Why Consider Extending Medicare To Mexico

The notion of extending Medicare to Mexico is sure to meet with opposition, or, at the very least, a great deal of skepticism. Concerns will be raised about financing the program, ensuring the quality of care, establishing a means for financial oversight, and justifying extension to Mexico while continuing to exclude coverage in other countries. In thinking about the possible extension of Medicare to Mexico, it is important to consider the arguments for such an extension from each of the relevant perspectives. This section briefly covers how an extension of Medicare to Mexico could benefit various relevant parties, providing justification for considering the proposition.

The Consumer Perspective: Americans and Former American Permanent Residents Living in Mexico

Medicare-eligible beneficiaries living in Mexico, of course, would like to be able to receive their Medicare benefits in Mexico. After investing in the system for years, they receive no benefitdirect or substitutein the communities in which they live. American citizens living in Mexico do maintain access to Medicare benefits in the United States, but this requires often significant travel expenses and is sometimes very difficult or impossible due to health conditions. For Medicare-eligible noncitizens, access is more limited, as U.S. residency expires after six months of living abroad, and re-entering the U.S. requires what can be a lengthy process of obtaining a visa.

The U.S. Government Perspective

Medigap Plans And Travel Coverage Options

If you are a frequent traveler and want a peace of mind when it comes to your medical care abroad, you have several options for a price.

Medigap plans can be added to Original Medicare and may provide coverage for emergency healthcare outside the United States. Exact coverage depends on your individual plan, but the Medigap plans that offer foreign care options are:

Plans E, H, I, and J cant be purchased anymore, but people who were enrolled in these plans before June 1, 2010, can keep their coverage. Plan C and F are no longer available to new enrollments but are available if you had Medicare before January 1, 2020. With most of these plans, the insurance company will pay 80% of the charges billed to you after you meet a $250 deductible. There may also be limits to coverage based on how long you have been traveling and how many claims you have filed. Medigap policies have a $50,000 cap on lifetime coverage for foreign medical care.

You cant add a Medigap plan to a Medicare Advantage plan, but some Medicare Advantage plans include coverage for foreign medical emergencies. Check with your plan when enrolling if this is something you need, and be sure to check your coverage before travelling.

Non-Medicare coverage options

If you dont want to add a Medigap plan or enroll in a particular Medicare Advantage plan just to get foreign travel coverage, you may want to consider other types of travel insurance that offer medical coverage.

For Example A Plan Like Worldtrips’ Atlas Travel Can Cover You For Situations Like:

- You’re taken to the nearest emergency medical facility following a severe injury in a fairly remote location. Unfortunately, the facility lacks sufficient equipment and the medical specialists require to treat you. You need to be transported by helicopter to a hospital better suited to your needs a cost that can exceed $100,000. under Atlas Travel, you’re covered for an emergency medical evacuation of up to $1,000,000.

- You’re relaxing on the beach in the Bahamas when you receive the devastating news that your sibling has passed away. You decide to return home immediately to help your family make funeral arrangements. Thankfully, Atlas Travel’s Trip Interruption benefit pays for your one-way ticket to return home.

- You’re hospitalized due to a medical emergency while traveling solo through Italy. Fortunately, Atlas Travel pays to fly a family member from your home country to your bedside.

- You’re injured in a terrorist attack in London. Atlas Travel pays for your covered injuries up to the $50,000 maximum lifetime limit allowed under the Terrorism benefit.

- Your husband and travel companion contracts an illness in the Caribbean and dies. Your joint Atlas Travel policy pays to transport his body back to your home country.

Atlas Travel also includes high coverage limits for seniors. Overall maximum coverage limits are as follows:

- Up to Age 69: $2,000,000

Don’t Miss: What Age Can You Get Medicare Part B

Medigap Plans With Foreign Benefits

Each of the 6 Medigap plans currently available that include coverage of foreign emergency care also include the following coverage:

Copyright 2022 TZ Insurance Solutions LLC. All rights reserved.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Does Medigap Cover You While Abroad

Most Medicare Supplement plans, include a foreign travel benefit check to see if yours does. Medicare Supplement plans C, D, E, F, G, H, I, J, M, and N that cover travel, pay for 80% of the cost of medically necessary emergency care outside of the U.S. and its territories.

Youll be responsible for a separate $250 deductible. The medical emergency must occur within 60 days of the start of your trip. So it wont work if you leave the country indefinitely. Plus, theres a $50,000 lifetime limit to the amount this benefit will payout.

