Why Choose A Medicare Supplement Plan

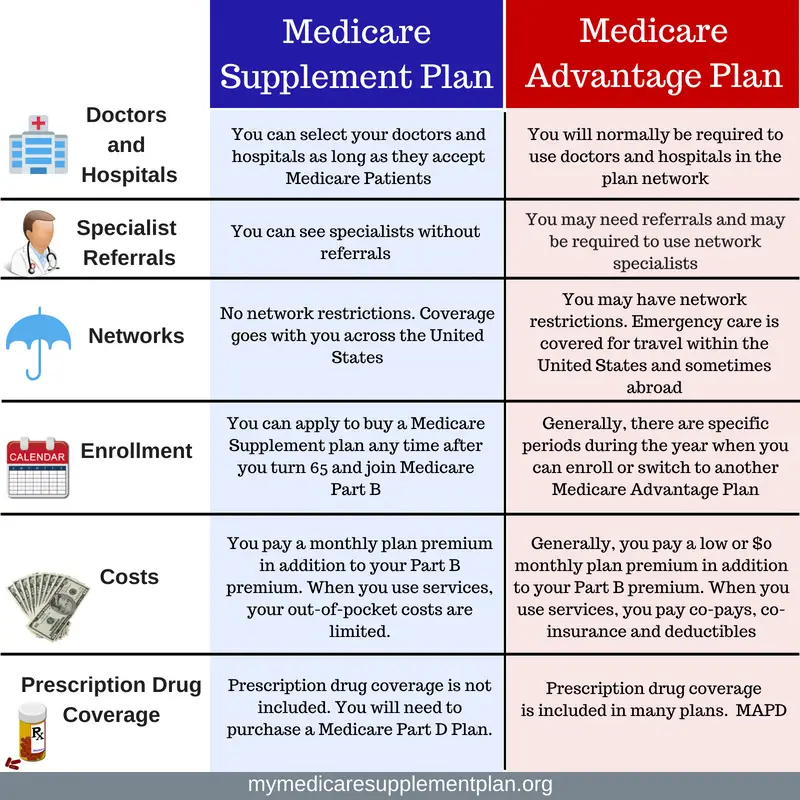

All of these companies also offer Medicare Advantage plans. Buying Medicare insurance isnt an easy decision, and understanding the difference between Medigap and Medicare Advantage plans before you choose one or the other is a good idea.

Medicare Supplement insurance plans work with Original Medicare, Part A, and Part B. They pay costs that Original Medicare doesnt.

Medicare Advantage is different. It replaces original Medicare and might be similar to the health insurance you had before you enrolled in Medicare. Because you are no longer in the federal system, the plans have differences. Reading and asking questions about those differences before you sign up is important.

Cost of supplemental plans vary

While the basic benefits are the same for every Medicare Supplement policy, costs vary widely, and some companies offer additional benefits that might make choosing their plans attractive to you.

What Does Plan N Cover

Plan N is standardized across all Medigap plan providers and includes coinsurance and deductibles for Part A, along with Part B coinsurance, skilled nursing facility care and more. However, it does not cover Part B deductibles or excess charges.

While all providers have to offer the same basic benefits, they can also add extra features. UnitedHealthcare, for instance, offers foreign travel emergency coverage and dental, vision and hearing care discounts.

Required Benefits of Plan N in Florida

- Medigap BenefitDoes Plan N Cover?

- Part A co-insurance and hospital costs up to an additional year after Medicare benefits are used upYes

- Foreign travel exchange 80%

How Do You Shop And Compare Medicare Supplement Plans

Researching the right plan for you is key to getting the coverage you need. Each plan offers specific benefits depending on your state, your desired benefits, and the costs.

Step 1: Determine if You Are Eligible to Enroll

In general, if youre approaching your 65th birthday but you havent started taking Social Security benefits yet, you are eligible for Medicare.

The best time to buy a Medicare Supplement policy is during your Initial Medicare Open Enrollment Period. This is a one-time only, six-month span when federal law allows you to sign up for any Medicare Supplement policy you want that is sold in your state. Preexisting conditions are accepted during this time period, and you cant be denied a Medicare Supplement policy or charged more due to past or present health problems. Make sure you know when your Open Enrollment Period starts.

Step 2: Find a List of Medicare Supplement Plans Available in Your State or ZIP Code

Using the tool available on Medicares website, you can search for coverage plans based on your location.

