When & How Do I Sign Up For Medicare

You can sign up anytime while you are still working and you have health insurance through that employer. You also have 8 months after you stop working to sign up.

- Your 8-month Special Enrollment Period starts when you stop working, even if you choose COBRA or other coverage thats not Medicare.

- Your coverage will start the month after Social Security gets your completed forms.

To qualify for the Special Enrollment Period, youll need to have your employer fill out a Form CMS-L564 . If the employer cant fill it out, complete Section B of the form as best you can, but dont sign it. Youll need to submit proof of job-based health insurance when you sign up. Forms of job-based health insurance proof:

The way you sign up depends on if you already have Part A coverage or if youre signing up for both Part A and Part B. Get forms and ways to sign up.

Avoid the penalty & gap in coverage

Do I Need Medicare If I Am Covered By My Spouse’s Insurance

If you have insurance through a spouse’s employer, you may also be able to delay Medicare past age 65. However, this depends on the rules the employer has for covered dependents of Medicare age. Some employers may require covered dependents to enroll in Medicare at age 65 in order to remain on the employer plan. In this case, you’ll need to talk directly with the employer’s benefits administrator to learn about what you can do about Medicare enrollment.

D Eligibility With Medicare

Once you are eligible for Medicare, you can decide which parts you want to sign up forParts A, B, C, or D.

Your first decision will be whether to opt for Original Medicare or a Medicare Advantage plan. You cannot have both. For clarification, Medicare Advantage plans offer everything that Parts A and B do but may provide additional benefits for an added cost.

In order to apply for Part D, you may enroll in Part A, Part B, or both. There is no option to apply for Part D alone.

Alternatively, you can choose to sign up for a Medicare Advantage plan. There are Medicare Advantage Prescription Drug Plans that include Part D coverage.

In summary, you will need to have one of these Medicare plans or combinations to be eligible for Part D coverage:

- Part D + Part A

- Part D + Original Medicare

- MA-PD

There are times you may be eligible for Medicare but are not allowed to enroll in a Part D plan. This occurs when you reside outside of the country or U.S. territories. When you return to the United States, you will be eligible to sign up. When you are incarcerated, you receive benefits from the prison system, not Medicare. You may enroll in Part D after you are released.

Don’t Miss: How Do I Find My Medicare Card Number Online

When You Can Change Or Cancel Your Plan

When you sign your contract, you are committing to pay monthly premiums through January 1 of the following year, so you cannot change or cancel your Part D plan whenever you want.

Not paying those premiums could result not only in loss of your prescription drug coverage but could also affect your credit history. But, Medicare recognizes that needs change.

The government allows you to change your plan once a year during the Open Enrollment Period and if you have a Medicare Advantage plan, and also during the Medicare Advantage Open Enrollment Period. They also allow you to make changes under special circumstances, when the Open Enrollment Period may be too far away.

Understanding when you can make these changes could save you money and get you Part D coverage that better meets your needs.

Open Enrollment Period

You can change your prescription drug coverage during the Open Enrollment Period every year from October 15 to December 7. During this time, you can swap Part D plans, change between Medicare Advantage plans with drug coverage, or switch from a Part D plan to a Medicare Advantage plan with drug coverage and vice versa. Since each of these options allows you to continue Medicare benefits uninterrupted, no late penalties will result with any of these changes.

Medicare Advantage Open Enrollment Period

Special Enrollment Periods

You have financial hardships.

You move to another address.

Your Part D plan changes.

You want a Five-Star plan.

How To Sign Up For Medicare Heres What You Need To Know

You can enroll in Medicare Part A and/or Medicare Part B in the following ways:

- Online at www.SocialSecurity.gov.

- In-person at your local Social Security office.

If you worked at a railroad, enroll in Medicare by contacting the Railroad Retirement Board at 1-877-772-5772 . You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative.

Also Check: What Age Can A Woman Get Medicare

How To Enroll In Medicare Part D

You will reap the benefits if you take the time and effort to learn more about your Part D options. Take these three steps to enroll in Medicare Part D.

Timing is everything when you want to avoid late penalties, especially since you could end up paying them for the rest of your life. Do not miss your enrollment period.

Medicare Advantage Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Advantage plan. You need to enroll in Original Medicare before you enroll in Medicare Advantage. Before enrolling in a plan, it may be a good idea to compare Medicare Advantage quotes.

To be eligible for Medicare Part C, you must already be enrolled in Part A and Part B.

If you are interested in joining a Medicare Advantage plan, you typically can only do so during specific times of the year.

The first time you may be able to enroll is during your Medicare Initial Enrollment Period, as outlined above.

