Medicare Supplement Underwriting Questions

Lindsay MalzoneReviewed by: Rodolfo MarreroHomeFAQsMedigap

An insurance company may want you to answer Medicare Supplement underwriting questions when applying for coverage. Medical underwriting is a risk assessment the insurance company uses your medical health history to determine how likely you are to file medical claims. Below will go over possible questions an insurance company could ask, reasons for policy denial, and how you can get help navigating medical underwriting.

What Do Medicare Supplement Plans Not Cover

Medigap policies do not extend coverage beyond Original Medicare.

For instance, they do not cover dental and vision care, hearing aids and non-skilled home care.

Except for plans written before 2006, Medigap also does not cover prescription drugs. Separate plans, called Medicare Part D, are available through private insurers approved by the federal government.

Lastly, Medigap does not cover private-duty nursing or long-term care. Such coverage would have to come from a standalone long-term care insurance policy.

Helping Pay Medicare Deductibles Co

In order to help pay for deductibles, co-payments, and co-insurance related to your Medicare policy, you can purchase an additional Medigap policy from a private insurance agency. Medigap policies also require a monthly premium that must be paid in addition to your Medicare premium, but can help offset the larger costs of health care services . Medigap policies are sold by private agencies but are regulated by the government and must be guaranteed to be renewable in other words, they cannot be cancelled if your health declines. They must also not duplicate your existing coverage.

Medigap policies often exclude many of the same services as Medicare , so it is important to carefully review what is and is not covered. You can purchase varying degrees of Medigap coverage based on what you are able and willing to pay for your monthly premium for example, some Medigap policies will help pay for medical expenses you may incur when traveling outside of the U.S. You also have a right to cancel a policy within a certain amount of time if you are not happy with the policy.

Also Check: Does Medicare Pay For Eyeglasses For Diabetics

Read Also: Can I Sign Up For Medicare Before I Turn 65

Medigap Policy Without Creditable Drug Coverage

You’ll probably have to pay a late enrollment penalty if you have a Medigap policy that doesn’t include creditable prescription drug coverage and you decide to join a Medicare Prescription Drug Plan later. This means you’ll pay a higher monthly premium than if you joined when you were first eligible.

Your penalty amount increases for each month you wait to join a Medicare drug plan. In general, you’ll have to pay this penalty for as long as you have a Medicare drug plan. Learn more about the Part D late enrollment penalty.

What’s New For Medicare Beneficiaries Under Age 65

Medicare Supplemental Insurance federal regulations do not guarantee eligibility to individuals under age 65 who are eligible for Medicare due to disability. However, thirty-three states have adopted state legislation extending guarantee issue to that group of individuals. North Carolina is one of the states that legislatively mandates eligibility to individuals eligible for Medicare due to disability.

North Carolina G.S. 58-54-45 guarantees that individuals under the age of 65 who qualify for Medicare are eligible to purchase a Medigap policy A, D, and G effective January 1, 2020. This change took place due to changes in federal legislation regarding Medigap Plans A, C, and F.

Below is the link to review the new regulation.

You May Like: How To Add Medicare Part B

Can My Plan Be Canceled

No, thats illegal. As long as you pay your premiums, your policy is renewable for the rest of your life. You can only be dropped if any of the following apply:

- You stop paying premiums.

- You lied on your original Medigap application.

- The company goes bankrupt.

If you choose to cancel your Medigap policy, you must do so by contacting the insurance company directly.

