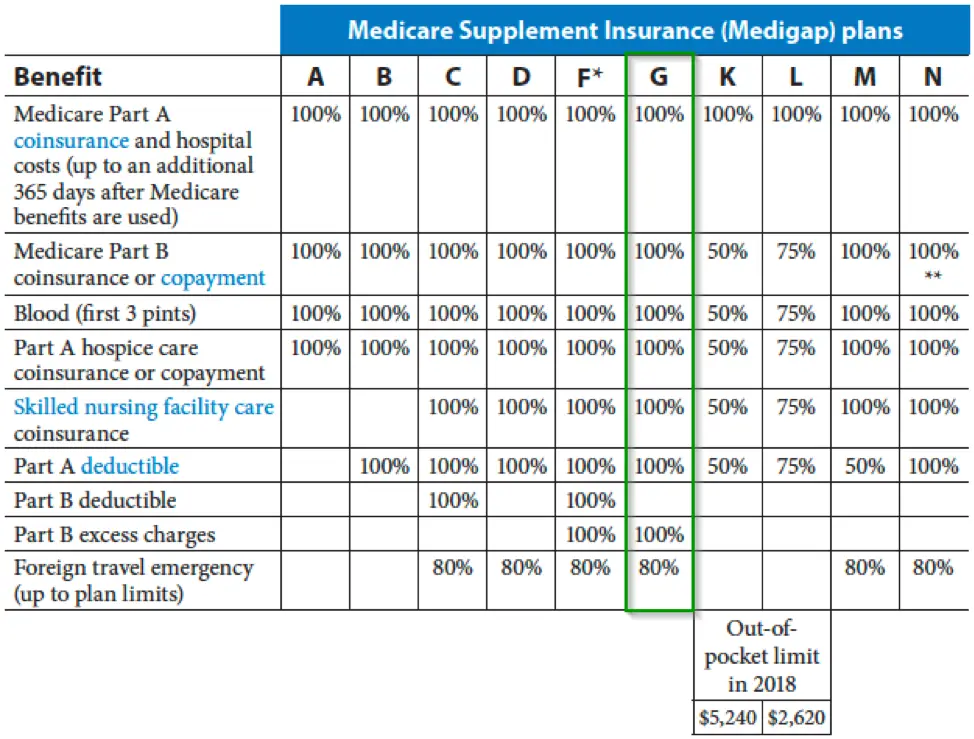

What Is Happening To Plan F And Plan C In 2020

The popular Medigap Plan F and Plan C will not be made available to anyone who becomes eligible for Medicare on or after January 1, 2020.

Some recent legislation has made it illegal for Medigap plans to cover the Medicare Part B deductible for newly eligible Medicare beneficiaries beginning in 2020. Plan F and Plan C are the only Medigap plans that cover the Part B deductible.

Anyone who is eligible for Medicare before January 1, 2020, may sign up for Plan F or Plan C after that date, as long as one of these plan options is available where they live.

If you are already enrolled in Plan F or Plan C before January 2020, you will be allowed to keep your coverage beyond that date.

Don’t Miss: When Does My Medicare Coverage Start

Who Can Enroll In Medicare Supplement Plan G

You can buy a MedSup Plan G policy if:

- Youre over 65.

- Youre not enrolled in a Medicare Advantage plan.

- You live in the plans service area.

Who cant buy a MedSup Plan G policy? One example is people under 65 with Medicare coverage due to a disability or end-stage renal disease. They may not be able to buy one of these plans. They may not be able to buy any MedSup or Medigap policy, period.

If youre in this situation and you want Plan G coverage, contact a few of the insurance companies in your area. They can tell you if youre allowed to buy one or not. If you cant, ask if you can buy any other MedSup policies.

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

You May Like: How Old Before You Qualify For Medicare

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.

What Medical Services Does Plan G Cover

Medicare Supplement Plan G covers your share of any medical benefit that Original Medicare covers, except for the outpatient deductible. So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more.

Medicare pays first, then Plan G pays all the rest after you pay the once annual deductible. In addition, Plan G Medicare Supplements offer up to $50,000 in foreign travel emergency benefits.

Read Also: How Much Do Medicare Supplements Increase Each Year

Find Cheap Medicare Plans In Your Area

Medicare Plan G is one of 10 Medicare supplement policies that fill the coverage gaps in original Medicare. For this reason, many seniors choose to purchase Plan G to provide them financial support while being enrolled in Medicare.

Although Plan G is one of the most comprehensive policies available, the plan will not cover the Medicare Part B deductible.

Medicare Supplement Plan G: What Are The Facts

Summary: Medicare Supplement Plan G is one of the most popular Medicare Supplement plans. This plan covers:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- Blood

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Foreign travel emergency

Read Also: How Much Is Medicare B Deductible

Paying For Your Coverage

If you have Original Medicare along with a Medigap plan, youll pay two premiums: one for Medicare Part B, and another for the Medigap plan . Medicare B premiums are deducted from your Social Security check, but Medigap premiums are paid directly to the private insurance carrier that provides the plan.

Neither Medigap nor Original Medicare will cover outpatient prescription drugs, so enrollees can also purchase Part D prescription drug coverage, which would be another separate policy with a separate monthly premium .

About Medicare Supplement Plans F G And N

Summary: Medicare Supplement insurance Plans F, G, and N are three of the standardized Medicare Supplement insurance plans offered in most states.

