What Is Medicare Supplement Plan E

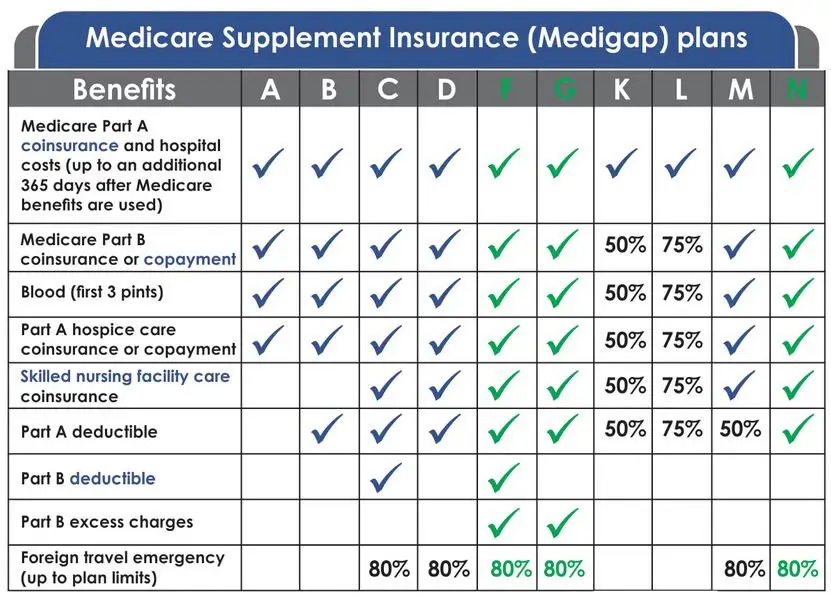

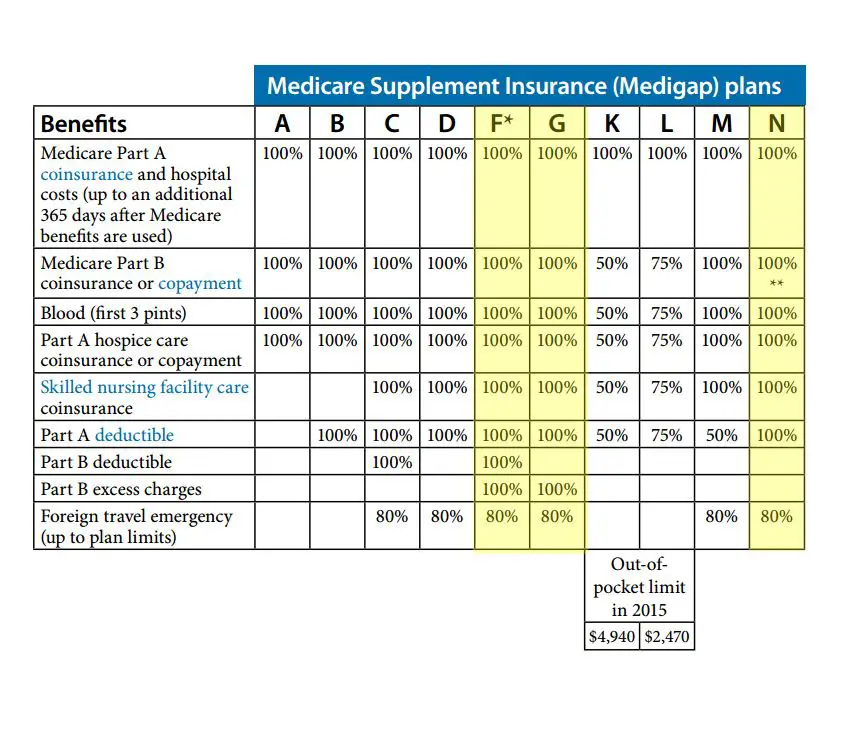

There are 10 Medigap plans that are currently offered in the marketplace: A, B, C, D, F, G, K, L, M, and N. Medicare Supplement Plan E is a previously offered Medigap plan that covered some Medicare Part A and Medicare Part B costs, plus blood transfusions, preventive services, and care needed during foreign travel.

In 2003 , the Medicare Prescription Drug, Improvement, and Modernization Act was enacted. This legislation made some big changes to original Medicare and Medigap plan offerings. Through this legislation, Medicare + Choice, the Medicare managed care program, became what we now know as Medicare Advantage . Medicare Part D, the prescription drug benefit program, also became available for all beneficiaries through private plans.

