What’s Better An Hmo Plan Or A Ppo Plan

- Is my doctor or medical group listed in my plan’s provider network?

- What kind of medical treatment access is most important to me?

- Do I want to choose my own specialist or have a PCP advocate for me?

- What is the most affordable coverage I can purchase?

Whether you have established care or plan on seeing someone new, you’ll want to make sure you have access to the type of medical treatment you’re seeking with the plan you choose. If the freedom and flexibility of choosing your own doctor or specialist is important to you, then you’ll probably want to opt for a PPO rather than a more restrictive HMO plan, where you must choose an in-network doctor from a list provided for you and referrals are necessary.

HMO plans are generally more affordable than PPO plans, so if you are looking for lower co-pays and premiums, an HMO may be the right plan for you. However, if you don’t mind paying a higher cost for the flexibility of being able to see a medical care provider of your choosing, regardless of network, or often need to see a specialist and don’t wish to wait for a referral, then a PPO might be best suited for your healthcare needs.

Tip #: Get Trustworthy Professional Help For Free

Still feeling overwhelmed with all the ACA choices? You’re in luck. There is free, impartial professional help available to help you choose and enroll in a plan. Just put in your zip code at Healthcare.gov/localhelp and look for an “assister” a person also referred to as a health care navigator on some state websites.”

Aaron DeLaO is one such navigator, and notes that he and his fellow guides don’t work on commission they’re paid by the government. “We’re not contracted with insurance agencies,” he says. “We do it completely autonomously, impartially. It’s about what’s best for the consumer.”

In 2021, the Biden administration quadrupled the number of navigators ahead of open enrollment.

Insurance brokers can be helpful, too, says Corlette. “Brokers do get commissions, but in my experience, the good brokers want repeat customers and that means happy customers,” she says. To find a good broker, she advises, “go through either Healthcare.gov or your local state department of insurance to find somebody that’s licensed and in good standing.”

Buyer Beware: New Cheaper Insurance Policies May Have Big Coverage Gaps

“Unfortunately, there are a lot of con artists out there who take advantage of the fact that people recognize health insurance is something that they should get,” says Corlette. She tells people: “Just go straight to Healthcare.gov. No matter what state you live in, you can go through that portal.” Any plan you find there will cover the ACA’s 10 essential benefits such as free preventive care and hospital coverage.

Recommended Reading: Does Medicare Pay For Private Duty Nursing

The Pros And Cons Of Medicare Advantage

Medicare Advantage plans have benefits and drawbacks. While they’re a slam dunk choice for some people, they’re not right for everyone.

Pros:

-

Additional benefits, which may include hearing, dental and vision care.

-

Potentially lower premiums for coverage.

-

Limits on how much you may have to pay out-of-pocket for hospital and medical coverage.

Cons:

-

Less freedom to choose your medical providers.

-

Requirements that you reside and get your nonemergency medical care in the plans geographic service area.

-

Limits on your ability to switch back to Original Medicare with a Medicare Supplement Insurance policy.

Why Are Some Medicare Advantage Plans Free

First, private insurance companies sell Medicare Advantage insurance plans.

These health insurance plans roll in traditional Medicare Part A and Part B, which is managed by the federal government, along with additional benefits. Because of that, the government reimburses these companies for those services directly instead of paying a provider.

To make their plans more appealing to Medicare enrollees, some private insurers offer $0 monthly premiums.

If you have been paying into Medicare, you will not have to pay Part A premiums whether you have a Medicare Advantage plan or not.

Some provider plans pay all or part of your Part B monthly premium, which is $148.50 in 2021. Part B also has an annual deductible.

If your Medicare Advantage insurance plan reimburses some or all of your Part B premiums, you will still need to pay other fees associated with Part B, such as copays and coinsurance.

You May Like: Is Pennsaid Covered By Medicare

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

What Do Medicare Advantage Plans Not Cover

The nice feature of Part C Medicare Advantage Plans is that they can cover so much beyond Original Medicare Part A and Part B benefits. These perks include coverage for prescription drugs, dental, vision, hearing, transportation and fitness classes/gyms like SilverSneakers.

