Levels Of Medicaid Coverage

Full dual eligible coverage

Qualifications for Medicaid vary by state, but, generally, people who qualify for full dual eligible coverage are recipients of Supplemental Security Income . The SSI program provides cash assistance to people who are aged, blind, or disabled to help them meet basic food and housing needs. The maximum income provided by the federal government for SSI in 2020 is $783 per month for an individual and $1,175 per month for a couple.2

To qualify for SSI, you must be under a specified income limit. Additionally, your assets must be limited to $2,000 for an individual and $3,000 for a couple.3 Qualifying assets typically include things like checking and savings accounts, stocks, real estate , and vehicles if you own more than one.

Partial dual eligible coverage

Individuals who are partial dual eligible typically fall into one of the following four Medicare Savings Program categories.

| Program | ||

|---|---|---|

|

Monthly income limit: $1,456 for an individual, $1,960 for a coupleResource limit: $7,860 for an individual, $11,800 for a couple |

Helps pay for Part B premiums |

|

|

Qualified Disabled Working Individual Program |

Monthly income limit: $4,339 for an individual, $5,833 for a coupleResource limit: $4,000 for an individual, $6,000 for a couple |

Pays the Part A premium for certain people who have disabilities and are working |

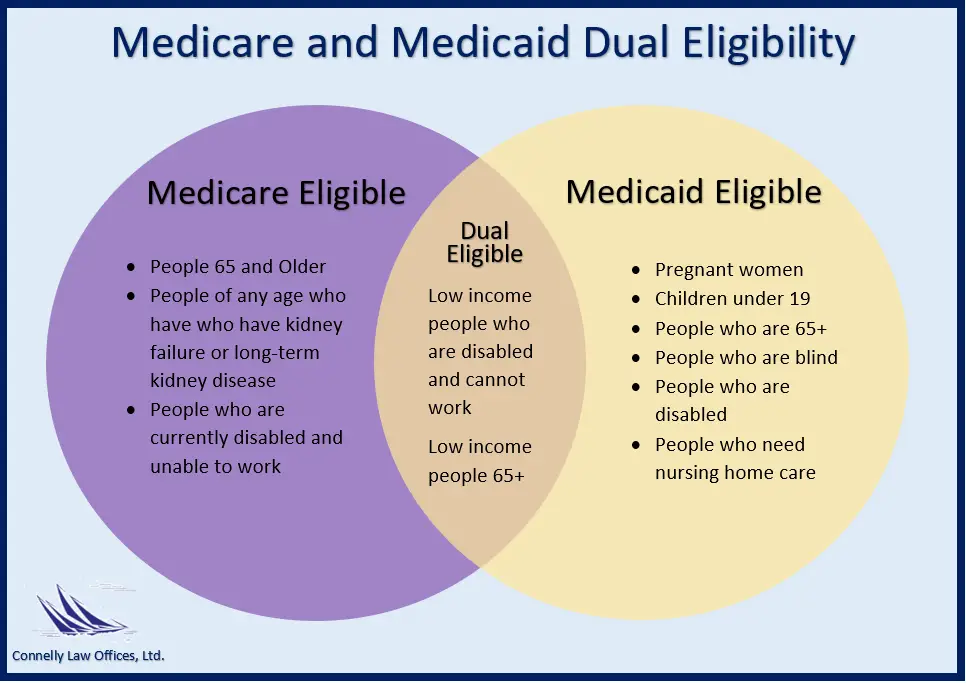

Who Are The Dual

People who are dual-eligible for Medicare and Medicaid are referred to as dual-eligible beneficiaries. Moreover, each state determines Medicaid coverage, and as a result, Medicaid benefits may differ.

Receiving both Medicare and Medicaid can assist in lowering healthcare expenditures for individuals who are in need.

According to general practice, Medicare pays for healthcare services first, with Medicaid covering any gaps that exist up to Medicaids payment flexibility limits.

According to an article in the journal Health Affairs, an estimated two-thirds of those who are dual-eligible meet the standards for Medicare based on age. The remaining one-third of dual-eligible people meet the criteria due to a disability.

There are a few main distinctions between Medicare and Medicaid.

Can I Have Both

Yes, you can have both. When you get treatment, Medicare will cover what it can, and then Medicaid will cover as much as it can for the remaining costs.