In 2008, the Medicare Improvements for Patients and Providers Act was enacted. This legislation made multiple improvements to Medicare, including some that greatly impacted Medigap offerings. Through this legislation, Medigap plans E, H, I, and J were all eliminated due to the Medicare changes.

As of , no new Medicare enrollees were eligible to enroll in Medigap Plan E. However, anyone who was enrolled in Medigap Plan E before it was discontinued in 2010 may be eligible to keep their plan and their plan benefits.

If you became eligible for Medicare after June 2010, there are a few current options that are similar to Plan J. Because Plan J was a very comprehensive plan, the two most similar plans offered today include Plan D and Plan G.

Changes To Medicare Supplement Plan F

Its worth noting that Medicare Supplement Plan F may not be available to those new to Medicare. Starting in 2020, Medicare Supplement plans that cover the Part B deductible are being gradually discontinued.

If you qualify for Medicare before January 1, 2020:

- You may be able to buy Medicare Supplement Plan F .

- You can typically keep your existing Plan F or Plan C.

You can talk to your insurance company about how these upcoming changes may affect you. In the meantime, its important to continue to pay your plan premiums.

Find Cheap Medicare Plans In Your Area

For seniors, these policies can provide peace of mind and simplify monthly Medicare costs. Without a Medigap plan, Original Medicare policyholders will find that tracking deductibles and paying for regular medical treatment out of pocket can become cumbersome. Furthermore, you may find that there are many different unexpected costs associated with your care.

To get a Medicare quote over the phone, call 915-0881 TTY 711 to speak with a licensed agent today!

Agents available M-F 9am-8pm EST

Read Also: How Much Does Medicare Part B Cost At Age 65

What Is Medicare Supplement Plan N

Like the other nine Medigap plans, Plan N is a privately administered type of Medicare supplement insurance. Its designed to help you cover specific out-of-pocket costs for your healthcare that Medicare Part A and Medicare Part B dont cover.

Plan N covers things like Medicare Part A coinsurance, an amount you must pay out-of-pocket for services and for hospital care, as well as Medicare Part B coinsurance for outpatient care. If you spend a lot each year on coinsurance and copays, Medicare Supplement Plan N might pay for itself pretty quickly.

Medigap Plan N policies are required by law to be standardized. That means that no matter which company you purchase a Medicare supplement Plan N from, it must offers the same basic coverage.

Not every Medigap plan is available in every location. Plan N doesnt have to be sold in every state, and insurance companies that sell Medicare supplement policies can choose where to sell their Plan N policies.

If you live in Massachusetts, Minnesota, or Wisconsin, the standardization of Medigap plans may differ.

Medigap only covers Medicare-approved services. Therefore, it wont cover things like long-term care, vision, dental, hearing aids, eyeglasses, or private-duty nursing.

Medicare supplement Part N covers the cost of the following:

- Medicare Part A deductible

- 80 percent of healthcare costs while traveling outside the United States

How Do Medicare Supplement Insurance Plans Work With Original Medicare

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as “Medigap”, are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits. The basic benefit structure for each plan is the same, no matter which insurance company is selling it to you. Note: The letters assigned to Medicare Supplement plans are not the same things as the parts of Medicare. For example, Medicare Supplement Plan A is not the same as Medicare Part A .

Recommended Reading: Does Social Security Automatically Sign You Up For Medicare

How To Choose The Best Medicare Supplement Plan For You In 2021

As you research which Medigap plan is the best fit for you in 2021, here are some points to consider:

Because there are so many options and people’s individual circumstances differ greatly, what is right for one person may not work for you. However, there are a few generalities we can discuss.

Below are a few scenarios you may find yourself in when choosing your Medicare Supplement plan, and what information you need to know for each:

SCENARIO ONE: If you have high Part A fees

Part A has three categories associated with it. These are:

- Part A coinsurance

- Part A hospice care coinsurance or copayment

- Part A deductible

If you have Original Medicare and are frequently using your Part A coverage but not your Part B coverage, a plan that covers these categories would work best for you. Every plan listed above covers 100% of these categories, except for plans A, M, L and K.

SCENARIO TWO: If you have high Part B fees

There are three categories for supplement plans that cover Part B fees. These are:

- Part B deductible

- Part B coinsurance or copayment

- The Part B excess charge

Transamerica Medicare Supplement Insurance

Transamerica offers several aMedicare supplement plans at reasonable prices. They also offer vdental, vision, and hearing plans unrelated to Medicare. You can bundle these with your supplemental Medicare plan to provide robust coverage.

