If You Have Retiree Health Benefits

- You canât get premium tax credits and other savings based on your income. This is true only if youâre actually enrolled in retiree coverage. If youâre eligible for but not enrolled in retiree coverage, you may qualify for premium tax credits and lower out-of-pocket costs based on your household size and income.

- If you voluntarily drop your retiree coverage, you wonât qualify for a Special Enrollment Period

A time outside the yearly Open Enrollment Period when you can sign up for health insurance. You qualify for a Special Enrollment Period if youâve had certain life events, including losing health coverage, moving, getting married, having a baby, or adopting a child, or if your household income is below a certain amount.

to enroll in a new Marketplace plan. You wonât be able to enroll in health coverage through the Marketplace until the next Open Enrollment period.

Your Social Security Benefits Could Be Reducedtemporarily

Your age matters here, as we’ll see below, but any reductions that do occur are temporary. The Social Security Administration will eventually recalculate your benefit and give you credit for months when you didn’t receive a benefit, thereby boosting your future benefit. So, don’t let a temporary reduction in payments keep you from returning to work. Here’s how the age rules work:

If you haven’t yet reached your full retirement age between 66 and 67 for people born in 1943 or laterworking could mean temporarily giving up $1 in benefits for every $2 you earn above the annual limit .

Here’s an example of how that might look:

What If You Keep Working

If you have healthcare coverage from your employer, you may continue to use that health insurance. Because you pay for Medicare Part A through taxes during your working years, most people dont pay a monthly premium.

Youre usually automatically enrolled in Part A when you turn 65 years old. If youre not, it costs nothing to sign up. If you have hospitalization insurance through your employer, then Medicare can serve as a secondary payer for costs not covered under your employers insurance plan.

If you have an insurance plan through your employer because youre still working, you may qualify to sign up late under a special enrollment period and avoid any penalties.

Discuss your retirement plans well in advance of your retirement date with the benefits administrator at your workplace in order to best determine when to sign up for Medicare. They might also give you tips on how to avoid penalties or additional premium costs.

Read Also: What Is Medicare Advantage Part C

Will I Be Enrolled In Medicare Automatically

Not necessarily â and thatâs something that confuses a lot of people, says Donovan.

You will be automatically enrolled in Medicare if:

- Youâre already receiving Social Security retirement benefits when you turn 65.

- Youâre younger than 65 and have been receiving Social Security disability benefits for 24 months. Then youâll be enrolled in Medicare starting in month 25.

- Youâre younger than 65 and have ALS . Youâre automatically signed up for Medicare the same month your Social Security disability benefits start

You will typically have to sign up for Medicare yourself if:

- You arenât receiving Social Security retirement benefits when you turn 65.

- Youâre under 65 and have end-stage renal disease, a type of kidney failure.

- You live in Puerto Rico. You may be automatically enrolled in Medicare Part A when you turn 65, but youâll need to sign up for Part B.

If you donât sign up for Medicare when you become eligible, you may have to pay a late enrollment penalty. Learn more about the late enrollment penalties.

Medicare Supplement Insurance Plan Premiums

If you purchase a Medicare Supplement insurance plan, remember you might end up paying several different monthly premiums:

- The Medicare Supplement insurance plan premium

- Your Medicare Part B premium

- Your stand-alone Medicare Part D Prescription Drug Plan premium, if applicable Premiums for Medicare Supplement insurance plans can vary widely. As with any purchase or proposed purchase, it is wise to shop for the best price for the coverage you think you will need.

Don’t Miss: Why Do I Need Medicare Part C

Who Is Eligible For Age 65

Medicare was created for the government through a program funded by taxes collected from many of its employees. When they reach the age of 60, the beneficiaries can receive medical assistance. Most people get free Medicare coverage because they pay off payroll deductions, but Medicare can have additional costs.

Do You Have To Pay For Medicare When You Retire

Medicare programs can help cover your healthcare needs during your retirement years. It is automatically offered when you turn age 65. While Medicare isnt necessarily mandatory, it may take some effort to opt out of.

