Medicare Part B And Coinsurance/copayments

You usually pay a 20% coinsurance amount for covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

Apply For A Medicare Part B Plan

If youre ready to apply for a Medicare Part B health plan, HealthMarkets can help at no cost to you. Start reviewing your options online today, or call 439-6916 to speak with a licensed insurance agent.You can also locate a licensed insurance agent near you to schedule an in-person or virtual meeting.

48105-HM-1021

Delaying Part B Coverage And Late Enrollment Penalties

You should enroll in Part A when youre first eligible near your 65th birthday, but some people may choose to delay Part B.

If you receive group health insurance at work or through your spouses employer you may be able to delay enrollment in Part B.

But once you stop working or that coverage ends, you must sign up for Part B within eight months. Otherwise, youll face a late enrollment penalty.

If you enroll in Part B after your group health insurance ends, you have options for how to apply.

You can do so online through an application on the Social Security website or by mail.

How to Sign Up for Part B by Mail After Employer Health Insurance Ends

You May Like: Is Smart Vest Covered By Medicare

Signing Up For A Medicare Advantage Plan

If you prefer to get your health coverage through a Medicare Advantage plan, you must first enroll in Original Medicare Part A and Part B and then switch to a separate Medicare Advantage plan.

All Medicare Advantage plans must offer the same Medicare Part A and Part B benefits as Original Medicare, but some plans include other benefits, such as prescription drug coverage, dental and vision.

Medicare Advantage Plans do not all offer the same benefits.

Use the Medicare Plan Finder or call your local SHIP representative to compare plans in your area.

Four Ways to Sign Up for a Medicare Advantage Plan

To join a Medicare Advantage plan, you will need your Medicare number and the date your Part A and Part B coverage began.

Don’t Leave Your Health to Chance

Do I Automatically Get Medicare Part B When I Turn 65

If you have been a United States Citizen for at least 5 years, you will become eligible for Medicare Part B at age 65. However, this does not mean you will automatically enroll in Medicare Part B coverage.

If you are turning 65 and have been receiving Social Security benefits you do not need to enroll in Medicare Part B on your own, you will automatically be enrolled in coverage. On the other hand, if you are not receiving Social Security benefits, you will need to contact your local Social Security office to enroll in Medicare Part B benefits.

Don’t Miss: When Do Medicare Premiums Increase

How Do I Sign Up For Medicare Part B If I Already Have Part A

If you are already enrolled in Medicare Part A and you would like to enroll in Part B under the Special Enrollment Period , you can apply online at Apply for Medicare Part B Online during a Special Enrollment Period. You can upload your application and documents that verify your group health plan coverage through your employer.

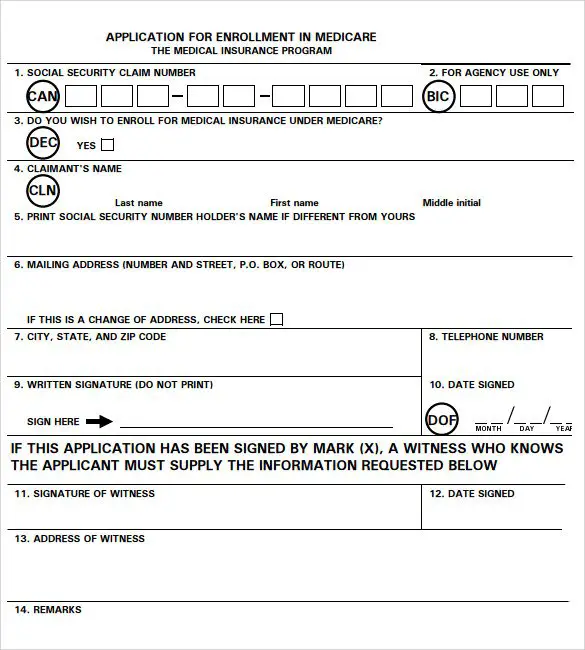

You can also fax or mail your completed CMS-40B, Application for Enrollment in Medicare Part B and the CMS-L564, Request for Employment Information enrollment forms and evidence of employment to your local Social Security office. If you have questions, please contact Social Security at 1-800-772-1213 .

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employer’s signature.

- Also submit one of the following forms of secondary evidence:

- Income tax returns that show health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

When Youre Ready Contact Social Security To Sign Up:

- Apply online This is the easiest and fastest way to sign up and get any financial help you may need. Youll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online.

- Contact your local Social Security office.

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

You May Like: What Is Part B Excess Charges In Medicare

How Can I Check On My Medicare Application

I applied for Medicare benefits last week. How can I check the status of my application?

