Medicare Under 65 In Arizona

In some states, Medicare supplement insurance carriers canchoose not to offer Medicare supplements to beneficiaries who under age 65.Arizona is one of these states. If you are under 65, you may not find anycompany offering Medigap to you. However, you can still gain access to greatcoverage by considering one of the many Arizona Medicare Advantage plans.

Later on, when you turn 65, you can take advantage of asecond open enrollment window to change over to Medigap if you wish to do so.This will begin on the 1st of your 65th birthday monthand will end 6 months later.

What Should I Do Next

If youre ready to investigate plan options and begin the enrollment process, consider these steps:

- Do some research on the specific Medicare plans available to you. The list above can be a good starting point. It might also be useful to talk with an experienced insurance agent who sells Medicare plans in Arizona and can offer guidance tailored to your individual situation.

- Read some reviews to see what other people are saying about plans you might be considering and their coverage. You could also ask trusted friends or acquaintances about their Medicare plans.

- Sign up for Medicare online through the Social Security Administration website. The application takes just minutes to complete. The site even includes a checklist to make it easier for you to gather the information you need.

What Types Of Medicare Advantage Plans Are Available In Arizona

Medicare Advantage plans fall into five main categories. Every provider offers a variety of plan types. You can find the acronym for the type of plan in the plans name. Heres what each one means:

- HMO: A health maintenance organization gives you a list of in-network primary care physicians and hospitals to choose from. You select a primary care physician and must get a referral to see a specialist.

- PPO: With a preferred provider organization, you have more flexibility. You can keep costs lower by staying in-network, but you dont need a PCP or get referrals.

- PFFS: Private fee-for-service plans have a list that outlines their payment guidelines. You can easily see what the insurance provider will pay and how much you pay. You can go to any care provider who will accept the terms of the PFFS plan.

- SNP:Special needs plans are highly individualized for select groups of people. Coverage is specific to a chronic disease or situation. A dual-eligible SNP is one type that is open to people who get both Medicaid and Medicare.

- MSA: Medical savings accounts are Medicare Advantage plans with high deductibles and a special savings account. Use the money in the savings account for medical bills. Money can roll over to subsequent years.

You May Like: What Is Centers For Medicare And Medicaid Services

How Much Does Medicare Part C Cost In Each State In 2021

The chart below shows the average monthly premium for Medicare Advantage plans that include prescription drug coverage in each state.1

- Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month.

- The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota.

*Medicare Advantage plans are not sold in Alaska.

| State |

|---|

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

How Do Medicare Supplement Insurance Plans In Arizona Work

Medicare Supplement insurance plans in Arizona are sold by private insurance companies. Also referred to as Medigap, these plans fill in gaps in Original Medicare coverage.

