When To Pay For Part C Part D And Medigap

Medicare Part C, Part D, and Medigap are all purchased from private insurers. The way youre billed for monthly premiums may vary based on your insurer. In some cases, you may receive a monthly bill. Other insurers may give you the option of paying quarterly.

Medicare Advantage plans may or may not have a monthly premium. This is determined by the plan you choose. Medicare Part D and Medigap plans typically do have monthly premiums.

Once you start receiving Social Security benefits, the monthly premiums for your Part C, Part D, or Medigap plan can be deducted from your benefits. However, this process isnt automatic youll need to contact the plan provider to set up automatic payment.

It may take 3 months or longer until your premiums begin to be automatically deducted from your Social Security benefits. Talk with your plan provider to find out whether you should continue to pay your usual premium amount during this time or withhold payment.

Sometimes, not paying during this lag time may result in a large, single withdrawal of benefit funds the first time your premiums are deducted.

You can pay your Medicare bill in several ways. Well go over how to pay for each part of Medicare in the sections below.

Medicare Part A Costs Are Not Affected By Your Income Level

Your income level has no bearing on the amount you will pay for Medicare Part A . Part A premiums are based on how long you worked and paid Medicare taxes.

Medicare Part A premium costs in 2021 are as follows:

2021 Medicare Part A Premium Cost|

Number of quarters you paid Medicare taxes |

2020 Medicare Part A monthly premium |

|

40 or more |

|

|

$471 |

Most Part A beneficiaries qualify for premium-free Part A coverage.

Two of the Medicare Savings Programs that may help pay Part A premium costs for qualified individuals include:

- Qualified Medicare Beneficiary Program

- Qualified Disabled and Working Individuals Program

Medicare Advantage and Medigap costs by income level

Medicare Part C plans and Medicare Supplement Insurance plans are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Recommended Reading: Do You Have Dental With Medicare

Ways To Pay Your Medicare Part B Premium

If youre like most people, you dont pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a Notice of Medicare Premium Payment Due . You will need to make arrangements to pay this bill every month.

If you are required to pay a Part D income-related monthly adjustment amount , you will also need a way to make your payment.

Help Paying Your Medicare Costs

To let you know you automatically quality for Extra Help, Medicare will mail you a purple letter that you should keep for your records. You don’t need to apply for Extra Help if you get this letter.

- If you aren’t already in a Medicare drug plan, you must join one to use this Extra Help.

- If you’re not enrolled in a Medicare drug plan, Medicare may enroll you in one so that you’ll be able to use the Extra Help. If Medicare enrolls you in a plan, you’ll get a yellow or green letter letting you know when your coverage begins, and you’ll have a Special Enrollment Period to change plans.

- Different plans cover different drugs. Check to see if the plan you’re enrolled in covers the drugs you use and if you can go to the pharmacies you want.

- If you have Medicaid and live in certain institutions or get home and community based services, you pay nothing for your prescription drugs.

Drug costs in 2020 for people who qualify for Extra Help will be no more than $3.60 for each generic drug and $8.95 for each brand-name drug. Look on the Extra Help letters you get, or contact your plan to find out your exact costs.

NOTE: When you apply for Extra Help, you can also start your application process for the Medicare Savings Programs. These state programs provide help with other Medicare costs. Social Security will send information to your state unless you tell them not to on the Extra Help application.

There are 4 kinds of Medicare Savings Programs:

Also Check: Why Is My First Medicare Bill So High

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259. |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203. After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Medicare Part A Costs

Most people are eligible for premium-free Part A. To be eligible, you or your spouse must have worked at least 40 calendar quarters and paid Medicare taxes during that time. If youre not eligible for premium-free Part A, you can choose to purchase it. The monthly premium cost for Part A ranges from $259 to $471 based on your work history.

You May Like: Who Must Enroll In Medicare

Ways To Sign Up For Medicare Easy Pay:

It can take up to 6-8 weeks for your automatic deductions to start. Until your automatic deductions start, you’ll need to pay your premiums another way. If you can’t process your Medicare Easy Pay request, we’ll send you a letter explaining why.

Contribute To Workplace Retirement Accounts

Workplace retirement accounts allow you to make contributions while working and then use them to pay for needs after retirement. Having money in a retirement account wont lower your premiums. However, it will help you afford healthcare premiums along with all your other living expenses. Itll feel like you reduce Medicare premiums when you have more money set aside for retirement.

You May Like: How To Get Medicare Insurance License

Who Doesn’t Have To Pay A Premium For Medicare Part A

A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you dont pay a premium for Part A.

You may also not have to pay the premium:

- If you havent reached age 65, but youre disabled and youve been receiving Social Security benefits or Railroad Retirement Board disability benefits for two years.

