Medicare Star Quality Ratings

Kaiser Permanente Medicare Advantage health plan is rated 5 out of 5 Stars in Washington for 2022. The Medicare Star Rating is based on quality, service, and member satisfaction. Our high rating means you can have peace of mind knowing that you’re getting high-quality care and coverage â all in a single plan at a great value.1

Eligibility For Medicare Advantage Plans

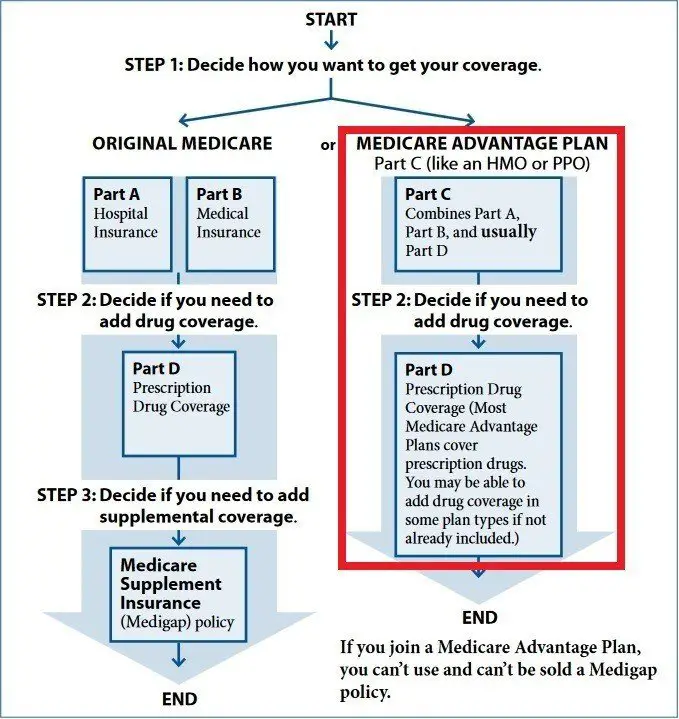

Medicare Advantage plan eligibility is based on your eligibility for Original Medicare, Part A and Part B . Generally, if you have Medicare Part A and Part B, you are eligible for Medicare Part C. However, you must live in the service area for the Medicare Advantage plan that youre considering.

If you have other health insurance coverage, for example through an employer or union, ask your plan administrator about that plans rules before you enroll in a Medicare Advantage plan.

In some cases, you may lose your other coverage if you enroll in the Medicare Advantage plan and you may be unable to get it back if you change your mind later. Enrollment Periods for Medicare Advantage plans You may only enroll in a Medicare Advantage plan during specified election periods:

Initial Coverage Election Period: You can enroll into a Medicare Advantage plan or Medicare Advantage Prescription Drug plan when you first become eligible for Medicare. Your Initial Coverage Election Period , is a seven-month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

Annual Election Period: The Annual Election Period , also called Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage, is October 15 through December 7 every year.

- Moving outside your Medicare Advantage plans service area

- Qualifying for Extra Help

- Moving into an institution

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

Recommended Reading: How Long Do You Have To Sign Up For Medicare

S For Using The Plan Finder Tool

To check which plans are in your area, you can use the Medicare Health Plan Finder. If you wish, you can create an account, log in, and return to saved plan searches later if youre not able to make your selection in one day.

Step 1: Select Search PreferencesTo begin your search for a plan, either create an account or click log in as a guest. Next, select Medicare Advantage from the menu provided, enter your zip code in the box that pops up, and click continue. Now youll be asked if you get help with your costs from one of several programs select not sure if necessary. Youll then be given the option to see the costs of specific drugs on different plans. This will be useful to you if you have regular prescriptions. The drug costs question is the final prompt youll receive before youll be shown a list of local Medicare Advantage plans.

Step 2: Examine Coverage DetailsWhen you first look at the plans, you may just want to scroll through them all to see the range of costs and types in your area. Once you have a sense of whats available, begin looking at the coverage offered in individual plans by clicking plan details. Here you can evaluate the copays/coinsurance of specific tests, office visits, and hospital stays, including for extra services like drug coverage, dental coverage, and more. Youll also find contact information for the plan in this section.

Medicare Advantage Enrollment Periods

There are six different time periods for joining a Medicare Advantage plan after youve enrolled in Parts A and B. Theres also a designated time during which you cant join a Medicare Advantage plan for the first time but you can switch between plans if already in a Medicare Advantage plan.

Open Enrollment PeriodsAnyone who has Original Medicare or Medicare Advantage can use the first open enrollment period. But the second open enrollment period only allows changes for people who are already using a Medicare Advantage plan. The designations of first and second are names that we have applied for the sake of clarity. These designations are not used in Medicares own literature.

| Open Enrollment Periods for Medicare Advantage and Other Health Plans | |||

|

Switch From OM* to MA |

Revert to OM |

Drop One MA Plan and Join Another |

Timeframe for Making Changes |

*OM = Original Medicare. Those who have Original Medicare get all A and B services from Medicare itself. See the coverage section of this article for more information.

