Can I Get Medicaid If I Have Money In The Bank

Medicaid is the government health insurance program for people with low income and the disabled. There used to be a limit on how much you could have in assets and still qualify for Medicaid. Medicaid does not look at an applicants savings and other financial resources unless the person is 65 or older or disabled.

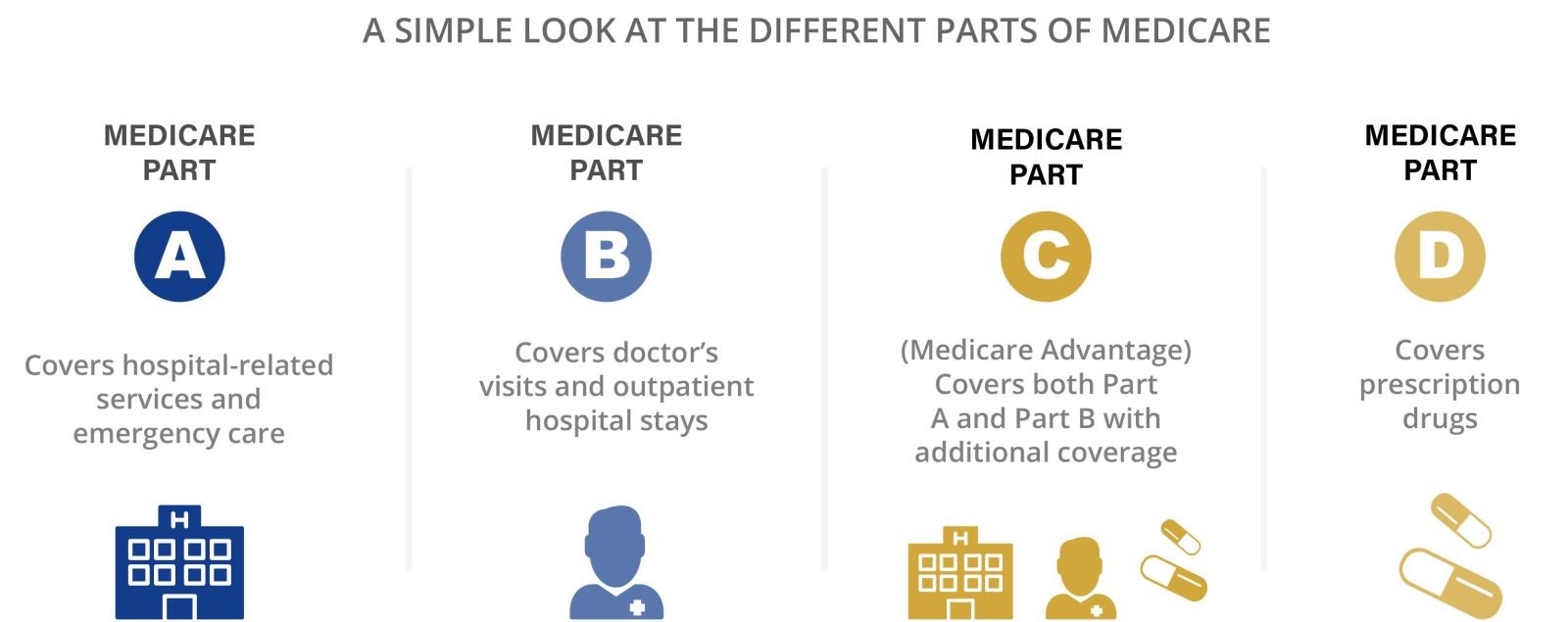

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Thoughts On Medicare Part B Late Enrollment Penalty

I am a retired federal employee and have FEHB through BCBS. If I keep FEHB and do not take Medicare B, will I be penalized? I have conflicting answers that I wont be penalized because I still have FEHB, and that I will be penalized because I am retired and not working. Which is correct? Where is this officially stated?

It seems that ignorance is expensive. Except for 4 years in the military, I worked for a municipal employer for 30 years that did not collect Social Security and Medicare taxes. I retired from that employer with a disability pension and health insurance that terminated at age 65. When I turned 65, my wife was 58 and we purchased insurance through the Affordable Care Act and continued with AFC insurance through this year. My wife applied for and received Medicare A and B when she turned 65 this year and I discovered that I could apply under her work record, which I did except that they only gave me Part A, with the option to enroll in Part B in January when Ill be 73. My question Why do they penalize those with quality AFC insurance?