Step 3: Determine Which Aspects of Coverage Are Most Important to You

Perhaps you are concerned about out-of-pocket copays or high deductibles, or you have a preexisting condition and want to know if there is a waiting period for coverage. Check each plan for the details that matter most to you.

Step 4: Compare the Difference in Cost Among Medicare Supplement Plans

Step 5: Consider Talking to a Broker or Consultant

Step 6: Sign Up

Read Also: Does Medicare Pay For Dental Cleaning

How Does Dual Coverage Work

Since dual coverage is just another term for having secondary dental benefits, it works just as weve already discussed. However, a quick step-by-step review might help clarify a fairly complex topic. While theres a lot more to it, using secondary insurance can be broken down into three steps:

Here are some simple answers to common questions on secondary dental insurance.

The Cost Of Medicare Supplement Plans In Maine

Medicare Supplement Plans can vary greatly depending on the plan and company. The most common pricing styles in Maine include:

- Attained-Age: This is the most common pricing style in Maine. Your premiums will increase as you get older.

- Issue-Age: While your age is a factor in your initial purchase, it will not vary as you get older.

- Community-Rated: In this pricing style, all policyholders pay the same amount for the same plan type. Plans D and M are the only exceptions.

Average Cost of Medicare Supplement in Maine

Sort by Plan Letter:

Don’t Miss: Does Supplemental Insurance Cover Medicare Deductible

Aarp / United Health Group

PLUSES

United Healthcares strong financial rating is an asset since once you sign up for a Medigap plan, you are likely to be that companys customer for life.1

MINUSES

AARP/United Health Groups policies are mainly attained age, which means the company will raise the price of your policy annually. While the rates start low, in the past, they have increased steadily.2

While AARP offers Medigap plans in every state and most territories, you may not be able to buy what you want. AARP offers six plans, plus,Plan F and C, which arent currently sold to new enrollees. If you want high deductible or other not-so-popular plans, you wont be able to buy them.3

Best For Member Satisfaction: Mutual Of Omaha Medicare Supplement Insurance

Service area: Every state except Massachusetts, plus Washington, D.C.

Medigap plans offered: A, F, G and N .

Standout feature: Members file significantly fewer complaints about Medigap policies from Mutual of Omaha than other insurers. The same very low complaint rate holds true when averaged across all of Mutual of Omahas insurance products.

Unlike many Medigap insurers, Mutual of Omaha doesnt sell Medicare Advantage or other health insurance plans. Its insurance offerings are meant to complement your main health insurance, such as Medicare Supplement Insurance, life insurance and long-term care insurance. It doesnt offer as many plan types as some competitors, but member satisfaction is high.

Pros

-

Members file complaints at rates about 62% below the average for all Medigap insurers on the market.

-

Mutual of Omaha sells Medicare Supplement Insurance in every state but Massachusetts.

-

A discount of up to 12% for some applicants living with another adult is larger than many other providers offer.

Cons

-

For new Medicare beneficiaries, only Medigap plans A, G and N are available in most states.

-

Mutual of Omaha spends less on member benefits and more on overhead than the average Medigap insurer.

-

It can be challenging to find some information on Mutual of Omahas website.

Recommended Reading: Can You Be Denied Medicare Coverage

Best User Experience: Cigna

-

Limited high-deductible plans

-

Rates increase based on age

Cigna stands out for its customer service and user-friendly website that explains how Medicare Supplement plans work. Its customer support is rounded out by access to a 24/7 nursing line for your healthcare questions. It also offers two mobile apps, the myCigna Mobile app used to track your benefits, and the Cigna Wellbeing App that provides information about chronic conditions like diabetes, wellness tips, healthy recipes, telehealth consultations with a medical professional, and tools to track your weight, blood pressure, cholesterol, and blood sugar.

Founded in 1792, Cigna entered the healthcare industry in 1912. It offers Medicare Supplement Plan G in 46 statesMassachusetts, Minnesota, New York, and Wisconsin are excludedbut has limited options for High-Deductible Plan G, which is only available in North Carolina.

Its price structure is based on an attained model in the majority of states it serves. Under this model, prices increase regularly based on your age. Its quote process is a bit lengthy: you can request a quote online by providing your name, date of birth, zip code, phone number, email address, and start dates of Medicare Parts A and B coverage. You can also get a free quote by calling one of their representatives. Rates may vary by age, smoking status, and location.

