Can You Take Your Medicare Advantage Plan With You If You Move

If you have a Medicare Advantage plan, you will need to enroll in a new one for the state youre moving to. Medicare Advantage plans are sold by private insurers that contract with Medicare.

You will also need to check with your Medicare Advantage plan to see if your coverage will continue once you move even if you are moving within your state.

There were 3,550 Medicare Advantage plans available nationwide for 2021, according to the Kaiser Family Foundation. But not all are available in every state. Plans vary widely from state to state and even between counties within a state.

If youre moving to a rural area where Medicare Advantage coverage is more limited, you may also want to consider switching to Original Medicare with a Medigap plan. You should also consider a standalone Medicare Part D prescription drug plan if you go this route.

What Does Medicare Cover While Youre Abroad

Medicare may pay for services at a foreign hospital if it is closer to your home than an American hospital. That circumstance could apply to Americans living on the Canadian or Mexican borders. The program will also cover you if you suffer a medical emergency while traveling in the U.S. and treatment at a foreign hospital is closest.

Medicare also covers medical care on cruise ships that are in U.S. territorial waters, meaning that the vessel is within six hours of an American port.

But beyond that, you need to plan for coverage in traveling abroad. To ensure emergency medical coverage and peace of mind youll need a policy that falls under one of three categories: Medicare Supplement, Medicare Advantage, or trip-specific travel health insurance.

Traveling With Medicare Advantage Or Part D

When it comes to Medicare Advantage or Part D plans, traveling can get tricky. Unlike Original Medicare, Medicare Advantage and Part D plans can be limited by the plans service area, and if you leave it, your plan may not cover you. Some Medicare Advantage plans may offer travel coverage , but the costs could vary depending on the plans rules about in-network versus out-of-network providers.

For Medicare Advantage and Part D plans, youll want to contact your plan provider to understand your options while traveling nationally or internationally.

Read Also: Who Pays For Part A Medicare

If Youre Transitioning Into Or Out Of Inpatient Care

If youve been hospitalized as an inpatient and move out of state after discharge, your Medicare benefits wont be disrupted.

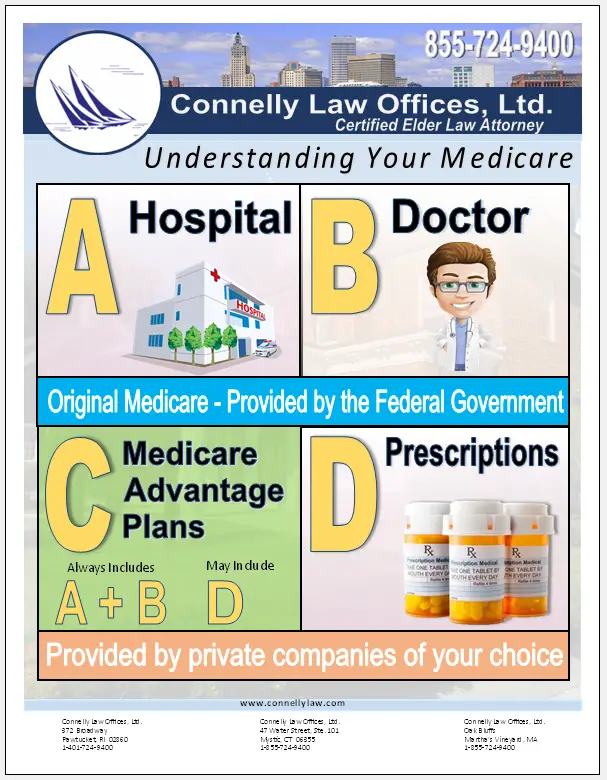

Hospitalization and inpatient care are covered under Medicare Part A, which is part of original Medicare and required to be a part of every Medicare Advantage plan.

While you may still need to switch your Medicare Advantage plan once you move, your Medicare Part A benefits will be covered either way.

Are There Any Special Rules For Medicare Coverage For Skilled Nursing Facility Or Nursing Home Residents Related To Covid

In response to the national emergency declaration related to the coronavirus pandemic, CMS is waiving the requirement for a 3-day prior hospitalization for coverage of a skilled nursing facility for those Medicare beneficiaries who need to be transferred as a result of the effect of a disaster or emergency. For beneficiaries who may have recently exhausted their SNF benefits, the waiver from CMS authorizes renewed SNF coverage without first having to start a new benefit period.