You may also enroll in a Medicare Advantage Dual-Eligible Special Needs Plan , which allows you to have all the benefits of Medicare Advantage while also allowing you to get the extra coverage to meet your financial needs. You dont have to pay to join, and prescription drug coverage will be built into the plan.

Recommended Reading: How To Qualify For Extra Help With Medicare Part D

What Year Are You Eligible For Medicare

A: In most cases, you are eligible for Medicare at age 65. However, you may be eligible prior to your 65th birthday if you are diagnosed with End-Stage Renal Disease or Lou Gehrigs disease, or if youve been receiving Social Security disability insurance for two years. Read more about eligibility for Medicare.

What Are Dual Health Plans

![Medicare vs. Medicaid [INFOGRAPHIC] Medicare vs. Medicaid [INFOGRAPHIC]](https://www.medicaretalk.net/wp-content/uploads/medicare-vs-medicaid-infographic.png)

Dual health plans are designed just for people who have both Medicaid and Medicare. Theyre a special type of Medicare Part C plan. Dual health plans combine hospital, medical and prescription drug coverage. Youll keep all your Medicaid benefits. Plus, you could get more benefits than with Original Medicare. And you could get it all with as low as a $0 plan premium.

View the “Do I Lose My Medicaid Benefits?” article.

Recommended Reading: What Medicare Plans Do I Need

Who Can Get Medicaid

- Depending on your income, household size, disability, family status, and other characteristics, you may be eligible for Medicaid in any state. However, if your state has expanded Medicaid coverage, you may be able to qualify solely based on your income.

- Enter the size of your family and your location. Well tell you who qualifies for Medicaid, if your state has expanded Medicaid, and if you qualify solely based on your income.

- You can create an account and apply for Medicaid through the Marketplace if you believe you are eligible. Well send your information to your state agency if it appears that anyone in your home qualifies for Medicaid or CHIP. Theyll get in touch with you about enrolling. You can submit your application at any time of the year.

- If you dont qualify for Medicaid, well let you know if youre eligible for financial assistance to purchase a Marketplace health plan.

What Is The Texas Health Information Counseling And Advocacy Program

If you are eligible for Medicare, the Texas’ Health Information, Counseling and Advocacy Program can help you enroll, find information and provide counseling about your options. This partnership between the Texas Health and Human Services system, Texas Legal Services Center and the Area Agencies on Aging trains and oversees certified benefits counselors across the state.

Also Check: Does Medicare Cover Full Body Scans

Medicaid And Medicare: An Overview

Both SSA disability programs have health insurance programs associated with them. For SSI it is Medicaid for SSDI it is Medicare which begins two years after the date of eligibility. Establishing eligibility for SSI or SSDI can be key to connecting with Medicaid or Medicare health insurance.

For Those Who Qualify There Are Multiple Ways To Have Your Medicare Part B Premium Paid

In 2021, the standard Medicare Part B monthly premium is $148.50. Beneficiaries also have a $203 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

These Part B costs can add up quickly, which is why many beneficiaries search for a way to lower or be reimbursed for these expenses. The good news is they have options that can help maximize their savings while on Medicare.

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

Read on to learn about Part B savings options that you may be able to take advantage of.

Read Also: Does Aetna Medicare Advantage Have Silver Sneakers

Can You Have Both Medicare And Medicaid

Yes, some people can have both Medicare and Medicaid. People who qualify for both Medicare and Medicaid are called dual eligible. If you qualify and choose to enroll in both programs, the two can work together to help cover most of your health care costs. You may also be eligible for a special kind of Medicare Advantage plan called a Dual Special Needs Plan. You can learn more about being dual eligible and how Medicare coverage can work for you here.

Gentle music plays as two speech bubbles with text appear over a blue background.

ON SCREEN TEXT: Medicare Conversations Dual Special Needs Plans…

A question appears beside a yellow circle labeled DSNP.

ON SCREEN TEXT:What is a Dual Special Needs Plan ?

A woman with light brown hair sits in a white chair as she interviews.

A pile of books sits on an end table beside her.

ON SCREEN TEXT: Holly Martin, Dual Special Needs Expert

ON SCREEN TEXT: Medicare Made Clear® by UnitedHealthcare®

HOLLY: Hello, everyone. I’m Holly Martin and over the last several years, I have worked on bringing education and awareness to Dual Special Needs Plans.