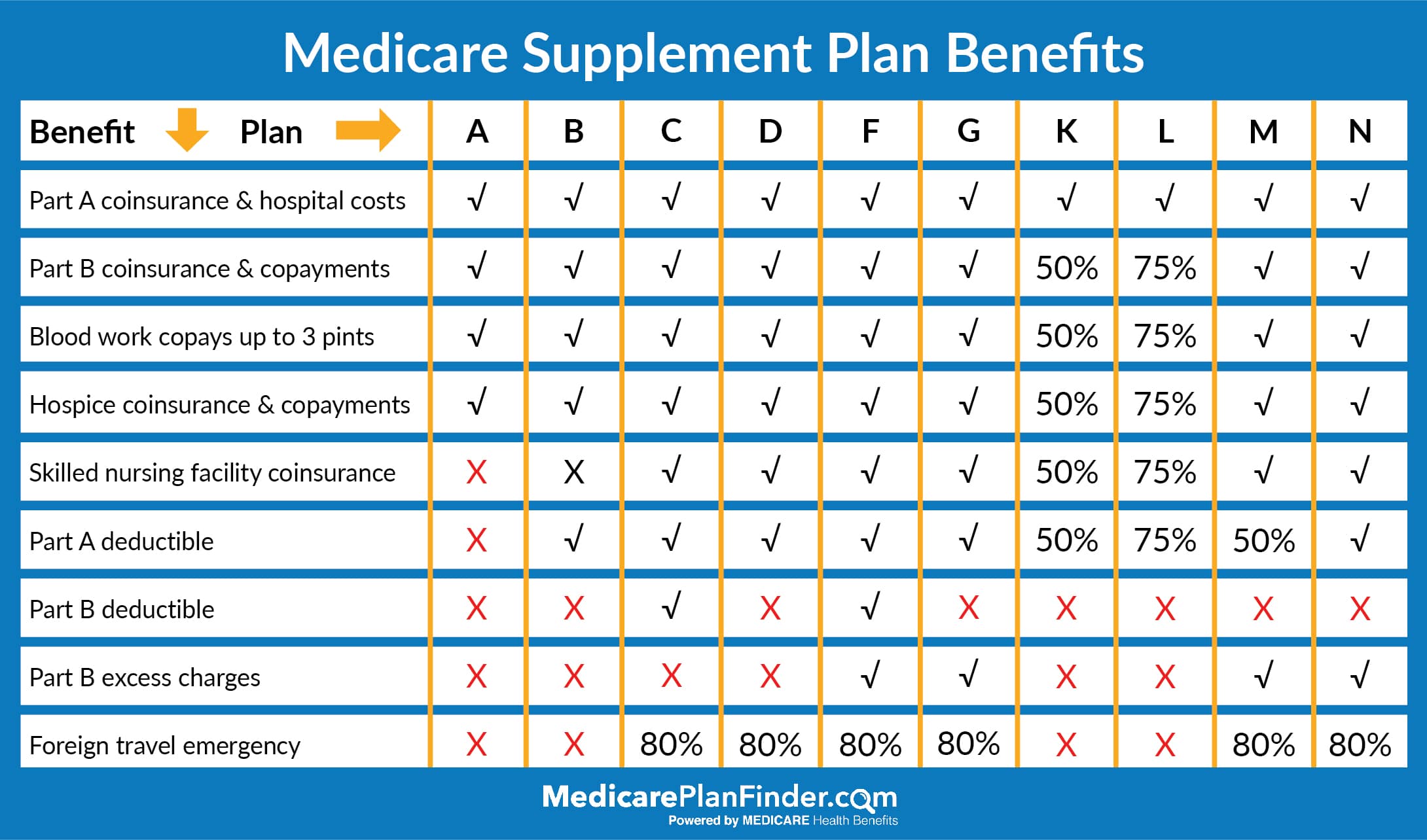

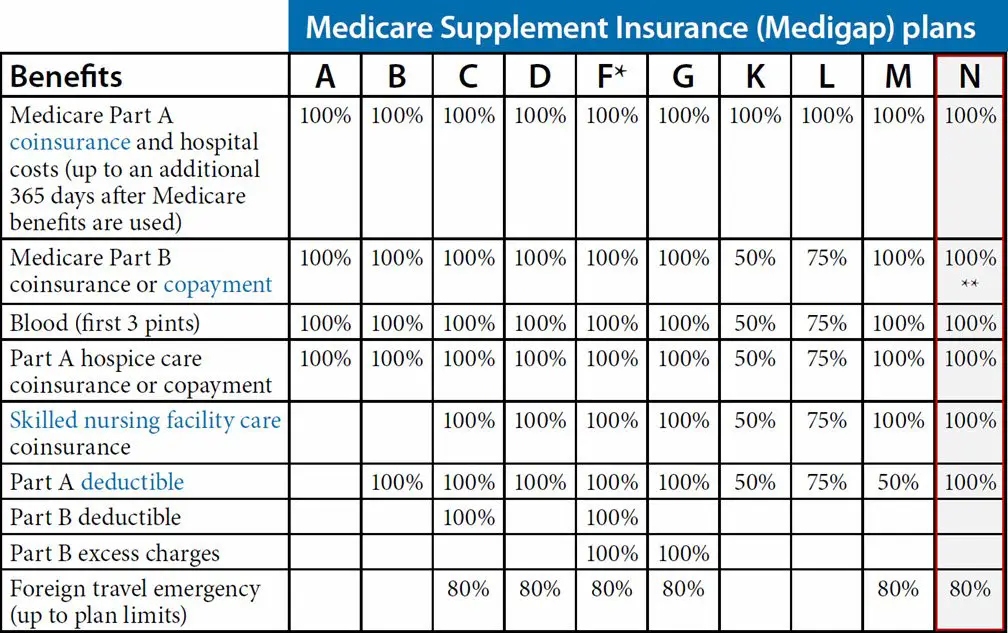

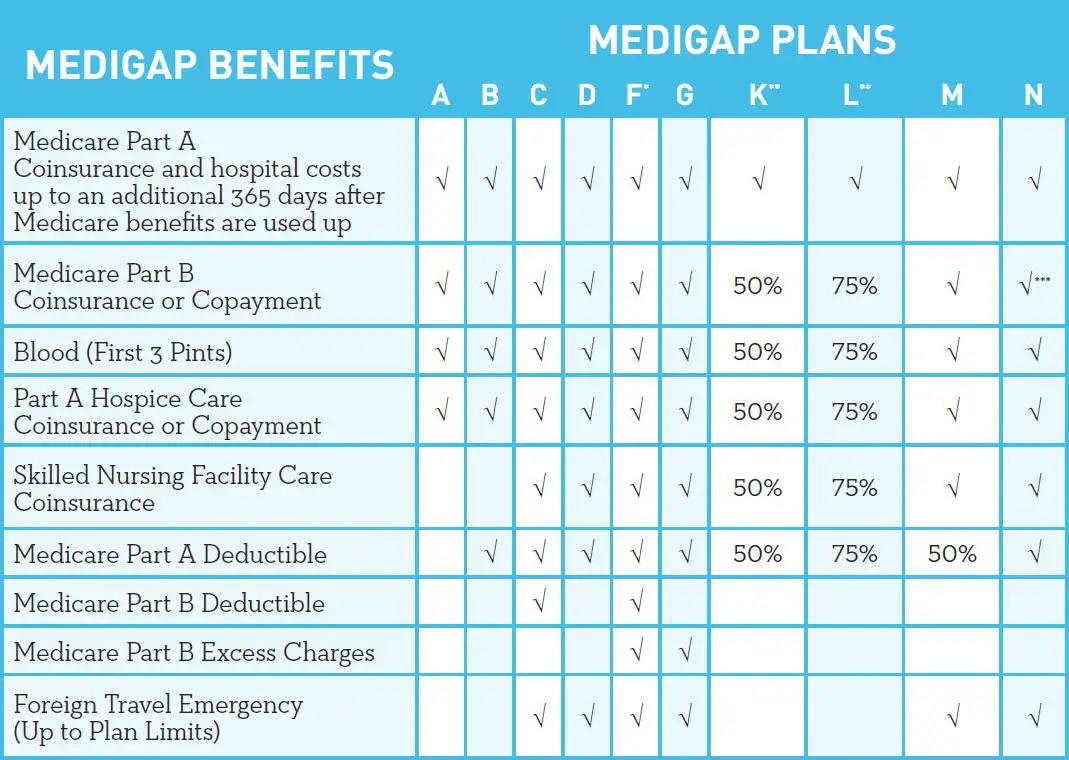

Coverage might include out-of-pocket costs such as deductibles, coinsurance, and copayments. All Medicare Supplement plans typically cover:

- Medicare Part A copayment/coinsurance and hospital costs for an additional year after Medicare benefits run out.

- At least some coverage of hospice care most plans pay the entire Medicare Part A copayment/coinsurance.

- Medicare Part B coinsurance/copayments .

Unlike a Medicare Advantage plan, Medicare Supplement insurance plans in Arizona are not designed to stand alone and may only be purchased in combination with Original Medicare Part A and Part B.

You can choose from a variety of Medicare Supplement insurance plans in Arizona, which are each named by a letter. However, you need to apply for and be accepted by the plan.

