Can You Have Both Medicare Part C And Part D

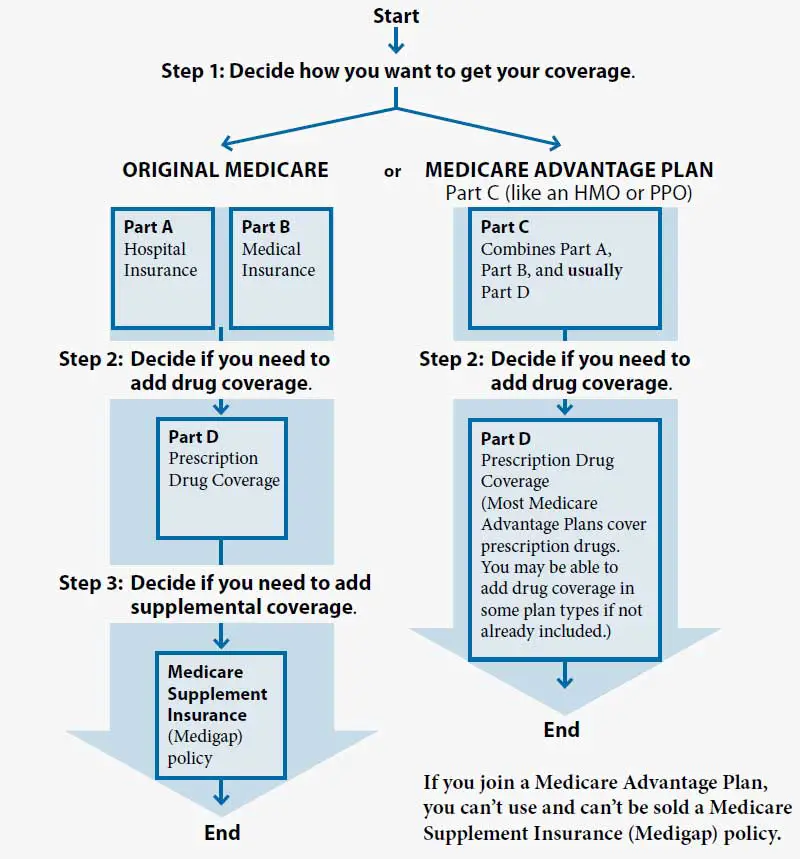

You cant have both parts C and D. If you have a Medicare Advantage plan that includes prescription drug coverage and you join a Medicare prescription drug plan , youll be unenrolled from Part C and sent back to original Medicare.

To help you get specific information on available drug plans and Medicare Advantage plans , the CMS has a Medicare plan finder at Medicare.gov. You have a choice of using this plan finder in either English or Spanish.

What To Do If Something You Need Isn’t Covered By Medicare Part C

If you do not have other prescription drug coverage, join an HMO or PPO that includes it. You cannot have a separate drug plan and an HMO or PPO at the same time. You can only purchase a separate drug plan if you are enrolled in a Part C plan that doesnt offer drug coverage, such as a PFFS or MSA.

You may be able to get other coverage under a second insurance plan. For example, if you are still working, you may be able to combine your Medicare Part C coverage with the coverage provided under an employer-sponsored health insurance plan. If you have private insurance, that plan usually pays first if your employer has at least 20 employees. Once the private plan processes the claim, a second claim is submitted to the Medicare Advantage insurer. You are responsible for any charges not covered by either plan.

Preferred Provider Organization Plans

A Medicare Advantage PPO offers more flexibility than an HMO because your insurance will usually cover out-of-network providers. It will cost you more than what you would pay if you went in-network, though. PPOs also dont require a primary care physician and they allow you to see a specialist without a referral.

You May Like: Will Medicare Pay For Breast Reduction

Medicare Advantage : How It Works

Medicare Advantage plans have recently become one of the more popular options among Medicare beneficiaries, accounting for about one third of Medicare coverage in 2019. Over the last ten years, the number of Medicare Advantage beneficiaries has nearly doubled. But what makes Medicare Advantage so appealing and, more importantly, should you take the leap?