What Does Medicare Supplement Insurance Cover

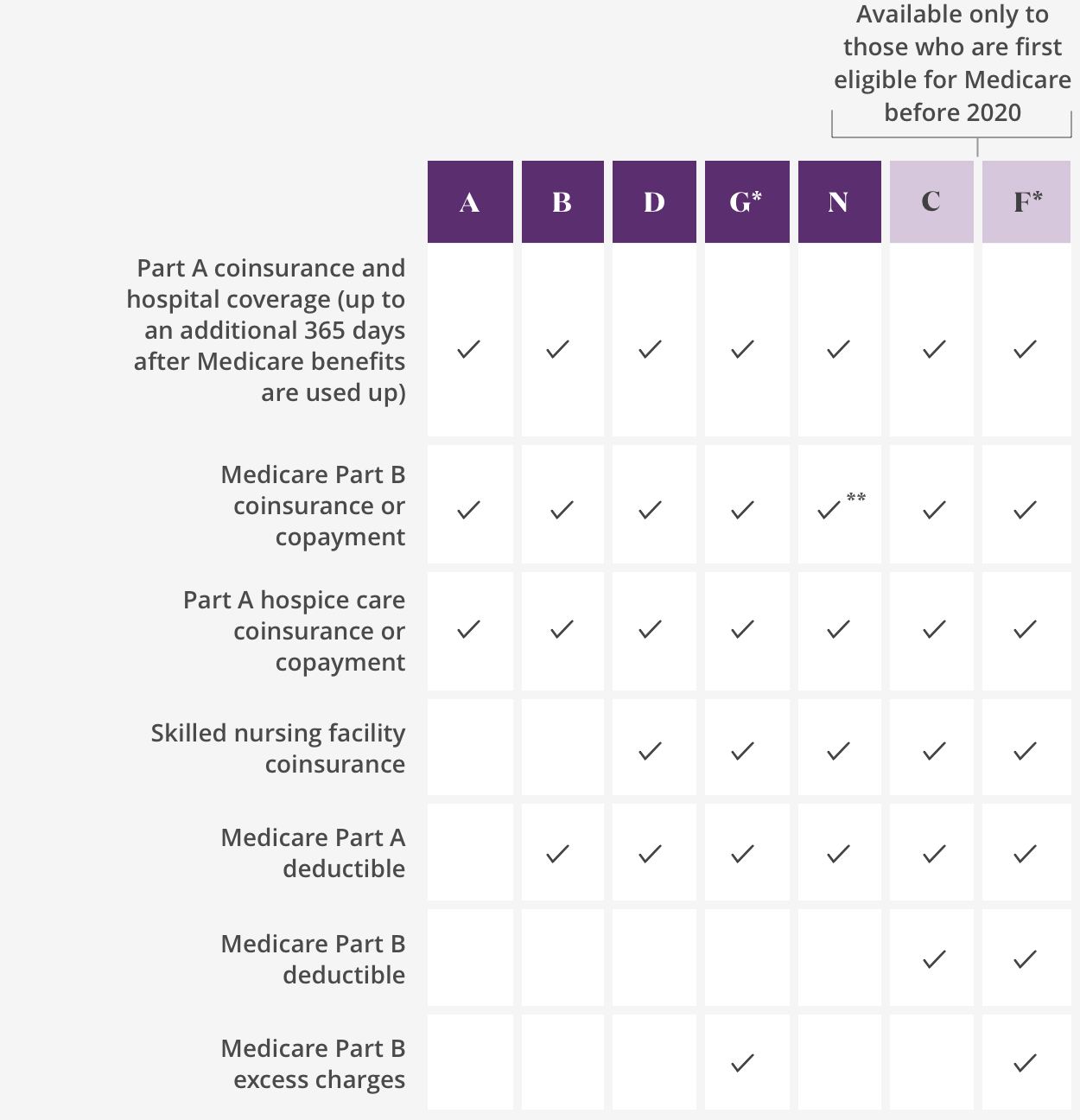

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

Recommended Reading: Does Medicare Part C Cover Home Health Care

Are There Other Types Of Supplemental Insurance

While Medigap is the most common, there are other types of supplemental insurance including:

- Employer-sponsored insurance: This provides retiree health coverage to Medicare beneficiaries. Depending on the size of the employer sponsoring the health plan, Medicare may be either your primary or secondary health coverage. The primary coverage pays for medical expenses first, and if there are leftover costs, the secondary coverage kicks in.

- Medicaid: Medicaid is a state-run program that provides hospital and medical coverage for people with low income. Each state has rules regarding who is eligible and what is covered. While some people can qualify for both Medicare and Medicaid, they are separate programs with separate coverage, eligibility requirements and enrollment periods.

The Medicare Supplement With The Most Coverage

Plan F pays 100% of all out-of-pocket expenses. If you are looking for a comprehensive plan that will pay for everything, this one is it.

Here are a few of the benefits that a Medigap plan can help pay for:

- Medicare Part A coinsurance hospital costs after initial Medicare coverage is exhausted

- Medicare Part B copayment

- Part B excess charges

- Preventive care coinsurance

I should note that Plan G and Plan N are also very popular sellers at our agency. These plans offer lower premiums than Plan F, and you do a little bit of cost-sharing on the back end of your policy.

Many people dont mind paying the Part B deductible out of pocket in return for the lower premiums that Plan G and Plan N can give them. For a closer look at the comparison between Medicare Plan F and Plan G, visit this post I wrote for Forbes.

It is important to note that Plan F was phased out at the end of 2019. If you were eligible for Medicare prior to 2020, you are grandfathered in and able to get Plan F beyond 2020.