How Do You Decide

âMake sure you have enough coverage to limit your financial liability in case of catastrophic injuries or disease,â Nance says. âWhile the plans that have better benefits often cost more, they will usually save you in the long run in terms of out-of-pocket fees.â Nance further recommends speaking to family and friends to compare experiences.

Also Check: Does Costco Pharmacy Accept Medicare Part D

Who Is Eligible For Medigap Plans

To be eligible for a Medigap plan, you must be enrolled in Original Medicare Parts A and B, but not a Medicare Advantage plan. You must also be in one of the following categories:

- Age 65 and older

- Under 65 and receiving disability benefits

- Under 65 and diagnosed with amyotrophic lateral sclerosis

- Under 65 and diagnosed with end-stage renal disease

Companies could delay coverage up to six months for a pre-existing condition if you didnt have creditable coverage before enrolling in Medicare.

Your Medigap open enrollment period starts the first month you sign up for Medicare Part B insurance at age 65 or older, even if you delayed enrollment because you had group health coverage. Medigap policies cannot be cancelled by the insurance company even if your health status changes as long as you pay your premiums. If youre already enrolled in a Medigap plan, you may apply to buy or switch plans.

Maine Medicare Supplement Plans Comparison Chart

You need to be eligible for Medicare to buy a Medicare Supplement Plan. All Medigap plans have different levels of coverage, and some are only available based on your eligibility for Medicare.

If you are a new enrollee, you may not be able to buy Plan F and C. However, you might be eligible for Plans G and D. Use MoneyGeeks chart to compare coverages and average rates.

Medicare Supplement Comparison Chart

Also Check: How Do I Get Free Diabetic Supplies From Medicare

Medicare Supplement Plan N: The Pay

Medicare Supplement Plan N is the most budget-friendly plan on our list. With this, however, comes more out-of-pocket costs. Medicare Supplement Plan N covers the full Medicare Part A deductible and Medicare Part B 20% coinsurance.

Thus, Medigap Plan N leaves you responsible for the Medicare Part B deductible, $20-$50 copays when visiting the doctor or hospital, and excess charges, if applicable in the state where you receive care.

Medicare Supplement Plan N is a fantastic option for those who do not regularly go to the doctor or hospital but still seek emergency coverage.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Medicare Supplement Plan N may be the best choice for those who:

- Seek a relatively low monthly premium

- Do not mind small copayments

- Are not concerned about excess charges

Medigap Plan N requires small copayments for certain services, such as $20 at the doctor and $50 for an emergency visit. However, you will not have copays if you visit one of your local urgent care facilities.

Also, Medigap Plan N does not cover Medicare Part B excess charges. However, not every state or doctor allows excess charges. The best way to avoid excess charges is to speak with your doctor.

Get A Free Quote

Find the most affordable Medicare Plan in your area

What Is Our Methodology

We selected the health insurance companies with the highest market share and reviewed them by financial strength, customer satisfaction, and other factors, such as what makes these plans so popular.

We also offer information on the companies, including financials, customer satisfaction, complaints, geographic reach, and pricing.

Also Check: Does Medicare Provide Life Insurance

Standardized Medicare Supplement Plans

Screenshot from “Choosing a Medigap Policy,” July 8, 2019.

As you can see in the table above, Medicare Supplement insurance plans can cover the following costs:

-

Part A – coinsurances and hospital costs, hospice care coinsurance or copayment, and the Part A deductible

-

Part B – coinsurances or copayments, the Part B deductible, and any Part B excess charges

-

Skilled nursing facility coinsurance

-

The first three pints of blood for transfusions

-

Emergency medical costs during foreign travel

No Medicare Supplement plan covers prescription drugs. Youll have to enroll in Medicare Part D for drug coverage.

Plan A

Plan A is the standard Medicare Supplement plan. All other plans build upon the benefits offered by Plan A, adding other benefits or modifying the coverage amounts.

Like all Medigap plans, Plan A covers Medicare Part A coinsurances and hospital costs 100%. That means you wont pay anything for Part A costs.

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

Best for: People who are looking for the lowest cost and the lowest level of coverage, especially those who dont pay the Medicare Part A deductible and can comfortably afford the Part B deductible.

Plan B

Plan B covers everything Plan A covers. It also covers 100% of the Medicare Part A deductible.

Plan C

Plan D

Plan M And Plan N: Best Medicare Supplement Plans For Travelers

One of the health care costs that can be covered by some Medicare Supplement Insurance plans is foreign travel emergency care, or emergency care received outside of the U.S. or U.S. territories.

