Canceling Part B Because You Got A Job With Insurance

If you have had Part B for a while but no longer need it because youve rejoined the workforce with access to employer-sponsored health insurance, congratulations! But before you drop Part B, find out if your jobs coverage is primary or secondary to Medicare.

A primary payer health plan pays before Medicare. That means your employer-provided health plan will cover its share of your health care costs first, and if theres anything left over that Medicare covers, Medicare will pay what remains.

Conversely, a secondary payer health plan covers only costs left over after Medicare covers its share.

If your health plan at work is a primary payer, thats great. Feel free to drop your Part B coverage if you wish. The Part B premiums might not be worth any additional coverage you receive. But if you have secondary-payer insurance at work, its usually better to keep Part B, or you could get stuck paying Medicares share of your health care expenses.

Talk to your human resources department at work to find out if your employer-sponsored plan is primary or secondary to Medicare. Generally, businesses with 20 or fewer employees have secondary payer plans, while larger companies have primary payer plans.

Medicare Part C: Medicare Advantage

Also known as Medicare Advantage, Part C is an alternative to traditional Medicare coverage. Coverage normally includes all of Parts A and B, a prescription drug plan , and, depending on your choice of a Medicare Advantage plan, other possible benefits.

Part C is administered by Medicare-approved private insurance companies that collect your Medicare payment from the federal government.

Depending on the plan, you may or may not need to pay an additional premium for Part C. You still need to pay your Medicare Part B premium. You don’t have to enroll in a Medicare Advantage plan, but for many people, these plans can be a better deal than paying separately for Parts A, B, and D. Beneficiaries will still pay separate premiums if they don’t choose to have the Part “C/D” premium taken out of their Social Security check.

If you’ve been pleased by the coverage of a Health Maintenance Organization , you might find similar services using a Medicare Advantage plan.

Enrolling In Medicare Advantage

To join a Medicare Advantage Plan, you will need to have Original Medicare coverage and live in an area where an Advantage plan is offered.

A Medicare Advantage plan will wrap your Medicare Part A and Part B coverage into one plan. But youll still have to pay the government a premium for Part B, in addition to the premium you pay for Medicare Advantage .

You can enroll in a Medicare Advantage plan when youre first eligible for Medicare, or during the annual Medicare open enrollment period in the fall .

Also Check: How Do I Get Dental And Vision Coverage With Medicare

Medicare Part B May Cover Certain Vaccinations In Full

Medicare Part B and Medicare Advantage plans provide coverage for a number of vaccinations such as influenza, pneumococcal and Hepatitis B. These vaccines are not subject to the Part B deductible or coinsurance.

If a vaccine becomes available, it should eventually be available at doctors offices and pharmacies similar to a flu shot. It may take some time for the vaccine to be widely available, however.

While you do not need to enroll in a prescription drug plan in order to receive full coverage of the COVID-19 vaccine, its typically a good idea to enroll in some form of prescription drug coverage.

Even if you are not taking any prescription drugs now, you never know when you might become sick or injured and may be prescribed some medication for treatment. And you may not be able to simply enroll in such a plan the moment you need it.

Medicare prescription drug coverage from a Medicare Advantage plan that covers drugs or from a standalone Medicare Part D plan is a good thing to have and an even better thing to not have to use.

Stay safe out there and stay up to date on how Medicare is helping serve beneficiaries during the coronavirus pandemic.

If you have any additional questions about the Medicare plans available near you that provide drug coverage, you can call today to speak with a licensed insurance agent who can help you compare plan costs, find out what plans cover your drugs and if youre eligible help you sign up for the right plan for you.

About the author

You Take Retiree Coverage Without Taking Part B

Most retiree plans will inform you that you have to take Part B in order to be covered by the plan. If you dont sign up for Part B when you first qualify for it, your retiree plan might pay little or nothing toward your health care.

Additionally, many employers offer retiree benefits through Employer Group Waiver Plans a type of Medicare Advantage plan. You have to be enrolled in Medicare Parts A and B to receive retiree benefits through an EGWP.

You May Like: When Does Medicare Coverage Start

Is It Better To Have Medicare Advantage Or Medigap

Beyond freedom of choice, theres coinsurance to consider. Most Medicare Advantage plans require you to pay for a portion of your care. The good news is that theres an annual out-of-pocket maximum for all your combined Medicare Part B copays and coinsurance.

The bad news: In 2021, the Medicare Advantage out-of-pocket maximum is $7,550, though some plans can set a lower ceiling. If you get cancer in September you are not going to be done with treatment until the next year, so you could easily incur $15,000 in coinsurance within six months, says Kunkle Roberts.

That would likely be more than you would owe if you had Original Medicare and also paid for a separate Medigap plan, and Medicare Part D prescription drug coverage.

