So Whats Not Covered By Medicare Part B

The list above seems long, but there are some medical categories not covered by Part B:

- Acupuncture

- Concierge care: When a doctors office charges you a membership fee for services or amenities not covered by Medicare. Also sometimes called concierge medicine, retainer-based medicine, boutique medicine, platinum practice, or direct care

- Cosmetic surgery: Unless medically needed because of injury or to improve function

- Dental care: Cleanings, fillings, tooth extractions, dentures, and dental plates

- Eye exams for glasses or contact lenses

- Gym memberships and fitness programs

- Hearing aids and associated exams

- Long-term care/custodial care: Help with basic personal tasks, such as bathing, dressing, eating, and using the toilet

- Massage therapy

- Routine foot care: Care related to nerve damage from diabetes or treatment of an injury or disease is covered

- Routine physical exams: Instead, Medicare covers only a Welcome to Medicare visit during your first 12 months on Part B and an annual Wellness visit

Many Medicare Advantage plans include coverage for some of the items above, including vision, hearing, dental, and gym memberships. If these services are important to you, learn more about Medicare Advantage.

Also, note that Part B doesnt pay 100% of expenses, even for covered services. You may be responsible for copays, coinsurance, and deductibles. To cover those additional costs, one solution to explore is a Medicare Supplement Plan, also known as Medigap.

Medicare Part B Premiums

Medicare premiums are subject to change every year. As of 2022, Part A costs $499 per month. However, most people who qualify for Medicare Part A dont need to pay monthly premiums.

Unfortunately, you cannot forgo Part B premiums. The current monthly premium for Medicare Part B is $170.10. You are required to make this payment every month to maintain the benefits of Part B.

Read on: Medicare Costs

Delaying Medicare Part B Enrollment

Most US citizens over the age of 65 are eligible for premium-free Medicare Part A benefits. However, Part B requires a mandatory monthly premium. As a result, many people choose to delay Medicare Part B enrollment and save money on premiums.

To delay Part B enrollment, you or your spouse must have a group health plan through an employer. As long as the health care plan and employment are maintained, you are not required to sign up for Part B. Once the job ends, you have eight months to sign up for Part B without incurring any late fees.

Continue Reading: When To Delay Medicare?

US citizens who live abroad might also want to delay Part B enrollment, as they cannot use their Medicare benefits. While most citizens living abroad need to sign up for Part B when they turn 65, there is one exception. If you are living abroad and do not qualify for premium-free Medicare Part A, you can delay signing up for Part B. In this situation, you have a grace period of up to three months after the date you return to the US to sign up without penalty.

Don’t Miss: How Does Medicare Supplement Plan G Work

Whos Eligible For Medicare Part B

Anyone whos eligible for Medicare is eligible for Part B, and thats anyone who is 65 or older, younger people with disabilities who have been receiving Social Security disability insurance benefits for 24 months and people with end-stage renal disease.3 Also, anyone who has Amyotrophic Lateral Sclerosis or Lou Gehrigs disease.

If youre not sure if youre eligible, try Medicares eligibility tool.

What Will Medicare Part B Cost

Medicare Part B requires a monthly premium,4 which will be automatically deducted from any benefit youre receiving from Social Security, the Railroad Retirement Board or the Office of Personnel Management. Otherwise, youll get a bill.

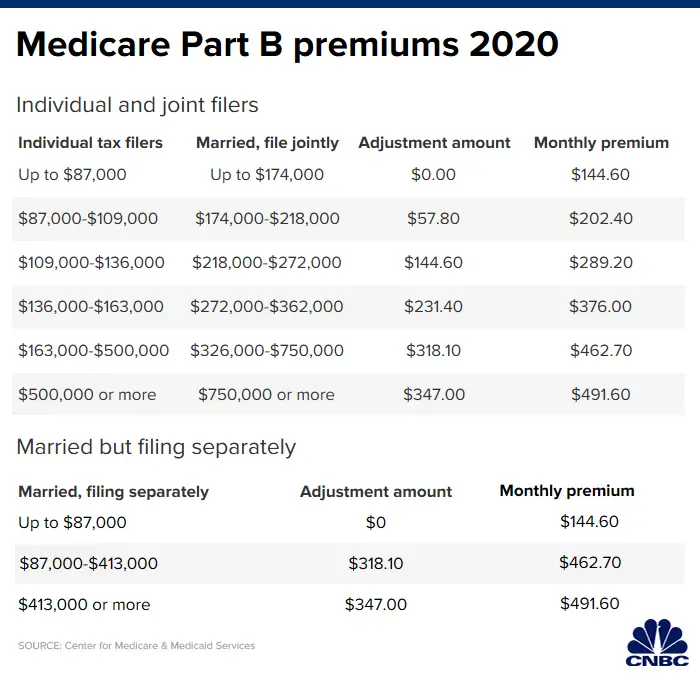

Youll generally pay a standard premium amount unless your modified adjusted gross income is over a certain amount. For this calculation, Medicare uses your IRS tax return from two years prior to identify whether youre a higher-income beneficiary. If you are, youll pay an income-related monthly adjustment amount . Heres how it works.

