Other Factors That Affect Coverage

How much a person will pay for DME depends on:

- other policies a person may have

- type of equipment

- how much the doctor charges

- if the doctor and supplier accept Medicare assignment

If a persons doctor and the DME supplier are enrolled in the Medicare program, it means they will accept payment directly from Medicare, and costs are regulated.

For example, Medicare pays 80% of the approved amount, while a person pays 20% after paying the standard Part B deductible of $203 per month in 2020, provided that a persons income is $87,000 or less. However, if the doctor or supplier is not enrolled in Medicare, a person may have to pay 100% of the cost.

Similarly, if a person is buying DME, they should check if the supplier participates in Medicare, which means the supplier will charge only 20% coinsurance and any remaining deductible for Part B. If the supplier does not participate in Medicare, they can charge higher costs.

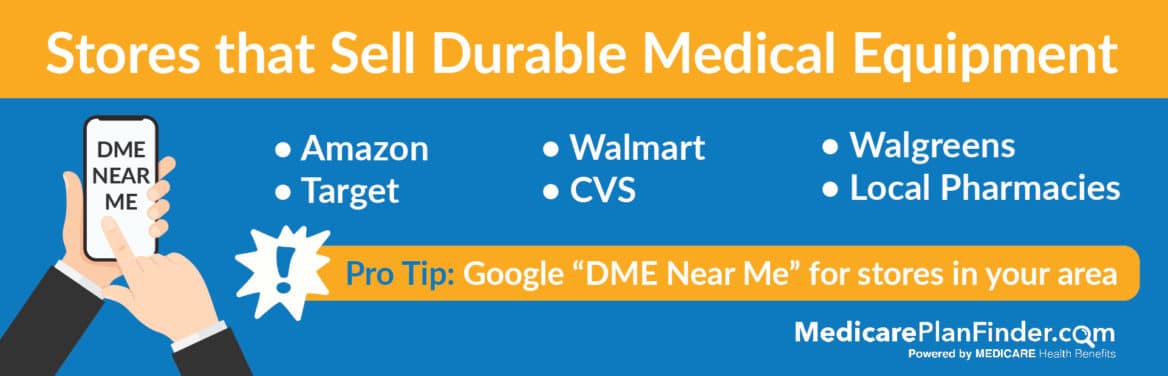

A person can use this online tool to find a DME supplier. People enter their zip code and are taken to a page where they can choose five products. If the product is not listed, the advanced search option may be useful.

Options include purchasing from separate medical suppliers or from one supplier who has all the products a person may need. The supplier contact information will include:

- name

B Covers 2 Types Of Services

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive services: Health care to prevent illness or detect it at an early stage, when treatment is most likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts

How To Buy Equipment

Medicare Part B will pay for the covered cost of equipment. Here are the steps you need to take to purchase equipment:

- Go to an in-person doctor visit, where your doctor will write an order for the DME.

- Take the order to a Medicare-approved DME supplier.

- Depending on the product, ask the supplier if they will deliver it to your home.

- Find out if Medicare requires prior authorization for your DME.

Medicare Advantage plans may have specific requirements based on individual plans and regions. Some plans may require you to:

- buy specific brands or manufacturers of DME

- pay deductibles before DME is covered

- visit in-network providers for supplies

- get prior authorization

Contact your Medicare Advantage plan directly to ask what is covered and about the associated costs.

Costs of DME depend on a few different factors like the type of plan you have , whether youd like to buy or rent, whether you use Medicare-approved providers, and even where you live.

Medicare requires you to purchase all DME supplies from providers that accept assignment. Those who agree to accept assignment have signed agreements that theyll accept the rates set by Medicare. This keeps costs low both for you and for Medicare.

Don’t Miss: Can You Apply For Medicare After 65

Medicare Deductible: Part B

Medicare Part B benefits include doctors office visits, preventive screenings, and durable medical equipment. For some of these services, a deductible will apply . Often, you will pay 20% of the Medicare-approved amount for a health-care service after this deductible is met. Make sure to check with your doctor and Medicare because each benefits coverage is different.

Even Though Medicare Part B Does Provide Coverage For Many Different Types Of Durable Medical Equipment Such A Wheelchair Itself Or A Lift To Help You Move From A Bed Or Chair Into A Wheelchair A Ramp Is Not Covered Under These

Does medicare part b cover stair lifts. Part b is typically where many think a stair lift may be covered. But medicare advantage plans may cover the cost. In some cases, individuals eligible for medicaid may get assistance paying for.