What we like: Transamerica offers four different, reasonably priced, Medicare supplement plans. They also offer supplemental vision and dental that is not related to Medicare but which can be useful.

Flaws: The company requires you to jump through several hoops to get information on their Medicare supplement plans. They dont cover Medicare Part D .

Recommended Reading: Does Humana Offer A Medicare Supplement Plan

Is There An Alternative To Plan F

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers, except for the Medicare Part B deductible. Plan G doesnt cover the Part B deductible, which was a selling point with Plan F. The cost of Plan F and Plan G is very similar, so thats a good alternative to Plan F.

What Are Medicare Supplement Plans

Medicare Supplement plans are designed to help pay your share of health-care costs under Medicare Part A and Part B. For example, they may pay your Medicare Part B coinsurance for Medicare-approved doctor visits and lab tests. Medicare Supplement plans are sold by private insurance companies, but they have standard benefits designed by the government. In other words, Medicare Supplement Plan A offered by Company ABC will have the same basic benefits as Plan A sold by Company XYZ. Some companies choose to offer additional benefits, but they must include the standard benefits, at a minimum.

Please note that Medicare Supplement Plan A is not the same as Medicare Part A. There are four parts of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

You May Like: Does Medicare Cover Full Body Scans

What Do These Benefits Mean

1. Part A coinsurance and hospital costs

Remember the example from the beginning, about the person who stayed in a hospital longer than 90 days? This benefit is great for those worst-case-scenario hospital stays. Under Medicare Part A, a hospital stay past 60 days will cost you coinsurance payments. Days 90 and beyond are far more expensive. The Part A coinsurance and hospital benefit remedies these potentially high costs, kicking in for up to a full year, once your Original Medicare benefits are used up.

2. Part B coinsurance and copayment

This covers the coinsurance or copayments doctors and other providers typically charge you under the Part B umbrella.

3. Blood

Under Original Medicare, you have to pay for every pint of blood you receive until you hit four pints in a calendar year. Youre covered for the first three pints you get in a year with this benefit.

4. Part A hospice care coinsurance and copayment

Medicare Part A covers hospice care, but there can be a few copayments. For instance, with just Original Medicare, you have to pay $5 per prescription drug. And if your hospice facility needs to temporarily move you to another facility, like a nursing home, youll have to pay 5% of respite care costs. With Part A hospice care copayment coverage, all these copayments would be taken care of, so hospice would essentially be free.

5. Skilled nursing facility care coinsurance

6. Part A deductible

7. Part B deductible

8. Part B excess charge

9. Foreign travel coverage

Medicare Initial Enrollment Period

The earliest time you can enroll in Original Medicare, a Medicare Advantage plan or a Medicare Part D prescription drug plan is during your Medicare Initial Enrollment Period .

Your Initial Enrollment period lasts for seven months:

- It begins three months before you turn 65

- It includes your birth month

- It extends for another three months after your birth month

If you are under 65 and qualify for Medicare due to disability, the 7-month period is based around your 25th month of disability benefits.

Recommended Reading: What Is Medicare Part G

What Is The Most Popular Medicare Supplement Plan

Learn more about popular Medicare Supplement plan options and get important information about Plans F, G, and N.

Everyday Health may earn a portion of revenue from purchases of featured products.

Whats the most surprising thing about Original Medicare? Most enrollees say its the unpredictable out-of-pocket costs. Medicare deductibles, coinsurance, and copayment costs can wreak havoc on a carefully planned budget. Thats why over 40 percent of people enrolled in Original Medicare buy a Medicare Supplement plan.

When choosing Medigap coverage, it is important to note that it isnt a one-size-fits-all solution for coverage. There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans Plan F, Plan G, and Plan N are the most popular . Heres an in-depth look at this trio of Medicare Supplement plans, and the reasons so many people choose them.

Medicare Advantage Vs Medicare Supplement Insurance Plans

Are you trying to decide between Medicare Advantage vs. Medicare Supplement insurance? Heres a rundown of the two types of coverage.

While Original Medicare covers many health-care expenses, it doesnt cover everything. Even with covered health-cares services, beneficiaries are still responsible for a number of copayments and deductibles, which can easily add up. In addition, Medicare Part A and Part B also dont cover certain benefits, such as routine vision and dental, prescription drugs, or overseas emergency health coverage. If all you have is Original Medicare, youll need to pay for these costs out-of-pocket.