You may be able to defer Medicare coverage, but its important to if you have a reason that makes you eligible for deferment or if youll face a penalty once you do enroll.

While you can decline Medicare altogether, Part A is usually premium-free for most people and wont cost you anything if you decide not to use it. Declining Medicare completely is possible, but if you do, youll be required to withdraw from all of your monthly benefits This means you can no longer receive Social Security or Railroad Retirement Board benefits and repay anything you have already received when you withdraw from the program.

Recommended Reading: Will Medicare Pay For A Podiatrist

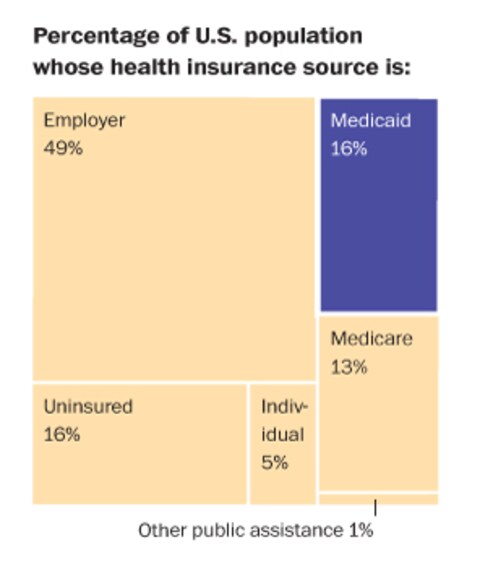

You Can Enroll In Medicare If You’re Not Retired But Do You Need To

Most Americans can enroll in Medicare Parts A and B at age 65, regardless of whether they’re still working or not. However, many workers with employer health benefits may not need to. Here’s a quick guide to determine if you’ll need to sign up for Medicare at 65, or if your other health insurance is sufficient until you retire.

Can I Get Medicare At 55

Medicare at age 55 started making headlines again after the Medicare at 55 Act was introduced in August of 2017. It is one of dozens of bills that Congress has yet to vote on, much less pass. The bill proposes to allow American citizens aged 55 to 64 to buy into the Medicare program.

Options would be the same as if you aged into the program. This includes Original Medicare, which includes Part A, hospital insurance, and Part B, medical insurance. If the bill passes, you could also choose to enroll in Medicare Part C, more commonly known as Medicare Advantage. You would also have access to Medicare Part D prescription drug coverage.

As of November 2021, Medicare at 55 is not a reality.

Recommended Reading: Am I Required To Sign Up For Medicare At 65

Timely Application And Proofs

If you have Medicare, we need your application and proofs more than one month prior to your retirement effective date. If your last day of work is in June and you want your insurance coverage to start July 1, your retirement effective date, we need your required proofs before June 1. If we get the request and proofs after the first of the month, one month prior to your retirement, but before the end of the month, you will not be enrolled until a month later.

For example, if you submit your application and proofs on June 1, for a retirement effective date of July 1, your actual insurance effective date will be Aug. 1.

Aging In To Medicare Coverage

As soon as you or anyone else covered by your health insurance becomes eligible for Medicare, that person must enroll in both Part A and Part B . You must have Medicare parts A and B to enroll in retiree insurance and prescription drug programs. If you, your spouse, or your dependents don’t enroll in Medicare Part B when first eligible, the insurance for that person will be canceled and there is a six-month wait to reenroll.

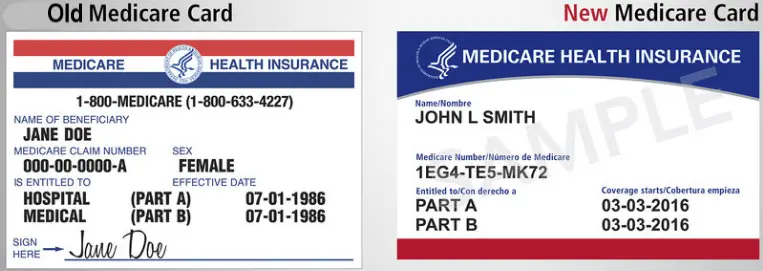

Tell ORS your Medicare number and effective dates for parts A and B

Once you are enrolled in Medicare you will receive your Medicare card from Social Security. As soon as you receive your card, tell ORS your Medicare number and effective dates for parts A and B.