You can check the status at our secure website, secure.ssa.gov/apps6z/IAPS/applicationStatus, but you must wait five days from the date you originally filed. You will need to enter your Social Security number and the confirmation number you received when you filed your application. Your application status also shows the date that we received your application, any requests for additional documents, the address of the office processing your application, and whether a decision has been made about your benefits. If you are unable to check your status online, you can call us at 1-800-772-1213 from 7 a.m. to 7 p.m. weekdays.

Can I Delay Enrolling In Medicare Part B

Some people may get Medicare Part A âpremium-free,â but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B comes with a monthly premium, some people may choose not to sign up during their initial enrollment period if they are currently covered under an employer group plan .

If you are still working, you should check with your health benefits administrator to see how your insurance would work with Medicare. If you delay enrollment in Medicare Part B because you already have current employer health coverage, you can sign up later during a Special Enrollment Period without paying a late penalty. You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends , you have an eight-month special enrollment period to sign up for Part B without a late penalty.

Keep in mind that retiree coverage and COBRA are not considered health coverage based on current employment and would not qualify you for a special enrollment period. If you have COBRA after your employer coverage ends, you should not wait until your COBRA coverage ends to sign up for Medicare Part B. Your eight-month Part B special enrollment period begins immediately after your current employment or group plan ends . This is regardless of whether you get COBRA.

This information is not a complete description of benefits. Contact the plan for more information.

You May Like: Why Is My First Medicare Bill So High

When Is The General Enrollment Period

If you didnt sign up for Medicare when you were first eligible, and dont qualify for special enrollment, you can sign up during the General Enrollment Period. This period is from January 1 to March 31 each year. Your coverage will start on July 1. You may have to pay a higher premium for missing the Initial Enrollment Period.

I Have Va Health Care Benefits

VA benefits cover care you receive in a VA facility. Medicare covers care you receive in a non-VA facility. With both VA benefits and Medicare, youll have options for getting the care you need.

Its usually a good idea to . VA health care benefits do not qualify as creditable coverage. You may have to pay a penalty if you delay Part B enrollment, unless you have other creditable coverage such as through an employer.

Don’t Miss: Is It Too Late To Change Medicare Advantage Plans

Signing Up For A Medigap Policy

To purchase a Medigap supplement insurance policy, you must first enroll in Medicare Part A and Part B.

Medigap policies are not required but enrolling in one can help you pay out-of-pocket costs, including deductibles, coinsurance and copayments.

The best time to enroll in a Medigap plan is when you are first eligible.

This is a six-month enrollment period that begins the month youre 65 and enrolled in Medicare Part B.

If you apply for Medigap coverage after this six-month window, private insurance companies may not sell you a policy if youre in poor health.

You can find a Medigap policy by using an online tool on the Medicare website, contacting your local SHIP or calling your State Insurance Department.

How to Sign Up for a Medigap Policy Online

What Is Medicare Part B

While Medicare Part A covers hospital bills, Medicare Part B covers outpatient medical services. These include visits to healthcare providers, ambulance services,2 and supplies, such as walkers and infusion pumps.3 Medicare Part B covers 80% of the cost of approved services and supplies.

Medicare Parts A and B do not cover long-term care, most dental care, glasses, hearing aids, dentures, routine foot care, acupuncture or cosmetic surgery. 4

Also Check: What Is The Yearly Deductible For Medicare

Medicare Part B Enrollment Sometimes Automatic Sometimes Not

U.S. citizens and legal permanent residents of at least five continuous years may be eligible for Medicare coverage. Youâre usually enrolled in Medicare Part A and Part B automatically when you turn 65 or qualify by disability at any age and you receive Social Security Administration or Railroad Retirement Board benefits. For details about how you qualify for automatic enrollment, see Medicare Enrollment.

Youâre not automatically enrolled in Medicare Part B in all situations. Here are a few examples of when you may qualify for Part B, but you need to sign up manually:

- If you live in Puerto Rico, youâre typically signed up for Medicare Part A automatically when you turn 65 if youâre collecting SSA or RRB benefits. However, you need to manually.

- If you have end-stage renal disease , regardless of your age, you may qualify for Medicare but you generally have to apply manually.

- If youâre not receiving SSA or RRB benefits when you turn 65, if you want to enroll in Medicare Part B, you need to sign up for it.

You can sign up for Medicare Part B during the following enrollment periods:

To add Medicare Part B, contact the Social Security Administration at 1-800-772-1213 , 7AM-7PM, Monday to Friday. For additional information, contact Medicare at 1-800-MEDICARE , 24 hours a day, 7 days a week.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Read Also: Will Medicaid Pay My Medicare Premium

How To Cancel Medicare Part B

The Part B cancellation process begins with downloading and printing Form CMS 1763, but dont fill it out yet. Youll need to complete the form during an interview with a representative of the Social Security Administration by phone or in person.