- You have end-stage renal disease and are receiving dialysis, and either you or your spouse or parent worked and paid Medicare taxes for at least 10 years. Coverage typically begins the first day of your fourth month of dialysis, but it can begin in your first month of dialysis if you use in-home dialysis treatment.

- You have amyotrophic lateral sclerosis and are eligible for Social Security Disability Insurance . Medicare coverage begins as soon as your SSDI begins, and Medicare Part A has no premiums as long as you or your spouse worked and paid Medicare taxes for at least 10 years.

How Do I Qualify For The Part B Premium Giveback Benefit

You may qualify for a premium reduction if you:

- Are enrolled in Medicare Part A and Part B

- Do not already receive government or other assistance for your Part B premium

- Live in the zip code service area of a plan that offers this program

- Enroll in an MA plan that provides a giveback benefit

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

Read Also: How To Change Primary Doctor On Medicare

Avoid Late Penalties By Signing Up When First Eligible

While avoiding penalties doesnt directly reduce Medicare premiums, it does prevent them from becoming higher. You can sign up for Medicare three months before your 65th birthday month. You then have a seven-month-long Initial Enrollment Period. Theres a financial motive to enroll during that time.

In general, if you wait and sign up for Part B later, you will pay a late enrollment penalty. Youll continue to pay the penalty each month for the rest of your life. You also face a late enrollment penalty if you dont enroll in a prescription plan when you are first eligible.

How Do I Get A Medicare Low

Many people dont realize theres a subsidy available to reduce Part D premiums and out-of-pocket costs for medications. People with Medicaid automatically qualify for the Extra Help subsidy.

However, you can obtain Extra Help, even if you dont qualify for Medicaid. When your income is low, a subsidy can help reduce Medicare premiums and other costs.

Also Check: Does Medicare Cover Chronic Pain Management

Medicare Premiums Deducted From Social Security Payments

If you have low income and receive Social Security assistance, you may receive premium-free Medicare.

Depending on your income, some people with Social Security benefits may still have to pay for Medicare. However, you can have your Medicare payments automatically deducted from your Social Security benefits.

You will receive a bill in the mail for your Medicare payments, unless one of the following applies to you:

- If you receive Social Security benefits, your payments may be automatically deducted from your benefits.

- If you receive Railroad Retirement benefits, your payments may be automatically deducted from your benefits.

- If you retire from civil services, your payments may be automatically deducted from your annuities

Once you receive your bill, there are a few ways you can pay it. You can pay directly through your bank , you can send in a check or money order, you can pay by debit or credit card by filling in the card information on your bill slip and mailing it back in, or you can sign up for Medicare Easy Pay, a free service which will automatically deduct the premium from your bank account.

Keep in mind that aside from your premiums, you may still have to pay copayments when you visit a doctor or other provider.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$504.90 |

There are several Medicare Savings Programs in place for qualified individuals who may have difficulty paying their Part B premium.

Medicare Part B includes several other costs in addition to monthly premiums. The 2021 Part B deductible is $203 per year.

After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Recommended Reading: What Is The Best Medicare Supplement Insurance Plan

When Do I Pay For My Medicare Premiums

If you enroll in Medicare before you begin collecting Social Security benefits, your first premium bill may surprise you. It will be due, paid in full, 1 month before your Medicare coverage begins.

This bill will typically be for 3 months worth of Part B premiums. So, its known as a quarterly bill.

If you have original Medicare , youll continue to receive bills directly from Medicare until you start collecting either Social Security or RRB benefits. Once your benefits begin, your premiums will be taken directly out of your monthly payments.

Youll also receive bills directly from your plans provider if you have any of the following types of plans:

- Medicare Part D, which is prescription drug coverage

- Medigap, also called Medicare supplement insurance

The structure of these bills and their payment period may vary from insurer to insurer.

Social Security and RRB benefits are paid in arrears. This means that the benefit check you receive is for the previous month. For example, the Social Security benefit check you receive in August is for July benefits. The Medicare premium deducted from that check will also be for July.

Medicare Savings Programs To Help Pay For Medicare Health Care Costs

You can get help from your state paying your Medicare premiums. In some cases, Medicare Savings Programs may also pay Medicare Part A and Medicare Part B deductibles, coinsurance, and copayments if you meet certain conditions. There are four kinds of Medicare Savings Programs:

- Qualified Medicare Beneficiary Program – helps pay for Part A and/or Part B premiums, and in addition Medicare providers aren’t allowed to bill you for services and items Medicare covers like deductibles, coinsurance, and copayments.

- Specified Low-Income Medicare Beneficiary Program – helps pay for Part B premiums.

- Qualified Individual Program – helps pay for Part B premiums and funding for this program is limited.

