How To Apply For Medicare Part A And Part B Before Age 65

Some people are automatically enrolled in Original Medicare. If youve been receiving disability benefits from Social Security or the Railroad Retirement Board for 24 months in a row, you will be automatically enrolled in Original Medicare, Part A and Part B, when you reach the 25th month.

If you have ALS or Lou Gehrigs disease, youre automatically enrolled in Medicare the month you begin receiving your Social Security disability benefits.

Some people will need to sign up for Medicare themselves. If you have end-stage renal disease , and you would like to enroll in Medicare Part A and Part B, you will need to sign up by visiting your local Social Security Office or calling Social Security at 1-800-772-1213 . If you worked for a railroad, please contact the RRB to enroll by calling 1-877-772-5772 , Monday through Friday, 9 AM to 3:30 PM, to speak to an RRB representative.

If The Employer Has Fewer Than 20 Employees

The laws that prohibit large insurers from requiring Medicare-eligible employees to drop the employer plan and sign up for Medicare do not apply to companies and organizations that employ fewer than 20 people. In this situation, the employer decides.

If the employer does require you to enroll in Medicare, then Medicare automatically becomes primary and the employer plan provides secondary coverage. In other words, Medicare settles your medical bills first, and the group plan only pays for services that it covers but Medicare doesnt. Therefore, if you fail to sign up for Medicare when required, you will essentially be left with no coverage.

Its therefore extremely important to ask the employer whether you are required to sign up for Medicare when you turn 65 or receive Medicare on the basis of disability. If so, find out exactly how the employer plan will fit in with Medicare. If not, ask for that decision in writing.

Note that in this situation, signing up for Medicare Part B when you also have employer insurance will not jeopardize your chances of buying Medigap supplemental insurance after the employment ends. When Medicare is primary to the employer plan, you have the right to buy Medigap with full federal protections if you do so within 63 days of the employer coverage ending.

How Does Medicare Work With My Job

Keep in mind that:

- Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security .

- If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Part A to avoid a tax penalty.

Don’t Miss: Can You Get Medicare Advantage Without Part B

Enrollment Windows Are Limited

If you’re thinking about delaying your enrollment in Medicare, keep in mind that there are enrollment windows that apply. After your initial enrollment window ends, you can only sign up for Medicare Part A and B during the general annual enrollment period from January 1March 31, with coverage effective July 1.

And you can sign up for Part D during the annual enrollment period from October 15December 7, with coverage effective January 1 of the coming year.

So if you delay your enrollment, you could be paying higher premiums when you eventually do enroll, and you’ll have to wait until an open enrollment period in order to have access to coverage. If you’re only enrolled in Part A, for example, and you get diagnosed with a serious illness in April, you’ll have to wait until the following January to have Part D coverage, and until the following Julymore than a year in the futureto have Part B coverage.

Keep all of this in mind when you’re deciding whether to enroll in the parts of Medicare that have premiums.

Can I Avoid Penalties

There are some special circumstances in which you can sign up late for Medicare without paying penalties. After the initial enrollment period, you can sign up for optional programs during special enrollment periods.

If you or your spouse continued working past your 65th birthday and had health insurance through your employer, you wont have to pay a penalty for late enrollment in any of the Medicare programs.

Beginning the month after you end your employment, or when your group health plan insurance from that employment ends, you have an 8-month window to sign up for Medicare parts A and B without penalty.

COBRA and retiree health plans are not considered as coverage under current employment and do not qualify you for a special enrollment period or save you from late enrollment penalties.

You can also qualify for a special enrollment period for Medicare parts A and B and avoid late enrollment penalties if you were volunteering in a foreign country during your initial enrollment period.

Don’t Miss: How Does Medicare Plan G Work

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Do I Need To Enroll At 65 If I Work For A Small Company

The laws that prohibit large companies from requiring Medicare-eligible employees to drop the employer plan and sign up for Medicare do not apply to companies with fewer than 20 people. In this situation, the employer decides.

You generally need to sign up for Medicare Parts A and B during your initial enrollment period, which begins three months before and ends the three months after the month you turn 65. If you dont, you could end up with large coverage gaps.