Nursing home residents who have Medicare coverage and who need inpatient hospital care, or other Part A, B, or D covered services related to testing and treatment of coronavirus disease, are entitled to those benefits in the same manner that community residents with Medicare are.

Medicare establishes quality and safety standards for nursing facilities with Medicare beds, and has issuedguidance to facilities to help curb the spread of coronavirus infections. In the early months of the COVID-19 pandemic, the guidance directed nursing homes to restrict visitation by all visitors and non-essential health care personnel , cancel communal dining and other group activities, actively screen residents and staff for symptoms of COVID-19, and use personal protective equipment .

Topics

Recommended Reading: How To Apply For Medicare Without Claiming Social Security

Changing Medicare Advantage Plans When Moving

Moving is a change that qualifies you for a Special Enrollment Period. The Special Enrollment Period will allow you to change your Medicare Advantage plan, only when you are moving out of your current plans service area. So, if youre moving down the street, you likely wont qualify for a plan change.

Does Medicare Cover Me While I Travel

Many older adults look forward to fulfilling their travel bucket list during retirement, but Medicare may not be along for the ride.

If you have Medicare coverage, you wont receive reimbursement for international medical bills. Healthcare services received beyond U.S. borders are not covered.

In some cases, Medicare may cover inpatient hospital costs, ambulance services or dialysis for the following circumstances:

In any of these situations, the foreign hospital is not required to file a Medicare claim. If it doesnt, be prepared to submit an itemized bill to Medicare.2

Your Medicare coverage follows you if you travel to:

- Another state in the U.S

- District of Columbia

Don’t Miss: Does Medicare Cover Rides To Medical Appointments

Searching For Providers Who’ve Opted Out

Search this database by first name, last name, National Provider Identifier , specialty, or ZIP code to find providers who’ve opted out of Medicare. Enter at least one field to start your search. You can also download a national list of providers whoâve opted out of Medicare. To find more ZIP codes near your street address or ZIP code, try entering “find ZIP codes in a radius” in your usual search engine.

If You Move Outside Your Current Plans Service Area

If you move out of your current Medicare Advantage plans service area, you can switch to a new plan in the month before or within 2 months after you move.

If you wait until youve moved to notify your current plan provider, you then have the month you notify the plan plus an additional 2 months to switch to a new plan.

Also Check: Will Medicare Pay For A Power Lift Chair

How To Bill Out Of State Blue Cross Blue Shield Plans

In this brief article, you'll learn how we at TheraThink always handle eligibility and benefits verification as well as claims filing for new patients with Blue Cross Blue Shield insurance plans filing from an out of state plan. We'll teach you what questions to ask and how to always file correctly for these tricky plans!

Filing to out of state Blue Cross Blue Shield plans can be a huge pain! But we have some specific, repeatable advice that will help you dramatically reduce your headache handling Out of State Blue Card billing. If you want to skip the pain completely, consider trying our insurance billing service exclusively for mental health providers. We take care of this nightmare for you.

The steps are simple and there are just three:

If You Are Retired And Neither You Nor Your Spouse Works While Abroad:

In this situation, you have a difficult decision to make: Either pay monthly Medicare Part B premiums for coverage you cant use outside the United States, or delay enrollment until you return to the U.S. and then become liable for permanent late penalties.

There is one exception to this Catch-22 rule. Some people dont qualify for Medicare Part A benefits without paying monthly premiums for them because they or their spouses havent contributed enough in payroll taxes at work. In this situation, you cannot sign up for Part A or Part B outside the United States. Therefore, in this specific circumstance, you can delay Medicare enrollment until your return, without being subject to late penalties regardless of how long you lived outside the U.S. or how many years have passed since you turned 65. Your special enrollment period begins during the month of your return as a U.S. resident and expires at the end of the third month following. Coverage begins on the first day of the month after you enroll.

If you decide to sign up for Part B while abroad, you can do so by contacting the nearest U.S. embassy or consulate in the country where you live. You can find contact information on the Social Security Administrations international website.

Read Also: Who Can Get Medicare Part D

What Telehealth Benefits Are Covered By Medicare And How Much Do Beneficiaries Pay

Based on new waiver authority included in the Coronavirus Preparedness and Response Supplemental Appropriations Act the HHS Secretary has waived certain restrictions on Medicare coverage of telehealth services for traditional Medicare beneficiaries during the coronavirus public health emergency. The waiver, effective for services starting on March 6, 2020, allows beneficiaries in any geographic area to receive telehealth services allows beneficiaries to remain in their homes for telehealth visits reimbursed by Medicare allows telehealth visits to be delivered via smartphone with real-time audio/video interactive capabilities in lieu of other equipment and removes the requirement that providers of telehealth services have treated the beneficiary receiving these services in the last three years. A separate provision in the CARES Act allows federally qualified health centers and rural health clinics to provide telehealth services to Medicare beneficiaries during the COVID-19 emergency period.

