Offer From The Motley Fool

The $16,728 Social Security bonus most retirees completely overlook: If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $16,728 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

What Happens After I Register For Medicare Online

Once you have submitted your application, it will be reviewed by Medicare to ensure all the information is accurate and complete. You should double-check your contact information to make sure it is correct. This is important to ensure prompt delivery of your Identification Card, as well as in the event Medicare needs to contact you about your enrollment.

After your application is received and processed, a letter will be mailed to you with the decision. If you encounter any questions or problems during the process, you can always contact Social Security for assistance.

Applying For Medicare With Employer Coverage

Can you still enroll in Medicare coverage, even if youre not yet seeking retirement? The answer is yes! Medicare coverage can coincide with your group coverage through your employer. If your employer has more than 20 employees, your group coverage will work as your primary insurance, and Medicare will be your secondary insurance.

You can choose to apply for Part B, or you can wait until leaving your employer group coverage. For more information on the benefits of obtaining Medicare while receiving group coverage through work, give our team a call, and we can review the pros and cons.

Sometimes beneficiaries dont want to apply for Part B when they initially become eligible because of employer health coverage. Should you lose your health insurance through your employer, or if you prefer to switch over to Medicare, you can apply any time while receiving coverage through your employer.

You May Like: Can I Get Glasses With Medicare

Ill Be 65 Years Old Soon When Should I Apply For Medicare

Monday, March 31st, 2014

We generally advise people to apply for Medicare three months before turning age 65. You will receive a Medicare card about two months before you turn age 65. Your coverage will begin at age 65.

If you are already receiving Social Security benefits when you become eligible for Medicare, we automatically will enroll you in Medicare Parts A and B. However, because you must pay a premium for Part B coverage, you can turn it down.

Note: Residents of Puerto Rico and foreign countries do not get Part B automatically. They must elect this benefit.

Apply online for Medicare only, or call 1-800-772-1213 between 7 a.m. to 7 p.m., Monday through Friday. Likewise, you can apply for retirement benefits and Medicare together online.

If you live outside the United States, refer to Service Around the World.

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Recommended Reading: Will Medicare Pay For In Home Physical Therapy

Documents You Need To Apply For Medicare

To begin the application process, youll need to ensure you have the following documentation to prove identity:

- A copy of your birth certificate

- Your drivers license or state I.D. card

- Proof of U.S. citizenship or proof of legal residency

You may need additional documents as well. Make sure to have on hand:

- Your Social Security card

- W-2 forms if still active in employment

- Military discharge documents if you previously served in the U.S. military before 1968

- Information about current health insurance types and coverage dates

If you are already enrolled in Part A and have chosen to delay enrollment in Part B, you will need to complete additional forms .

Do I Need Medicare Part B

We always advise our clients to contact their employer or union benefits administrator before delaying Part A and Part B to learn more about how their insurance works with Medicare. Employer coverage may require that you enroll in both Part A and Part B to receive full coverage.

Common reasons beneficiaries delay Part B include:

Don’t Miss: What’s The Eligibility For Medicare

Do I Need To Sign Up For Medicare When I Turn 65

It depends on how you get your health insurance now and the number of employees that are in the company where you work.

Generally, if you have job-based health insurance through your current job, you dont have to sign up for Medicare while you are still working. You can wait to sign up until you stop working or you lose your health insurance .

- If youre self-employed or have health insurance thats not available to everyone at the company: Ask your insurance provider if your coverage is employer group health plan coverage If its not, sign up for Medicare when you turn 65 to avoid a monthly Part B late enrollment penalty.

- If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you dont have gaps in your job-based health insurance. Check with the employer.

-

If you have COBRA coverage: Sign up for Medicare when you turn 65 to avoid gaps in coverage and a monthly Part B late enrollment penalty. If you have COBRA before signing up for Medicare, your COBRA will probably end once you sign up.