If your yearly income in 2020 was:

| File taxes as an individual | File taxes as married filing jointly | File taxes as married, filing separately | Youll pay each month in 2022* |

|---|---|---|---|

| $91,000 or less | |||

| $578.30 |

In addition to your monthly premiums, Medicare Part B has a deductible of $233 in 2022. Once you hit your deductible during the year, youll usually be responsible for 20% of Medicare charges for all Part B services .

Although the costs above are standard, if you dont enroll in Part B when youre first eligible and you didnt have a valid reason to delay enrollment your premium may go up 10% for each 12-month period you couldve had it .5 In most cases, youll pay this late enrollment penalty for as long as you have Part B, so dont miss your window.

Recommended Reading: Does Medicare Cover Pill Pack

Medicare Part B Premium For 2022

In 2022, the standard Part B premium is $170.10 per month. Most people pay the standard premium amount. Its either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

People with tax-reported incomes over $91,000 and $182,000 must pay an income-related monthly adjustment amount . The table below shows Part B premiums for 2022 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago.

Filing Individual Tax Returns Total Monthly Part B Premium

$91,000 or less

Total Monthly Part B Premium

$170.10

$544.30

$578.30

Part B premiums for high-income beneficiaries who are married, lived with their spouse at any time during the taxable year, but who are filing separate are shown in the table below.

| Total Monthly Part B Premium |

|---|

|

$91,000 or less |

$91,000 or less

Total Monthly Part B Premium

$170.10

What Does Medicare Part B Cover

Part B is the portion of Medicare that provides financial help for outpatient services and treatments that are medically necessary. The most common cost covered by Part B is the cost of visiting a doctor. But there are many other services that Part B covers, such as diagnostic tests, ambulance services, medical equipment, mental-health services, and second opinions under many circumstances. To be medically necessary, the services must help medical professionals address a disease or medical condition as they go through the process of detection, diagnosis, and cure.

Preventive services are also often covered. For instance, if you’re new to Medicare, then you’ll be able to get a one-time preventive visit for free that includes a close look at your medical history. Your doctor will then look at your present condition, including measuring vision, height and weight, body mass index, and blood pressure. A look at risk factors for depression also gets included. After the visit, you’ll receive a written plan that will detail any services your doctor thinks you should have to avoid any big health problems down the road. In subsequent years, you’ll get annual checkups to stay healthy.

Read Also: Do Husband And Wife Pay Separate Medicare Premiums

Medicare Part A Deductible

Medicare Part A covers certain hospitalization costs, including inpatient care in a hospital, skilled nursing facility care, hospice and home health care. It does not cover long-term custodial care.

For 2022, the Medicare Part A deductible is $1,556 for each benefit period. If you re-enter the hospital or skilled nursing facility any time after your benefit period ends, you will have to pay the first $1,556 again as a new deductible.

How Much Does Medicare Part B Cost In 2021

The standard Part B premium in 2021 is $170.10 per month.

Part B premiums are based on your reported modified adjusted gross income from two years prior if you’re a higher income earner. So your 2022 Part B premiums may be based on your reported income from 2020.

- Individuals with a reported 2020 income of less than $91,000 per year and couples with a combined income of less than $182,000 per year pay the standard Part B premium of $170.10 per month in 2022.

- Anyone with incomes above those thresholds pay more for their Part B coverage based on the Income-Related Monthly Adjusted Amount, or Medicare IRMAA.

The table below breaks down 2022 Medicare Part B premiums according to income.

Medicare Part B IRMAAThe premiums for Part A and Part B can potentially increase every year.

Part B also includes a deductible, which is $233 per year in 2022.

After you meet your Part B deductible, you typically pay 20 percent of the Medicare-approved amount for most covered services. This is called the Part B coinsurance or copayment.

You May Like: What Is The Number For Medicare

Medicare Part B Medical Coverage

What it helps cover:

What it costs:

- Most 2021 Medicare members must pay a monthly premium of $148.50.

- If you don’t enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll.

- The penalty could be as high as a 10% increase in your premium for each 12-month period that you were eligible but not enrolled.

Other Part B costs:

- There is a $203 annual deductible for Medicare Part B in 2021. After the deductible, youll pay a 20% copay for most doctor services while hospitalized, as well as for DME and outpatient therapy.

- There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

- If you receive these services at a hospital outpatient department or clinic, additional copays or coinsurance amounts may apply.

Medical Equipment Used To Administer Medications

- Infusion pumps

- Nebulizer machines

* Oral chemotherapy and anti-nausea agents have to meet certain criteria to be covered by Part B. While the majority of injectable medications will be covered by Part B, keep in mind that some drugs may be excluded. The coverage requirements change on an annual basis.

** Hepatitis B risk factors for the purpose of Part B coverage include diabetes mellitus, ESRD, hemophilia, living with someone who has Hepatitis B, or being a healthcare worker who could be exposed to blood or other bodily fluid.

Also Check: Are Legal Residents Eligible For Medicare

Using Medigap To Pay Medicare Deductibles

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles.

These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia. There are different standardized plans for Minnesota, Massachusetts and Wisconsin.