Telehealth services are not limited to COVID-19 related services, and can include regular office visits, mental health counseling, and preventive health screenings. During the emergency period, Medicare will also cover some evaluation and management, behavioral health, and patient education services provided to patients via audio-only telephone.

Tips For Traveling With Medicare

If you are planning to travel to another state and have Original Medicare, look up some doctors offices, health clinics and hospitals convenient to where youll be staying and find out if they accept Medicare insurance.

If you will be traveling and you have a Medicare Advantage or Medicare Part D plan, contact your plan carrier or consult the plans directory of network providers to see where you may be able to receive coverage during your travels.

Don’t Miss: Will Medicare Pay For A Hospital Bed At Home

Medicare Doesn’t Cover Routine Vision Care

Medicare generally doesnt cover routine eye exams or glasses . But some Medicare Advantage plans provide vision coverage, or you may be able to buy a separate supplemental policy that provides vision care alone or includes both dental and vision care. If you set aside money in a health savings account before you enroll in Medicare, you can use the money tax-free at any age for glasses, contact lenses, prescription sunglasses and other out-of-pocket costs for vision care.

Medicare Doesn’t Cover Long

One of the largest potential expenses in retirement is the cost of long-term care. The median cost of a private room in a nursing home was roughly $105,800 in 2020, according to the Genworth Cost of Care Study a room in an assisted-living facility cost $51,600, and 44 hours per week of care from a home health aide cost $54,900.

Medicare provides coverage for some skilled nursing services but not for custodial care, such as help with bathing, dressing and other activities of daily living. But you can buy long-term-care insurance or a combination long-term-care and life insurance policy to cover these costs.