Please note: Medicare Supplement Plan F wont be sold to people who qualified for Medicare on or after January 1, 2020 . You wont have to give up your Plan F or Plan C if you already have one.

Medicare Supplement insurance plans are offered by private insurance companies and can help you pay for out-of-pocket costs for services covered under Original Medicare . Theyre standardized in most states, meaning that different insurance companies must offer the same basic benefits for plans of the same letter. Plans F, G and N are three of the most comprehensive plans.

Don’t Miss: Is Stem Cell Treatment Covered By Medicare

How Do I Enroll In High

High-deductible Medigap Plan G may be offered where you live in 2020. Call today to speak with a licensed insurance agent who can help you compare the Medigap plan options that are available in your area.

Compare Medigap plan benefits in your area.

1 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

Does Medicare Cover Vision

Find affordable Medicare plans

Generally, Original Medicare does not cover routine eyeglasses or contact lenses. However, following cataract surgery that implants an intraocular lens, Medicare Part B helps pay for corrective lenses one pair of eyeglasses or one set of contact lenses provided by an ophthalmologist.

Read Also: When Is The Next Medicare Open Enrollment

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a “funding warning” is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 “window”. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

How Can I Lower My Medsup Plan G Costs

Here are a few things you can do to lower your Medicare Supplement Plan G costs:

- Move to an area where this kind of coverage costs less than it does where you live now.

- Shop around and switch to a plan that charges less than your current one does.

- See if the insurance companies that serve your area offer any discounts on these plans. Some give discounts to women, non-smokers, married couples, people who pay yearly and more.

- Quit smoking.

Also Check: Does Medicare Pay For Stem Cell Knee Replacement

How Does Medicare Part G Work

For starters, you need to be enrolled in Original Medicare, or Medicare Parts A and B. Then you can buy Medicare Part G from a private insurance company that serves your ZIP code.

Once thats out of the way, here’s how Medicare Part G works:

- You pay your monthly Medicare Part B premium. If you receive benefits from Social Security, the Railroad Retirement Board or the Office of Personnel Management, your premium will be automatically deducted from your benefit payment.

- You also pay the monthly premium for your Plan G policy.

- After you visit a healthcare provider, Medicare will pay its share of the Medicare-approved amount for covered treatments.

- Your MedSup policy then pays its share of those costs, if needed.

Why Should I Choose Medicare Supplement Plan G Over Plan F

One reason to choose Medicare Supplement Plan G over Plan F is that insurance companies no longer offer MedSup Plan F to new Medicare enrollees.

Thanks to the Medicare Access and CHIP Reauthorization Act of 2015, insurers cant sell MedSup Plan F to people who became eligible for Medicare on or after Jan. 1, 2020.

Dont worry, if youre already enrolled in Plan F, youll be able to keep it. If you dont have MedSup coverage and you want to buy Plan F now, though, you won’t be able to do so. The same is true if youre enrolled in a different MedSup plan and you want to switch to Plan F.

Long story short: if you want MedSup Plan F but can no longer enroll in it, Plan G may be the best Medicare Supplement policy for you.

You May Like: How To Get Motorized Wheelchair Through Medicare

Is There A Lower Premium Option For Plan G

Do you find the benefits for standard Plan G attractive but the monthly premiums are more than you want to spend? High Deductible Plan G offers the same benefits for a lower premium. However, in exchange for the lower monthly cost, youll need to reach the deductible prior to receiving 100% coverage.

What Is The Deductible For High Deductible Plan G In 2021

The deductible for High Deductible Plan G is $2,370. Beneficiaries reaching this deductible is what keeps the premiums low for this plan. Alternatively, if youre more comfortable with higher monthly premiums and would rather not pay the higher deductible, standard Plan G would be the better choice for you.

You May Like: What Does Medicare Extra Help Pay For

Medicare Supplement Plan G

Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs, such as deductibles, copayments, and coinsurance.

Medigap Plan G is a Medicare supplement plan that offers eight of the nine benefits available. This makes it one the most comprehensive Medigap plan offered.

Keep reading to find out more about Medigap Plan G, what it covers, and what it doesnt.

How Does High Deductible Plan G Work

High Deductible Plan G works very similarly to other Medigap plans. Like other Medigap options, the plan works with regular Medicare Part A and B and fills in the gaps in Medicare. There are no networks on HDG or any other Medigap plans you can use the plan at any doctor or hospital that accepts Medicare.

High deductible Plan G has a deductible of $2370 . What this means is that, when you use medical services, Medicare will pay their 80%, and you will be responsible for the other 20% until you meet the $2370 deductible. In other words, you will pay 20% of Medicare-approved charges up to $2370 per calendar year.

After you have paid out $2370 in a calendar year, your HDG plan will act exactly like a regularPlan G. The plan will pay what Medicare does not pay . HDG, like standard Plan G, does not cover the Medicare Part B deductible however, that deductible goes towards the larger HDG deductible so you would have already met it by the time you reach the $2370 HDG deductible.

The deductible for HDG resets each calendar year, so you would have to start over with meeting the deductible each year. High deductible Plan G, just like any other Medigap plan, can never be cancelled for reasons other than non-payment of premium. The plan is guaranteed renewable and does not have to be renewed annually, nor does it have any sort of annual renewal period.

Read Also: Does Medicare Cover You When Out Of The Country