Medigap policies are not a Medicare replacement. Theyre an additional benefit on top of your existing coverage under Original Medicare . And be aware that Medicare Part D prescription benefits also do not extend outside the U.S. and its territories.

Read Also: How Do Zero Premium Medicare Plans Work

What Countries Accept Us Medicare

Medicare will help cover you in some emergencies whileyoure abroad, but you shouldnt rely on it to work as it does in the U.S. Youcan only use your Medicare benefits as usual in the United States and itsterritories such as:

- Puerto Rico

Outside of the United States, your coverage under Medicarewill be limited to emergency situations.

What Are The Steps Forward

Given the possibility that an extension of Medicare to Mexico could benefit consumers, the Mexican government, and the American government, further consideration of the policy options and a detailed analysis of the issues make sense. Although we argue that Options 2 and 4 are likely the most sensible to pursue, we suggest modeling each option to assess the effects on various parties across several dimensions. A critical starting point for such a modeling exercise is to develop more-accurate estimates and projections for the size of the Medicare-eligible population in Mexico. Today’s estimates vary significantly , as do projections of future increases. A model could then be developed to demonstrate explicit benefits and costs of extending Medicare to Mexico under different policy scenarios. Such a model would assimilate information about population sizes, relative prices, behavioral responses, and program costs to generate estimates of the fiscal consequences for CMS, the quality of care in Mexico, and the expansion of the health economy in Mexico. We have included a short description of what such a modeling exercise would entail in Box A.

Recommended Reading: Does Medicare Cover Eye Exams For Glaucoma

Do I Need Travel Insurance If I Have Medicare

Since Original Medicare offers limited coverage outside of the U.S., purchasing a travel insurance policy may be necessary when visiting other countries.

Purchasing travel insurance while on Medicare will help cover emergency and non-emergency costs from situations that may arise overseas. Travel insurance benefits vary by policy and carrier.

When you purchase travel insurance, your policy will help cover international costs that Medicare does not cover. If you require healthcare and cannot make it back to the U.S., you will not need to pay out-of-pocket, as you would with Original Medicare.

So, suppose you have Original Medicare and plan to travel outside the country. In that case, enrolling in a travel insurance plan is essential to help cover unexpected health costs.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Does Medicare Cover Overseas Travel

Although you might think that you havent broken a bone in seventeen years, unfortunately, accidents happen. What if you need to see a doctor if you are staying abroad? In a minute, youll learn whether Medicare covers overseas travel. Lets go!

Also Check: Does My Doctor Accept Medicare Advantage

Do Medicare Supplement Plans Cover Foreign Travel

Medicare Supplement plans are a form of secondary insurance to cover the out-of-pocket costs Medicare Part A and Part B leave behind. These policies offset the prices you would pay out-of-pocket if you only had Original Medicare. With a Medicare Supplement plan, beneficiaries do not lose any benefits that come with Original Medicare.

Get A Free Quote

Find the most affordable Medicare Plan in your area

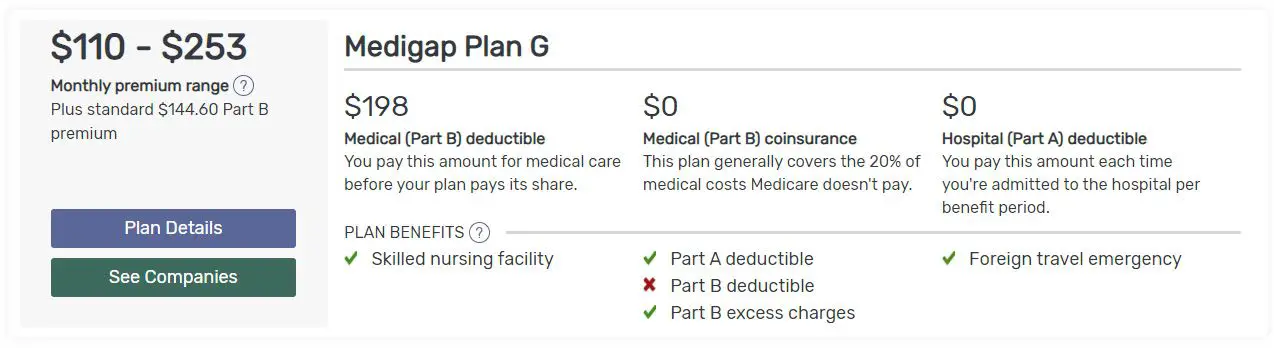

Medicare Supplement plans include additional benefits providing foreign travel emergency coverage. Medicare Supplement Plan C, Plan D, Plan F, Plan G, Plan M, and Plan N provide emergency coverage in foreign countries. Additionally, Medigap High Deductible Plan F and High Deductible Plan G also include coverage overseas.

