Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021 . If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 . If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259 . |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203 . After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Coronavirus : Insight And Considerations For The Hospital Environment

As you have learned, the price of your prescription is based on a lot of things. Perhaps the most important thing to understand is that, in the end, there is very little that anyone can do to affect the price you pay. Manufacturers get to set the price at whatever they want, and insurance companies have similar freedom. The best thing you can do is work with your physician and pharmacist to find a therapy that suits you best and is affordable.

Can I Buy A Generic Version Of Eliquis

A generic version of Eliquis is not currently available to buy. However, the FDA approved a generic version of Eliquis in early 2020. This generic version will simply be called Apixaban. For now, we cant tell how much Apixaban will cost. However, it will likely be significantly cheaper than name-brand Eliquis.

Recommended Reading: What Age Does Medicare Eligibility Start

How Much Does Medicare Part A Cost In 2022

Premiums for Medicare Part A are $0 if youâre getting or are eligible for federal retirement benefits. Itâs also premium-free if youâre under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease. If youâre eligible for Medicare, but not other federal benefits, youâll pay a Part A premium of $274 or $499 each month, depending on how long youâve paid Medicare taxes.

The deductible for Medicare Part A is $1,556 per benefit period. A benefit period begins the day youâre admitted to a hospital and ends once you havenât received in-hospital care for 60 days.

The Medicare Part A coinsurance amount varies, depending on how long youâre in the hospital. Coinsurance is typically a percentage of the costs, but Medicare designates the coinsurance as a flat fee.

Hereâs how much youâll pay for inpatient hospital care with Medicare Part A:

-

Days 1-60: $0 per day each benefit period, after paying your deductible.

-

Days 61-90: $389 per day each benefit period.

-

Day 91 and beyond: $778 for each “lifetime reserve day” after benefit period. You get a total of 60 lifetime reserve days until you die.

-

After lifetime reserve days: All costs.

The cost of a stay at a skilled nursing facility is different. This is what a skilled nursing facility costs under Medicare Part A:

Hospice care is free.

Read more about how Medicare Part A covers these costs here.

