How Do You Shop And Compare Medicare Supplement Plans

Researching the plan thats right for you is key to getting the coverage you need. Each plan offers specific benefits depending on your state, which benefits you desire, and the costs.

Step 1: Determine if You Are Eligible to Enroll

In general, if you’re approaching your 65th birthday, but you haven’t started taking Social Security benefits yet, you are eligible for Medicare.

The best time to buy a Medicare Supplement policy is during your Initial Medicare Open Enrollment Period. This is a one-time only, six-month span when federal law allows you to sign up for any Medicare Supplement policy you want that is sold in your state. Preexisting conditions are accepted during this time period, and you can’t be denied a Medicare Supplement policy or charged more due to past or present health problems. Make sure you know when your Open Enrollment Period starts.

Step 2: Find a List of Medicare Supplement Plans Available in Your State or ZIP Code

Using the tool available on Medicares website, you can search for coverage plans based on your location.

Step 3: Determine Which Aspects of Coverage Are Most Important to You

Perhaps you are concerned about out-of-pocket copays or high deductibles or you have a preexisting condition and want to know if there is a waiting period for coverage for it. Be sure to check each plan for the details that matter most to you.

Step 4: Compare the Difference in Cost Among Medicare Supplement Plans

Step 5: Consider Talking to a Broker or Consultant

Online Access To Your Plan

myCigna.com gives you 1-stop access to your coverage, claims, ID cards, providers, and more. Log in to manage your plan or sign up for online access today.

Accidental injury, critical illness, and hospital care.

Controlling costs, improving employee health, and personalized service are just a few of the ways we can help your organization thrive.

Use Cigna for Brokers to access everything you need to manage your business and complete enrollments.