- Log in to miAccount and send a secure message on Message Board, using the Submit My Medicare Number category. Include the name, Medicare number, and effective dates for parts A and B in your message for the individual going on Medicare.

- Use miAccount to update your Medicare information and complete a plan change to enroll in the Medicare health and prescription drug plan. Print the confirmation page and mail or fax it to ORS.

- Make a copy of your Medicare card. Write your name, member ID, address, and date of birth on the copy and mail or fax the copy of your card.

- Mail or fax a completed Insurance Enrollment/Change Request form to ORS with your Medicare information.

Medicare enrollment is automatic for most people if:

- You have paid into Medicare for 10 years.

- You are turning 65.

Also Check: Does Medicare Cover Overseas Expenses

If Medicare Coverage Is In Effect How Do I File Medical Part B And Pharmacy Claims

If Medicare is the primary insurance, your provider must submit claims to Medicare first. Once Medicare processes the claim, Medicare will send you a quarterly Medicare Summary Notice . Exception: If you are enrolled in the IYC Medicare Advantage plan, your provider will submit claims to that plan and they will send you an Explanation of Benefits .

IYC Health Plan Medicare:Many of the health plans have an automated procedure after Medicare processes the claim, through which the provider then submits it to the health plan for processing. However, some health plans require members to submit a copy of the MSN and, in certain circumstances, a copy of the providers bill. You should discuss with your provider if they will bill Medicare and your health plan on your behalf. Contact your health plan for additional information.

IYC Medicare Advantage:

IYC Medicare Advantage, offered by UnitedHealthcare, allows members to seek care anywhere in the United States and its territories. The benefits are the same in- or out-of-network. You can see any provider that accepts Medicare and is willing to treat you and bill UnitedHealthcare. When you visit your provider, you must show your health plans card. Your provider will submit your claims directly to the health plan. To request reimbursement for a covered service charge that you paid, send your receipt and a copy of your card to the address on the back of that card. Contact UnitedHealthcare for more information.

Criteria For Enrolling In Medicare At Age 62

Although 65 is the true age at which you can get Medicare, there are instances where taxpayers can get benefits before the age of 65. If youre receiving Social Security Disability Insurance , you can start receiving your Medicare benefits early. Youll likely also be approved if you suffer from end-stage renal disease.

Another important answer to what age can you get Medicare relates to your marriage. If youve logged the required 10 years of work, but your spouse hasnt, your spouse may qualify for premium-free Medicare Part A once he or she reaches 65 and youre at least 62. Even if you havent yet reached 62, your spouse should go ahead and enroll at age 65 to keep Part B premiums low once Medicare eligibility begins.

Read Also: Do I Have To Sign Up For Medicare At 65

A You Can Continue Working And Start Receiving Your Retirement Benefits

If you start your benefits before your full retirement age, your benefits are reduced a fraction of a percent for each month before your full retirement age.

You can get Social Security retirement benefits and work at the same time before your full retirement age. However your benefits will be reduced if you earn more than the yearly earnings limits.

After you reach your full retirement age, we will recalculate your benefit amount to give you credit for any months you did not receive a benefit because of your earnings. We will send you a letter that explains any increase in your benefit amount.

If you delay filing for your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. If you also continue to work, you will be able to receive your full retirement benefits and any increase resulting from your additional earnings when we recalculate your benefits. Once you reach full retirement age, your earnings do not affect your benefit amount.

If you start receiving retirement benefits before age 65, you are automatically enrolled in Original Medicare when you turn 65. If you or your spouse are still working and covered under an employer-provided group health plan, talk to the personnel office before signing up for Medicare Part B. To learn more, read our Medicare publication.

How Does Medicare Work After Retirement

Retirement age is not a number thats set in stone. Some people may have the option to retire early, while others need or want to keep working. The average retirement age in the United States in 2016 was 65 for men and 63 for women.

