How Much Will I Have To Pay If I Qualify

With Original Medicare coverage , eligible seniors will pay nothing for home health care services that are ordered by a doctor and provided by a certified home health agency. Any additional services provided outside of the approved care plan will not be covered and must be paid for out of pocket.

Be aware that before services begin, the home health agency should provide an itemized receipt or plan of care that identifies what is eligible for Medicare coverage and what is not. A written notice called the Advance Beneficiary Notice of Noncoverage will detail any services and durable medical equipment that Medicare will not pay for as well as the costs the patient will be responsible for.

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Choosing Traditional Medicare Plus A Medigap Plan

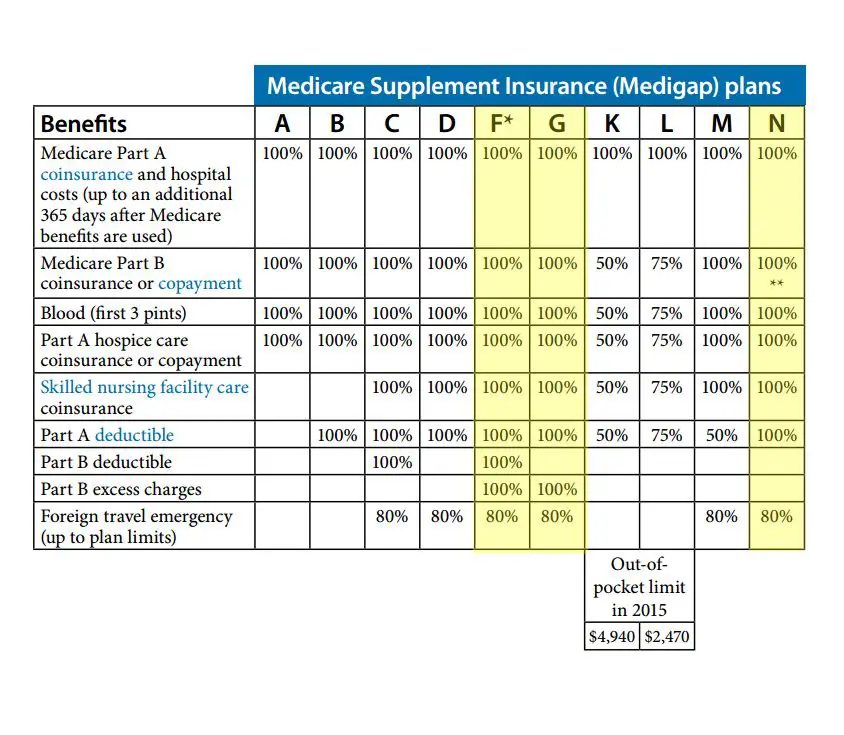

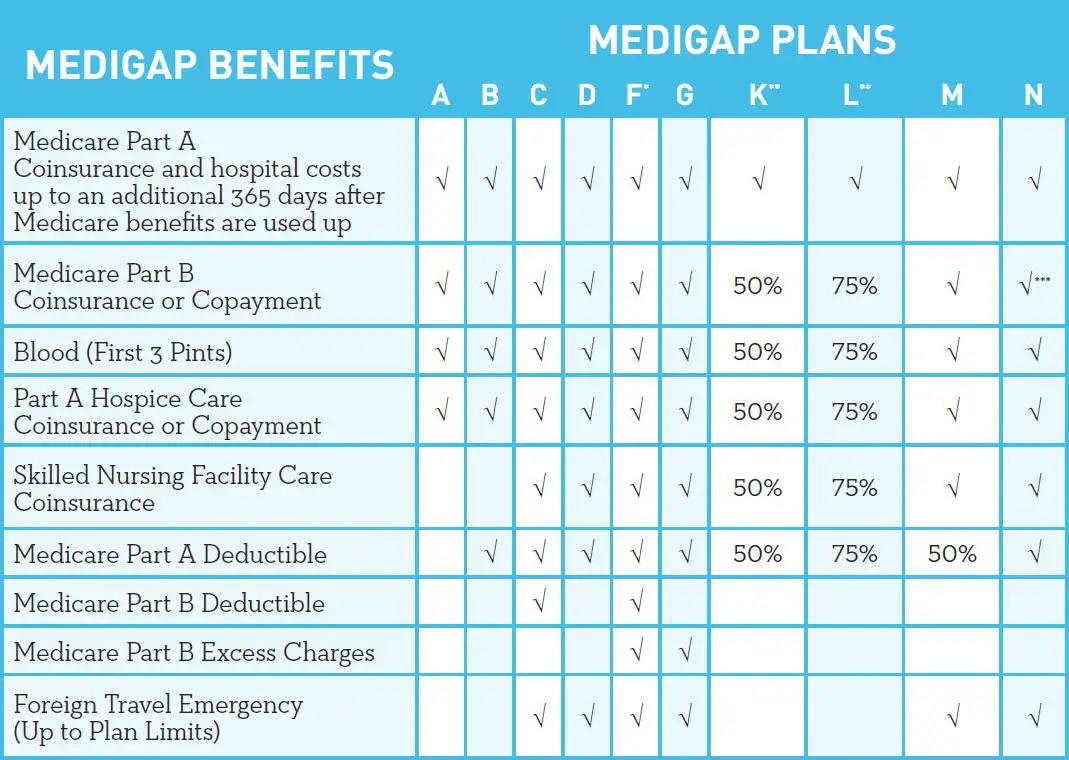

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Read Also: Is Fehb Better Than Medicare

What Do Medicare Supplement Plans Cost

The costs of Medicare Supplement plans vary by state and by insurance company. The main factors that determine cost are your location and age. Keep in mind that a policy that looks less expensive at age 65 could become the most costly at age 85, so ask the insurance company how they set their premium pricing.

Policy prices are determined in three ways:

- Community-rated: The same monthly premium is charged to everyone who has the Medigap policy, regardless of age.

- Issue age-rated: The premium is based on your age at the time of the Medigap policy purchase. The younger your age, the lower the premium. The premium costs for this type of rating wont go up due to your age, but may increase because of inflation or other factors.

- Attained age-rated: The premium is based on your current age and will increase as you get older. Though premiums in this form of rating may start at the lowest price, they have the potential to reach the highest price eventually and can also be impacted by inflation and other factors.

Not all companies offer all Medigap plans. Rates may vary depending on the company, and some plans may be provided with a high-deductible option.