A circle labeled DSNP appears with text, then another DSNP circle appears with a blue circle.

A final circle appears with an animated woman in front of it.

ON SCREEN TEXT: What they are Why they are different Who is eligible

So, let’s go ahead and get started.

A question appears beside two circles, one labeled Medicaid, the other labeled Medicare.

Can I Have A Medicare Advantage Plan With Medicaid

In a growing number of counties, there are Medicare Advantage plans specifically designed for by private insurance companies for Medicare beneficiaries who also qualify for Medicaid. They are called Medicare Advantage Special Needs Plans, or just SNP for short. These unique plans take into account the special needs of low-income seniors in the region they serve and do not have the same cost-sharing requirements as normal Medicare Advantage plansMedicare Advantage , also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare …..

Some smaller, rural counties may not have SNP plans but will have a local Medicaid plan. You will need to call your local Medicaid office to learn more. Typically Medicaid coverage offers many more benefits than Original Medicare alone.

Recommended Reading: What Is Retirement Age For Medicare

Unitedhealthcare Senior Care Options Plan

UnitedHealthcare SCO is a Coordinated Care plan with a Medicare contract and a contract with the Commonwealth of Massachusetts Medicaid program. Enrollment in the plan depends on the plans contract renewal with Medicare. This plan is a voluntary program that is available to anyone 65 and older who qualifies for MassHealth Standard and Original Medicare. If you have MassHealth Standard, but you do not qualify for Original Medicare, you may still be eligible to enroll in our MassHealth Senior Care Option plan and receive all of your MassHealth benefits through our SCO program.

Medicare Services & Fees

Eligible recipients of Medicare have a choice. They may enroll into either Original Medicare or into a private health plan known as Medicare Advantage . All plans cover the same basic Medicare-covered health services, but there are differences in premiums, deductibles, coinsurance and provider networks. People should carefully consider their own situations before choosing. If their needs change, people may also change plans during the Open Enrollment period each year.

People enrolling in Original Medicare should also consider enrolling in a stand-alone Prescription Drug Plan , also known as Part D, to cover their outpatient prescription drugs. Most Medicare Advantage Plans already cover prescription drugs.

Below is more detail on coverage provided by Medicare parts A, B, C and D:

Original Medicare members can also enroll in Medicare Supplement Insurance, also called Medigap, which fills in the gaps not covered by Original Medicare. Medigap is offered by private, approved insurance companies. These plans pay for costs such as coinsurance, copayments and deductibles.

In Connecticut, a Medigap cannot be used as a stand-alone plan, and is designed to be used in combination with Parts A and B. These plans do not provide prescription drug benefits. The state offers up to 10 standardized policy options, each labeled with a letter. All plans of the same letter offer the same benefits, no matter which insurance company offers the plan.

Don’t Miss: When Can You Start Collecting Medicare

% California Working Disabled Program

The 250% California Working Disabled program helps Californians who are working, disabled and have income too high to qualify for free Medi-Cal. Californians who qualify may be able to receive Medi-Cal by paying a small monthly premium based on their income. Premiums range from $20 to $250 per month for an individual or from $30 to $375 for a couple.

To qualify, you must:

Also learn about how AB 1269 made the California Working Disabled program event better. This bill was signed into law in 2009 and became effective August 2011.

All these CWD rules are explained in more detail in the Medi-Cal section of the Disability Benefits 101 website.

How Do I Qualify For Medicare And Medicaid Programs

Luckily for many, the qualifications outlined by Medicare and Medicaid are cut-and-dry, meaning youll have a great understanding of whether youre eligible before you begin the application process. Those who are eligible for Medicares services typically tend to be at least 65 years old. However, you may also qualify for Medicare before the age of 65 if you have been receiving Social Security disability for 24 months, have Lou Gehrigs disease or end-stage renal disease.

Those who have already been receiving Social Security benefits are automatically enrolled in Medicare Parts A and B upon the month they turn 65. Additional coverage options will then be made available for those who are interested. Those who need to manually enroll themselves into a Medicare program can do so through the Social Security Administration . They can enroll through the SSA website, calling 1-800-772-1213 or by visiting their local Social Security office.

After becoming a part of the Medicare program, enrollees can expect to receive welcome packages with their new Medicare card, also known as the Red, White & Blue Card, included. Its important to keep this card close so that you can protect yourself from Medicare fraud, as well as those who could scam you, as many seniors fall victim to scams as it relates to Medicare.