Hi Bob we are sorry to hear about your situation. That is why we try to educate as many people about Medicare as possible. Health insurance through the Affordable Care Act is not creditable for Medicare, so those who enroll are vulnerable to penalties. Additionally, it is illegal for someone to try to sell a plan through the Marketplace to a Medicare beneficiary.

Don’t Miss: Who Funds Medicare And Medicaid

I Want To Delay Part B

If you qualify and decide you want to delay enrolling in Medicare Part B, you should not face any late enrollment penalties for Part B. When you lose your employer coverage, you will get an 8-month Special Enrollment Period during which to enroll in Medicare Part B, and Part A if you havent done so already.

Youll also be able to enroll in a Medicare Advantage plan or Part D prescription drug plan in the first two months of this period. Note: if you enroll in Part C or Part D after the first two months of your Special Enrollment Period, you may face late enrollment penalties for Part D. Youll want to also ensure you provide proof of creditable coverage when you enroll in Part D.

You do not need to notify Medicare that you will be delaying Part B unless you are already receiving Social Security or Railroad Retirement Board benefits.

What Do Medicare Supplement Plans Cover

Medigap policies cover the following out-of-pocket costs:4

- Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits are used up.

- Part B coinsurance or copays.

- Blood .

- Foreign travel emergency .

- Above out-of-pocket limits.

The Part B excess charge is little understood but essential to know. Doctors who accept Medicare assignment agree to rates set by Medicare for covered services. Those who dont can charge up to 15% more than the Medicare-approved amount.

Unless you have a Medigap plan that covers excess charges, you will be responsible for those charges. The alternative? To only use participating doctors, although thats not always easy in an emergency or surgery involving many doctors.

Also, Original Medicare does not cover you outside the U.S. But some Medigap policies do.

Read Also: When Can I Start Medicare Part B

If I Dont Like My Plan When Can I Change

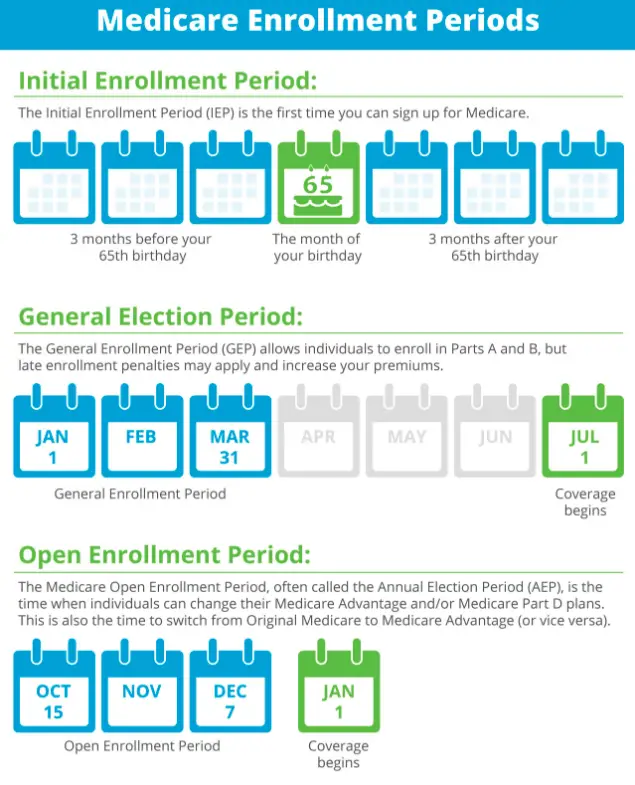

Each year between October 15 and December 7, there is an annual enrollment period for Medicare beneficiaries. At this time, you can change your MAPD or PDP plans for a January 1 start date. There are other special enrollment periods that may allow you to change your plan during the rest of year. Read this article to find out more.

Also Check: What Is The Difference Between Medicare

Delaying Enrollment In Medicare When You’re Eligible For It Could Result In A Penalty That Will Remain In Effect For The Rest Of Your Life

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month.

While Medicare Part A which covers hospital care is free for most enrollees, Part B which covers doctor visits, diagnostics, and preventive care charges participants a premium. Those premiums are a burden for many seniors, but heres how you can pay less for them.