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

Don’t Miss: Do You Have To Pay For Part B Medicare

If You Have A Disability Esrd Or Als

Americans with a disability who have received Social Security disability benefits for 24 months are automatically enrolled in Medicare Part A and Part B. Automatic enrollment also applies to beneficiaries who have serious illnesses such as end-stage renal disease, ESRD, and amyotrophic lateral sclerosis, ALS. Youll receive your card when you qualify.

You dont need to do anything to sign up.

Similarly, if youve received disability benefits from the Railroad Retirement Board for 24 months, youll be enrolled automatically in Medicare Parts A and B.

Medicare Advantage Can Bundle Your Health Care

Medicare Advantage plans, also known as Medicare Part C, are Medicare-approved plans from private insurance companies that bundle your Part A and Part B coverage with other benefits. This is usually prescription drug coverage, but Medicare Advantage plans can also include many vision, hearing and dental benefits that Original Medicare does not.

Medicare Advantage plans are all-in-one, more like traditional insurance, but they come with less flexibility. You may pay lower out-of-pocket costs for most services, but higher fees if you want to see a specialist out of your network. Depending on your location and individual health care needs, this may be a good option.

Don’t Miss: Will Medicare Pay For A Roho Cushion

When You Can Switch Part D Plans

In general, you may only switch plans during the Annual Election Period . This is between October 15 and December 7 each year. Coverage begins the following January 1. Outside of the AEP, you may change plans if you have a Special Election Period , such as if you:

- Move to another region outside the service areas of your plan

- Enter a nursing home

- Change nursing homes or other institutions

- Qualify for the extra help/Low-Income Subsidy program

- Lose your eligibility for extra help/LIS

- Lose your full Medi-Cal benefits

When Am I Eligible For Medicare Part D

The first time youre eligible for Part D benefits is during your Medicare Part D Initial Enrollment Period . Your IEP for Part D is the same time as your IEP for Original Medicare and Medicare Part C, also called Medicare Advantage. Your IEP lasts for seven months and:¹

- Begins three months before, and ends three months after, you turn 65, or

- Begins three months before, and ends three months after, your 25th month of getting Social Security or Railroad Retirement Board disability benefits.

If you didnt get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment. However, you might pay the Part D late enrollment penalty if:²

- You did not join a plan during your IEP, or

- You went more than 63 days past your IEP without having other credible drug coverage.

If you receive assistance to pay your Part D drug costs through the Medicare Extra Help program, you dont pay the penalty.

Outside of these election periods for Medicare drug benefits, you can join, change, or drop Part D coverage if youre eligible for a Special Enrollment Period . There are various life events that can qualify you for an SEP, including moving to a location that has new plan options or losing coverage from Medicaid, an employer, or union.

Also Check: Is Medicare Part B Based On Income

Medicare Open Enrollment: What You Cant Do

The annual Medicare open enrollment period does not apply to Medigap plans, which are only guaranteed issue in most states during a beneficiarys initial enrollment period, and during limited special enrollment periods.

If you didnt enroll in Medicare when you were first eligible, you cannot use the fall open enrollment period to enroll. Instead, youll use the Medicare general enrollment period, which runs from January 1 to March 31.

Medicares general enrollment period is for people who didnt sign up for Medicare Part B when they were first eligible, and who dont have access to a Medicare Part B special enrollment period. Its also for people who have to pay a premium for Medicare Part A and didnt enroll in Part A when they were first eligible.

If you enroll during the general enrollment period, your coverage will take effect July 1.

Learn more about Medicares general enrollment period.

What Is The Late Enrollment Penalty

The Late Enrollment Penalty is a fee that is meant to encourage enrollment in a prescription drug plan at the point of eligibility. If you are enrolled in a Medicare prescription drug plan, you may owe a Late Enrollment Penalty, if for any 63 days or more after the Initial Enrollment Period, you went without 1 of these:

- A Medicare Part D Prescription Plan

- A Medicare Advantage Plan

- Another Medicare health plan that offers Medicare prescription drug coverage

The Late Enrollment Penalty is added to your monthly Part D premium for as long as you have Part D coverage, even if you change your Medicare Part D plan. The Late Enrollment Penalty amount changes each year. You may also have this penalty if you have a Medicare Advantage plan that includes prescription drug coverage . You can avoid the late enrollment penalty by making sure you enroll when you are eligible and keeping your coverage.

If you qualify for Extra Help due to a lack of income or resources, you can enroll late without a penalty. However, if you lose Extra Help, you may be charged a penalty if you have a break in coverage.