Seeing a specialist is more complicated under a Medicare Advantage plan than a Medicare Supplement plan because your primary care provider will need to make a referral first.

Under a Medicare Advantage health plan, you will be responsible for copays and coinsurance.

Youll also want to speak to your licensed insurance agent about health coverage during foreign travel. Medicare coverage is more limited under a MA plan than a Medigap plan when you travel both abroad and domestically.

Read Also: Does Medicare Medicaid Cover Dentures

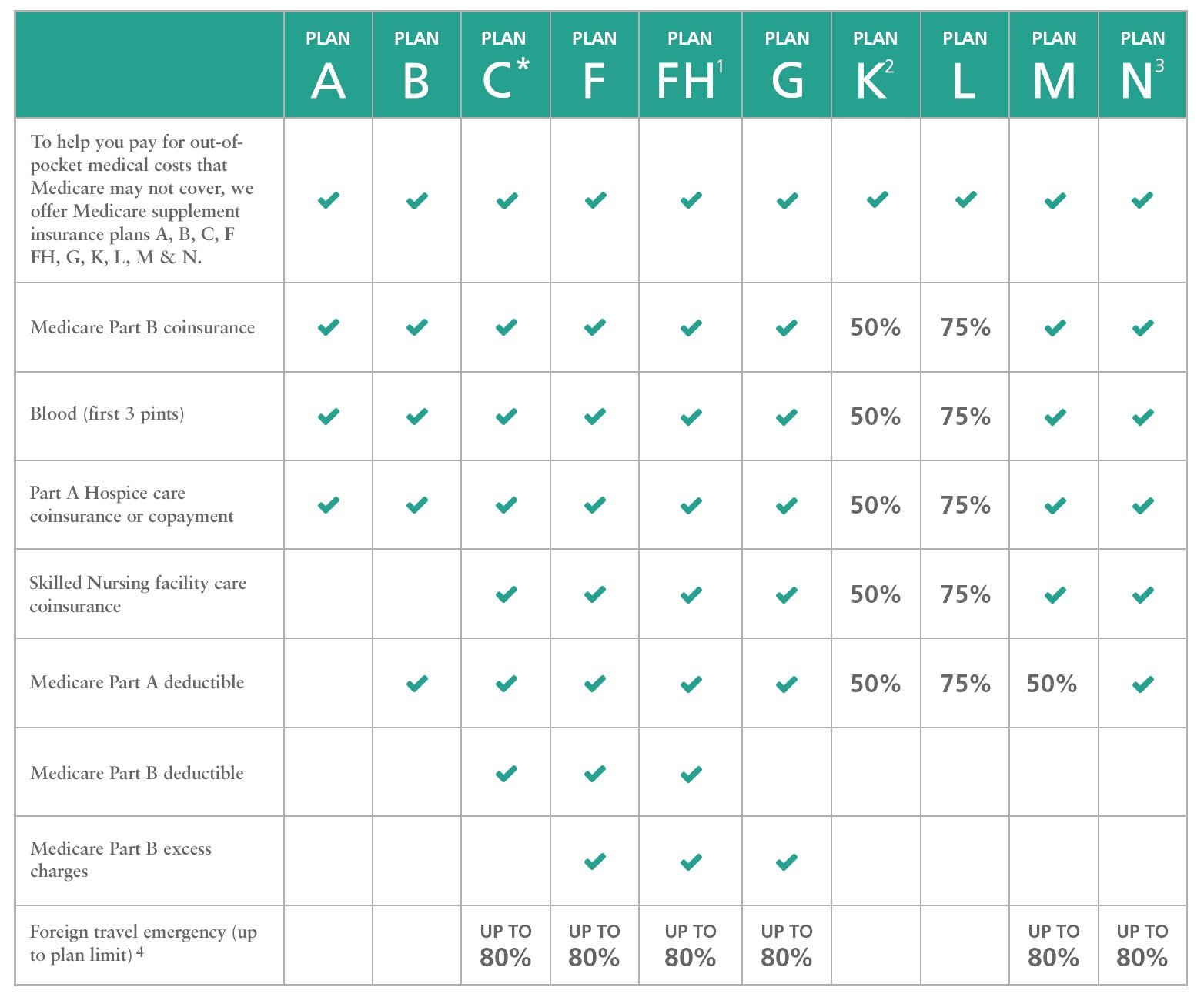

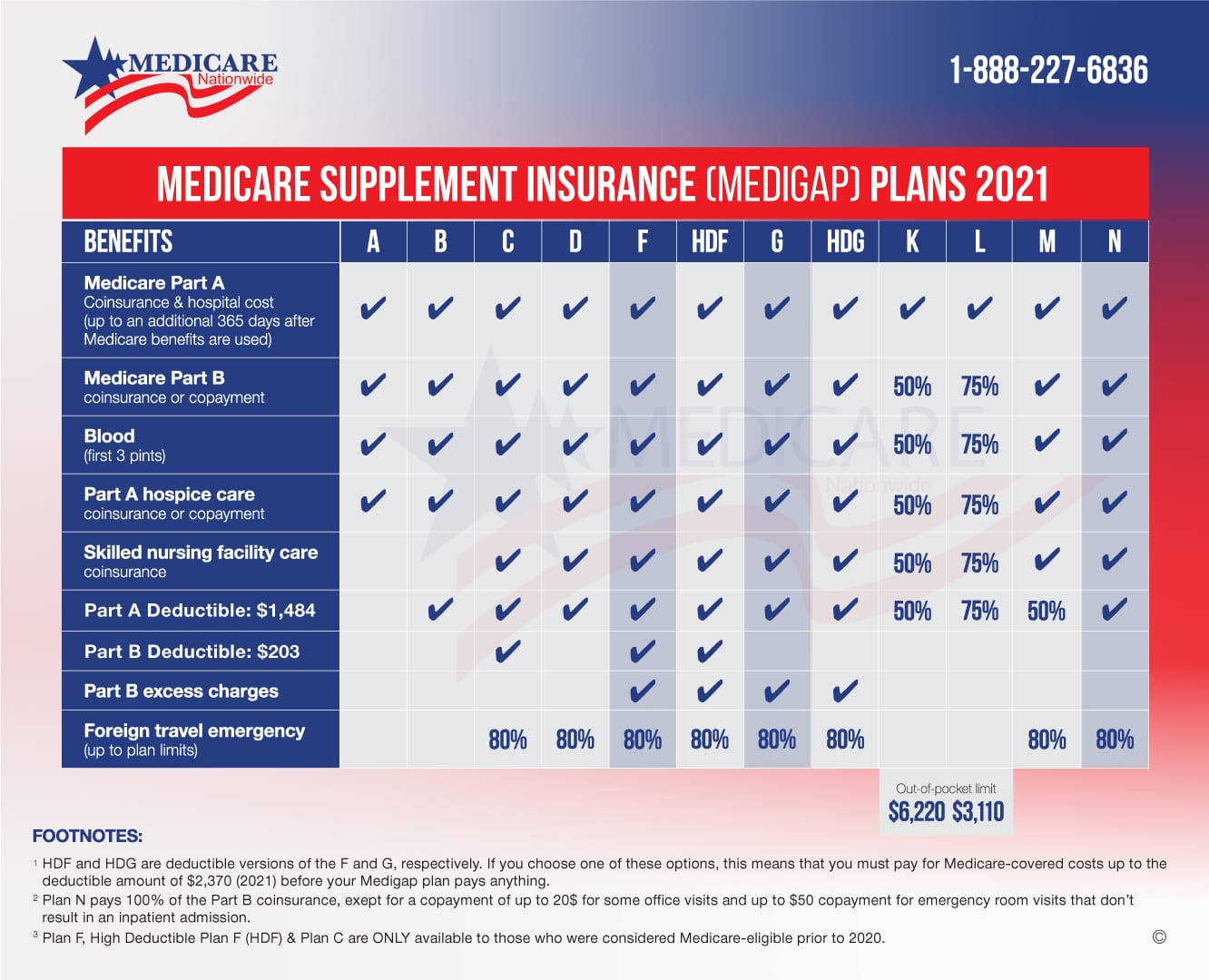

Medicare Supplement Plans Comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

The current Medicare supplement insurance plans offered are Plan A, B, C, D, F, G, K, L, M, and N. Some providers also sell high-deductible Plan F and high-deductible Plan G, which have a lower monthly premium. You can purchase Medigap insurance from private insurance providers.