Recommended Reading: Does Medicare Pay For Revitive

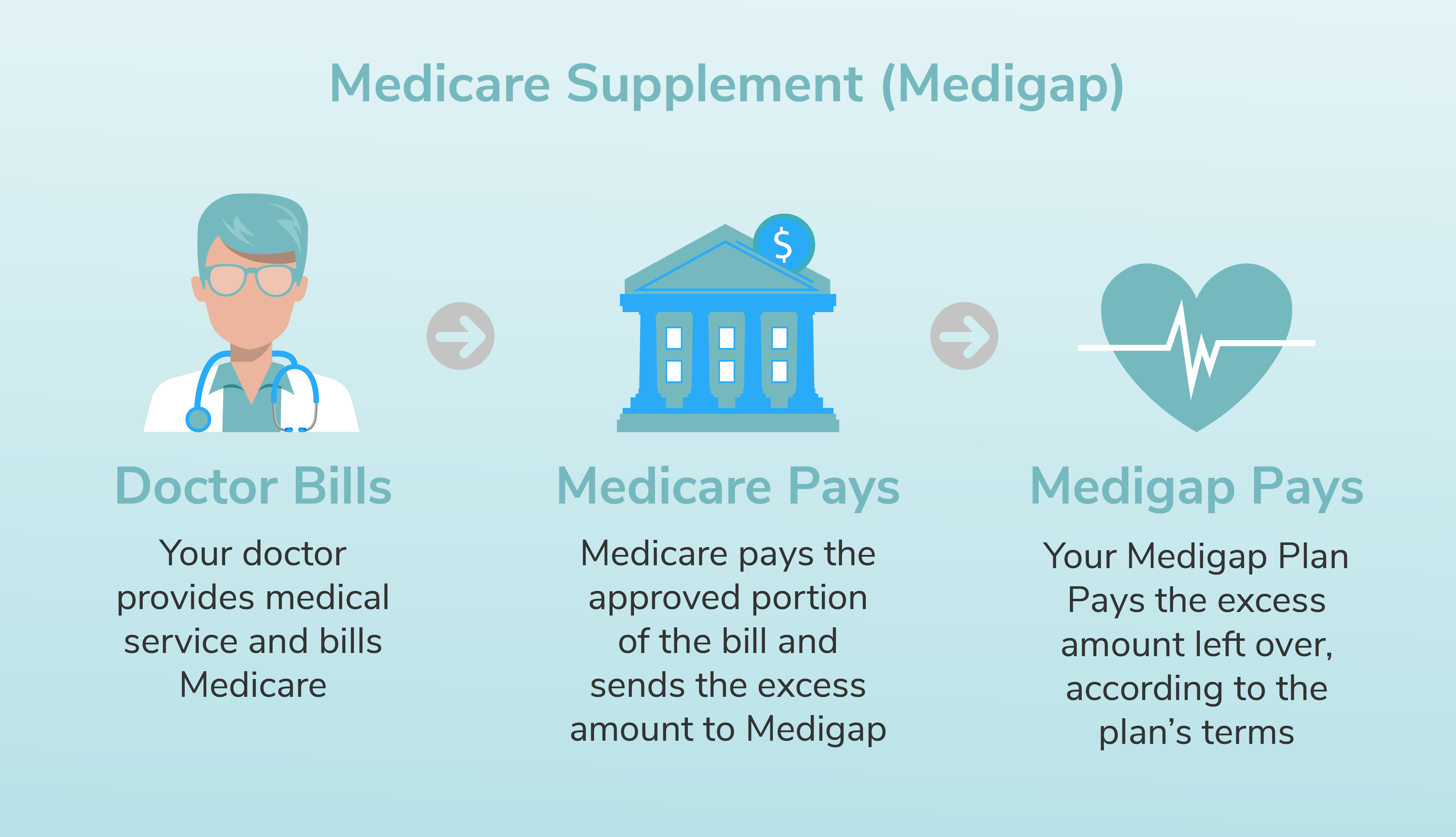

How To Use Medigap Out

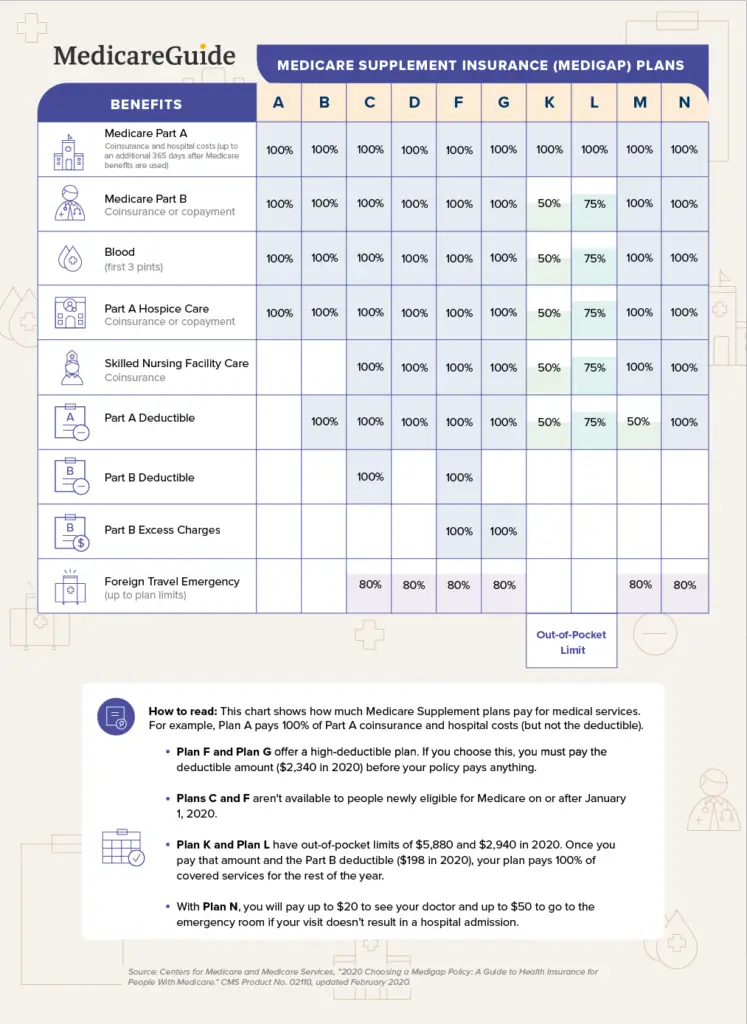

Medigap, or Medicare Supplement Insurance, is a form of private Medicare insurance that covers some of the out-of-pocket costs associated with Original Medicare such as deductibles, copayments and coinsurance.

Medigap insurance is accepted by any health care provider who accepts Original Medicare. If you can use your Original Medicare coverage, you can use your Medigap plan, too.