Q: What Should You Do To Prepare For Medicare At Age 64

A: If you take Social Security at age 65, you automatically get put into Medicare. Unfortunately the retirement age is now 66 and if you wait until then to take Social Security, youll likely need to prepare for Medicare at age 64 on your own, and a lot of people dont realize that.

You enroll in Medicare through the Social Security Office. You can either enroll online, on the Social Security website it takes about 10 minutes or you can go to a Social Security office. They recommend calling first to make an appointment, so you wont be waiting there all day. Or, you can enroll over the phone, by calling Social Security. You usually wait on hold for a while, but its another option.

Corinne Lofchie, LICSW, is an Elder Care Advisor at Somerville-Cambridge Elder Services

You can start the process three months before your 65th birthday. That way, your coverage will start the month that you turn 65. Lets say your birthday is January 15. If you enroll in the three-month period before January, your Medicare coverage will begin on January 1. After your birthday month, you have 3 more months to enroll. If you wait, say until January, your coverage will begin on February 1. It always starts the next month, unless you enroll before your birthday month.

Read Also: Does Medicare Pay For Varicose Veins

When Can You Enroll In Medicare

You can apply for Medicare during three distinct enrollment periods: your Initial Enrollment Period, the General Enrollment Period and a Special Enrollment Period when youre getting off your employers health coverage.

Medicare Enrollment Dates

| Change to a 5-star Medicare Advantage or Part D prescription drug plan. |

You’re Retired But Are Still Covered Under Your Spouse’s Group Health Plan

The penalties that come with not enrolling in Medicare on time only apply if you don’t have access to an eligible group health plan. It may be the case that you’re retired and don’t have employer benefits at all. But if you’re married to someone who’s still working and are on your spouse’s group health plan, the same rules apply — as long as that plan covers 20 people or more, you don’t have to worry about penalties for delaying Medicare.

Of course, if you’re not happy with your spouse’s group health plan — say, you’re being charged a lot to stay on it — then it could pay to look into Medicare. But if your costs under that plan are reasonable and you’re happy with its scope of coverage, then there’s no reason to make changes to your health insurance until your spouse retires and that group coverage goes away.

Medicare may end up being more flexible than you’d expect, at least when it comes to enrollment. Though age 65 is when Medicare coverage begins, if either of these situations applies to you, you may not want to enroll right away.

Recommended Reading: What Is A Medicare Supplement Plan N

You’re Still Working And Have Access To A Group Health Plan

Just because you’re turning 65 doesn’t mean you’re on the cusp on retirement. You may still have plans to work another few years — or longer.

If you have access to a group health insurance plan through your employer, and you’re happy with that coverage, then enrolling in Medicare doesn’t make sense — especially if it will cost you more than what you currently pay for insurance. As long as your company’s group health plan covers 20 or more people, you won’t face penalties for missing your initial Medicare enrollment window. Rather, you’ll get a special enrollment period that will begin once you no longer have your group health plan.

Now if you still have access to a great health plan but are turning 65, you may want to consider signing up for Medicare Part A, which covers hospital care. Part A, unlike Part B, is generally free for enrollees. And if you put that coverage in place, Part A can be your secondary insurance for hospital care — and potentially pick up costs that your primary insurance doesn’t cover.

The only caveat here is that once you enroll in any part of Medicare — whether it’s coverage you pay for or not — you’ll no longer be eligible to participate in a health savings account . HSAs offer a number of tax breaks, so if you’re currently funding one, you may want to hold off on signing up for Medicare — even Part A.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Recommended Reading: Does Medicare Pay For Tdap Vaccine

Learn More About Medicare And Move To The Next Step

Once you have a Medigap Plan in place, you can focus on your Medicare drug plan. This is an important part of completing your Medicare coverage. If you dont secure a Part D plan, you could be subject to a late enrollment penalty. This applies to anyone who goes without Part D for a continuous period of 63 days after your Initial Enrollment Period. You can access Medicares drug plan database to compare Part D plans.

Be diligent and continue to learn about what Medicare covers so youre not surprised down the road. A great resource is the Medicare and You handbook. Medicare will usually mail a copy to you each year. Extra copies can be requested at Medicare.gov.