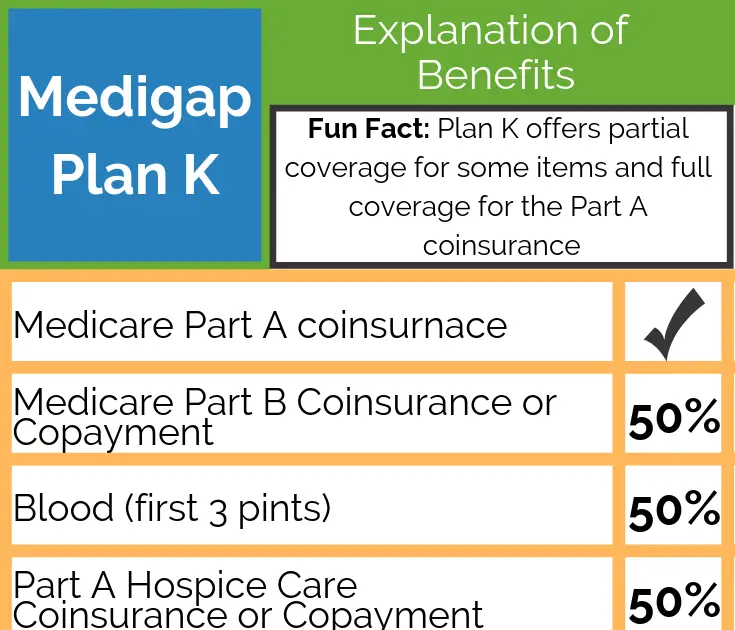

Medicare Supplement Plan A, Plan B, Plan K, and Plan L do not offer additional foreign travel emergency coverage.

Overview of Medicare Supplement foreign travel emergency coverage:

- Carries a $250 deductible

- Coverage only lasts the first 60 days of your trip

- Your plan pays 80% of your medical bills while out of the country

- The lifetime coverage limit is $50,000.

Your Medicare Supplement plan will provide foreign travel coverage if your health services are for emergencies. If you only have Original Medicare, you will not have this extra coverage outside the U.S.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Will Medicare Cover Me If I Travel Outside The United States

En español | Medicare doesnt pay for medical services outside the United States and its territories, except in the following rare situations:

- Youre traveling between Alaska and another state and have a medical emergency that means you must be treated in Canada.

- A medical emergency occurs while youre in the United States or its territories, but the nearest hospital is in a foreign country for example, across the border in Canada or Mexico.

- You live within the United States or its territories and need hospital care , but the nearest hospital is in a foreign country.

- Youre on a ship that’s within six hours of a U.S. port.

Some Medigap supplemental insurance policies cover emergencies or urgently needed treatment abroad, if the need for care begins during the first 60 days of your trip. In this situation, you pay a $250 deductible and 20 percent of the cost of the medical treatment you receive, up to a lifetime maximum of $50,000.

Some Medicare Advantage plans also cover medical emergencies. So do some employer or retiree plans and TRICARE military benefits. Check with your plan whether it will cover you during your trip.

Otherwise, you need to buy travel insurance that covers medical emergencies when planning journeys abroad.

Read Also: Does Medicare Cover The Cost Of A Shingles Shot

Getting Medicare While Traveling Or Living Overseas

Many retirees look forward to traveling in their retirement, and more and more are actually retiring overseas, in part as a way to stretch savings. But what happens to retirees’ federal benefits while they are out of the country? The short answer is that although Social Security benefits are available to retirees in other countries, Medicare generally is not. In this installment we look at Medicare.

Traditional Medicare does not provide coverage for hospital or medical costs outside the United States . In rare cases, Medicare may pay for inpatient hospital services in Canada or Mexico.

Local Elder Law Attorneys in Your City

City, State

Some Medicare Advantage plans may provide coverage benefits for health care needs when enrollees travel outside the United States. But those retiring overseas — or travelers enrolled in the traditional Medicare program or whose Medicare Advantage plan does not cover foreign travel — will need to purchase health insurance from another source.

Whatever option retirees choose while abroad, if they return to the United States they will still be covered by Medicare Part A. Medicare Part A covers institutional care in hospitals and skilled nursing facilities, as well as certain care given by home health agencies and care provided in hospices. There are no premiums for this part of the Medicare program and anyone who is 65 or older and is eligible for Social Security automatically qualifies.