Enrollment Periods Based on Individual Circumstances If youre unable to utilize one of the open enrollment periods, or if youd like to enroll before or after those periods, chances are good that youll qualify for one of the five other Medicare Advantage enrollment periods below.

You May Like: How Do I Apply For Medicare In Arizona

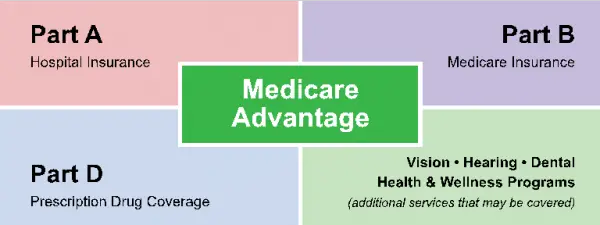

Mapd Medicare Covers More Than Medicare Parts A & B Alone

When choosing a Medicare Advantage Plan Part C, you no longer use the benefits associated with Original Medicare Parts A or B. Thats because Medicare Advantage plans typically include Rx drug coverage at no added cost. However, it has been observed that Rx drug coverage usually has higher co-payments compared to stand-alone Medicare Prescription Drug plans.

Oftentimes, you cannot be enrolled in a Medicare Advantage Part C plan and a stand-alone Part D plan simultaneously. Most commonly, the way to get traditional Part D coverage is to obtain Original Medicare along with Medicare Supplement coverage. Should you desire to take this path, then most people have three options: Original Medicare, Medicare Supplement and Prescription Drugs , which replace Medicare Advantage plans. Medicare Supplement plans typically feature higher premiums, but the benefits and networks are much more ideal.

Certain Medicare Advantage plans cover routine hearing and vision services as a separate package . All plans are legally obligated to have annual limits on out-of-pocket expenses. Another difference is that most policies require you to pay a higher premium should you visit a doctor or specialist outside the network.

The Majority Of Medicare Advantage Enrollees Are In Plans That Receive High Quality Ratings And Related Bonus Payments

Figure 11: Share of Medicare Advantage Enrollees Required to Receive Prior Authorization, by Service, 2020

In 2020, more than three-quarters of Medicare Advantage enrollees are in plans with quality ratings of 4 or more stars, an increase from 2019 . An additional 4 percent of enrollees are in plans that were not rated because they were part of contracts that had too few enrollees or were too new to receive ratings. Plans with 4 or more stars and plans without ratings are eligible to receive bonus payments for each enrollee the following plan year. The share of enrollees in plans with 3 stars declined by half from 6 percent in 2019 to 3 percent in 2020.

For many years, CMS has posted quality ratings of Medicare Advantage plans to provide beneficiaries with additional information about plans offered in their area. All plans are rated on a 1 to 5-star scale, with 1 star representing poor performance, 3 stars representing average performance, and 5 stars representing excellent performance. CMS assigns quality ratings at the contract level, rather than for each individual plan, meaning that each plan covered under the same contract receives the same quality rating most contracts cover multiple plans.

Don’t Miss: Do I Need Medicare If I Have Other Insurance

Other Things You Need To Know About Medicare Advantage Plans

Its critical that you recognize and understand all the differences between Medicare Advantage Plans and Original Medicare. Some key things to keep in mind about MA Plans include the following:

- You can sign up for an MA Plan regardless of any pre-existing conditions. And, there is no waiting period.

- If you are currently in an advantage plan HMO, you have to select a PCP. You can only use the pre-determined network services.

- If your MA Plan doesnt cover prescription drugs, you can choose to join a Medicare Part D plan in your state. But if you are currently in an MA Plan with prescription drug coverage, you cannot join a Medicare Prescription Drug Plan. This will cause you to be automatically unenrolled from your current MA Plan. You will then be booted back to Original Medicare.

- You can join a different plan or go back to Original Medicare if your MA Plan should decide to stop participating in Medicare.

- It isnt necessary for you to purchase a Medigap , as long as youre presently enrolled in an MA Plan. Truthfully, it is highly illegally for any organization to sell you a Medigap policy if you are enrolled in an MA Plan. Your MA Plan in fact, covers the specific Medigap benefits. Also, the supplement will not cover your plans coinsurance, copayments or deductibles.

Medicare Part C Vs Original Medicare

Under Part A and B, there are no provider networks so, you can go to any doctor or hospital you want, so long as they accept Medicare.

Private insurance companies offer Part C through HMOs and PPOs. For each, theres a list of in-network healthcare providers.

If you go to a provider out of the network, your claim may not have coverage, or youll pay more for services.

By comparing Medicare Advantage vs. Medicare Supplement side by side, you can figure out which you prefer.

Also Check: Why Choose Medicare Advantage Over Medigap

Do I Need Medicare Part C

A Medicare Advantage plan allows you to bundle your Medicare Part A and Part B benefits into a single plan.

If want coverage for prescription drugs, dental benefits, routine vision care and other benefits that aren’t covered by Original Medicare, you may want to consider a Medicare Advantage plan that offers those benefits.