If the employer does require you to enroll in Medicare, which is most common, Medicare automatically becomes your primary coverage at 65 and the employer plan provides secondary coverage. In other words, Medicare settles your medical bills first, and the group plan pays only for services it covers but Medicare doesnt.

So if you fail to sign up for Medicare when required, you essentially will be left with no coverage.

Extremely important: Ask the employer whether you are required to sign up for Medicare when you turn 65 or are eligible to receive Medicare earlier because of a disability. If so, find out exactly how the employer plan will fit in with Medicare. If youre not required to sign up for Medicare, ask the employer to provide the decision in writing.

When Medicare is primary coverage and the employer plan is secondary, you have the right to buy Medigap later with full federal protections. But you must do so within 63 days of the employer coverage ending.

You May Like: How To Get Medicare To Pay For Hearing Aids

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

What Happens If I Miss My Medicare Enrollment

If you miss your initial enrollment period, you can still sign up for Medicare, but you could face late enrollment penalties. Anyone can sign up during the Medicare general enrollment period, which happens from Jan. 1 to March 31 each year. If you meet the qualifying circumstances, you can sign up any time through a Medicare special enrollment period.

You May Like: Can You Sign Up For Medicare Part A Only

Dont Register For Medicare Alone

If youre uncomfortable with applying for Medicare alone, we can help! Our services are entirely free for you. When applying, if you would like an agent by your side, we can walk you through setting up all your coverage.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

- Was this article helpful ?

Do You Have To Sign Up For Medicare If You Are Still Working

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because theyre still working, theyre likely covered under their employers health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Being covered under your employer-provided health insurance plan has no bearing on your Medicare eligibility. Medicare works in conjunction with several other types of health insurance including health insurance provided by employers or unions and wont prevent you from enrolling.

However, if you are not collecting Social Security retirement benefits at least four months before you turn 65, you will not be automatically enrolled in Medicare when you turn 65. In this case, you will have to manually sign up for Medicare when youre ready to enroll.