Medicare, not the Cigna Part D Plan, will determine the penalty amount. You will receive a letter from the plan notifying you of any penalty. For further questions or concerns about the Late Enrollment Penalty, call Medicare at 1 MEDICARE or visit www.medicare.gov.

You May Like: How Old To Be Covered By Medicare

How To Apply For Medicare Part D

Our comprehensive guide helps you find the best Part D drug plan for you

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs.1

But before diving into the deep end of Part D plans, youll want to perform due diligence to get the best plan for your needs. In this guide, well walk you through how to research and then successfully sign up for a Part D plan.

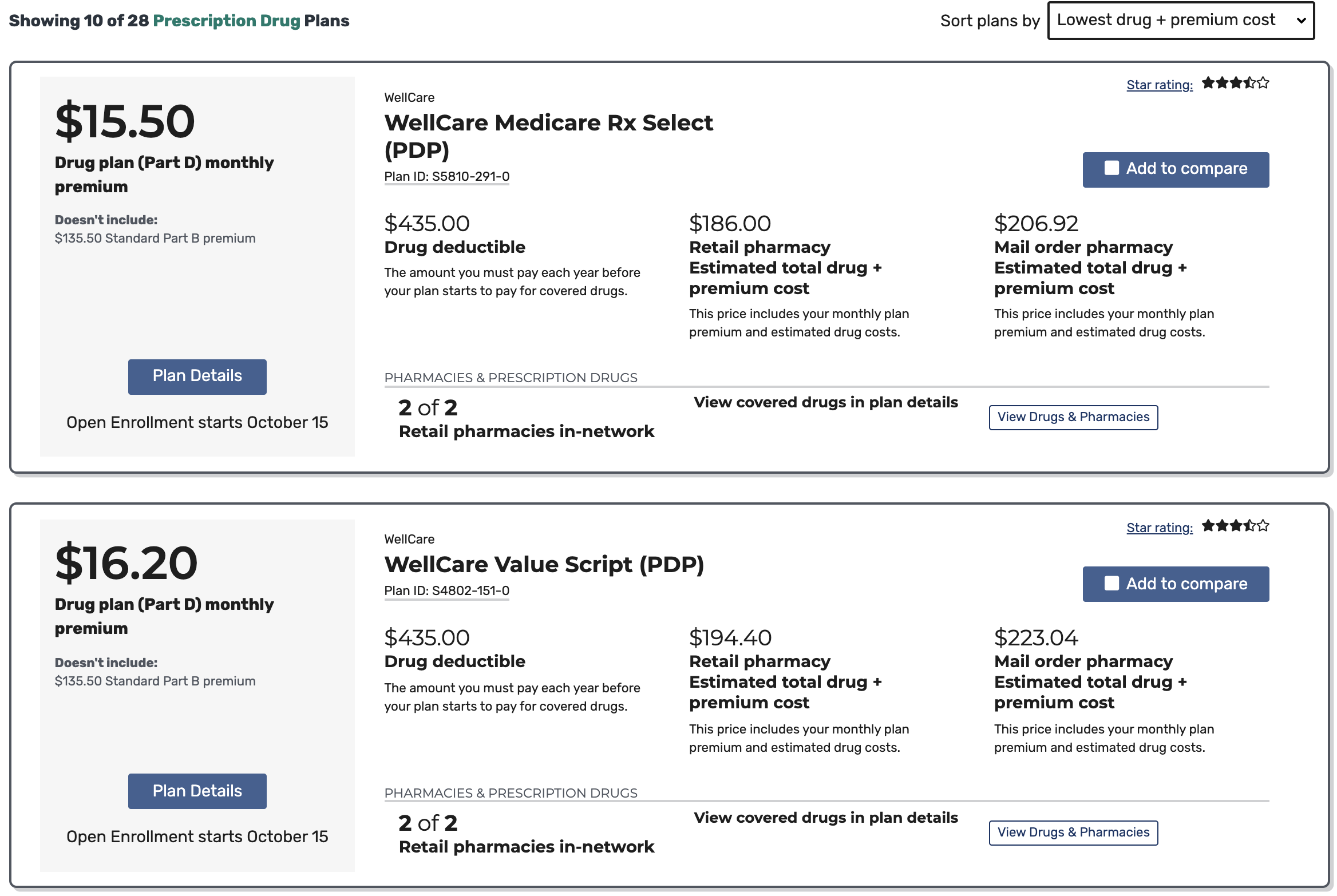

How Do I Choose A Medicare Part D Plan

According to the Kaiser Family Foundation, the average Medicare beneficiary has 30 stand-alone Medicare Part D prescription drug plans to choose from in 2021. Its important to comparison shop to find the one thats right for you. In addition to monthly premiums and deductibles, you should definitely compare plan formularies, especially if you take daily medications.