Medigap plan premiums vary based on where you live. But even in the pricey New York City market, you can get the most generous Medigap plan for around $280-$300 a month, and nationwide the average Part D benefit adds another $30 or so. Just as an example, even if you paid $350 in combined premiums for Medigap and a Part D plan, Original Medicare could end up costing much less than if you ended up being hit with the maximum out of pocket cost for Part A and Part B coverage in a MA plan.

Medicare Advantage plans can be a case study of penny wise, pound foolish. The lowor no premiumsare a good dealuntil you get sick. The challenge for healthy 65-year-olds is to work through the math of potential costs if at some future time costly treatment is needed.

Medicare Part D: Prescription Drugs

Prescription drug coverage, known as Part D, is also administered by private insurance companies. Part D is optional and is normally included in any Medicare Advantage plan. Depending on your plan, you may have to meet a yearly deductible before your plan begins covering your eligible drug costs. Some Part D plans have a co-pay.

Medicare prescription drug plans have a coverage gapa temporary limit on what the drug plan will cover. The coverage gap is often called the “doughnut hole,” and this gap kicks in after you and your plan have spent a certain amount in combined costs. For example, in 2020 the donut hole occurs once you and your insurer combined have spent $4,020 on prescriptions.

Once you have paid $6,350 in out-of-pocket costs for covered drugs , you have reached the level of “catastrophic coverage,” for 2020 in out-of-pocket costs for covered drugs. This means you are out of the prescription drug “doughnut hole” and your prescription drug coverage begins paying for most of your drug expenses again.

Many states have insurance options that will close the coverage gap, but these may require paying an additional premium.

Recommended Reading: What Age Can You Start To Collect Medicare

What Are The Medicare Prescription Drug Coverage Options

All Part D and prescription drug plans are offered through private insurance. Availability varies by state.

The right plan for you depends on your budget, medication costs, and what you want to pay for premiums and deductibles. Medicare has a tool to help you compare plans in your area looking ahead to 2020.

- Part D. These plans cover prescription medications for outpatient services. All plans have to offer some basic level of drug coverage based on Medicare rules. Specific plan coverage is based on the plans formulary, or drug list. If your doctor wants a drug covered thats not part of that plans list, theyll need to write a letter of appeal. Each nonformulary medication coverage decision is individual.

- Part C . This type of plan can take care of all your medical needs , including dental and vision coverage. Premiums might be higher and you might have to go to network doctors and pharmacies.

- Medicare supplement .Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums. Choose the best option to give you maximum benefits at the lowest rates.

New Medigap plans dont cover prescription drug copays or deductibles. Also, you cant buy Medigap insurance if you have a Medicare Advantage plan.

What Parts A And B Don’t Cover

The largest and most important item that traditional Medicare doesn’t cover is long-term care if the only care you need is custodial. If you are diagnosed with a chronic condition that requires ongoing long-term personal care assistance, the kind that requires an assisted-living facility, Medicare will cover none of the cost. However, Medicare will cover the costs for acute-care hospital services, for patients who are transferred from an intensive care or critical care unit. Services covered could include head trauma treatment or respiratory therapy.

Read Also: What Medications Are Covered By Medicare

More Disadvantages Of Medicare Advantage Plans

Dr. Brent Schillinger, former president of the Pam Beach country Medical Society, has pointed out a host of potential problems he encountered with Medicare Advantage Plans as a physician. Here’s how he describes them:

- Care can actually end up costing more, to the patient and the federal budget, than it would under original Medicare, particularly if one suffers from a very serious medical problem.

- Some private plans are not financially stable and may suddenly cease coverage.

- One may have difficulty getting emergency or urgent care due to rationing.

- The plans only cover certain doctors, and often drop providers without cause, breaking the continuity of care.

- Members have to follow plan rules to get covered care.

- There are always restrictions when choosing doctors, hospitals, and other providers, which is another form of rationing that keeps profits up for the insurance company but limits patient choice.

- It can be difficult to get care away from home.

- The extra benefits offered can turn out to be less than promised.

- Plans that include coverage for Part D prescription drug costs may ration certain high-cost medications.

Tips For Choosing A Medicare Part D Plan

Remember, the plan you choose isnt set in stone. If your needs change year to year, you can switch to another plan in the next open enrollment period. Youll have to stay in the plan an entire year, so choose carefully.

When using the Medicare plan finder to choose a Part D plan, enter your medications and doses, then select your pharmacy options. Of the available drug plans, youll see the lowest monthly premium plan displayed first. Keep in mind, the lowest premium plan may not fit your needs.