Humana Medicare Supplement Insurance Plans

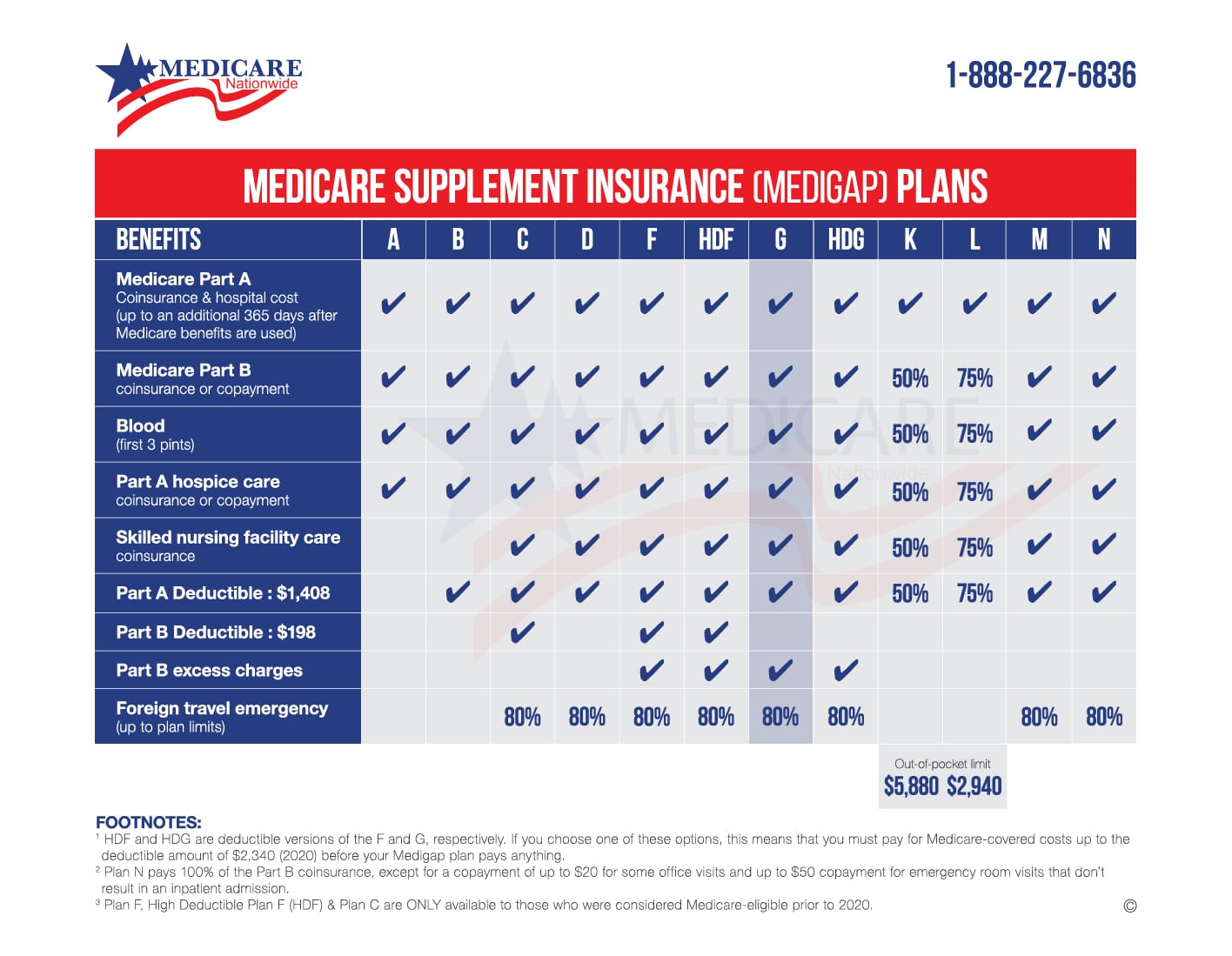

In most states*, policies are standardized into plans labeled A through N. All policies cover basic benefits, but each has additional benefits that vary by plan.

Medicare Supplement insurance plans A through G generally provide benefits at higher premiums with limited out-of-pocket costs compared to plans K through N. Plans K through N are cost-sharing plans offering similar benefits at lower premiums with greater out-of-pocket costs. Some companies may offer additional innovative benefits.

Effective Jan. 1, 2020, plan options C, F and High Deductible Plan F are only available for purchase by applicants first eligible for Medicare prior to 2020.

Recommended Reading: Is Silver Sneakers Available To Anyone On Medicare

Best Set Pricing: Aarp

-

Must join AARP to enroll

-

Need birthday and current Medicare information for price details

-

No link to Medicare Supplement coverage from the main website

AARP is a nonprofit, nonpartisan membership organization that helps people who are ages 50-plus with a variety of services and information. One of the most trusted names for retirees and other seniors, the organization boasts 38 million members and is insured through UnitedHealthcare, which earns an A rating from AM Best for financial strength.

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesnt charge more as you grow older. This is especially helpful if you are still covered under your employer’s insurance and may require coverage after the age of 65.

AARP covers Parts A, B, C, F, G, K, L, and N, though its important to note that plans C and F are only available if you were enrolled in Medicare before January 2020. You can get pricing information easily by entering your ZIP code, and there’s a Spanish language website as well.

Whats The Purpose Of Medigap

With Original Medicare, you pay the deductibles, copays, and 20% for services you receive from doctors. Medicare Supplement plans can pay some or all of these costs for you. They supplement or fill the gaps in Original Medicare. If Medicare doesnt cover the service, then generally your Medicare Supplement plan doesnt cover the costs either and you would pay for those services yourself.

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

In general, Medicare plans are individual plans and only cover one person per policy. This is a great advantage since a husband and wife with different needs can have different plans. They are able to pick the plan that is right for them.

Recommended Reading: Is Passport Medicaid Or Medicare

Medicare Supplement Insurance Explained

by Christian Worstell | Published April 26, 2021 | Reviewed by John Krahnert

Medicare Supplement Insuranceis private insurancethatcan help cover some of the out-of-pocket costs that Original Medicare does not, such as copayments, coinsurance and deductibles. Comparing Medicare Supplement Insurance plans can help you find the right policy for your health care needs.

Things To Know About Medigap Policies

Having Medicare Part A and Part B is a requirement.

Medigap insurance is not the same as a Medicare Advantage plan. Medigap policies are meant to supplement your Original Medicare benefits, not to replace them.

You pay a monthly premium to a private insurance company for your Medigap plan. Besides the monthly Part B fee that Medicare charges, you must also pay an additional monthly premium.

Only one individual is covered by Medigap coverage. To get Medigap coverage, you and your spouse will need to acquire separate policies.

A Medigap coverage can be purchased from any insurance company that is authorized to do business in your state.

Even if you have a pre-existing medical condition, regular Medigap coverage is assured to be renewed. As long as you continue to pay your premiums, your Medigap policy will be unaffected.

Drugs were covered by some Medigap policies that were previously sold. However, from January 1, 2006, Medigap policies can no longer include prescription medication coverage. You can enroll in a Medicare Prescription Drug Plan if you need prescription drug coverage . In some cases, you may be required to pay two premiums if you purchase Medigap and Medicare prescription coverage from the same provider. Find out how to pay your insurance premiums by contacting the company.