Each plan has a letter for a name. Some of these plans may cover all or a portion of your Part A deductible.

Medigap Plan Coverage of Part A Deductibles

| A |

|---|

How Part B Coverage Is Determined

Not all states have the same Medicare Part B. There will be some differences in what gets covered and what does not. The same basic categories of medical expenses are all covered, no matter what state you buy Part B from, but there is some variety between what fits under the same classifications of coverage from one state to the next. This can leave some people wondering what is Medicare Part B in their state or local area.

There are federal and state laws that decide what coverage is provided by specific medical insurance plans. Local laws and local insurance companies can decide what is considered medically necessary and what isnt. Medicare can change the coverage on Part B as well. When Medicare makes changes, though, then those changes tend to be nationwide and affect every version of this plan.

What all of this means for you is that Medicare Part B, like any Medicare plan, can be in a state of flux. Its not always the same plan no matter where you go, and it isnt always going to offer you the same coverage. Be sure you look at what applies to you locally when you go to sign up for any medical insurance plan. You might be counting certain coverage to be provided that isnt offered in your area, and you need to be prepared for that and have a way to deal with those extra expenses if they occur.

Recommended Reading: Which One Is Better Medicare Or Medicaid

Medicare Program Medicare Part B Monthly Actuarial Rates Premium Rates And Annual Deductible Beginning January 1 2021

A Notice by the Centers for Medicare & Medicaid Services on

Document Details

Information about this document as published in the Federal Register.

- Printed version:

- The premium and related amounts announced in this notice are effective on January 1, 2021.

- Effective Date:

Document Details

Document Statistics

- Page views:

- as of 12/27/2021 at 4:15 am EST

Document Statistics

Enhanced Content

Relevant information about this document from Regulations.gov provides additional context. This information is not part of the official Federal Register document.

- Docket Number:

- Medicare Part B Monthly Actuarial Rates, Premium Rates, and Annual Deductible Beginning January 1, 2021

- Docket RIN

Enhanced Content

This document has been published in the Federal Register. Use the PDF linked in the document sidebar for the official electronic format.

-

Enhanced Content – Table of Contents

This table of contents is a navigational tool, processed from the headings within the legal text of Federal Register documents. This repetition of headings to form internal navigation links has no substantive legal effect.

Enhanced Content – Table of Contents

Enhanced Content – Submit Public Comment

Enhanced Content – Submit Public Comment

Enhanced Content – Read Public Comments

Enhanced Content – Read Public Comments

Enhanced Content – Sharing

Enhanced Content – Document Print View

Enhanced Content – Developer Tools

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

Recommended Reading: What Medicare Supplement Covers Hearing Aids

Can I Reject Part B Altogether

Medicare Part B is optional. You can choose to skip it altogether and avoid the premiums. But that means youre on the hook for the full cost of any services that would otherwise be covered under Part B. For healthy enrollees, that might amount to the occasional office visit and nothing more. But if you end up needing extensive outpatient care such as kidney dialysis, chemotherapy, radiation, physical therapy, etc. your bills could add up quickly.

As noted above in the discussion about late enrollments, you will have a chance to sign up for Part B each year, regardless of how long youve delayed your enrollment. But the late enrollment penalty could become substantial, depending on how long youve been without Part B coverage. And if and when you do decide to enroll, youll have to wait until the January-March general enrollment period, with your coverage taking effect in July. So going without Part B when you dont have other coverage from an employers plan is an option, but its a fairly risky option.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

When Can You Enroll In Medicare Part B

You can sign up for Medicare Part B during the 7-month period that begins 3 months before your 65th birthday and 3 three months after that birthday.

If you have ALS, you may enroll in Medicare as soon as your Social Security disability insurance goes into effect.

If you have ESRD, you can enroll for Medicare starting on the first day of your fourth month of dialysis. If you do home dialysis, you dont have to wait 4 months and can apply immediately.

You may also apply immediately for Medicare if youre hospitalized for a kidney transplant.

Recommended Reading: Should I Get Medicare Supplemental Insurance

When To Enroll In Medicare Part B

The periods to enroll in Medicare Parts A or B are the same. You are eligible to enroll in Medicare Part B if you are a US citizen who is 65 or older. If you meet these requirements, you can first sign up during the 7-month Initial Enrollment Period. For most people, this begins three months before their 65th birthday and ends three months after.

Continue reading: When to signup for Medicare?

If youre receiving retirement benefits, you dont need to worry about signing up you will automatically be enrolled in Medicare Parts A and B when you turn 65.

If you miss the initial enrollment period and havent begun collecting retirement benefits , you can enroll in Medicare Part B during the General Enrollment Period. This period begins at the start of every calendar year and continues for three months .

Agent Tip

If you dont enroll in Medicare Part B on time, you can be subject to a life-long penalty. If you are unsure if you should sign up you give us a call at .

Finally, some people can sign up for Part B during a Special Enrollment Period . SEPs provide a way for people covered under a group health plan to sign up for Part B. However, even if you do have a group health plan, youre only eligible if youre working or have finished work within the last eight months.