While patient lifts are listed on medicares website as part of dme coverage, stair lifts, unfortunately, do not fall into this category. Part b only helps pay for the lifting device, not the chair itself. There is one possible exception to this rule in regards to original medicare.

However, there maybe be other options for you to get a stair lift without paying the full price. We have already established that the original medicare doesnt cover the costs of stair lifts and installation. For example, the lifting device coverage does not include fabric, cushions or any.

The short, uncomplicated answer is, for all practical purposes, original medicare does not pay for stair lifts. In 2019, the standard monthly part b premium is $135.50, although you might pay more if your income exceeds a certain amount. However, a doctor must deem them necessary for the patient.

However, medicare part b does have coverage for different types of durable medical equipment for home usage. Stair lifts currently are not considered a medical necessity. Medicare part b covers patient lifts as durable medical equipment that your doctor prescribes for use in your home.

Best Salem Stair Lift Installer Cains Mobility Or

All About Stair Lifts

Pilot Straight Stair Lift

You May Like: How Much Does Medicare Part C And D Cost

What Costs You Need To Cover

If Medicare approves coverage of your wheelchair, you still have a financial obligation to meet. Customary with any health insurance, you must meet your Part B deductible for that year, then cover 20% of the Medicare-approved amount. Usually, this approved amount wont exceed the actual charge or fee Medicare sets for the item.

Medicare will generally pay for the most basic level of equipment needed. If you need upgrades or extra features and your supplier thinks Medicare wont cover them, youll need to sign an Advance Beneficiary Notice before receiving the item. On this waiver form, you must check the box stating you wish the upgrades and will agree to cover their full cost if Medicare denies coverage.

You may have to cover the full cost of your wheelchair if you get it from a supplier that isnt a contract supplier.

If My Item Falls Under Medicare Dme Coverage Do I Pay Anything

If you have only have Original Medicare, youll have some out-of-pocket costs for your Durable Medical Equipment. Youll need to meet your Medicare Part B Deductible , and pay 20% coinsurance. If the provider doesnt accept Medicare assignment, you may also be charged an additional 15%. Your costs may vary depending on whether you rent or buy.

Fortunately, if you have a Medicare Supplement plan, you may not have to pay anything out-of-pocket. Medicare Supplement Plan F and Plan G are two of the more popular plans, and cover your Medicare Part B coinsurance. Coinsurance can quickly become pricey, depending on the amount or type DME you need, so its wise to consider your options for insurance.

Nothing on this website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

Also Check: How To Apply For Medicare Insurance

An Example Of The Medicare Part B Deductible

Hereâs an example that illustrates how the 2022 Medicare Part B deductible works:

- You come down with an illness in March, 2022. You visit your doctor for an evaluation, and you are billed $150 for the visit. This is the first medical care covered by Part B you have received in 2022.

- You will be responsible for the full $150 for your appointment since you have not yet satisfied your 2022 Part B deductible.

- In July, you injure your knee and schedule another appointment with your doctor. This time you are billed $200 for the appointment.

- You will be responsible for paying the first $117 of the $200 for the appointment out of your own pocket, because that is how much is left on your deductible.

- After the $117 is paid, you have reached $233 in out-of-pocket spending for covered Part B services in 2022. You have reached your deductible and you will now be responsible for any Part B coinsurance charges.

Should you need any more health care for the remainder of 2022, you will only have to pay 20% of the Medicare-approved amount for anything that is covered under Part B .

There is no annual out-of-pocket spending limit for Medicare Part A or Part B.

Getting Wheelchairs Covered By Medicare

Medicare Part B helps cover wheelchairs, either manual or powered, as durable medical equipment . Your doctor must submit a written order stating that your medical condition requires you to use the wheelchair at home. Medicare wont pay for a wheelchair used outside of the home.

Learn what type of Medicare coverage pays for wheelchairs, how to get Medicare to pay, and the costs youll need to pay.

Recommended Reading: Do I Have To Use Medicare When I Turn 65

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

What If I Need To File A Claim For Reimbursement

You rarely need to file a claim yourself for a DME product or supply. The DME provider will file claims for your supplies if you have original Medicare.

All claims must be filed within 1 year of rental or purchase for Medicare to reimburse it. You can find more information here on the process of filing a claim.

Check your Medicare Summary Notice statements to make sure the provider filed the claim. If your provider has not filed a claim, you can call and ask them to file. If time is running out on your 1-year limit, you can file a claim using the Patient Request for Medical Payment form.

You can also call 800-MEDICARE or visit Medicare.gov for help with questions on filing a claim or other questions about DME products.