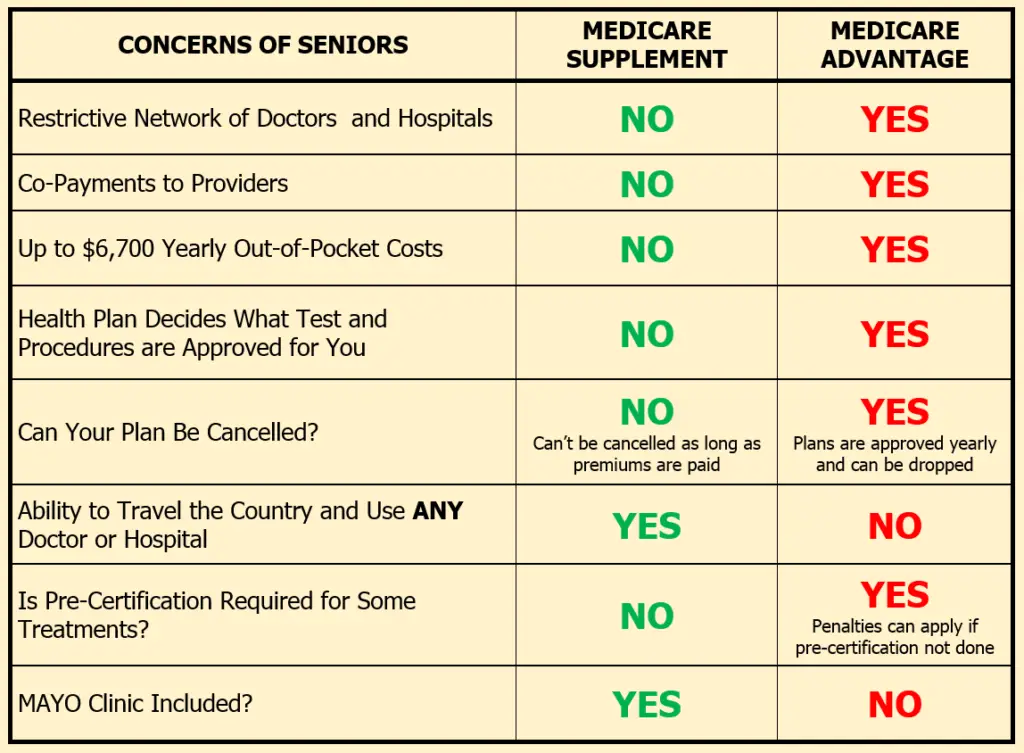

Medigap Helps Cover Medicare Copayments

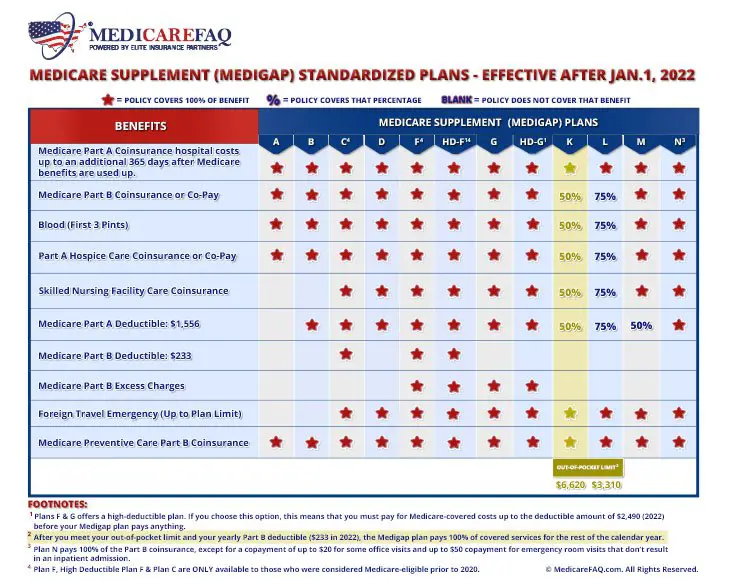

There are 10 standardized Medigap plans available in most of the United States. These plans help you pay out-of-pocket costs associated with Original Medicare.

Most Medigap plans cover some or all of the costs of your Medicare Part A and Medicare Part B deductibles, copayments and coinsurance. Two of the 10 plans cover either 50 or 75 percent of copayment and coinsurance costs.

You cannot, however, buy a Medigap plan if you have a Medicare Advantage plan.

Also Check: What Does Part B Cover Under Medicare

Eliquis Coverage Through Medicare Part D

Medicare Part D is a part of Medicare that covers prescription drugs, and is offered by private insurance companies. Unlike original Medicare, the pricing is only partially set by the government. Medicare Part D will cover your Eliquis prescription, but you may have to pay a deductible, copayment, or coinsurance.

Insurance Factors That Affect Costs

| What is it? | ||

|---|---|---|

|

Increases cost at the start |

This is the dollar amount you need to pay before your insurance really “kicks in.” |

|

|

Medicare Coverage Gap |

Increases cost |

After your insurance pays a certain amount, your costs will significantly increase until you pay a certain amount |

|

Formulary |

Might increase or decrease |

Your insurance keeps a tiered list of drugs that they want you to use based on cost. If you use their choices, you will pay less. Otherwise, you will pay more. |

|

Prior Authorization |

Insurance won’t pay anything |

Your physician will need to convince your insurance that the medicine is necessary for you before they will pay |

|

Step Therapy |

Insurance won’t pay yet |

Your insurance requires you to try a different, cheaper drug first in hopes that it will be effective |

Recommended Reading: What Is Medicare Advantage Plus

Medicare Part Dprescription Coverage

What it helps cover:

- Medicare Part D covers prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays vary by plan, so you should compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

What Is A Copayment

Your copayment is a set out-of-pocket dollar amount you are obligated to pay for each medical service you receive, including visits to your doctor and prescriptions.

Copayments are a type of cost-sharing . The other types are coinsurance and deductibles.

Original Medicare does not use copayments in the same way as other health plans. Instead, enrollees pay a deductible , and then coinsurance. For Medicare Part B, the coinsurance is 20 percent of the cost of care. But under Medicare Part A, a patient who is hospitalized for more than 60 days would begin paying a flat-dollar coinsurance for each additional day in the hospital. In other types of health coverage, coinsurance refers to a percentage of the claim, whereas copay refers to a flat dollar amount. But with Medicare Part A, the term coinsurance is used to describe a flat-dollar amount dont let that confuse you!