There are up to 10 standardized lettered plans. As of January 1, 2020 two Medicare Supplement Plan C and Plan Fcannot be sold to people who first became eligible for Medicare January 1, 2020 or later. Plans C and F cover the Medicare Part B deductible. Congress passed a law that stops Medicare Supplement plans from providing coverage for the Part B deductible for those newly eligible for Medicare in 2020 and later.

NEW TO MEDICARE?

Read Also: What Date Does Medicare Coverage Start

Can You Have Medigap With A Medicare Advantage Plan

While you can have both a Medigap plan and Medicare Advantage plan, its not beneficial to have both. If you decide to add a Medigap plan, it will be secondary to your Original Medicare plan. If you decide to enroll into a Medicare Advantage Plan, it will be your primary coverage and Original Medicare will be your secondary coverage.

Best Extensive Coverage Plan G

- Plan G is the most comprehensive Medicare Supplement insurance plan in Arizona for beneficiaries with a Part B effective date after January 1, 2020.

- For those also qualified for Plan F, Medicare Plan G offers lower premiums with almost the same benefits.

- Covers Part A deductible but not Part B deductible.

- Covers Part B excess charges and coinsurance plus copayments and foreign travel emergency expenses.

You May Like: Can Medicare Take Your House

Which Medigap Plans Are Ideal For Diabetes

Medicare Part B covers most diabetes medication and treatment, so if youre looking for supplemental insurance, you should choose a plan that covers the deductible, coinsurance, and copayment for Part B plans. For that reason, we recommend Medigap Plans C and F for diabetes coverage for anybody under the age of 65.

Pro Tip: Wisconsin, Minnesota, and Massachusetts have different Medigap plans than the rest of the country, so be sure to contact a provider directly if you live in one of these states.

For example, a client of mine had $2,000 per month in diabetes costs. Medicare covered $1,600, leaving $400 per month for him to pay. He ended up finding a Medigap plan that covered the balance, so he had no out-of-pocket costs for medication or visits.

How Much Does Medicare Advantage Cost In 2022

In most states Medicare benificiaries can find an HMO with a zero monthly premium. Some states also offer a PPO with a zero monthly premium, although it is becoming less common.

In Arizona, costs vary from county to county, but the average premium for a Medicare Part C plan in the state is $12.25 per month. If you choose an MAPD plan, the average monthly cost is $16.35.

Don’t Miss: How To Apply For Medicare Without Claiming Social Security

Need More Information About Medicare Supplement Insurance Plans In Arizona

I am happy to help you find the information you need you can schedule a phone call or request an email by clicking on the buttons below. You can also find out about Medicare plan options in your area by clicking the Compare Plans button.

The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

What Are The Benefits Of Buying A Medicare Supplement Plan

The benefit of a Medicare Supplement plan is that it pays for the costs that are not paid for by Original Medicare. These include coverage for prescription medications, hospital stays, hospice care, bloodwork, and emergency room visits. It can drastically limit the out-of-pocket expenses that you may be hit with.

Also Check: Do You Have To Pay For Part B Medicare

Still Unsure About How Supplemental Medicare Insurance Works In Arizona

Are you trying to reduce your overall health care costs by lowering your out-of-pocket costsOut-of-Pocket Costs for Medicare are the remaining costs that are not covered by the beneficiary’s health insurance plan. These costs can come from the beneficiary’s monthly premiums, deductibles, coinsurance, and copayments….? One of these article may be what you’re looking for:

Insurify Composite Score: 7134

- Prescription Drug Plan Deductible: $295

- Out-of-Pocket Limit: $3,900

- Counties: Maricopa, Pinal

This plan offers the same network as above. And though its slightly more expensive, theres still a lot to love. All Tier 1 drugs come with $0 copays, whether you use a preferred provider or not.

And youll get low-to-no-copay coverage for office visits, most diagnostic services, hearing, preventive dental, routine vision, and mental health care.

However, this plan does not cover comprehensive dental.