Comparing The Potential Costs Of Original Medicare And Medicare Advantage Plans To A Medigap Policy

A Medigap policy will generally, to one degree to another, pick up your hospital deductible and the 20% out-patient expense that is associated with original Medicare.

Medicare only

The Part A deductible is $1316. That can be amortized over 12 months to equal $109.66 per month. Medicare deductibles and premiums will probably continue to increase each year. You are still responsible for 20% of all out-patient costs. How much is 20% of an emergency room visit or a CAT scan or two? Hundreds? Thousands? Medicare supplement Plan F for example would have paid all your costs.

Medicare Advantage plan

Some Medicare Advantage plans have $0 monthly premiums and some have premiums over $100. One plan with a $0 monthly premium is AARP MedicareComplete. If you have a premium, after it is paid you are still responsible for cost-sharing amounts for services in the form of co-payments, coinsurance and deductibles.

That inexpensive Medicare Advantage plan could actually cost you more that a Medicare supplement policy. Although to be fair you should add the cost of a Part D plan to your Medigap premium since Medigap does not offer Medicare drug coverage. But still you do the math.

You May Like: What Is Medicare Part A And B

Mutual Of Omaha Has You Covered

Since 1909, weve existed as a Mutual company serving for the benefit and protection of our customers. Which means we dont answer to Wall Street, we answer to you.

Medicare Supplement insurance is offered to protect our customers health and wallets. Its a great option to add to your existing Medicare Part A and B plans, as Medicare supplement insurance helps cover some out-of-pocket costs that Part A and Part B may leave you with. These include expenses like copays, coinsurance, and deductibles. Medicare Supplement plans also make traveling – even internationally – easy, while being a steady monthly bill you can budget for. Check out Medicare Supplement Insurance Basics for the information you need to make the decision thats right for you.