Each Medicare supplement insurance plan offers varying levels of coverage. For instance:

- Medigap Plan A doesn’t cover the Medicare Part A or Part B deductible.

- Medigap Plan B covers the Medicare Plan A deductible only.

- Medigap Plans K and L cover a smaller percentage of costs like skilled nursing coinsurance and hospice coinsurance and also have out-of-pocket maxes.

Before you choose a Medigap plan, it’s a good idea to compare Medicare supplement plans. Every plan offers a different level of coverage and has a unique premium. Also, keep in mind that not all insurance providers offer every plan.

Plans F and G are similar. Heres a look at how Plans F and G compare:

| Standard Plan F | |

|---|---|

| N/A | $2,340 |

Also, remember that you need Part D for Medicare prescription drug benefits. Medicare supplement plans don’t help with prescription drug costs. You can also choose a Medicare Advantage plan rather than Original Medicare and most of Medicare Advantage plans offer prescription drug benefits, too.

How To Compare Medicare Advantage Plans

When comparing Medicare Advantage plans, you may want to look for the following features.

- Prescription drug coverage: Many Medicare Advantage plans include coverage for prescription drugs or Medicare Part D. Most men and women who enroll in a Medicare Advantage plan look for Part D coverage. If youre interested in Part D coverage, be sure the plan you choose offers this benefit.

- Additional benefits beyond original Medicare:In addition to Part D coverage, you may have additional benefits you prioritize. For example, if your family has a history of hearing loss, you may want to consider a Medicare Advantage plan that covers hearing aids and hearing exams.

- Service area: Not every insurance provider is authorized to offer coverage in every state. Be sure to consider each plans service area before you enroll especially if you plan on moving within the year.

Don’t Miss: What Is The Annual Deductible For Medicare Part A

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

Important Facts About Medicare Plan F:

- Its important to note that Medicare supplements are not standalone policies. You must have both Medicare Parts A and B to qualify.

- You pay for your Medicare Part B and Medigap separately. If you or your spouse did not work the full 40 quarters required, you will also pay for your Part A coverage.

- Each person needs their own Medicare supplement policy. These policies only cover one person. However, many companies offer a household discount.

- Medicare Plan F is offered through private insurance companies and only those authorized to sell in your state can provide this policy.

- Health problems do not disqualify you from a Medigap policy if you enroll during your 6-month individual enrollment period. During this period, you have guaranteed issue rights and cannot be turned down. You may continue to renew these indefinitely if you pay the monthly premium.

- If you have a Medicare Advantage plan it is illegal for an insurance company to sell you a Medigap plan. The only exceptionIn a Medicare Part D plan, an exception is a type of prescription drug coverage determination. You must request an exception, and your doctor must send a supporting statement explaining the medical reason for the… is if you are going back to Original Medicare.

Read Also: Where Do I Apply For Medicare Benefits

Should You Choose Medicare Advantage Or Original Medicare

From the perspective of peace-of-mind, original Medicare + Medigap + Medicare Plan D Drug plan can be a better financial investment if you get sick. But its definitely an investment, given the premium costs of Medigap and a Medicare Part D plan for prescription drug coverage. Like auto insurance and homeowners insurance, the goal is to budget for the most protection you can afford.

Mississippi Medigap Open Enrollment

The ideal time to enroll in any Medigap plan is during the Medigap Open Enrollment window. Your Open Enrollment window will start when you turn 65 or upon the effective date for your Medicare Part B. During this period, you can apply for any Medicare supplement plan that is available to you. Insurance companies cannot turn you down for any reason during your Open Enrollment window.

If you are under the age of 65 and on Medicare due to a disability or health condition, the Open Enrollment window also applies to you. Under these circumstances, you will have six months from the effective date of your Part B enrollment to enroll in a Medigap plan without health questions. You will receive an additional Open Enrollment window when you turn 65.

People on Medicare due to disabilities are generally charged much higher prices for supplement plans than people who are 65 and older, so the second Open Enrollment window is an excellent chance for you to lower your premiums.