You May Like: Can You Get Medicare If You Live Outside The Us

Top 10 Supplemental Medicare Insurance Companies In 2022

The above are the top 10 most well-known companies offering Medicare Supplement policies. Every Medigap plan meets government standardization requirements. No matter which company you choose, the benefits are the same when the plan is identical. So, Plan G coverage with Mutual of Omaha is the same as Plan G with Medico.

Plan N coverage is also the same across the board, regardless of whether you go with Cigna, UnitedHealthcare, or any other company that offers the plan. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment which is the majority of doctors, coast-to-coast.

Thus, while comparing options, you may wonder why your premium rate quotes vary between carriers for the same letter plan. In the case of Medicare Supplement plans, many factors affect what youll pay each month. Demographic information such as age, location, and tobacco use affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board.

How Much Do Medicare Supplement Plans In Arizona Cost

While same-lettered Medicare Supplement plans in Arizona offer the same basic benefits, premiums may vary based on the insurance company offering the benefits. Premiums also vary based on the Medicare Supplement plans coverage. Generally, Medicare Supplement plans that provide more coverage cost more than plans that cover only a portion of Original Medicares out-of-pocket costs. Medicare Supplement insurance sold today does not cover prescription drug coverage.

Finally, when you buy a plan can affect the cost of a Medicare Supplement insurance plan in Arizona. You may choose to buy a Medicare Supplement insurance plan in Arizona during your six-month Medigap Open Enrollment Period, which begins on the first day of the month that youre both at least 65 years old and enrolled in Medicare Part B. During this period, insurance companies are not allowed to deny coverage or charge higher premiums due to pre-existing medical conditions. After the Medigap Open Enrollment Period , you can apply for a Medigap plan anytime but your acceptance isnt guaranteed except during your Medigap OEP. After your OEP, an insurer for a Medicare Supplement plan in Arizona can charge a higher premium or refuse to accept your application if you have a health condition.

You May Like: Will Medicare Pay For Handicap Bathroom

Your Arizona Medicare Dental Options

If you have Original Medicare , you may already know that it doesnt include dental coverage. Instead, you will have to choose one of the many Medicare Advantage plans that include dental coverage. Or, you can choose to purchase standalone senior dental coverage from a private insurance company. If you arent looking for full dental insurance, you can enroll in a dental discount plan to help reduce your out-of-pocket costs.

Selecting A Medicare Supplement Insurance Company That Works For You

After youve researched and compared companies, you will select a supplemental insurance company that works best for you. You will want to consider things like the reputation and reviews of the insurance company as well as how easy it is to navigate their website and apply for coverage. Additional factors to consider include types of plans available, pricing, and deductibles. You may also want to select a company that has an app so you can manage your policy on the go.

Also Check: How To Apply For Medicare In San Diego

Medicare Part D In Arizona

Neither Medicare nor Medigap plans cover Part D costs.

Its your responsibility to enroll in a drug plan. When the Initial Enrollment Period passes, a late enrollment penalty will likely apply.

Some Part D policies are less than $20 a month.

However, the lowest premium isnt always the best policy.

To better discover the policy that works for you, give our agents a call. Our agents cross-check your medications with the available coverage options, giving you the best value.

When Can I Enroll In Medicare Supplement Plans In Arizona

Open Enrollment for Medicare Supplement Insurance Plans in Arizona begins the month you turn 65 and enroll in Part B, and lasts for six months. During Open Enrollment, you can buy any plan sold in your state, and you cant be charged more for your plan due to your health status. If you dont buy Medigap during this period, your insurance company may make you pass medical underwriting before approving you for a plan, except in certain other very specific situations.

If you miss your Medicare Supplement Open Enrollment Period, you may be subjected to medical underwriting. Medical underwriting looks at your medical history and current health status. If you have a serious or chronic health condition, you may not be approved, or you could pay higher premiums.

Don’t Miss: What Is The Advantage Of Medicare Advantage

Blue Cross Blue Shield Medicare Supplement

Medicare supplement plans are heavily regulated. Therefore, you wont find much difference between Medigap plans offered by different companies. What you get with Blue Cross Blue Shield, however, is unparalleled access and acceptance.