Don’t Miss: How To Get Prior Authorization For Medicare

What Are The Medicare Prescription Drug Coverage Options

All Part D and prescription drug plans are offered through private insurance. Availability varies by state.

The right plan for you depends on your budget, medication costs, and what you want to pay for premiums and deductibles. Medicare has a tool to help you compare plans in your area looking ahead to 2020.

- Part D. These plans cover prescription medications for outpatient services. All plans have to offer some basic level of drug coverage based on Medicare rules. Specific plan coverage is based on the plans formulary, or drug list. If your doctor wants a drug covered thats not part of that plans list, theyll need to write a letter of appeal. Each nonformulary medication coverage decision is individual.

- Part C . This type of plan can take care of all your medical needs , including dental and vision coverage. Premiums might be higher and you might have to go to network doctors and pharmacies.

- Medicare supplement .Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums. Choose the best option to give you maximum benefits at the lowest rates.

New Medigap plans dont cover prescription drug copays or deductibles. Also, you cant buy Medigap insurance if you have a Medicare Advantage plan.

How To Cancel Medicare Part B

The Part B cancellation process begins with downloading and printing Form CMS 1763, but dont fill it out yet. Youll need to complete the form during an interview with a representative of the Social Security Administration by phone or in person.

Due to the COVID-19 pandemic, all Social Security Administration offices are currently closed. The SSA is still answering phone calls, and you can access many services on its website. See the latest COVID-19 updates.

You can schedule an in-person or over-the-phone interview by contacting the SSA. If you prefer an in-person interview, use the Social Security Office Locator to find your nearest location. During your interview, fill out Form CMS 1763 as directed by the representative. If youve already received your Medicare card, youll need to return it during your in-person interview or mail it back after your phone interview.

What happens next depends on why youre canceling your Part B coverage.

Recommended Reading: Does Medicare Cover Wheelchair Repairs

I Recently Turned 65 And I Am Eligible For Medicare Part A Without Having To Pay A Premium But I Have Not Yet Signed Up For Medicare Part A Or Part B Can I Purchase A Marketplace Plan

Yes, if you are not covered by Medicare, an insurer can sell you a Marketplace plan. But because you are eligible for premium-free Medicare Part A, you are not eligible to receive the premium tax credit to help reduce the cost of a Marketplace policy, even if you would qualify based on your income.

Also keep in mind that if you sign up for a Marketplace plan, rather than enroll in Medicare Part B when you are first eligible to do so, and then later you decide to sign up for Medicare, you may be required to pay a penalty for delaying enrollment in Medicare Part B. Your monthly Part B premium may go up 10% for each year that you could have had Part B, but didnt. You may also owe a late enrollment penalty for Part D drug coverage, which is equal to 1% of the national average premium amount for every month you didnt have coverage as good as the standard Part D benefit.

Basics Of Medicare Part D

There are two ways to get prescription drug coverage through Medicare Part D.

- Enroll in a stand-alone Medicare prescription drug plan . If you enroll in a stand-alone prescription drug plan, it works alongside your Original Medicare benefits.

- Or, enroll in a Medicare Advantage plan with prescription drug coverage, or an MA-PD. A Medicare Advantage plan is an alternative way to get your Original Medicare benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications.

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance. The amounts can vary from plan to plan.

Prescription Drug plans include formularies, which are a list of the medications that are covered under the plan. Some formularies have tiers. Medications in lower tiers may have lower costs. Generic medications are often included in the lower tiers. When you are preparing for Medicare Part D enrollment, it is important to make sure the medications you take are included in the plans formulary.

Don’t Miss: Is Everyone Eligible For Medicare

Medicare Part B Enrollment Avoiding The Part B Penalty

There are a few situations when you may be able to delay Medicare Part B without paying a late-enrollment penalty. For example, if you were volunteering overseas or if you were living out of the country when you turned 65 and werent eligible for Social Security benefits, you may be eligible for a Special Enrollment Period when you return to the United States. The length of your SEP will depend on your situation. If you arent sure if you qualify for a Special Enrollment Period, call Medicare to confirm at 1-800-633-4227 , 24 hours a day, seven days a week.

Have more questions about Medicare coverage? You can talk to one of eHealths licensed insurance agents youll find contact information below.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

Do I Need Medicare Part B

Whether or not you need or should start Medicare Part B when you turn 65 depends on your situation. Medicare Part B is a requirement for some plans, and you could face penalties for not picking it up in the correct timeframe.