Also, make sure you read all communication from Social Security. I recently had a client who was shocked by a hefty bill for her Part B premium. She didnt realize that even though she delayed receiving her Social Security benefit, she still had to pay the Part B premium. For this reason, I cant stress enough how important it is to read and keep all your correspondence from Social Security.

More than likely, you will have questions even after purchasing a Medigap plan. At reMedigap.com, our lines of communication are always open. Many of our clients found our website and had their questions answered before, during, and after purchasing Medigap insurance.

When Can You Sign Up If You Missed The Initial Enrollment Period

If you didnt sign up when you were first eligible and you dont have current healthcare coverage elsewhere , youll have to wait for the next General Enrollment Period which runs each year from January 1 through March 31.

Your coverage will then begin in July of that year, and you may have to pay a late enrollment penalty on your Medicare Part B premium for as long as you have Part B coverage. Your premium will go up by 10% for every 12-month period you werent enrolled.

Read Also: How Do I Stop Medicare Calls

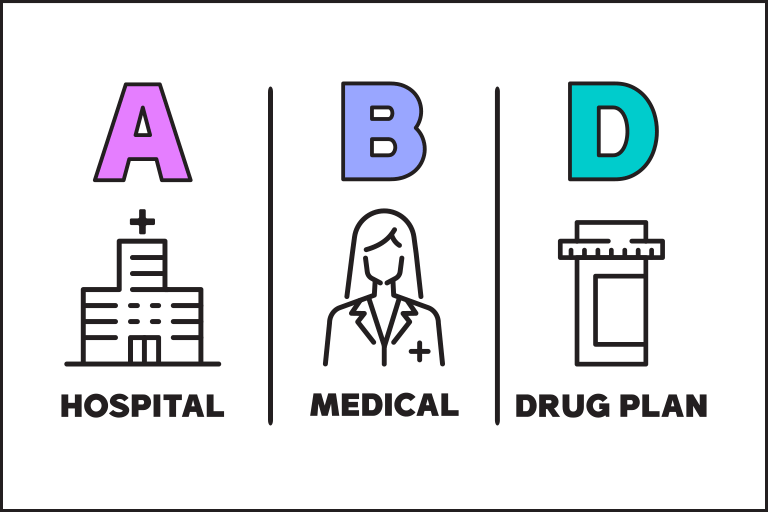

What Do The Different Parts Cover

Medicare Part A covers hospital stays and care, while Part B covers physician fees and other costs associated with diagnosing and treating medical conditions. Medicare Part C, called Medicare Advantage, offers options for extra coverage that may include vision, dental, and wellness care. Medicare Advantage plans cover at a minimum what Medicare Part A and Part B cover . Most MA plans also provide prescription drug coverage. You can only apply for a Medicare Advantage plan if you’re already enrolled in both Part A and Part B. Medicare Part D covers prescription medications. If you have a Medicare Advantage plan with prescription drug coverage, you probably don’t need a separate Part D plan.

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

You May Like: Who Provides Medicare Advantage Plans

When To Sign Up For Medicare

How can you make sure that youre adhering to the deadlines? Rest assured that were here to help you sort through the important dates, so that you never fall behind. If youre approaching your 65th birthday, then read on to discover more about the dates and deadlines to keep in mind when it comes to Medicare enrollment.

What Can I Do Next

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Because the company has less than 20 employees, your job-based coverage might not pay for health services if you dont have both Part A and Part B.

Don’t Miss: Does Medicare Cover Bed Rails

Can You Sign Up For Medicare At Any Time

No, you can only enroll in Medicare during one of the enrollment periods. The first opportunity you have to enroll is during your Initial Enrollment Period. If you miss your Initial Enrollment Period, your second opportunity to sign up is during the General Enrollment Period. Outside both of these enrollment windows, you can sign up during a Special Enrollment Period if you qualify.

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

Don’t Miss: What Are Medicare Requirements For Bariatric Surgery

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.