Some plans use a pharmacy network. If you have a pharmacy you really like, make sure its part of the plans network. Look for other benefits, such as mail-order pharmacies, that can help save money out-of-pocket.

Read Also: Does Medicare Cover Knee Injections

Sign Up For Original Medicare

Most Americans need to sign up for Medicare Part A, hospital insurance, and Medicare Part B, medical insurance when they reach 65. You can do so online or through your Social Security office.

In most cases, you wont receive Medicare benefits automatically unless you sign up. But if you already receive benefits from Social Security or the Railroad Retirement Board, youll be automatically enrolled.

If you dont enroll in Part B during the seven months around your 65th birthday, your Initial Enrollment Period, you could incur a penalty.

There is an exception, though: If youre still working and have health coverage through your job, you can sign up for Part A, which usually involves no premium, and you may be able to delay signing up for Medicare Part B . To avoid penalties for delayed enrollment, you must have medical coverage through your or your spouses job.

If you or your spouse have worked for at least 10 years, you typically wont pay a premium for Medicare Part A coverage.

Theres A Push For Change

If the rules governing the transition to Medicare sound complicated, rest assured that experts agree. Moving into Medicare from other kinds of health insurance can be so complicated that it should be a required chapter in Retirement 101, Mr. Moeller said.

The only government warning about the risks associated with late enrollment comes in the form of a very brief notice near the end of the annual Social Security Administration statement of benefits.

The Medicare Rights Center and other advocacy groups have proposed legislation that would require the federal government to notify people approaching eligibility about enrollment rules, and how Medicare works with other types of insurance. The legislation the Beneficiary Enrollment Notification and Eligibility Simplification Act, also would eliminate coverage gaps now experienced by enrollees during the Initial Enrollment Period and General Enrollment Period. The legislation was introduced in Congress last year, and will be reintroduced this year.

In the meantime, Mr. Baker proposes a simple rule of thumb to help people approaching Medicare eligibility to avoid costly errors.

If you are eligible for Medicare, you should really consider it to be your default, primary coverage. If you are going to decline Medicare, think very carefully and take the time to really understand all the rules.

You May Like: How To Check Medicare Status Online

Although You Don’t Need To Renew Medicare Every Year It’s Smart To At Least Review Your Options During The Annual Enrollment Period

As long as you continue to pay any applicable premiums, you should not need to sign up for or re-enroll in Medicare coverage every year. This is the case whether youre enrolled in Original Medicare, a Part C Medicare Advantage plan, or Part D prescription drug plan. Unless you fall into one of the few exceptions, your coverage should automatically renew every year.

Read on to learn when you may have to reapply or re-enroll in your Medicare plan to avoid late enrollment penalties and fees, and ensure you have the coverage you need when you need it.

Changing Or Canceling Your Plan

Life is full of twists and turns. You could be faced with new health challenges. Your financial situation could change if you retire or lose your job. Your insurance company could make changes to your plan. All of these things could affect how much prescription drug coverage you need and how much you can afford.

You may need to consider changing your Part D plan. The good new is you are not stuck with the same Part D plan forever. You have choices. The trick is to know when to make those changes.

You May Like: Is Omnipod Covered By Medicare

What Is The Annual Enrollment Period

You should review your coverage annually to make sure it still meets your needs. Benefits, in-network providers and pharmacies, drug formularies, and costs can change from year-to-year and can affect your coverage and how much you pay out-of-pocket.

Review the information your plan sends out each year, including the Annual Notice of Change , drug formulary, and Evidence of Coverage . If you find that the plan or coverage no longer meets your needs or budget, you have a few opportunities to change it.

During the Annual Enrollment Period, you have the opportunity to make changes to your coverage by:

- Signing up for a Medicare Advantage plan

- Changing from one MA plan to another

- Leaving an MA plan and returning to Original Medicare

- Signing up for a Medicare Part D prescription Drug plan

- Changing from one Part D plan to another

- Dropping your prescription drug plan

From during the Medicare Advantage Open Enrollment Period, you can make additional changes to your health coverage including switching from one MA plan to another or dropping your MA plan and returning to Original Medicare. If making that change causes you to lose your prescription drug coverage, you may also join a stand-alone Medicare Part D drug plan.

If you are happy with your existing costs and coverage, you do not have to take any action and your Medicare coverage will automatically renew for the following year.