If youre enrolled in a Medicare Advantage Plan, no one can sell you a Medigap policy unless youre going back to your Original Medicare.

Read Also: Is The Medicare Helpline Legit

What Should I Know About Medicare Supplement Insurance Policies

Medicare Supplement insurance policies have grown more popular over the years. According to the American Association for Medicare Supplement Insurance, there were 14.5 million individuals with a Medigap policy in 2020.1

Those who are interested in a Medicare Supplement insurance policy have many options available to them. They are sold by private insurers, and buyers have numerous insurance companies to choose from.

Those who are eligible for Medicare effective January 1, 2020 and after have a choice between ten different Medicare Supplement plans. These plans are standardized across companies, except in Massachusetts, Minnesota, and Wisconsin where Medicare Supplement insurance plans are standardized in a different way.2 With a variety of coverage and premium options available, an individual is likely to find a plan to fit their needs.

Does Plan F Cover Dental

Original Medicare doesnt cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you want dental coverage, you need to purchase a separate dental insurance plan. Also, many Medicare Advantage plans, which private insurance companies offer, provide dental coverage, so thats another option.

Don’t Miss: How Much Does Medicare Part B Cost At Age 65

Choosing My Type Of Medicare Coverage

Your first decision when it comes to health coverage after 65 is between Original Medicare and Medicare Part C.

Original Medicare covers most hospital and doctor expenses. The balance is left to you, with no cap on how high your out-of-pocket costs can go.

Original Medicare allows you to see any doctor in the U.S. who accepts Medicare. It provides excellent flexibility: it has no networks or referral requirements.

Medicare Part C bundles hospital, doctor and drug coverage. It covers most of those expenses, but you pay deductibles, copayments, and coinsurance. Medicare Advantage plans cap out-of-pocket expenses.

Medicare Advantage is all-encompassing, even offering dental and vision coverage . But, you are limited to its doctor network and need referrals to see specialists.

How Do I Know If Im Eligible For A Medigap Policy

To buy a Medigap policy, you generally must have Medicare Part A and Part B. You are guaranteed the right to buy a Medigap policy if you are in your Medigap open enrollment period or covered under a Medigap protection. You might not be able to buy a Medigap policy if you are in a Medicare Advantage Plan, have Medicaid, already have a Medigap policy or are under the age of 65 and you are disabled or have End-Stage Renal Disease.

Also Check: How Many Parts Medicare Has

How Does Medicare Supplement Insurance Work With Medicare

Medicare Supplement Insurance works with Original Medicare Parts A and B. If you choose to buy a standalone Part D Prescription Drug plan, Medicare Supplement works with that, too.

Medicare Supplement Insurance is different from Medicare Advantage. You can have either a Medicare Advantage Plan or a Medicare Supplement Plan, but not both at the same time.

Medicare Supplement Insurance Comparison

Comparing Medicare Supplement plans side by side is a great way to determine which plans cover the services you use the most.

Each type of Medigap plan covers four standard benefits:

- Part A coinsurance and hospital costs

- Part B coinsurance or copayment

- Your first three pints of blood

- Part A hospice care coinsurance or copayment

Each type of plan may also cover one or more of these five additional benefits:

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B excess charge

- Foreign travel exchange

The chart below illustrates all possible benefits covered by Medicare Supplement Insurance and which plans cover them.

| 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,490 in 2022. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,620 in 2022. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

Also Check: How To Get Medical Equipment Through Medicare

Medicare Replacement Plan Vs Medicare Supplement Policy

Private Medicare insurance plans come in a variety of flavors. And among them are Medicare replacement plans and Medicare Supplement Insurance . So whats the difference between these two types of plans?

Income Disclosure: I recommend products based on my personal experience working with seniors. I may earn a commission on items purchased from affiliate links in this guide. Learn More.

The short answer is that a Medicare Advantage plan replaces your Original Medicare coverage hence the term replacement plan while a Medicare supplement plan supplements your Original Medicare benefits.

To put it another way, Medicare Advantage is used in place of Original Medicare, while a Medicare Supplemental plan is used on top of Original Medicare.

This can be a complicated distinction that can have a big impact on your health care spending. Lets further explore the differences.

How Can I Learn More About Medicare Enrollment Periods

Learning about different enrollment periods for Medicare Supplement Insurance, Medicare Advantage, and Original Medicare can be overwhelming and it’s hard to know which rules apply to you.

The official government Medicare website is a good source of information for enrollment periods and other topics like Medicare Advantage plans and Part D drug coverage.

You can also visit PolicyScouts Medicare Hub to learn more about Medicare in general, a specific Medicare Advantage plan, and Medicare Supplement Insurance plans.