Don’t Miss: Does Medicare Cover Varicose Vein Treatment

Find A Medicare Advantage Plan That Covers The Dme You Need

Are you looking for Medicare coverage for your approved DME? Do you want to find a plan that may also cover additional medical equipment that isnât covered by Original Medicare? You may be able to find a Medicare Advantage plan that offers the benefits you need.

Or call 1-800-557-6059TTY Users: 711 24/7 to speak with a licensed insurance agent.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelorâs degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Other Ways To Pay For Durable Medical Equipment

Sometimes Medicare or Medicaid won’t pay for the item you need, or maybe you just don’t want to wait to find out if what you need will be approved. In either case, here are a few other ways that you can pay for durable medical equipment:

- Private insurance: Private insurers typically cover durable medical equipment. Speak directly with your private insurer to find out details about coverage.

- Veterans health care: Veterans and their spouses can turn to the Department of Veterans Affairs for help with a Medicare copayment for DME or with the entire cost of DME. The VA has several programs available, such as CHAMPVA benefits and Tricare.

- Private pay: Paying out of pocket is always an option, even if you have insurance. You might even find that it’s the quickest way to get the equipment you need. Just make sure you understand the cost difference if you choose to pay for something privately that Medicaid, Medicare, or another insurance policy would cover. Buying DME secondhand often halves the cost, so check eBay or Facebook Marketplace, classified ads, and thrift stores like Goodwill.

- Nonprofit or state assistance: Some nonprofits, national foundations, and states help seniors pay for durable medical equipment through grants, low-interest loans, assistive technology programs, and financial aid programs. Visit your state’s website or call your local Area Agency on Aging office for assistance in locating available programs.

Recommended Reading: Is A Chiropractor Covered By Medicare

Deductibles For Drug Coverage And Medicare Advantage

Deductibles for Medicare Part C, also known as Medicare Advantage plans, and Medicare Part D prescription drug coverage varies based on the plan you purchase. Both Medicare Advantage and Part D plans are sold by private insurers that have contracts with the Medicare program.

Medicare Advantage plans may offer coverage that absorb some of your out-of-pocket costs. Though Medicare Advantage deductibles may vary, all plans must set a limit on your maximum out-of-pocket expenses. This is a total spread across your deductibles, coinsurance and copayments.

For 2022, the MOOP for Medicare Advantage plans is $7,550 for in-network care. It can be higher for out-of-network care or services. But once you hit your MOOP for the year, the plan has to cover 100 percent of all further costs.

Some Medicare Part D prescription drug plans dont have a deductible. Those that do may not have a deductible of more than $480 in 2022.

Prepare for the Medicare Advantage Open Enrollment Period

Oxygen Equipment And Accessories

Medicare Part B generally covers the rental of oxygen equipment and related accessories, but you must meet certain criteria to qualify.

Requirements to Qualify for Oxygen Equipment Coverage

- Your doctor diagnoses you with a severe lung disease or determines youre not getting enough oxygen.

- Other alternative measures arent working.

- Oxygen therapy may help improve your health.

- Your arterial blood gas level falls within a certain range.

You will pay 20 percent of Medicare-approved costs along with the Part B deductible for oxygen equipment.

Other breathing therapy devices such as nebulizers and continuous positive airway pressure machines may also be covered with Medicare Part B.

You May Like: What Age Does A Person Qualify For Medicare

How Does Medicare Plan G Work

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

Medicare Plan G is a supplemental policy, meaning itâs not your primary coverage but fills many of the gaps in a Medicare policy. Part A or Part B benefits would pay for health services you need. Once those benefits are exhausted, Plan G pays for any remaining costs.

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,408. If you donât have Plan G, then youâll pay that deductible out of pocket. But with Plan G coverage, your health insurer would pay for the entire deductible.

What Is The Difference Between Medicare Part A And Part B

-

At-home Intravenous Immune Globulin

-

Vaccines for flu, pneumococcal pneumonia, Hepatitis B, and more

-

Transplant or immunosuppressive drugs if Medicare helped pay for your organ transplant

Most of the time you can expect to pay 20% of the Medicare-approved amount for Part B-covered drugs you receive in a doctors office or pharmacy. This is after youve paid your Part B deductible.

Part A covers drugs, medical supplies, and medical equipment used during an inpatient hospital stay or at a skilled nursing facility.

Part D covers many drugs you would fill at a pharmacy, including brand-name and generic prescriptions. Check your Part D formulary the list of covered drugs for medications that Part B doesnt cover, unless you have comparable drug coverage from another source.

Also Check: Does Medicare Offer Gym Memberships

Don’t Miss: How To Determine Medicare Part B Premium