There are 6 Medigap plans that will pay for 80% of your foreign travel emergency care costs. Two of those plans are Plan M and Plan N, which provide coverage of foreign emergency care while typically offering lower monthly premiums than the other types of Medigap plans that also offer this coverage.

Plus, these plans also offer coverage for Medicare Part B excess charges, which allows members to see a greater variety of health care providers within the U.S. and U.S. territories.

Also Check: How To Apply For Medicare In Alaska

The 10 Medigap Plans Offer Different Levels Of Benefits That Pay For Expenses Not Covered By Original Medicare

Each year, seniors have important decisions to make regarding their Medicare coverage.

Original Medicare provides a number of great benefits to enrollees, but this coverage does have some gaps. For instance, Part B will cover only 80% of your medical expenses, after you hit the deductible, with no out-of-pocket maximum. That means you could be on the hook for a significant bill if you become gravely ill. Part A will only pay for the first 60 days you spend in the hospital, again after a deductible is met, before you must start paying co-insurance.

Because of this, many beneficiaries choose to enroll in either a Medicare Advantage plan or a supplemental policy to help cover those costs.

If you decide to go with a Medicare supplement policy , you then must select which plan you want. Medigap plans are administered by private insurance companies. These plans come in 10 letter designations . All plans with the same letter have the same coverage, but prices can vary based on the insurance company.

Which plan is right for you depends on your personal preferences and how much medical care you expect to need that year. The plans offer a range of benefits with some covering many of your Medicare costs while others require more costs sharing.

If you were considering Plan F, then take a look at Plan G. It provides the same coverage as Plan F except for the Part B deductible.

Best Medicare Supplement Plans For 2022

Plan G is the most comprehensive Medigap policy in 2022, but it’s also one of the more expensive Medicare Supplement plans, averaging $190 per month.

Find Cheap Medicare Plans in Your Area

Medicare Supplement policies, also called Medigap, can prevent unexpected medical bills. Without a Medigap plan, Original Medicare policyholders will find tracking deductibles can be cumbersome and paying for regular medical treatment out of pocket can be expensive. The best Medicare Supplement plan for you will depend on your health and budget.

To get a Medicare quote over the phone, call 855-915-0881 TTY 711 to speak with a licensed agent today!

Agents available Monday-Friday 9am-8pm EST

Read Also: Which Medicare Supplement Plans Offer Silver Sneakers

When Should I Buy Medicare Supplement Insurance

Its best to buy Medicare Supplement insurance within the first six months after you turn 65 and enroll in Medicare. During that time, you can buy any Medigap policy sold in your state, even if you have health problems. After this six-month period, you may not be able to enroll in a Medicare Supplement plan, or you may have to pay more due to pre-existing conditions or current health problems.

What Is The Typical Cost Of A Medicare Supplement Plan G

Costs for Medicare Supplement Plans vary widely depending on your age, gender, and where you live. Chronic medical conditions are taken into account, including whether or not you smoke and if you sign up after the one-time Medigap Open Enrollment Period that starts when you first enroll in Medicare Part B and ends six months later.

Plan G costs were reviewed across four regions of the United States in 2020. Based on ages 65 to 75 years old, gender, smoking status, and cost summaries from Medicares Find a Plan search engine, Part G costs ranged $189 to $432 on the east coast , $104 to $479 in the midwest , $88 to $417 in the south , and $115 to $308 on the west coast . Costs could be higher or lower based on specific regional data.

You May Like: Will Medicare Pay For A Patient Lift

What Is Medicare Advantage

Medicare Advantage is private health insurance through Medicare that often also includes prescription drug coverage, or Medicare Part D. The plans usually provide coverage for things like vision, dental, disability services, home health, and other health care needs not covered by original Medicare.

âMedicare Advantage plans offer the convenience of providing all of these services in one plan,â Erin Nance, MD, a New York City-based orthopedic surgeon, tells WebMD Connect to Care. âThe costs and coverage details vary depending on the specific insurance company and what state you live in.â

Medicare Advantage plans can be HMOs, PPOs, Special Needs Plans , private fee-for-service plans, or Medical Savings Account plans.

While Medicare Advantage patients donât need referrals to see a specialist, there are some limits when it comes to providers.

âThere are different types of Medicare Advantage Plans that may limit your ability to see a certain provider,â Nance says. âThe vast majority of doctors accept Original Medicare and the Medigap supplemental insurance.â