Weve made it our mission to make health care insurance and coverage easy to understand for everyone.

If you would like to learn more about the federal Medicare program, a Medicare Advantage plan in your area, or your health coverage options, reach out to one of our consultants by telephone or send us an .

- Estimate potential prescription cost with online tool

- Compare plans in as little as 60 seconds

- over 700 employees nationwide

Also Check: What Is Part B Excess Charges In Medicare

How Does Medigap Serve Or Help Me

Medicare coverage lasts for the rest of your life. As you age, doctor visits and hospitalizations may increase. But, it is impossible to project your future healthcare needs.

Medigap policies work hand-in-hand with Original Medicare to limit your exposure to unexpected out-of-pocket medical costs. You decide how much you want to be covered and what premium you want to pay.

Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020. There are high deductible versions of Plans F and G..

These 8 plans are standardized, which means that benefits will be the same no matter which company sells the policy to you. Plan A is the basic benefit package. Plan A from one company is the same as Plan A from another company. Since Medicare Supplement policies are standardized, you are free to shop for the company with the best price and customer service. To see what benefits are offered with each plan,.

Generally, Medicare Supplement policies pay most, if not all, Medicare copayment amounts, and policies may pay Medicare deductible amounts except for the Part B deductible. Although the benefits are the same for each standard plan, the premiums may vary greatly. Before purchasing a supplement policy, determine how the company calculates its premiums.

An insurance company can calculate premiums one of three ways.

- Issue Age: If you were 65 when you bought the policy, you will pay the same premium the company charges people who are 65 regardless of your age.

- Attained Age: The premium is based on your current age and will increase as you grow older.

- No Age Rating: Everyone pays the same premium regardless of age.

Don’t Miss: Where Do I Get A Medicare Card

Medigap Guaranteed Issue Rights

You may qualify for guaranteed issue in specific situations outside the Medigap open enrollment period by federal law. For example, if:

- You no longer have coverage because your Medigap insurance company went bankrupt

- Your employer-sponsored supplemental/retiree coverage is ending

- Your Medicare Advantage Plan or PACE withdraws from your area, you moved to a new place not covered by your plan, or you chose to withdraw from a plan during the trial period.

- You choose to drop your Medicare Advantage plan within 12 months of enrolling.

- You choose to drop your Medigap or Medicare Advantage coverage because your insurance company broke rules or misled you.

Some states go beyond the federal requirements regarding Medigap guaranteed issue rights. For example, states such as New York and Connecticut require insurance companies to accept Medigap applications at any time throughout the year insurance companies are not allowed to charge more for a policy due to an applicants health.

Standardized Medicare Supplement Plans

Screenshot from “Choosing a Medigap Policy,” July 8, 2019.

As you can see in the table above, Medicare Supplement insurance plans can cover the following costs:

-

Part A – coinsurances and hospital costs, hospice care coinsurance or copayment, and the Part A deductible

-

Part B – coinsurances or copayments, the Part B deductible, and any Part B excess charges

-

Skilled nursing facility coinsurance

-

The first three pints of blood for transfusions

-

Emergency medical costs during foreign travel

No Medicare Supplement plan covers prescription drugs. Youll have to enroll in Medicare Part D for drug coverage.

Plan A

Plan A is the standard Medicare Supplement plan. All other plans build upon the benefits offered by Plan A, adding other benefits or modifying the coverage amounts.

Like all Medigap plans, Plan A covers Medicare Part A coinsurances and hospital costs 100%. That means you wont pay anything for Part A costs.

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

Best for: People who are looking for the lowest cost and the lowest level of coverage, especially those who dont pay the Medicare Part A deductible and can comfortably afford the Part B deductible.

Plan B

Plan B covers everything Plan A covers. It also covers 100% of the Medicare Part A deductible.

Plan C

Plan D

Also Check: Does Humana Offer A Medicare Supplement Plan

Find Cheap Medicare Plans In Your Area

Medicare Supplement policies, also called Medigap, can provide peace of mind and simplify your expenses. Without a Medigap plan, Original Medicare policyholders will find that tracking deductibles can be cumbersome and paying for regular medical treatment out of pocket can be expensive. Furthermore, you may find that there are many different unexpected costs associated with your care.

For 2022, the average cost of a Medicare Supplement plan is $163 per month. However, rates can vary widely from $50 to more than $400 per month.

To get a Medicare quote over the phone, call 855-915-0881 TTY 711 to speak with a licensed agent today!

Agents available Monday-Friday 9am-8pm EST