The Future Of Medicare Advantage

If you depend on Medicare for your healthcare, then you must compare plans each year before the open enrollment period begins on October 15. Researching your options well in advance ensures that youll get the best value for your budget and needs. As HMO plans are on the rise with Medicare Advantage, you also may think about switching back to original Medicare if you prefer a wider selection of doctors.

Overall, Medicare Advantage continues to be the lower-cost option, with more value for those who need to cover basic and more serious healthcare needs.

There are a few other types of plans that youll find sponsored by the government under Medicare Part C. Its best to choose a plan based on your specific needs and always look for the plan that offers the most services for the premium that you pay. If your budget isnt that big, you may want to stick to basic services or choose a PFFS plan.

Enrolling in Medicare Part C can only be done at certain times of the year or when you first become eligible for Medicare. Please visit HealthNetwork.com to compare Medicare Advantage plans and get connected with a licensed sales agent that can provide you more information on your Medicare options.

Read Also: What’s Part B Medicare

Medicare Part C Pros And Cons

Medicare Part C pros:

- Generally lower premiums than Original Medicare + Medigap + Part D

- No need to purchase any additional coverage

- Coverage includes a cap on out-of-pocket costs

- Various supplemental benefits are included, depending on the plan

- Available to all Medicare beneficiaries who live in the plan’s service area, even if they’re under 65 and eligible for Medicare due to a disability

- Annual opportunities to switch to a different Medicare Part C plan or Original Medicare

Medicare Part C cons:

- Provider networks are more limited than Original Medicare’s nationwide provider access.

- Out-of-pocket costs are often higher than a person would have with Original Medicare and a Medigap plan.

- Prior authorization and referrals are much more likely to be required with Medicare Part C than with Original Medicare + Medigap.

- After an initial 12-month trial period, Medicare Part C enrollees with pre-existing conditions may find it impossible to buy a Medigap plan if they want to switch to Original Medicare.

Do You Need Medicare Part C

These plans are optional, but if you need more than just basic hospital and medical insurance, Medicare Part C might be a good option for you.

If youre happy with your current Medicare coverage and are only interested in receiving prescription drug coverage, a stand-alone Medicare Part D plan may be the best option.

If you have Medicare coverage but only need additional help with costs, a Medicare supplemental insurance policy might work for you.

For some people, Medicare Part C is an additional cost that they just cant afford in this case, shopping around for Part D and Medigap coverage may help save money.

You May Like: Are Knee Scooters Covered By Medicare

If You Qualify For Both Medicare And Medicaid You’re What’s Known As Dual Eligible

Medicare provides medical coverage and benefits to people age 65 or older, or who have a qualifying disability. Medicaid is a federal and state program that helps with medical costs for some people with limited income and resources, and also offers benefits not normally covered by Medicare.

In most cases, even if you have Medicaid, you must enroll in Medicare when youre eligible. This is because Medicare is the primary insurance and will provide benefits and coverage for health care services you need. If you do not enroll when youre eligible, you may face a late enrollment penalty.

That said, you are able to be enrolled in both Medicare and Medicaid at the same time, and just because you become eligible for Medicare does not mean youll lose Medicaid. This is called dual eligibility, and more than 12 million people are dual eligible each year.

Understanding when youre eligible, how to be eligible, and how Medicare and Medicaid work together can help bring clarity to your health care coverage needs.

How To Enroll In Medicare Advantage Plans

Your first chance to sign up for Medicare Advantage is during your . The IEP for Medicare starts 3 months before the month you turn 65 and ends 3 months after.

If you have Original Medicare and want to enroll in Medicare Advantage for the first time, you can choose a Medicare Advantage plan during . Medicares AEP runs from Oct. 15 to Dec. 7.

If youre already enrolled in Medicare Advantage, you can switch plans during the . The Medicare Advantage OEP runs from Jan. 1 to March 31, or the annual enrollment period for Medicare.