Due to the COVID-19 pandemic, all Social Security Administration offices are currently closed. The SSA is still answering phone calls, and you can access many services on its website. See the latest COVID-19 updates.

You can schedule an in-person or over-the-phone interview by contacting the SSA. If you prefer an in-person interview, use the Social Security Office Locator to find your nearest location. During your interview, fill out Form CMS 1763 as directed by the representative. If youve already received your Medicare card, youll need to return it during your in-person interview or mail it back after your phone interview.

What happens next depends on why youre canceling your Part B coverage.

Recommended Reading: What Age Qualifies You For Medicare

Other Questions Surrounding Medicare Part B Enrollment

What are the premium costs for Medicare Part B?

The standard monthly Part B premium in 2020 is $144.60 .1 But how much you’ll pay depends on your income. See below how the Part B premium is figured.

If your yearly income in 2018 was*

| File individual tax return |

|---|

*Cost based on Medicare.gov. Data effective 11/12/19.

Also Check: How Do I Report A Lost Medicare Card

How Much Does Medicare Part B Cost

Medicare Part B comes with some costs on your end. Thereâs a monthly premium, and there may be deductibles, coinsurance and/or copayments. Letâs get into these one at a time.

The Medicare Part B monthly premium may change from year to year, and the amount can vary depending on your situation. For many people, the premium is automatically deducted from their Social Security benefits.

The standard monthly Part B premium: $170.10 in 2022.

If your income exceeds a certain amount, your premium could be higher than the standard premium, as there are different premiums for different income levels.

If you are receiving Social Security, Railroad Retirement Board, or federal retirement benefits, your Part B premium will be deducted directly from your monthly benefit. If not, you will be sent a bill every three months.

The chart below shows the Medicare Part B monthly premium amounts, based on your reported income from two years ago . These amounts may change each year. A late enrollment penalty may be applicable if you did not sign up for Medicare Part B when you were first eligible. Your monthly premium may be 10% higher for each 12-month period that you were eligible, but didnât enroll in Part B.

| Medicare Part B monthly premium in 2022 | |

| You pay | |

| $578.30 | $750,000 or more |

How To Sign Up For Medicare Heres What You Need To Know

You can enroll in Medicare Part A and/or Medicare Part B in the following ways:

- Online at www.SocialSecurity.gov.

- In-person at your local Social Security office.

If you worked at a railroad, enroll in Medicare by contacting the Railroad Retirement Board at 1-877-772-5772 . You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative.

Recommended Reading: Does Medicare Cover Knee Injections

What Is The Medicare Advantage Plan Initial Coverage Election Period:

Most beneficiaries are first eligible to enroll in a Medicare Advantage plan during the Initial Coverage Election Period. Unless you delay Medicare Part B enrollment, this enrollment period takes place at the same time as your Initial Enrollment Period , starting three months before you have both Medicare Part A and Medicare Part B and ending on whichever of the following dates falls later:

- The last day of the month before you have both Medicare Part A and Part B, or

- The last day of your Medicare Part B Initial Enrollment Period.

If youre under 65 and eligible for Medicare due to disability, your IEP will vary depending on when your disability benefits started.

What Does Medicare Part B Cover

Part B provides coverage for a mixture of outpatient medical services. This includes coverage for preventive vaccines, cancer screenings, annual lab work, and much more.

It will cover preventive services in addition to specialist services. Part B even covers services for mental healthcare, durable medical equipment that your doctor finds medically necessary.

Also, Part B will cover some services you receive while in the hospital. This includes surgeries, diagnostic imaging, chemotherapy, and dialysis if you obtain drugs while at the hospital, it will also provide coverage for those.

You May Like: Can You Switch Back To Medicare From Medicare Advantage

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment for its services, some people may find it difficult to pay for the monthly costs associated with this portion of Medicare. Those with limited incomes, in particular, may wonder if there are cost assistance programs in place to help mitigate the financial burden.

In fact, there are a few ways that you can reduce your monthly premiums, or at least make your healthcare more affordable using different programs. One such way is to enroll in a Medicare Savings Program. Run by individual states in conjunction with Medicare, Medicare Savings Plans help you pay for medical costs associated with deductibles, coinsurance and copayments, in some cases. There are four Medicare Savings Programs available, but only three of them relate to Medicare Part B. They are:

The Qualified Medicare Beneficiary Program

- The Qualifying Individual Program

- The Specified Low-Income Medicare Beneficiary Program

Each program has its own eligibility requirements. For example, members of the QI Program must apply every year for assistance. Acceptance is based on a first-come, first-served basis, with priority given to past recipients. You also wont qualify for the QI Program if you receive Medicaid benefits. If you think that you qualify for one of these programs or need financial assistance, then you should contact the Medicaid program in your state to find out more information.