For more about the Medicare program, .

What If I Have A Medigap Medicare Supplement Policy For Foreign Travel

Since Medicare does not cover 100% of your medical needs, a Medigap is a supplement policy which is purchased to fill in the gaps leftover from Medicare. Your Medigap policy will cover you for medical emergencies abroad if you have purchased a policy which includes travel health insurance.

These are known as plans C, D, E, F, G, H, I, J, M, and N, and can cover up to 80% of your medical bills abroad after you pay a $250 deductible. They also have a lifetime limit of $50,000.

However, to make sure, you have to contact your Medigap policy provider and ask them where you stand on medical travel insurance abroad and just how much coverage you need.

Remember that Medigap policies are not as comprehensive as actual travel insurance policies, which include higher limits, evacuation coverage, as well as coverage for trip cancellation or disruption.

If you do not have a Medigap policy, you can find plans on the official US website for Medicare after you enter your ZIP code .

Recommended Reading: How Do You Qualify For Medicare Part A And B

Medigap May Cover Certain Healthcare Costs As You Travel Abroad

According to Medicare.gov, standard Medicare supplement insurance plans C, D, E, F, G, H, I, J, M, and N provide coverage for some emergency healthcare expenses incurred overseas if both the following are true:

- You receive emergency medical care during the first 60 days of your trip

- Medicare would not otherwise cover the care you receive

Heres How Much Youll Pay for Covered Medical Expenses Outside the U.S.

Medigap plans C, D, E, F, G, H, I, J, M, and N will pay 80% of your billed medical expenses for certain medically necessary treatments abroad. This means you will pay 20% of covered costs. However, your Medigap policy will only begin to pay its share after you have met your $250 deductible for the year.

Medicare Travel Insurance: What Options Do You Have

If you are travelling internationally, you can purchase a travel insurance plan which will cover your medical expenses abroad.

Travel insurance policies, unlike Medicare, offer more than simply health insurance. The best travel insurance policy should have at least the following coverage:

- Medical treatment. If you fall ill or get into an accident during your trip, your travel insurance will cover for medical treatment, doctor consultations, emergency services, hospitalization, surgery, prescription drugs and medicine, etc.

- Trip cancellation, interruption, or curtailment. If you have to cut your trip short or cancel it for some reason, you will be partially reimbursed for any lost travel and or accommodation costs.

- Lost, stolen, or damaged possessions. As long as it is due to recklessness, travel insurers can reimburse you for a part of the cost of your lost or damaged luggage.

- Repatriation and evacuation, in case of an emergency.

Read Also: Is Keystone First Medicaid Or Medicare

Medicare’s Lack Of Coverage Abroad

The U.S. Social Security Medicare Program does not cover health services outside of the United States. Medicare-eligible beneficiaries who travel or reside abroad must obtain some form of supplemental insurance to cover health care costs incurred abroad or pay out-of-pocket. The policy may be a disincentive for retirees in the United States to travel or live abroad and certainly presents an inconvenience for those who do travel or live abroad. On the surface, this policy may be viewed as a potential cost-saver for Medicare: Medicare is not required to reimburse costs incurred abroad nor to develop what could certainly be a costly administrative infrastructure to certify providers and reimburse for care abroad.

Many Medicare beneficiaries purchase Medigap policies to cover gaps in their Original Medicare coverage, such as coinsurance, co-payments, and deductibles. Medigap policies are standardized private health insurance policies designed to supplement Original Medicare. Of the standard Medigap policies A through L, C through J offer a Foreign Travel Emergency Benefit up to plan limits. However, the benefit applies only when beneficiaries are away from the United States for six weeks or less, covers emergency services only, and requires the beneficiary to pay a separate deductible of $250 USD per year.

Medigap Coverage Outside The United States

Medigap is supplemental insurance offered through the Medicare program. Its different from Medicare Advantage plans in that it doesnt cover things like long-term care, vision, dental, hearing aids, eyeglasses, or private-duty nursing.

Medigap is another private insurance option within Medicare thats designed to help cover costs like deductibles, copays, and other medical services not covered by other Medicare parts.

Medigap plans provide coverage for care related to medical emergencies that happen while youre outside the United States. This type of insurance is often used to provide coverage during international travel.

Medigap can also help offset high deductibles and copays for insurance while you travel. In fact, depending on the plan you choose, Medigap may cover up to 80 percent of international medical emergencies once youve met your deductible and youre within your policys maximum limit.

Don’t Miss: Is Medicare Part B Necessary