Regardless of when you plan to retire, Medicare has designated age 65 as the starting point for your federal health benefits. If you choose to retire early, youll be on your own for health coverage unless you have specific health issues. Otherwise, youre advised to sign up for Medicare programs in the few months before or after your 65th birthday.

If you continue working after age 65, different rules apply. How and when you sign up will depend on what kind of insurance coverage you have through your employer.

Recommended Reading: Does Medicare Pay For Scooters

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

What Are The Typical Age Requirements For Medicare Coverage

The typical Medicare age requirement is 65, or younger if you qualify for disability benefits. In addition to meeting the age requirement of 65, you must also be a U.S. citizen or legal permanent resident before you are eligible for Medicare.

Most people who are 65 qualify for premium-free Medicare Part A because they have worked for at least ten years and have paid Medicare taxes. Medicare Part A helps cover hospitalization, skilled nursing facility, home health care, and hospice costs. If you are not eligible for premium-free Part A because you have not worked and paid Medicare taxes, but are a citizen with permanent residency and are 65, you can pay premiums to have Part A coverage. If your spouse has worked long enough to qualify for premium-free Part A, your Part A premiums will be free after your spouse turns 62.

When you meet the requirements for Part A, you also qualify for Medicare Part B which helps cover medical out patient costs such as doctors visits, urgent care, durable medical equipment , some preventive care, and more. If you have Part B, there is a monthly premium you pay, which is $148.50 for 2021, and an annual deductible of $203.

Read Also: Which Part Of Medicare Covers Doctor Visits

You May Need To Do Some Planning With Any Employer Health Insurance

Eligibility for employer-offered group health insurance is one of the primary reasons many people under age 65 stay in, or return to, the work force. If you’re 65 or older and already covered by Medicare, check with your employer’s human resources department about how their insurance coverage would work with your Medicare. In short, Medicare could help pick up the tab for expenses not covered by your group plan, but the rules vary depending on how many employees your employer has. For more information, read “Medicare and Other Health Benefits: Your Guide to Who Pays First.”

If you have private health insurance, compare your benefits and coverage with plans offered by a new employer. Although group plans tend to be less expensive than individual policies, you could be better off keeping your individual policy rather than canceling it and hoping you can get your old coverage and rates back later.

Signing Up For Medicare Part B At 65 If Youre Still Working

If youre still working at age 65 and youre not claiming Social Security benefits, the government will not automatically enroll you in Medicare Part B, which covers doctors visits, diagnostic tests, medical equipment, ambulance transportation, and mental health care.

If you work for an employer with 20 or more employees and youre enrolled in the employers health insurance plan, you dont have to enroll in Part B. You might not want to do so, because it isnt free.

Also Check: Is Medicare A And B Free

Will I Get My Spouses Medicare If I Retire At Age 62

No. Even if your spouse has Medicare when you retire at 62, you arenât eligible for Medicare until you turn 65 .

If you retire before age 65, you may be able to continue to get health insurance through your employer, or you can purchase coverage from a private insurance company in the meantime.