What we like: With Blue Cross Blue Shield, you have almost unlimited flexibility in who you see wherever you are in the US. They cover all the established and regulated Medicare supplement plans.

Flaws: BCBS doesnt cover co-payments for all services for some reason. The quality of customer service varies considerably from state to state.

Best Pricing: Aarp By Unitedhealthcare

AARP by UnitedHealthcare

-

Best discounts for people new to Medicare

-

User-friendly website

-

Rates do not increase based on age

-

Offers Part D drug plans

-

Does not offer high-deductible Plan G

-

Requires dues for AARP membership

Unlike many other Medicare Supplement companies, AARP UnitedHealthcare uses community-rated pricing in most states. Under this model, everyone in the community is charged at the same rate, regardless of age or gender. This can be beneficial because your premiums will not increase as you age, though, like any plan, they could still increase as a result of inflation.

Founded in 1977, UnitedHealthcare is the insurance arm of UnitedHealth Group. In 1997, it partnered with AARP, one of Americas largest advocacy groups for people over 50 years old. Together, they offer Medicare Supplement Plan Gwhich is available in all states except for Massachusetts, Minnesota, and Wisconsin. High-deductible plans are not available at this time.

Their website is chock full of helpful information and is easy to use. When enrolling in a plan, you can visit their website for an online chat, or call them 7 days a week. To be eligible for an AARP UnitedHealthcare Medicare Supplement Plan G, you must be an AARP member. Membership starts at $12 per year and comes with many perks such as financial advisory tools, health and wellness programs, shopping discounts, and more.

Also Check: How Do I Qualify For Medicare Low Income Subsidy

Medicare Supplement Plans In Massachusetts

Like we mentioned above, Medicare Supplement Insurance plans are structured differently in Massachusetts. Residents of the Bay State only have two plans to choose from: the Core Plan and the Supplement 1 Plan.

-

Coinsurance for Part A services plus 365 additional hospital days

-

Coinsurance and copayments for hospice costs under Part A

-

Coinsurance for medical services under Part B

-

First three pints of blood

Screenshot from “Choosing a Medigap Policy,” July 8, 2019.

Additionally, both plans cover state-mandated insurance benefits, such as annual Pap smears and mammograms. A full list of mandated insurance benefits can be seen here. The state government establishes maximum benefit amounts for some of these benefits. You can find complete plan details for 2019, along with plan premiums, on this link.

In addition to the basic benefits and mandated benefits, the Core plan covers 60 days of hospitalization in a mental health facility. It does not cover any deductibles for Medicare Part A or Part B.

Best for: People who can afford their Part B deductible, especially those who do not have a history of mental health hospitalizations and who do not foresee a need for nursing home or inpatient care. Depending on the insurer, premiums for the Core plan can be much lower than the Supplement 1 plan.

How Does Medicare Work

Coverage for different health care services is broken down into Medicare parts. The different parts detail what health care services are covered under each part.

Medicare parts include:

Part A: Medicare Part A, or hospital coverage, covers inpatient hospital or skilled nursing facility stays. It also covers some portion of home health care and hospice care.

Part B: Medicare Part B is known as medical coverage, and is similar to the benefits you expect from a non-Medicare health insurance plan. Part B covers doctor visits, outpatient hospital visits, ambulance services and preventive services. Your Part B plan has a monthly premium, or cost to have the plan. The combination of Part A and Part B is known as Original Medicare.

Part C: Medicare Part C is technically Medicare Advantage. This is a health insurance plan from a private health insurance provider that offers benefits of Part A and Part B in one plan. Medicare Advantage plans often also offer some benefits of Part D. The plans also usually offer additional benefits not offered by Original Medicare, such as dental or vision coverage.

Part D: Medicare Part D plans offer prescription drug coverage through private insurance companies.

Additional coverage: Medicare parts dont always cover all of your health care needs. You can add a Medicare Supplemental Insurance plan to your Medicare coverage to help fill in the gaps.

You May Like: Do I Need To Keep Medicare Summary Notices