Medicare Part D plans can either use coinsurance or copays for prescription drugs. And Medicare Advantage plans can also be designed to cover things like doctor visits and prescription drugs with copays, making them similar to the sort of private plans to which many people are accustomed to prior to enrolling in Medicare.

Read Also: How Much Is Medicare Part B Now

Who Is Eligible For Free Medicare Part

Anyone age 65 and older is eligible for Medicare. Most people age 65 and older are covered for free under Medicare Part A because of their employment history or their spouse’s employment history. People 65 and older who are not eligible for free Medicare Part A coverage can sign up and pay a monthly fee for the same coverage.

I’m Just Going To Change Pharmacies

- Remember, the price of your prescription is usually set by your insurance, not by the pharmacy.

- There are cases where your insurance has signed a deal with a certain pharmacy company. Ask your insurance if that is the case.

- If your not saving money, changing pharmacies can be dangerous. Sticking with one pharmacy allows that pharmacy team to get to know you and your drug therapy. They will be able to help you the best.

- Instead of changing, work with your pharmacist to find more cost effective alternatives.

You May Like: How Much Does Medicare Supplemental Insurance Cost Per Month

Medicare Supplement Plan N Reviews

The feedback we hear from clients about Plan N is positive. As long as theyre prepared to pay small copays, they always seem happy with Plan N.

When researching reviews for a specific letter plan, make sure to focus on reviews about the plan benefits, not the carrier. A lot of times, the negative reviews have to do with complaints about the carrier, not the plan.

How Much Does A Medicare Part D Copay Cost

Again, because Medicare Part D plans are sold by private insurance companies, there is no set standard Medicare Part D copay amount. Part D copay amounts vary between plans, and are usually determined by the type of coverage you receive, the type of plan you choose, and the location in which you live. For example, some plans may have copays as little as $3 for Tier 1 drugs, while others may charge $5 or more for the same prescription drug.

Shopping and comparing plans before enrolling in Medicare Part D is important , especially for those who take speciality or higher cost drugs. Review the plans formulary to see which tiers your prescriptions drugs fall under to determine how much your share of the cost will be.

Also, if cost is a concern for you, it is important to be aware of the specific enrollment periods for Medicare Part D. Avoid a costly and permanent late enrollment penalty by enrolling a Part D plan when first eligible.

You May Like: Does Medicare Cover Whooping Cough Vaccine

What Is Medicare Coinsurance

Coinsurance is the percentage of a medical bill that you may be responsible for paying after reaching your deductible. Coinsurance is a form of cost-sharing it’s a way for the cost of care to be split between you and your provider.

The deductible is the amount you are required to pay in a given year or benefit period before Medicare begins paying its share.

Who Is Entitled To Medicare Part B

Everyone who qualifies for Medicare pays a Part B premium. People age 65 and older who have not contributed to Medicare alone or through their spouse are still eligible for Medicare. However, Medicare must pay a monthly premium to get coverage for both Part A and Part B.

Hsa limit 2021Should you Max your HSA? The maximum amount you can deposit into the HSA in 2017 is $3,400 for yourself or $6,750 for your family. When you turn 55, you can pay an additional $1,000 as a side tax.What to do if contribute too much to HSA?If you feel you contributed too much to your HSA, you should take steps to avoid paying penalties to the IRS. The solution is very simple

Recommended Reading: What Are All The Medicare Parts

How Expensive Is Eliquis With Medicare Advantage

The average Medicare Advantage premium will be around $23. This is lower than Medicare Part D. However, when you have Medicare Advantage, you will still have Part B premiums. In addition to this, youll still have to pay a deductible and coinsurance for your Medicare Advantage plan.

In addition to this, your premiums can vary. Make sure to check the cost of plans in your area and compare them to Part D plans.

Cms Announces Medicare Premiums Deductibles For 2022

The Medicare Part A deductible for inpatient hospital services will increase by $72 in calendar year 2022, to $1,556, the Centers for Medicare & Medicaid Services announced Friday. The Part A daily coinsurance amounts will be $389 for days 61-90 of hospitalization in a benefit period $778 for lifetime reserve days and $194.50 for days 21-100 of extended care services in a skilled nursing facility in a benefit period. The monthly Part A premium, paid by beneficiaries who have fewer than 40 quarters of Medicare-covered employment and certain people with disabilities, will increase by $28 in CY 2022 to $499, CMS announced . Certain voluntary enrollees eligible for a 45% reduction in the monthly premium will pay $274 in CY 2022.