What Is The Social Security Income

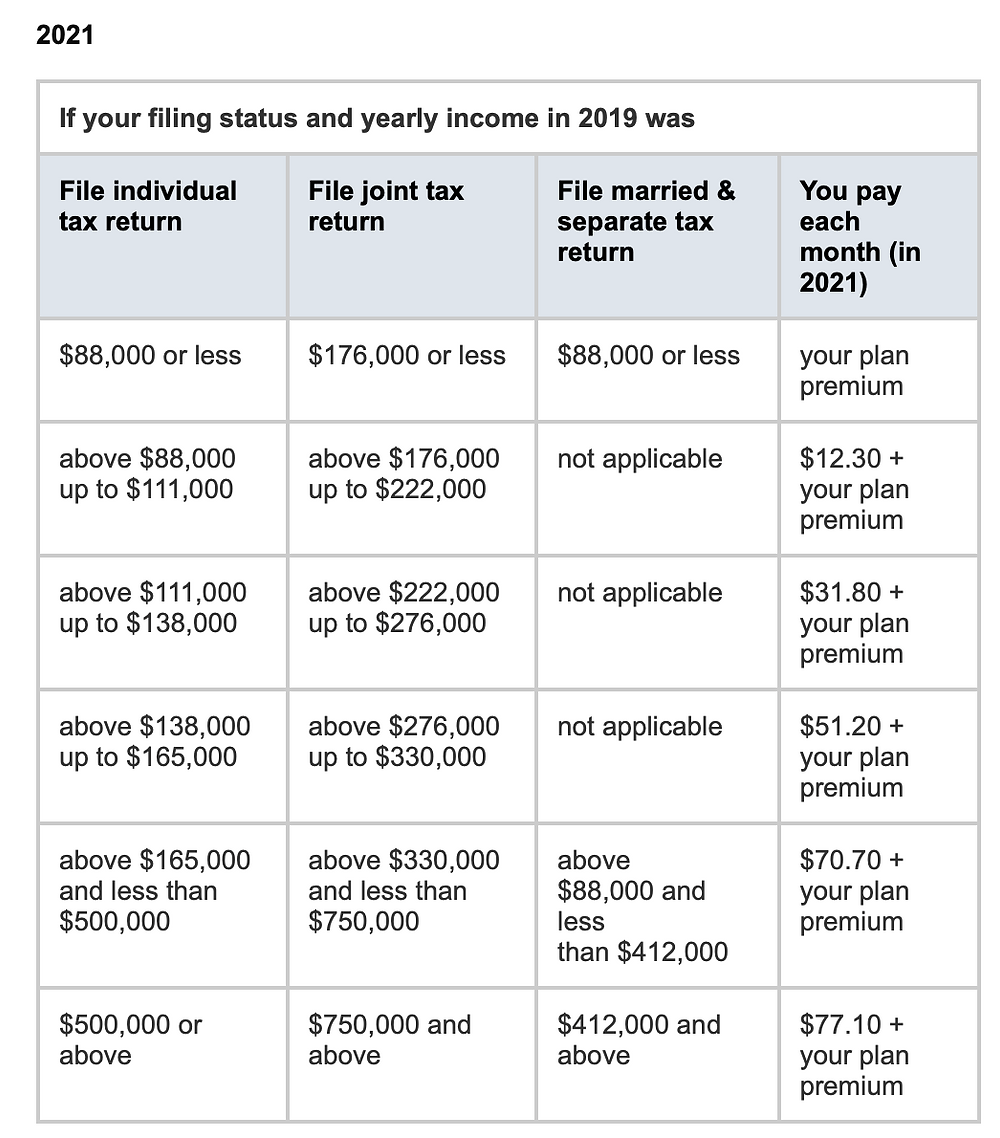

If you are enrolled in Medicare and your modified adjusted gross income exceeds certain limits established by federal law, you may be required to pay an adjustment to your monthly Medicare Part B and Medicare Part D plan) coverage premiums. The additional premium amount you will pay for Medicare Part B and Medicare prescription drug coverage is called the income-related monthly adjustment amount or IRMAA. Since Medicare beneficiaries enrolled in the State of Wisconsin Group Health Insurance Program are required to have Medicare Parts A, B and D, the IRMAA may impact you if you have higher income.

To determine if you will pay the additional premiums, Social Security uses the most recent federal tax return that the IRS provides and reviews your modified adjusted gross income. Your modified adjusted gross income is the total of your adjusted gross income and tax-exempt interest income.

Social Security notifies you in November about any additional premium amounts that will be due for coverage in the next year because of the IRMAA. You must pay the additional premium amount, which will be deducted from your Social Security check if its large enough. Failure to pay may result in Medicare terminating your coverage. The IRMAA is paid to Social Security, not the State of Wisconsin Group Health Insurance Program. It is not included in your State of Wisconsin Group Health Insurance Program premium.

Don’t Miss: How To Get Dental And Vision Coverage With Medicare