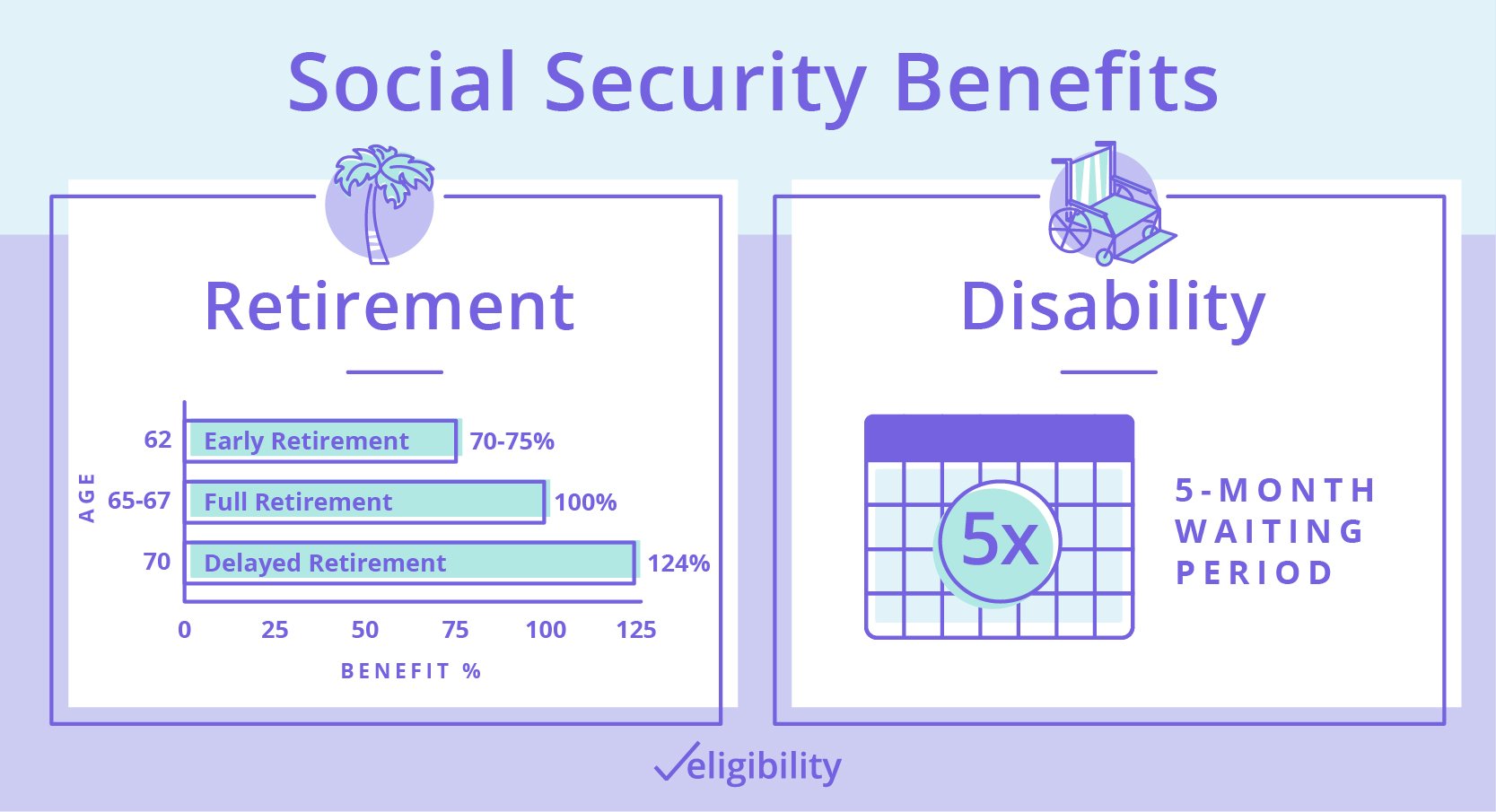

Many people choose to delay their Social Security retirement benefits until a later age when they can collect the full amount. If you choose to delay your retirement benefits, you must still sign up for Medicare manually once youre eligible in order to avoid any late enrollment penalties .

Some people who are still working sign up for Medicare anyway, because Medicare can work as extra insurance along with an employer group health insurance plan. Some people may decide that Medicare is more affordable than their employers insurance, so they may continue working but disenroll from their group plan and enroll in Medicare instead.

You May Like: Do You Have Dental With Medicare

Working At A Large Company

The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance .

Many people with large group health insurance delay Part B but sign up for Part A because it’s free.

“It doesn’t hurt you to have it,” Roberts said.

However, she said, if you happen to have a health savings account paired with a high-deductible health plan through your employer, be aware that you cannot make contributions once you enroll in Medicare, even if only Part A.

Also, if you stay with your current coverage and delay all or parts of Medicare, make sure the plan is considered qualifying coverage for both Parts B and D.

If you’re uncertain whether you need to sign up, it’s worth checking with your human resources department or your insurance carrier.

“I find it is always good to just confirm,” said Elizabeth Gavino, founder of Lewin & Gavino and an independent broker and general agent for Medicare plans.

Some 65-year-olds with younger spouses also might want to keep their group plan. Unlike your company’s option, spouses must qualify on their own for Medicare either by reaching age 65 or having a disability if younger than that regardless of your own eligibility.

How Medicare Affects Your Coverage

Medicare is the federal health insurance program for people who are 65 or older, or otherwise receiving Social Security disability benefits.

Medicare is divided into four different parts, which cover specific services. You will only need to focus on these three if you enroll in a state-sponsored retiree insurance plan:

Don’t Miss: Does Medicare Advantage Pay For Incontinence Supplies

Citizenship And Residency Requirements

In most cases, to be eligible for Medicare, you need to be a U.S. citizen living in the U.S.

You can also qualify for Medicare if you’re a permanent U.S. resident who has been living in the U.S. for five continuous years prior to the month you apply for Medicare.

Even though these two eligibility criteria are specifically for Medicare Part B, they also apply to most other parts of Medicare. That’s because Part B enrollment is required for enrollment in Medicare Part C, Medicare Part D, Medigap and the Medicare Part A paid plans.

However, if you qualify for the free Medicare Part A plan because of your work history, you can be enrolled in Part A plan without being enrolled in Part B.