Theres a drop-down selection to the right of the screen listing three options: lowest monthly premium, lowest yearly drug deductible, and lowest drug plus premium cost. Click through all the options and look at your choices before making a final decision.

Don’t Miss: When Is Open Enrollment For Medicare

B Premium Reduction Give Back Plans

The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isnt available in all areas. Those with this plan may see a higher amount on their Social Security check, depending on their Part B premium payment method.

Small Networks Of Doctors

Medicare Advantage plans also come with much smaller networks of doctors compared to Medigap plans. Medigap will pay for all providers across the United States who accept Medicare assignment. Always check an Advantage plans provider directory before you enroll to confirm ALL your doctors are in the plans network.

Also, be aware that your doctor is free to leave the plans network at any time of the year. Unfortunately, you will still be stuck in that plan until the next Annual Enrollment Period. So, youll either need to pay 100% of your medical costs or find a new doctor in your plans network.

Read Also: Is Pennsaid Covered By Medicare

What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

Are Medicare Advantage Plans Worth It

Medicare Advantage plans are certainly worth the zero-dollar premium however, its your choice to decide if the coverage is right. The value of an Advantage plan depends on your location, healthcare needs, budget, and preferences.

Some healthy people live in prime Medicare Advantage areas, and they prefer to pay as they go. But at the same time, people do leave Medicare Advantage plans for good reasons.