In fact, one of the benefit areas that is covered by some Medigap plans is foreign emergency care. Original Medicare only covers emergency care received outside the U.S. or U.S. territories under limited circumstances. But certain Medigap plans can cover 80% of the cost of such care.

Ask Your Doctor For A Referral

If you simply cannot afford to stick with your doctor, ask them to recommend the next best doctor in town who does accept Medicare. Your current doctor has probably already prepared for this eventuality and arranged to transfer Medicare patients to another physician’s care.

Just because you are eligible for Medicare doesn’t mean you have to enroll in all four parts. If you have other health insuranceâfor example, you’re still working and can remain covered by your employer’s group planâyou may want to stick with that plan. Medicare Advantage Plan networks are another alternative to investigate. Physicians in those HMO-like plans have agreed to accept the network’s fees.

Also Check: How Soon Can You Enroll In Medicare

Using Medicare Advantage Plans Outside Of The Us

While some Medicare Advantage plans can be used out of state, these plans usually dont provide coverage outside of the U.S. Seniors who are traveling out of the country may choose to purchase travel medical insurance.

In limited circumstances, Medicare Advantage plans provide coverage outside of the U.S. For example, if seniors are traveling between Alaska and another state and must pass through Canada, Medicare may pay for emergency care provided in a Canadian hospital. Medicare also pays for medical care seniors receive on cruise ships, provided the ship is in U.S. territorial waters.

Can I See A Doctor In Another State With Medicare

With Original Medicare , you can see doctors anywhere in the United States, as long as they accept Medicare.

If you travel or move to another state, your Original Medicare coverage goes with you. The same is true if you move to or travel to Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa and the Northern Mariana Islands.

If you have a Medicare Supplement Insurance plan , a Medicare Advantage plan or a Medicare Part D prescription drug plan, this guide can help explain what you need to do to use your Medicare plan in another state.

You May Like: Can You Have Medicare And Medicaid Both

Does Medigap Cover You While Abroad

Most Medicare Supplement plans, include a foreign travel benefit check to see if yours does. Medicare Supplement plans C, D, E, F, G, H, I, J, M, and N that cover travel, pay for 80% of the cost of medically necessary emergency care outside of the U.S. and its territories.

Youll be responsible for a separate $250 deductible. The medical emergency must occur within 60 days of the start of your trip. So it wont work if you leave the country indefinitely. Plus, theres a $50,000 lifetime limit to the amount this benefit will payout.

Medigap policies are not a Medicare replacement. Theyre an additional benefit on top of your existing coverage under Original Medicare . And be aware that Medicare Part D prescription benefits also do not extend outside the U.S. and its territories.

Transferring Medicare Part D

Like Medicare Advantage, Medicare Part D prescription drug plans are optional and are sold through private insurance companies. The available plan options and costs will vary based on where you live.

If you currently have a stand-alone Part D plan, follow the same steps as listed above for Medicare Advantage to make sure you can transfer your coverage to your new area of residence.

You May Like: Does Medicare Pay For Dtap Shots

If You Or Your Spouse Is Working While Abroad:

You can delay Medicare enrollment in Part B if you have health care coverage from:

- An employer for which you actively work and which provides group health insurance for you

- The public national health service of the country where you live regardless of whether you or your spouse works for an employer or are self-employed

- The sponsoring organization of voluntary service you provide abroad

When you stop working or lose your coverage from any of the above situations, you will be entitled to a special enrollment period of up to eight months to sign up for Medicare without risking late penalties. So if you stop working but dont return to the United States within that time frame, youll confront the same dilemma that nonworking people abroad face either sign up for Part B and pay premiums for coverage you cant use or delay enrollment until your return to the U.S. and then become liable for permanent late penalties.

The rules for Part D drug coverage are the same as those noted in the information provided above for nonworking Americans abroad.

How Does Medicare Work When You Move To A Different State

Medicare is a federal healthcare program for people age 65 and over, as well as those who have certain health conditions or disabilities.

Because its a federal program, Medicare provides services in every part of the country. It doesnt matter which state you live in your basic Medicare coverage will stay the same.

Although your Medicare coverage wont end or change when you move, youll often need to find new healthcare professionals who participate in Medicare. Doctors must accept Medicares payment terms and meet certain requirements to participate in the program.

Regardless of where you live, participating doctors and healthcare professionals will submit a bill to Medicare for the services they provide to you.

Read Also: Are Grab Bars Covered By Medicare