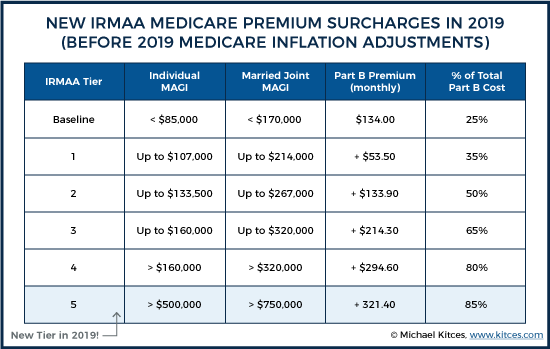

The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced. CMS Administrator Chiquita Brooks-LaSure the increase in the Part B premium continued evidence that rising drug costs threaten the affordability and sustainability of the Medicare program.

You May Like: Does Medicare Cover 24 Hour Care

How Much Is The Medicare Part A Premium

If you paid Medicare taxes in less than 30 quarters, the standard Part A premium is $458. If you paid 3,039 quarters of Medicare taxes, the standard Part A premium is $252. The standard Part B bonus amount is $ . $198.

Work from home tax write offs]Can I deduct expenses for working from home? If you work from home, you can also deduct certain business expenses, such as the cost of computers, printers and other office equipment, landline or cell phone bills, shipping costs, and office supplies. You can also deduct the cost of training programs needed to do your job.Can employees deduct home office?Employees who work fro

Medicare Part A Deductible

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time youve been admitted into the hospital through 60 consecutive days after youve been out of the hospital.

So, if youre discharged from the hospital and return within the 60-day period, you dont need to pay another deductible.

If youre admitted after the 60-day period, then youve started another benefit period and you will be expected to pay another deductible.

Recommended Reading: Can I See A Doctor In Another State With Medicare

Are Medicare Premiums Increasing In 2022

Medicare Part B premiums will also rise in 2022. The new standard monthly Part B premium in 2022 is estimated in dollars per month, increasing by $10 per month from dollars per month in 2021, and the largest increase in the annual Part B premium corresponds to making an appointment. Higher earners may pay more for their share B bonuses in 2022.

Is There A Copay With Medicare

- Medicare is a government-funded health insurance option for Americans age 65 and older and individuals with certain qualifying disabilities or health conditions.

- Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs.

- There are financial assistance programs available for Medicare enrollees that can help pay for your copays, among other costs.

Medicare is one of the most popular health insurance options for adults age 65 and older in the United States. When you enroll in Medicare, you will owe various out-of-pocket costs for the services you receive.

A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and prescription drug refills. Most copayment amounts are in the $10 to $45+ range, but the cost depends entirely on your plan.

Certain parts of Medicare, such as Part C and Part D, charge copays for covered services and medications. Deductibles, copays, and coinsurance fees all contribute to the out-of-pocket maximums for these plans.

In this article, well explore the parts of Medicare that charge copay fees, how to compare copay costs when enrolling in a Medicare plan, and how to find help paying your out-of-pocket costs.

Recommended Reading: Is Oral Surgery Covered By Medicare

How Do You Enroll In Medicare

You can enroll in original Medicare directly through the Social Securitys website during your initial enrollment period. This period includes the 3 months before, the month of, and the 3 months after your 65th birthday.

If you miss your initial enrollment period or want to change or enroll in a different Medicare plan, here are the additional enrollment periods:

- General and Medicare Advantage enrollment: from January 1 to March 31

- Open enrollment: from October 15 to December 7

- Special enrollment: a number of months depending on your circumstances

The initial enrollment period is the time in which you can enroll into Medicare parts A and B. Once youre enrolled in original Medicare, though, you may decide that you would rather enroll into a Medicare Advantage plan.

Before you choose an Advantage plan, youll want to shop around to compare the different plans available in your area. Comparing benefits, health perks, and plan costs including copay amounts can help you choose the best Medicare Advantage plan for you.

What Is Medicare Part A At 65

Part A includes hospital stays, skilled nursing home care, hospice care, and some home care. Coverage if you or your spouse paid Medicare taxes during the time you worked. This is also known as a free part A. Most people get part A without the bonus. You can get your Part A premium for free at age 65 if:.

You May Like: How To Sell Medicare Advantage Plans