Do I Really Need Supplemental Insurance With Medicare

Lets start our discussion by addressing the elephant in the room. Is a Medicare supplement plan really necessary, and, if so, why?

As you may already be aware, Original Medicare only covers about 80% of your major medical costs. The remaining 20% of all Medicare-approved costs are the beneficiarys responsibility. These costs, which include deductibles, copayments, and coinsurance on the healthcare services you use can be paid in several different ways, including:

These are the most common ways people cover their major medical costs when they have Medicare. If you dont qualify for one of the benefits listed above, then you self-pay out of pocket, or you buy a Medigap plan.

If youre thinking about the self-pay option, think twice. This is a very risky proposition. While you can probably swing the cost of regular doctor visits, the cost of advanced diagnostic or hospitalization due to a critical illness or injury, is enough to send most people to bankruptcy court. Compare how much is Medigap per month vs. self-pay and it wont be difficult to see which costs less.

Think about it. Could you afford to pay 20% of the cost of cancer treatment or a hip replacement? A 2013 cost-effectiveness study reported a total cost of $40,102 for first-line mesothelioma treatment. Thats just the treatment, which does not include your inpatient care. The average cost of a hip replacement in the United States is almost as costly at $32,000.

You May Like: Does Medicare Cover House Calls

How Much Does A Medicare Supplemental Insurance Plan Cost

If you are new to Medicare, you might want to consider taking a closer look at Medicare Supplemental insurance plans. Because Original Medicare only covers 80% of your health care bill, a Medicare Supplement may be very helpful in taking care of the remaining expenses.

Medicare Supplement insurance also called Medigap insurance, is a kind of insurance that works together with your Medicare. It is sold by private insurance companies and will serve as a way to minimize the out-of-pocket costs from Medicare Part A and B.

Just like other health insurance, you need to pay a monthly premium if you get a Medigap plan. That premium is on top of what you pay for your Medicare Part B premium.

Why Should You Consider Medicare Supplement Plans

Supplemental insurance plans allow you to receive private health insurance benefits outside of the federally regulated Medicare plans.

Supplemental insurance plans also open up the opportunity for sicker patients to have a larger amount of their medical expenses covered. Unexpected and regular out-of-pocket expenses can add up quickly. Having supplemental insurance offers a safety net to help keep these expenses from becoming lifelong, major debt.

MORE ADVICE

Insurance companies offering Medicare Supplement plans arent required to offer every type of Medigap plan.

Also Check: What Is A 5 Star Medicare Plan

Medicare Select Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

It differs from Medicare Supplement insurance because you are expected to use a network of hospitals associated with the insurance company. In return, you will usually pay lower premiums. Also, in order to enroll in a Medicare SELECT plan, you must live within the service area of a network facility.

Plan N Monthly Premiums

If you enroll in a Medigap plan, youll have to pay a monthly premium. This will be in addition to your Medicare Part B monthly premium.

Because private insurance companies sell Medigap policies, monthly premiums will vary by policy. Companies can choose to set their premiums in a variety of ways. The three main ways they set premiums are:

- Community rated. Everyone with the policy pays the same monthly premium, regardless of his or her age.

- Issue-age rated. Monthly premiums are set based on how old you are when you purchase your policy. Individuals who buy at a younger age will have lower monthly premiums.

- Attained-age rated. Monthly premiums are set based on your current age. Because of this, your premiums will increase as you get older.

You May Like: What Is A Medicare Physical Exam

Cost Of Medicare Part B

- Standard cost in 2022: $170.10 per month

- Annual deductible in 2022: $233

For most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums.

For high-earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates, and below you can find an exact breakdown of the different income thresholds for Medicare Part B premiums. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $578.30 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2022, the Part B deductible is $233, which means you would need to pay $233 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

Who Can Enroll In Medicare Supplement Plan F

If you already have Medicare Advantage, you may be considering switching to original Medicare with a Medigap policy. Previously, anyone enrolled in original Medicare could purchase Medigap Plan F. However, this plan is now being phased out.