Recommended Reading: What Age Do You Apply For Medicare

What About A Travel Emergency Does Plan G Cover Me

If you travel outside the continental United States and its territories, Original Medicare and Medicare Advantage do not cover you if you have a medical emergencyWhen you believe you have an injury or illness that requires immediate medical attention to prevent a disability or death….. Most Medicare supplement insurance policies, including Plan G, do cover you .

Which Path You Take Will Determine How You Get Your Medical Care And How Much It Costs

by Dena Bunis, AARP, Updated October 12, 2021

Getty/AARP

En español | As you think about how Medicare will cover your health care needs, your first major decision should be whether you want to enroll in federally run original Medicare or select a Medicare Advantage plan, the private insurance alternative.

Think of it as choosing between ordering the prix fixe meal at a restaurant, where the courses are already selected for you, or going to the buffet , where you must decide for yourself what you want.

If you elect to go with original Medicare, your buffet will include Part A , Part B and Part D . If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

Some aspects of your care will be constant whichever plan you choose. Under both choices, any preexisting conditions you have will be covered and you’ll also be able to get coverage for prescription drugs.

But there are significant differences in the way you’ll use Medicare depending on whether you pick original or Advantage. Here’s a comparison of how each works.

Don’t Miss: When Does Medicare Part D Start

Best Comprehensive Coverage: Medigap Plan G

Medicare Supplement insurance Plan G offers the most comprehensive coverage, but it is also the most expensive Medigap insurance policy for policyholders newer to Medicare.

Plan G offers almost identical health insurance benefits as Plan F, however, it does not pay for your Part B deductible. Federal guidelines now prohibit Medigap plans from covering the Part B deductible, which is $203 in 2021, and is projected to be $217 in 2022.

Heres the overview of Plan G:

- Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used

- Medicare Part B coinsurance and copayment

- Blood

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B excess charges, what you owe over Medicare allowable amount

- Foreign travel emergency

Because of its broad coverage, Plan G has one of the most expensive monthly premiums.

Here is a snapshot:

- $121.81 in the 28205 zip code in Charlotte, NC, with a range of $86.46 to $121.81 per month

- $163.81 in the 80231 zip code in Denver with a range of $126.48 -$219.67 per month

What Is A Preferred Provider Organization

Another type of Medicare Advantage plan is a Preferred Provider Organization, more commonly known as a PPO plan. With this type of managed care, you’ll have the flexibility to choose any primary or specialty medical provider you’d like to see, including hospitals, regardless of network availability.

In other words, you won’t need to choose a PCP like you would with an HMO, and referrals aren’t necessary for you to see specialists like an internist or oncologist.

PPO plans also normally provide coverage for your prescription drugs. Review the plan’s benefits or simply look for one labeled as an MA-PD if you prefer to bundle your Parts A, B, and D benefits in a single plan.

In terms of cost with a PPO, you will pay less for your medical care if you go to an in-network, or “preferred” provider for your healthcare needs. But unlike an HMO, you can go to an out-of-network provider and still have your care covered, you’ll just pay a higher co-pay. You may also find that monthly premiums are higher, given that coverage under a PPO is more comprehensive and offers a larger provider range than many HMO plans.

Don’t Miss: How To Check Medicare Status Online

How Much Does A Medigap Plan Cost

It depends! Generally, the more coverage on a plan, the higher the cost. But prices also vary depending on the insurance company, where a beneficiary is located, and how many other people are on that plan in your area. Again, every plan must cover the same benefits by law, so shopping around can save you money.

Whats The Purpose Of A Medigap Policy

With Original Medicare, you pay the deductibles, copays, and 20% for services you receive from doctors. Medicare Supplement plans can pay some or all of these costs for you. They supplement or fill the gaps in Original Medicare. If Medicare doesnt cover the service, then generally your Medicare Supplement plan doesnt cover the costs either and you would pay for those services yourself.

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

In general, Medicare plans are individual plans and only cover one person per policy. This is a great advantage since a husband and wife with different needs can have different plans. They are able to pick the plan that is right for them.

Recommended Reading: How Much Do Medicare Supplements Increase Each Year