Read Also: Will Medicare Pay For Handicap Bathroom

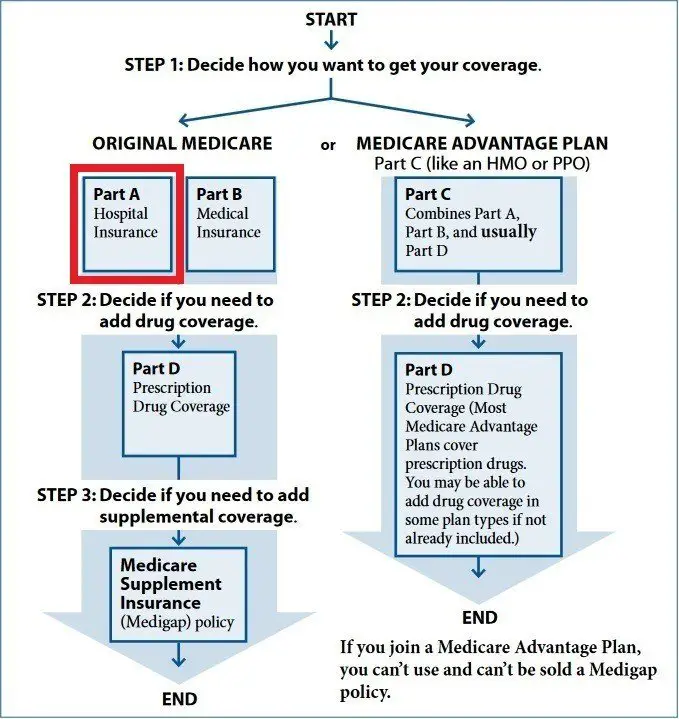

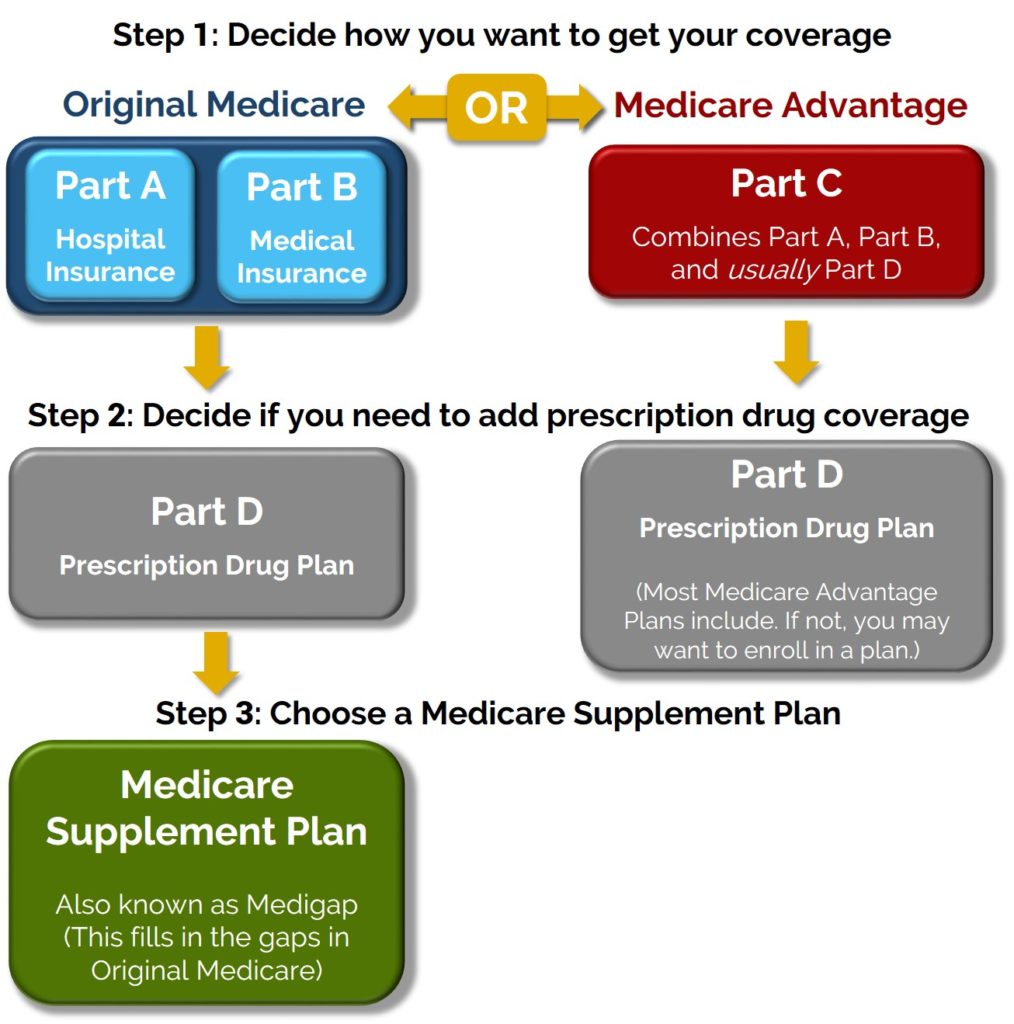

Original Medicare And Medicare Advantage

Original Medicare, a government program, consists of the combination of Part A hospital insurance with Part B medical insurance.

However, if you sign up for Medicare Part A only, then you do not qualify for other helpful benefits through Medicare health plans, which require having Original Medicare.

A central choice that Medicare beneficiaries make lies between getting health insurance through the government Medicare program, or through a private plan that provides equal or greater coverage than the government program.

Without both Medicare Part A and Part B, a person cannot get any benefits from Part C: Medicare Advantage plans, or the added protection of Medigap.

Medicare Advantage plans can offer more benefits than Original Medicare while possibly costing less. These Part C can even build in the prescription coverage of Part D.

Comparison shopping will help subscribers compare Original Medicare to Medicare Advantage.

Do I Need To Do Anything After I Enroll In A Medicare Advantage Plan

Once you enroll in a Medicare Advantage plan during Annual Enrollment, the plan will work with Medicare to transfer your benefits. You dont have to contact Medicare yourself. Your new plan will begin covering you on January 1.

If you have a stand-alone Part D prescription drug plan or other private Medicare plan, youll need to contact the plan provider directly to dis-enroll. Simply call the number on the back of your insurance member ID card.

When deciding to change to a Medicare Advantage plan, keep the following in mind:

- You may choose a different Medicare Advantage plan or return to Original Medicare during the Medicare Advantage Open Enrollment Period, January 1 March 31.

Recommended Reading: Does Medicare Cover Bladder Control Pads

What Is The Part B Premium Reduction Plan

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage, youll see a section that says Part B premium buy-down this is where you can see how much of a reduction youll get. Although, your agent or the customer service number on the back of your card can also tell you about the coverage.

Is Medicare Advantage A Good Deal

Whether Medicare Advantage is a good deal depends on who you ask. Some additional coverage is better than none. If youre on a limited budget and cant afford the monthly premiums for a Medigap plan, then an Advantage plan with sufficient coverage for your health needs is a good deal.

If you need to use your benefits often, then it may not be such a good deal. Your cost-sharing will quickly add up and could easily exceed a years worth of Medigap premiums.

Also Check: How Much Is Medicare B Deductible

Notes On Part D Changes

- If youre enrolled in a Medicare Advantage plan that includes prescription drug coverage, you can simply enroll in a stand-alone Part D Prescription Drug Plan, which will automatically disenroll you from your Medicare Advantage plan .

- If your Medicare Advantage plan does not include prescription drug coverage and youre planning to switch to Original Medicare plus a Part D plan, youll need to actively disenroll from the Medicare Advantage plan and then enroll in a Part D Prescription Drug Plan. Its recommended that you complete both actions within the same month if you disenroll from a Medicare Advantage plan in January but dont enroll in a Part D prescription plan until February, your Original Medicare coverage would take effect in February, but your drug coverage wouldnt kick in until March.

- Youll also have the option to apply for a Medigap plan when you switch to Original Medicare, albeit with medical underwriting in most cases .