Recommended Reading: How Do I Check On My Medicare Part B Application

How Do I Know If I Qualify For Medicaid And Medicare

Twelve million individuals are currently enrolled in both Medicaid and Medicare.1 These individuals are known as dual eligible beneficiaries because they qualify for both programs. As long as you meet the federal qualifications for Medicare eligibility and the state-specific qualifications for Medicaid eligibility, you will qualify as a dual eligible. To qualify for Medicare, individuals generally need to be 65 or older or have a qualifying disability.

There are several levels of assistance an individual can receive as a dual eligible beneficiary. The term full dual eligible refers to individuals who are enrolled in Medicare and receive full Medicaid benefits. Individuals who receive assistance from Medicaid to pay for Medicare premiums or cost sharing* are known as partial dual eligible.

*Cost sharing is the amount of your health care that you pay out of your own pocket. Typically, this includes deductibles, coinsurance, and copayments.

Get Important News & Updates

Sign up for email and/or text notices of Medicaid and other FSSA news, reminders, and other important information. When registering your email, check the category on the drop-down list to receive notices of Medicaid updates check other areas of interest on the drop-down list to receive notices for other types of FSSA updates.

Also Check: How Much Does Medicare Pay For A Doctors Office Visit

What Is The Medicare Savings Program

There are four types of Medicare Savings Programs:

- Qualified Medicare Beneficiary Program

- Specified Low-Income Medicare Beneficiary Program

- Qualifying Individual Program

- Qualified Disabled and Working Individuals Program

If you answer yes to these 3 questions, to see if you qualify for assistance in your state:

If you qualify for the QMB program, SLMB, or QI program, you automatically qualify to get Extra Help paying for Medicare drug coverage.

Medicaid Part B Reimbursement Options

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.

Recommended Reading: Should I Get Medicare Supplemental Insurance

Paying For Your Health Care

Generally speaking, Medicare pays first and Medicaid pays second. What costs Medicare leaves on the table can oftentimes be taken care of by Medicaid. The amount paid by Medicaid, however, has a limit that is set by each state.

Medicare Savings Programs, if you qualify for one, can help cover additional costs.

For those who qualify for the QMB program: Medicaid will pay your Medicare costs, including Part A premiums, Part B premiums, deductibles, coinsurance, and copayments. This is the case even if a Medicare service is not usually covered by Medicaid or if you see a healthcare provider who does not accept Medicaid for payment.

For those who qualify for other Medicare Savings Programs: These programs also reduce out of pocket costs but are not as extensive in their benefits. In this case, states do not have to pay if the Medicare service is not also a Medicaid service or if the beneficiary saw a Medicare provider who is not also a Medicaid provider.

What Is A Medicaid Waiver Program

The Medicaid waiver program is one of many ways that Medicare and Medicaid work together to meet the healthcare needs of beneficiaries.

Section 1915 of the Social Security Act describes a waiver program that authorizes home and community-based services to provide health and other basic necessities to people who would otherwise be cared for in a long-term care facility.

A community-based program, in this case, isnt a nursing home. It refers to care you might receive in a family member or caregivers home, assisted living facility, senior care home, or similar residential setting.

With this program, you may be eligible to have a home health aide, personal care aide, or homemaker assist you with activities of daily living.

Healthcare professionals may also provide services like rehabilitation with a physical therapist or speech and language pathologist. Transportation, meal delivery, and adult day care services may also be included.

Because Medicaid is run by state governments, each states waiver program operates differently. States cannot target specific populations to receive these benefits, but they are allowed to target different health conditions in the waiver program.

Some of the commonly covered conditions in HCBS programs include:

Also Check: Do Medicare Advantage Plans Have Dental Coverage

Dual Eligible Special Needs Plans

In some states, dual eligible beneficiaries may have the option of enrolling in a D-SNP, which is different from a traditional SNP or Special Needs Plan. These plans are specially designed to coordinate the care of dual eligible enrollees. Some plans may also be designed to focus on a specific chronic condition, such as chronic heart failure, diabetes, dementia, or End-Stage Renal Disease. These plans often include access to a network of providers who specialize in treating the specified condition. They may also include a prescription drug benefit that is tailored to the condition.