Thats one strategy, but looking at Plan G is a good idea. You can save on premiums and have the confidence that your plan is not being discontinued anytime soon.

Recommended Reading: Which Is Better Original Medicare Or Medicare Advantage Plan

What Are National General Medicare Supplement Plans

Several states throughout the U.S. offer National General Medicare Supplement plans. Because the government standardizes the benefits for Medicare Supplement plans, it is not uncommon for carriers to provide special perks for their enrollees.

National General Medicare Supplement plan perks include:

- Year-round enrollment

- A 7% household premium discount for qualifying members

The Cost Of Original Medicare

When it became law, Original Medicare provided an unprecedented level of care for Americans 65 and older. But there are costs associated with the coverage. For example, with Part A, you are responsible for paying a $1,340 deductible before your benefits kick in. After that, if you have a problem that requires hospitalization for up to 60 days, Part A covers your needs. If your stay is more than 60 days, youll have to cover part of the price of your stay. And hospital costs can add up quickly, even with Part A chipping in.

Read Also: Do You Automatically Get Medicare When You Turn 65

What Is A Medigap Plan And Why Should I Buy It

A Medigap plan , sold by private companies, can help pay some of the health care costs Original Medicare doesn’t cover, like copayments, coinsurance and deductibles.

Some Medigap plans also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap plan, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap plan pays its share.

Why Does Medicaid Pay Less Than Medicare

And Medicaid does pay less than the other major insurers: Based on its own data, the average initial claim filed is $98 for Medicaid patients, whereas Medicare averages $137 and private insurers average $180. But the problem goes deeper than that, according to this new analysis. … Fewer providers take Medicaid patients.

Don’t Miss: Should I Carry My Medicare Card With Me

Coverage Gaps In Original Medicare

People can receive Medicare benefits in one of two ways: Original Medicare or Medicare Advantage.

Original Medicare, also known as traditional Medicare, consists of Part A and Part B. At age 65, you can automatically be enrolled or manually enroll in Original Medicare.

Original Medicare has several out-of-pocket costs, including monthly premiums, annual deductibles and copayments for doctor services.

Unlike Medicare Advantage, there is no yearly out-of-pocket maximum in Original Medicare.

These gaps in Original Medicare insurance can quickly add up, especially if youre in poor health or on a fixed budget.

2022 Original Medicare Out-of-Pocket Costs at a Glance

- 20 percent of all Part B services, including doctor visits, durable medical equipment and outpatient therapy

- $1,556 Part A hospital deductible for each benefit period

- $233 Part B deductible

- $170.10 monthly Part B premium

Most people dont pay a monthly premium for Medicare Part A. But if you didnt work enough before turning 65, you may face this extra fee, which can cost up to an additional $499 a month.

There are also several coverage gaps in Original Medicare. For example, vision, dental and hearing are not covered unless deemed medically necessary.

Medigap, also known as Medicare supplement insurance, can help pay some of the remaining health care costs Original Medicare doesnt cover.

Dont Leave Your Health to Chance

Medigap policies are sold by private insurance companies.

Medigap Plan Coverage Highlights

Compare The Costs Of Medigap Plans

Insurance companies may charge different premiums for the same exact policy. As you shop for a policy, be sure you’re comparing the same policy. For example, compare Plan A from one company with Plan A from another company.

In some states, you may be able to buy another type of Medigap policy called

. If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy.

| Note |

|---|

You May Like: Where To Get A New Medicare Card

Whats The Difference Between Medicare Advantage And Medicare Supplement

Medicare Advantage combines Medicare Part A and B for comprehensive coverage, all in one plan. It often includes Part D Prescription Drug coverage, too. These are also called Part C plans.

Medicare Supplement, also called Medigap, insurance policies help pay the out-of-pocket expenses not covered by Original Medicare . It is not part of the governments Medicare program, but provides coverage in addition to it.

Types Of Medicare Health Plans

People in Medicare are either in Original Medicare, or fee-for-service Medicare, or theyre in a Medicare Advantage plan, says Gretchen Jacobson, Ph.D., vice president of Medicare at The Commonwealth Fund, a foundation that supports independent research on health care issues and makes grants to improve health care practice and policy.

Generally, you need to pay a portion of the cost for each service Original Medicare covers out of pocket. And, according to the U.S. governments official Medicare handbook for 2022, theres no limit to what you may pay in a year unless you have other coverage, such as a Medicare Supplement, Medicaid or employee or union coverage, or you enroll in a Medicare Advantage plan.

Confused About Medicare Supplement Insurance Options?

Find committed, licensed agents who work to understand your coverage needs and find you the best Medicare option.