As a result, many people with Medicare enroll in two types of plans to cover these gaps in coverage. There are two options commonly used to replace or supplement Original Medicare. One option, called Medicare Advantage plans, are an alternative way to get Original Medicare. The other option, Medicare Supplement insurance plans work alongside your Original Medicare coverage. These plans have significant differences when it comes to costs, benefits, and how they work. Its important to understand these differences as you review your Medicare coverage options.

Read Also: Can I Get Glasses With Medicare

Medicare Plan N Vs Plan G

When compared to Medicare supplement Plan N, Plan G provides more comprehensive coverage. Both policies will not cover the Part B deductible however, Plan N will not pay for expenses related to the Medicare Part B excess charges. Excess charges can occur when there is a difference between what is billed to Medicare for your treatment and what is actually paid by Medicare. This difference would be paid for you out of pocket if you had Plan N, for example.

However, since Plan N has less coverage, the monthly premium for the policy will be less than Plan G. For 2020, Plan N will cost between $149 and $289 per month.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

When Can You Typically Buy Medicare Supplement Plan F

Without guaranteed-issue rights, you might not be able to enroll in Medicare Supplement coverage after your Medigap Open Enrollment Period has passed. This is the six-month period that starts the first month when youre enrolled in Part B and age 65 or older during this period, you typically have a guaranteed right to enroll in any Medicare Supplement plan of your choice without medical underwriting.

Would you like to learn more about Medicare Supplement Plan F? I can answer any questions you may have or show you other plans that may help with your out-of-pocket costs. To get started, use the links below to set up a phone appointment or have me email you some personalized Medicare plan options. If youd rather browse on your own, simply click the Compare Plans button on this page to see plan options in your zip code.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Read Also: Which Insulin Pumps Are Covered By Medicare

How Much Do Medicare Supplement Plans Cost

Each insurance company prices its plans differently. It may be a good idea to compare premiums from several insurers before you buy, since the benefits will be essentially the same.

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies:

- Community-rated, which means everyone pays the same premium regardless of age

- Issue-age rated, which means your premium is based on your age at the time you buy the policy

- Attained-age rated, which means your premiums go up as you get older and hit certain preset milestones.

Although the premium for a community-rated plan may be higher at first, it may be least expensive over time. Attained-age Medicare Supplement plans usually start with a low premium, but the increases at different age milestones can be steep. Be sure you know how your plan is rated before you buy so you arent hit with unexpected premium hikes later on. Also note that plans canand dochange their premiums from time to time.

Best Overall Medicare Supplement Pre

Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020. Anyone who currently has Plan F will be able to keep their coverage.

Also Check: What Age Can You Start To Collect Medicare

The Value Of Medigap Insurance

The value of a Medigap plan maybe more than you think. If you have a hospital stay for more than 60 days without Medigap, you will have $371 coinsurance per day. Moreover, if your hospital stay is more the 90 days without Medigap, you will have $742 coinsurance per day!

However, Medicare supplement insurance pays this expensive hospital coinsurance. As a result, you can stay in the hospital as long as needed without worrying about the cost. Furthermore, Medigap Plans give you these benefits:

- Freedom to choose your own doctors and hospitals

- No referrals required to see a specialist

- No claim paperwork claims are automatically filed with your supplement company

Compare The Costs Of Medigap Plans

Insurance companies may charge different premiums for the same exact policy. As you shop for a policy, be sure you’re comparing the same policy. For example, compare Plan A from one company with Plan A from another company.

In some states, you may be able to buy another type of Medigap policy called

. If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy.

| Note |

|---|

Also Check: How To Get Medicare Insurance License

Medicare Parts Vs Medigap Plans

Although the names sound similar, Medicare Parts such as Part A and Part B is not the same as Medigap Plan A, Plan B, etc. To buy a supplement policy you must have Medicare Part A and Part B. Learn more about the 4 Parts of Medicare.

Medigap Plans only cover one person. So your spouse or other family member must have a separate supplement policy. When you enroll two or more people, you can get a household discount and save money on your monthly premiums. Non-smokers can get additional discounts, as well. Call Senior Healthcare Direct at 1-855-368-4717 and find out how much you can save.

Furthermore, Medigap Plans do not include drug coverage. So if you need prescription drugs, you can add a separate Part D drug plan.