What Do I Need to Know about Medicare Part B?

Medicare Part B covers your outpatient medical services, like your annual wellness exam. On average, it pays up to 80% of these costs, which prevents you from having to pay the majority of your bill out-of-pocket.Medicare Part A and Part B together are referred to as Original Medicare. The typical Medicare Part B premium in 2021 is $148.50.Most people gain Medicare Part B eligibility on the first day of the month in which they turn 65. For instance, if your birthday is March 17th, youd be eligible for Medicare on March 1st. You have seven months in which to apply, beginning three months before your birth month, and ending three months after. If youre drawing Social Security, youll be automatically enrolled. You can sign up for or postpone your Part B by contacting the Social Security Administration directly.

When Do You Need Medicare Part B?

Don’t Miss: How Much Does Medicare Pay For Dental

Do I Need Medicaid If I Have Medicare

Medicaid and Medicare are the two largest publicly funded health programs in the country, with different missions that often overlap. Medicare provides health coverage to seniors and some individuals with disabilities. Medicaid covers adults and children who cannot afford insurance, or who have health care costs they cannot afford. Often, an individual will be eligible for coverage through both programs. The following blog will describe how Medicare and Medicaid interact. Part one gives an overview of Medicare, what it covers, and what options are available for more coverage. Part two will describe how Medicare and Medicaid work together.

Part 1: Medicare, MediGap, and Medicare AdvantageFor many seniors, health insurance coverage can be very confusing. Most seniors know that they are eligible for Medicare when they reach age 65, but its easy to get confused about what is and isnt covered. Lets dive into the different Medicare options to help make things clear.

Seniors who are retired should enroll in both A and B as soon as they are eligible. If they enroll late, they may be penalized by having to pay Part A premiums or a higher premium for Part B. Seniors who are still working or whose spouse is still working may be able to delay enrolling in Medicare and keep the insurance provided by the employer.

Donât Miss: Are Walkers Covered By Medicare

What If You Cant Enroll In A Medigap Policy

If you dont qualify for a Medigap policy, youll have to pay all your Original Medicare out-of-pocket expenses yourself. Because Original Medicare doesnt have a cap on those expenses, your out-of-pocket costs can add up pretty quickly.10

Heres an example:

| Carl has outpatient surgery. His total Medicare-approved bill under Part B is $10,000Carl is responsible for a 20% coinsurance, which amounts to $2,000 out-of-pocket | Carl has a Medigap policy that pays 100% of his Part B coinsurance after meeting the Part deductible.Carls Medigap policy pays the $2,000 coinsurance directly to his doctor, leaving Carl with $0 out-of-pocket |

Read Also: Does Medicare Pay For Hearing Aids

Medicare Part D Enrollment

The Medicare Part D enrollment period takes place each year form April 1 to June 30. If you enrolled in coverage for Medicare parts A or B and want to add Part D, you can enroll during this period the first time. After this, to change Part D plans, you must wait for open enrollment to come around again.

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Recommended Reading: Does Medicare Cover Chiropractic X Rays

Don’t Miss: Should I Get Medicare Supplemental Insurance

When Is The Best Time For Medicare Part D Enrollment

There are different times when you might qualify for Medicare Part D enrollment:

Initial Enrollment Period for Medicare Part D Enrollment

Your Initial Enrollment Period occurs when you first become eligible for Medicare. For most people, eligibility happens when you turn 65. The IEP begins three months before the month you turn 65. It includes your birthday month and the three months following for a total of seven months. During that time, you can enroll in a Part D Prescription Drug plan or a Medicare Part C plan that includes prescription drug coverage.

Fall Open Enrollment Period for Medicare Part D Enrollment

Medicare also offers a Fall Open Enrollment Period every year that runs from October 15 to December 7. This period allows for Medicare Part D enrollment as well. You can also switch from one prescription drug plan to another during this time.

Special Enrollment Period for Medicare Part D Enrollment

Special Enrollment Periods or SEPs offer the chance for Medicare Part D enrollment when certain events happen in your life. Those events might include changing where you live or losing your current coverage. If your current plan changes its contract with Medicare or you have an opportunity to get other coverage, you might also qualify for an SEP.