Medicare Advantage plans also include an annual out-of-pocket spending limit, which Original Medicare doesn’t cover. Out-of-pocket Medicare costs can add up quickly, and an out-of-pocket spending limit could potentially help you save money.

Speak with a licensed insurance agent to learn more about whether a Medicare Advantage plan may be right for you.

1 Freed M. et al. . Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. Retrieved from www.kff.org/issue-brief/medicare-advantage-2022-spotlight-first-look.

2 Medicare evaluates plans based on a 5- star rating system.

Find a $0 premium Medicare Advantage plan today.

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Who Is Eligible To Join Advantage Plans

If you live in the designated service area of the specific plan, and already have Part A and Part B , you may join a Medicare Advantage plan instead of Original Medicare . If you have union- or employer-sponsored insurance, you may be able to add an Advantage plan, but be forewarned that in some cases you may lose your employer or union coverage when you enroll in an Advantage plan.

Individuals with End-Stage Renal Disease were generally not eligible to enroll in Advantage plans prior to 2021 with the exception of Medicare Advantage ESRD Special Needs Plans, although these are not widely available. But this changed as of the 2021 plans year, as a result of the 21st Century Cures Act. Medicare Advantage plans are guaranteed-issue for all Medicare beneficiaries as of 2021, including those with ESRD.

You should know that if you enroll in a Medicare Advantage Plan, you will not need to purchase Medigap coverage, nor will you be able to buy it. If you already have Medigap coverage, you can keep the coverage , although it wont pay for Medicare Advantage out-of-pocket expenses, such as copayments and deductibles.

You May Like: How Do I Lookup My Medicare Provider Number

Is There A Penalty For Signing Up Late For Part C

No, signing up for Medicare Part C – Medicare Advantage is voluntary and there is not a direct penalty for signing up late. However, there is a penalty for signing up late for Part A and B, and due to the fact Part C bundles Original Medicare Part A and B into one plan, you may face the penalties associated with Part A and B when you sign up for Part C.

How Has Health Reform Impacted Medicare Advantage

The Patient Protection and Affordable Care Act has restructured payments to Medicare Advantage plans in an effort to reduce budget spending on Medicare, but for the last few years, the payment changes have either been delayed or offset by payment increases. When the law was first passed, many people including the CBO projected that Medicare Advantage enrollment would drop considerably over the coming years as payment reductions forced plans to offer fewer benefits, higher out-of-pocket costs, and narrower networks.

But that has not been the case at all. Medicare Advantage enrollment continues to grow each year. There were nearly 28 million Advantage enrollees in 2021, which accounts for more than 43% of all Medicare beneficiaries Thats up from just 13% in 2004, and 24% in 2010, the year the ACA was enacted.

The number of Medicare Advantage plans available has increased for 2022 to the highest in the last decade, with a total of 3,834 plans available nationwide. The majority of beneficiaries still have at least one zero-premium plan available to them, and the average enrollee can select from among 39 plans in 2022.

Also Check: Can You Get Medicare Advantage Without Part B

Who Can Enroll In Medicare Part C

To enroll in Medicare Part C, you generally must be enrolled in Medicare Part A and Part B. You also must live in the plans service area. If you have end-stage renal disease, you may be excluded from some Medicare Part C plans. However, you may be able to enroll in a Medicare Part C special needs plan for people with ESRD.

Medicare Part C Costs

You will still have to pay your Medicare Part B premium , and depending on the Part C plan you choose may or may not have an additional monthly premium for Part C.

Overall, Medicare Part C plans provide an economical option. Some providers even offer zero dollar plans, where you dont have to pay any premium on top of your Part B premium, which you are required to keep paying. It is possible for insurance providers to offer additional benefits at no additional premium, because the federal administration provides financial aids to the private insurance policies.

Depending on the policy, next to your monthly premium, there might be other out of pocket costs such as co-pays or deductibles. This is why you always need to look at the total costs if you compare Medicare advantage plans. When you do some comparison, you will notice that costs and benefits will vary greatly from one particular policy to the next.

Recommended Reading: How Do I Choose The Best Medicare Advantage Plan

What Are The Different Medicare Part C Plans

The number of Medicare Advantage plans available to you will depend in part on where you live and how many companies offer coverage in your area.

There are 5 major types of Medicare Advantage plans:

The Pros And Cons Of Medicare Advantage Part C Plans

When we turn 65, we might be faced with several decisions to make.

Among these are deciding if or when to retire, whether to downsize or not now that kids have left the nest and what healthcare coverage to choose.

At 65 we are eligible for healthcare through the federal governmentMedicare parts A and B. If we qualify for traditional Medicare, we have the option of choosing Medicare Advantage Part C instead.

Its a tough decision, but one way to decide is by weighing the pros and cons of Medicare Advantage Part C.

And these benefits or downsides really depend on each individual. Theres no one-size-fits-all. But if youre informed, then you can decide which option is right for you.

Read on to learn more about the pros and cons of Medicare Advantage Part C.

Don’t Miss: How Old Before Eligible For Medicare