- Qualified Disabled and Working Individuals Program – helps pay for Part A premiums only.

If you qualify for a QMB, SLMB, or QI program, you automatically qualify to get Extra Help paying for Medicare prescription drug coverage.

Recommended Reading: Does Medicare Cover Any Weight Loss Programs

Do You Have To Apply For An Msp During Medicare’s Annual Election Period

No. You can apply for MSP assistance anytime. As noted above, youll do this through your states Medicaid office, which accepts applications year-round.

But the marketing and outreach before and during Medicares annual election period can be a good reminder to seek help if you need it. You might decide to make a change to your coverage during the annual open enrollment period, and simultaneously check with your states Medicaid office to see if you might be eligible for an MSP or Extra Help with your drug coverage.

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2021, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

You May Like: Is It Mandatory To Have Medicare Part D

Medicare Part B Costs

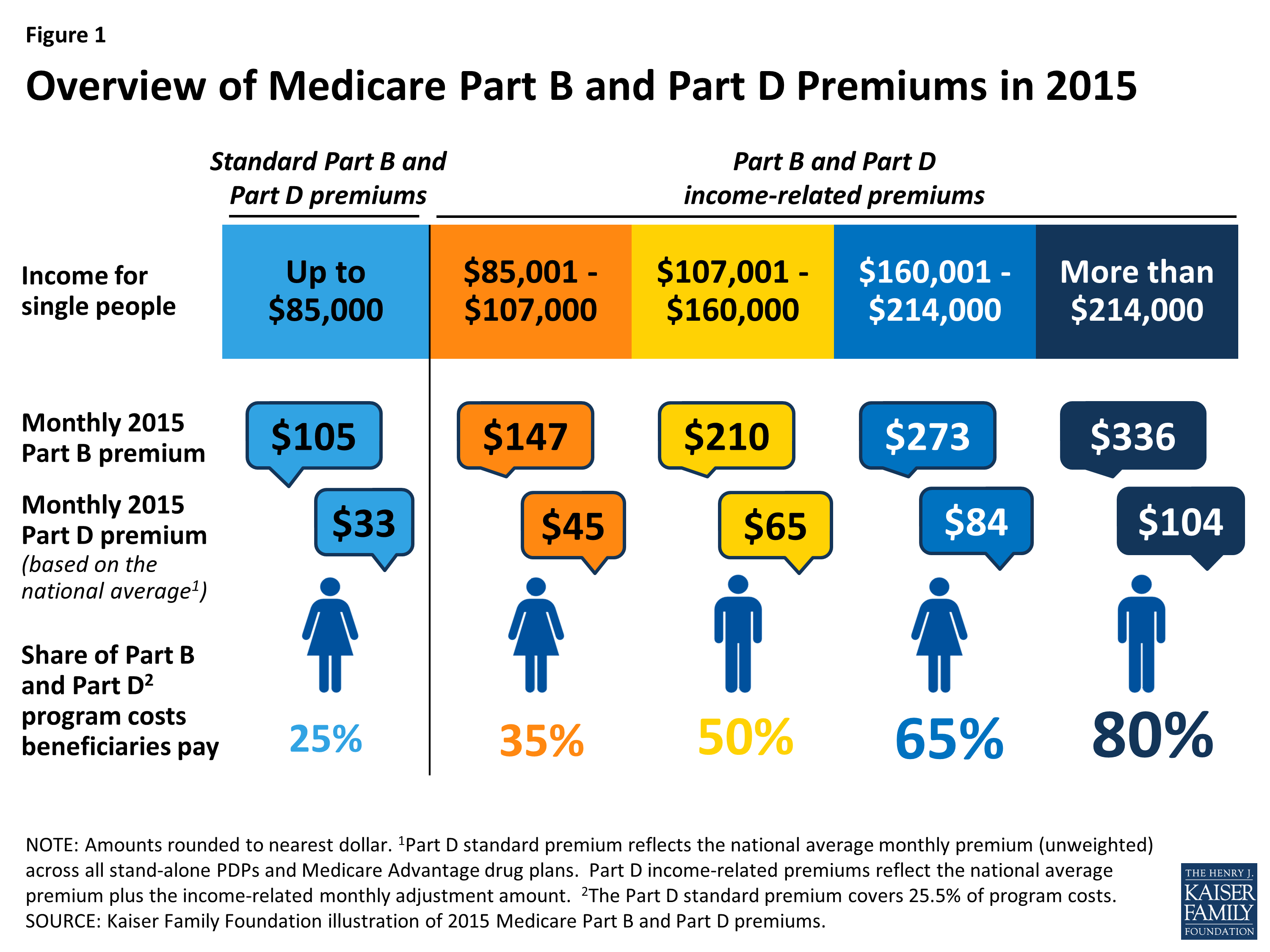

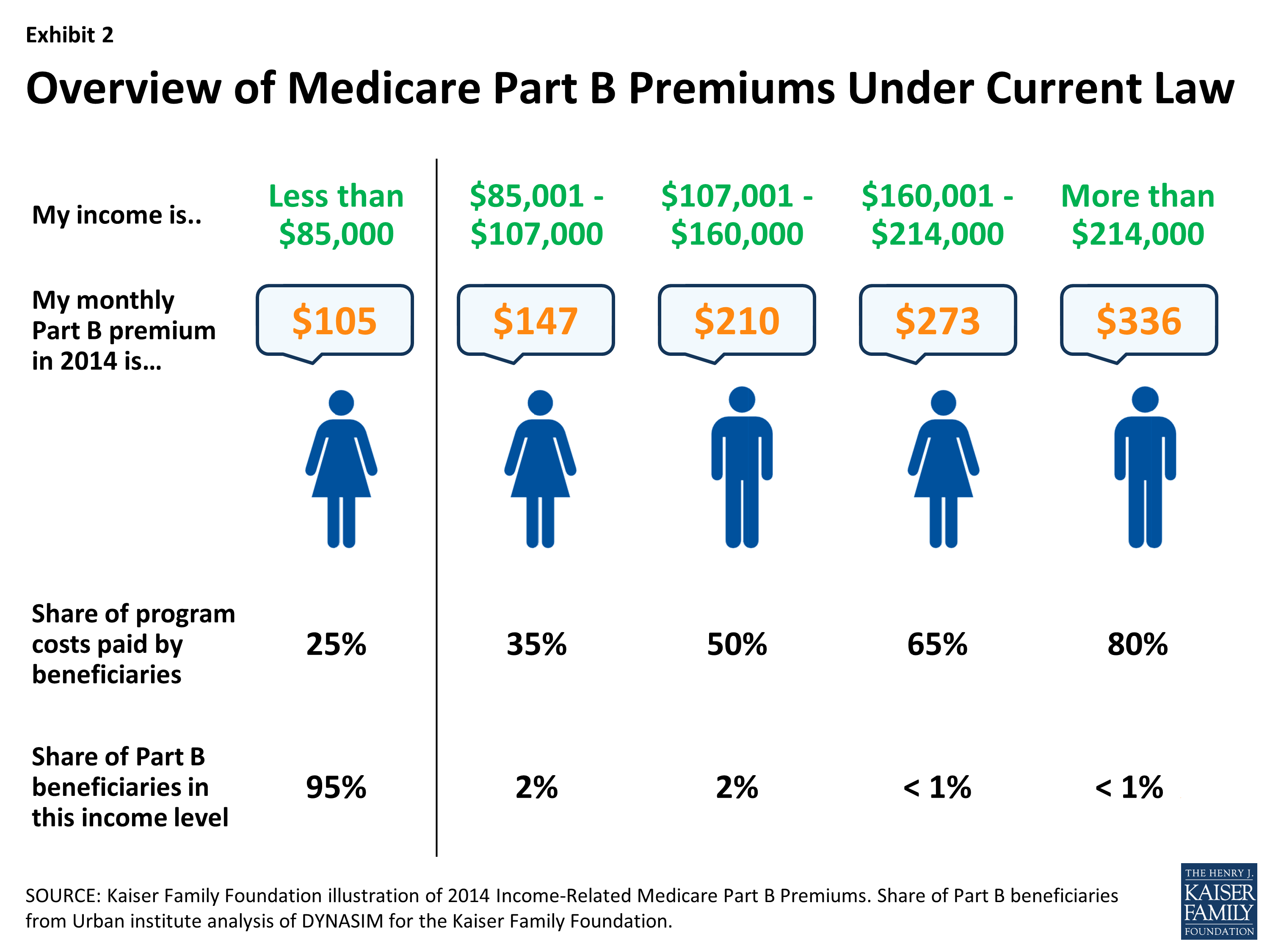

Most people pay the standard Part B premium. In 2021, that amount is $148.50.

If the modified adjusted gross income you reported on your taxes from 2 years ago is higher than a certain limit, though, you may need to pay a monthly IRMAA in addition to your premium. The maximum you can expect to pay for your Part B premium is $504.90 per month.

Medicare Part B also has out-of-pocket costs associated with it. These include an annual deductible of $203. After youve met your deductible, youll pay coinsurance on most services that Medicare Part B covers. This amount is 20 percent of the Medicare-approved costs of services and supplies.

Medicaid Part B Reimbursement Options

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.

You May Like: Does Medicare Cover Any Dental Surgery