As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020.

If you were already enrolled in Medigap Plan F, you can keep the plan and the benefits. Also, if you were eligible for Medicare before January 1, 2020, but missed the enrollment, you may still be eligible to purchase Medigap Plan F.

If you are planning to enroll in Medigap, there are certain enrollment periods that you should take note of:

- Medigap open enrollment runs 6 months from the month you turn 65 years old and enroll in Medicare Part B.

- Medigap special enrollment is for people who may qualify for Medicare and Medigap before turning age 65, such as those with end stage renal disease or other pre-existing conditions.

It is important to note that during the Medigap open enrollment period, you cannot be denied a Medigap policy for pre-existing health conditions. However, outside of the open enrollment period, insurance companies can deny you a Medigap policy because of your health, even if you qualify for one.

Therefore, its in your best interest to enroll in Medicare Supplement Plan F as soon as possible if you still qualify.

Recommended Reading: Do I Need To Sign Up For Medicare Part B

How Can I Save Money On A Medigap Plan And Still Be Covered For All Major Medical Costs

We just talked about how a Plan N Medicare supplement can save you money, but its not the only plan with cost-sharing. Plan K and Plan L are also options. With these two plans, you share a percentage of your Part A and Part B costs, but they protect you from catastrophic costs with a maximum out-of-pocket limit.

An amount patients pay for their share of the cost of medical service or supply, like a doctors visit, hospital inpatient visit, or prescription drug…. plans, like K and L, work for healthy people who can afford to take a little financial risk and for people who are good at saving for their healthcare costs. For example, if you rarely see a doctor and can absorb Plan Ks $5,880 annual deductible in your budget before the plan starts paying, then it could be an option. Likewise, if you put $100 per month or more into a savings account specifically for your healthcare costs, then a shared-cost plan could work for you because youre basically putting the money you save on premiums into savings.

Saving on a Medigap plan comes down to understanding both your health and financial needs. Many people, especially the good savers, like the high deductible plan options on Plan F and Plan G. If you choose one of the high-deductible options, you pay all Medicare-covered costs up to the deductible amount before your policy kicks in and starts paying 100%.

Medicare Supplement Plan N Rate Increase History

Among the factors that affect your monthly premium rates is the pricing method that your carrier uses. In the last five years, premium rates for Plan N have increased between 2% and 4%. These increases are lower when compared to Plan F and comparable when compared to Plan G.

As Plan N benefits are the same from carrier to carrier, its important to discuss with your agent rate history increase for the company you are considering enrolling with. Additionally, research carrier reviews for Plan N.

Recommended Reading: How To Replace A Medicare Health Insurance Card

What You Should Know About Medicare Supplement Plans

Understanding how Medicare Supplement Plans work can take some time. Here are the basics :

-

Medigap plans cover one person. If your spouse or partner also wants a Medicare Supplement Plan, they must buy a policy of their own.

-

Medigap plans cant cancel you for health issues. All standardized Medigap plans are guaranteed renewable, which means they cant cancel your policy if you have health problems, as long as you continue to pay the premiums.

-

Medigap doesnt cover prescription drugs. Medigap policies are no longer allowed to include prescription drug coverage. For that, youll need a Medicare Part D Prescription Drug Plan.

-

You cant buy Medigap if you have Medicare Advantage. In fact, its illegal for someone to sell you a Medigap plan if you have Medicare Advantage. If you change back to Original Medicare, you can purchase a Medigap plan.

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

You May Like: When Can You Start Medicare

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How Long Does It Take To Get Medicare B

The Kind Of Medicare Supplement Plan That You Choose

The premium that you will have to pay will depend on the plan option or type of Medigap plan that you will get.

All the Medigap plans offer the same primary benefits, but not all of them provide 100% coverage for the said benefits.

Aside from the basic benefits, other Medigap plans offer additional benefits. Additional benefits make the plan wider and comprehensive. Some Medigap policies offer up to 100% coverage of the Part A deductible and 100% of the Part B excess charge. There are also plans that provide foreign travel coverage.

The more the benefits a Medigap plan offer, the higher the premium that you have to pay.