If Im Still Working At Age 65 When Do I Sign Up For Medicare

En español | If you arent already receiving Social Security benefits at age 65, you wont be signed up automatically. So youll have to make a decision.

Whether you need to enroll in Medicare if you continue to work and have health benefits through your job depends on the size of the employer. The same rules apply if your health insurance is through your spouses job.

Also Check: Does Medicare Advantage Cover Chiropractic Care

Avoiding Penalties For Not Signing Up For Medicare With Special Enrollment Periods

There are some situations where you might be able to delay enrollment in Medicare without having to pay a late enrollment penalty. You might qualify for a Medicare Special Enrollment Period. For example, if youâre still covered under an employer or union plan, or your spouseâs plan, you may be able to switch to Medicare coverage after your Medicare Initial Enrollment Period without a penalty. Generally thereâs a time limit on making this transition, so if your other coverage is coming to an end, you might want to talk to your plan administrator about switching over to Medicare. You can also ask a licensed eHealth insurance agent.

Tell Ors Your Medicare Number And Effective Dates For Parts A And B

When your new 11-digit Medicare card arrives, tell ORS your Medicare number as soon as you receive your card.

- Log in to miAccount and send a secure message on Message Board, using the Submit My Medicare Number category. Include the name, Medicare number, and effective dates for parts A and B in your message for the individual going on Medicare.

- Use miAccount to update your Medicare information and complete a plan change to enroll in the Medicare health and prescription drug plan. Print the confirmation page and mail or fax it to ORS.

- Make a copy of your Medicare card. Write your name, member ID, address, and date of birth on the copy and mail or fax the copy of your card.

- Mail or fax a completed Insurance Enrollment/Change Request form to ORS with your Medicare information.

Do not enroll yourself or your eligible dependents in an individual Part D plan . All prescription drug plans offered by the retirement system for Medicare members are Part D plans, including those offered by our HMO options.

Also Check: What Is Medicare Id Number

Is Medicare Part A Mandatory

Technically, no Medicare Part A is not mandatory.

If you dont sign up for Medicare Part A, however, you must withdraw from all federal benefits programs. That means you cannot receive Social Security or Railroad Retirement Board benefits. You must also repay any benefits you have already received if you decline Medicare. This is one reason why most people keep their Part A coverage once their eligible.

You will qualify for premium-free Medicare Part A benefits if you worked and paid Medicare taxes for at least 10 full years .

Most beneficiaries qualify for premium-free Part A. Enrolling in Medicare Part A does not kick you off your existing health coverage.

Medicare works with other types of insurance, such as employer coverage, VA insurance and Tricare. If you are still working and have quality health insurance provided by your employer, you can have coordination of benefits to cover your health care costs.

- If your employer has fewer than 20 employees, Medicare will be the primary payer. That means Medicare will pay first for any covered care you receive, and then your employer insurance will pick up the rest of the services covered by that plan.

- If your employer has 20 or more employees, your employer insurance will pay first and Medicare will serve as the secondary payer to pick up any additional covered services.

Some Medicare beneficiaries have to pay a premium for their Part A coverage.

Who Should Sign Up At 65 Even If They Have Other Insurance

This leaves a fairly long list of other types of insurance that become secondary payers to Medicare. Therefore, if you’re turning 65 and any of these situations apply to you, you should sign up for Medicare during your initial enrollment period.

- You have group coverage through your or your spouse’s employer, but the employer has fewer than 20 workers.

- You have retiree coverage, either through your former employer or your spouse’s former employer.

- You have group coverage through COBRA.

- You have TRICARE, the healthcare program for military service members, retirees, and their families. Retired service members must get Medicare Part B when eligible in order to keep their TRICARE coverage.

- You have veterans’ benefits.

- You have coverage through the healthcare marketplace or have other private insurance. Once your Medicare coverage begins, you’ll no longer get any reduced premium or tax credit for marketplace coverage, and you should drop this coverage as you’ll no longer need it .

If one of these situations applies to you and you don’t sign up for Medicare Part B during your initial enrollment period, you could face permanently higher premiums when you do.

The Motley Fool has a disclosure policy.

Recommended Reading: Does Medicare Have Open Enrollment