Also Check: What Month Does Medicare Coverage Begin

Medicare Supplement Insurance Plan Overview

Before deciding whether you need a Medicare Supplement insurance plan when you retire, you may want to read this brief overview of this type of plan.

The difference between what Medicare pays and the amount you owe for medical care is sometimes called the Medicare coverage âgapâ. If you have Medicare Part A and Part B, you might have the option of purchasing a Medicare Supplement insurance plan to help pay the out-of-pocket costs of Medicare Part A and Part B. These plans are offered by private insurance companies.

In most states, Medicare Supplement insurance plan are standardized and assigned lettered names: Medicare Supplement insurance plans A-N. Each plan may cover a different combination of Original Medicareâs out-of-pocket costs, at different levels. For example, Medicare Supplement insurance Plan F* covers all of the Medicare Part A deductible, while Medicare Supplement insurance Plan K covers 50% of the Part A deductible.

In Massachusetts, Minnesota, and Wisconsin, Medicare Supplement insurance plan are standardized differently.

With most Medicare Supplement insurance plans you can use any doctor, health professional or hospital in the United States that accepts Medicare patients. Only one type of Medicare Supplement insurance plan, called Medicare SELECT, may require you to see doctors and other providers in the plan network.

Explore Our Plans And Policies

Back to Knowledge Center

View state disclosures, exclusions, and limitations

1Original Medicare coverage is required in order to purchase a Medicare Supplement plan.

2 These programs are NOT insurance and do not provide reimbursement for financial losses. Some restrictions may apply. Programs and services may be added or discontinued at any time. Customers are required to pay the entire discounted charge for any discounted products or services available through these programs. The Healthy Rewards program is provided by Cigna Health and Life Insurance Company. Programs are provided through third party vendors who are solely responsible for their products and services. Program availability may vary by location, and are not available where prohibited by law.

3 Insured by Cigna Health and Life Insurance Company, American Retirement Life Insurance Company, Loyal American Life Insurance Company, or Cigna National Health Insurance Company. In Kansas, insured by Cigna National Life Insurance Company, Cigna Health and Life Insurance Company and Loyal American Life Insurance Company. American Retirement Life Insurance Company is not available to residents of Kansas. In Pennsylvania, Maryland North Carolina and Utah, insured by Cigna National Health Insurance Company domiciled in Ohio. In New Mexico, Idaho and Ohio, insured by Cigna Health and Life Insurance Company.

4 Medicare Supplement plans may be subject to medical underwriting, and coverage may be denied.

MS-SITE-Compare2022

Recommended Reading: Is Lincare A Medicare Provider

Applying For Original Medicare

Applying for Medicare requires you to have a few details about yourself and verification documents ready:

- Your date and place of birth, which is usually verified by showing your birth certificate or Permanent Resident Card if you are not a U.S. citizen

- If applicable, your Medicaid number, along with start and end dates for coverage

- If applicable, your current health insurance, including start and end dates for both coverage and your employment if its a group health plan

- Your Social Security number, which is verified by showing your Social Security card

- W-2s or other tax forms

With all of this in hand, you can choose to apply online, by phone, or in person at your local Social Security office. For in-person applications, you may need to call ahead and make an appointment.

B Late Enrollment Penalty

If you dont sign up for Part B when youre eligible, you will most likely have to pay a late penalty. This penalty will last for as long as you have Part B.

To calculate the penalty, take your standard monthly premium amount and increase it by 10 percent for each 12-months you could have had Part B but didnt. For example, if you could have had Part B for two years but didnt, youd have to pay a 20 percent penalty. Your monthly premium would be increased by 20 percent for as long as you have Part B.

Don’t Miss: Does Aarp Medicare Supplement Insurance Cover Hearing Aids

Are There Any Other Considerations

To keep your Medicare supplemental insurance coverage, you need to pay premiums throughout the year. This is an additional cost during retirement. If you don’t end up needing treatment, it’s possible you could pay more in premiums than the value you’d get from the policy, similar to any health insurance program.

Keep in mind that these policies only cover medical bills. They do not provide coverage for prescription drugs, dental care, routine eye care or long-term care. Instead, you would need to pay for these out of pocket or have coverage in place through another insurance policy.

How Is Medicare And Medicaid Different

Medicare is a federal program that provides health coverage if you are 65+ or under 65 and have a disability, no matter your income. Medicaid is a state and federal program that provides health coverage if you have a very low income. … They will work together to provide you with health coverage and lower your costs.

Also Check: How Can I Get My Medicare Card Number