Also Check: How To Get Medicare To Pay For Wheelchair

Ways You Can Avoid Medicare Scams

Medicare scams are nothing new, and there was a lot of this kind of activity in recent years. In April 2020, the Centers for Medicare and Medicaid Services reported that scammers might use the pandemic to try stealing everything from peoples Medicare numbers and banking information to personal details like birthdates and Social Security numbers.

Will Medicare Cover My Hearing Aid

Did you know that about 15% of American adults have some form of hearing loss?1 And, the odds increase with age. Hearing loss affects up to 39.3% of adults in their 60s.2 Despite those numbers, most people who could benefit from hearing aids dont use them. In fact, fewer than 20% of people who need

Read Also: What Is Medicare Part A And B

Medicare Part C: Medicare Advantage

Also known as Medicare Advantage, Part C is an alternative to traditional Medicare coverage. Coverage normally includes all of Parts A and B, a prescription drug plan , and, depending on your choice of a Medicare Advantage plan, other possible benefits.

Part C is administered by Medicare-approved private insurance companies that collect your Medicare payment from the federal government.

Depending on the plan, you may or may not need to pay an additional premium for Part C. You still need to pay your Medicare Part B premium. You don’t have to enroll in a Medicare Advantage plan, but for many people, these plans can be a better deal than paying separately for Parts A, B, and D. Beneficiaries will still pay separate premiums if they don’t choose to have the Part “C/D” premium taken out of their Social Security check.

If you’ve been pleased by the coverage of a Health Maintenance Organization , you might find similar services using a Medicare Advantage plan.

Pros And Cons Of Medicare Advantage Plans

Medicare Advantage plans tend to benefit healthier people who use fewer services with lower costs, says Orestis. But regardless of your health care needs, there are pros and cons of Medicare Advantage plans worth considering. Below, our experts break down some of the more common advantages and disadvantages of MA plans.

| Pros | Cons |

|---|---|

| Many plans feature $0 monthly premiums. Most of the time, you dont pay anything upfront for services, excluding the Part B premium, which everyone must pay each month, says Ari Parker, co-founder and head advisor at Chapter, an independent Medicare advisor organization. Theres an out-of-pocket limit. Medicare Advantage plans dont impose a lifetime coverage limit, and they do provide a maximum out-of-pocket limit guarantee, which protects enrollees from costs of expensive treatments spiraling out of control, says Orestis.They provide comprehensive coverage. These plans often include ancillary benefits, such as dental, vision and hearing coverage, which are not typically provided by Original Medicare. | Many plans do have network restrictions. One of the limitations of Medicare Advantage plans is that they often impose network restrictions on the providers you can see, says Parker. They are more similar to the HMO or PPO plans you may have had through an employer. |

Read Also: Is Medicare Supplement Plan N Good

When Can I Sign Up For Medicare Part C Or Part D Or Change Plans

- If youre new to Medicare, you can enroll in Medicare Part C or Part D during your Initial Enrollment Period.

- The fall may be a good time to compare plans and see if youre getting the best possible Medicare health or prescription drug plan for your needs. You can change plans during the Annual Election Period.

Is it time to compare plans to see if theres any plan in your area that may be better for you? Just click the button on this page to get started with no obligation. You can also contact eHealth to reach our licensed insurance agent.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Find Plans in your area instantly!

Dont Miss: Who Do You Call To Sign Up For Medicare

Medicare Advantage Ppo Plans

Preferred Provider Organizations are the most popular healthcare plan choice for additional coverage. This type of plan allows a greater level of freedom for buyers.

With a PPO plan, you can go to your preferred doctors, specialists, and healthcare facilities, whether or not they are in your plans network. However, PPO plans do charge different rates based on a list of in-network or out-of-network providers.

PPOs are also convenient because you dont need a referral to see a specialist.

Also Check: What Does Original Medicare Mean

How Do Medicare Part C Plans Work

Medicare Advantage plans all offer you care through a network of health care providers. Plans are divided into multiple types based on whether you can use providers outside of your network and how much you would have to pay for doing so. This is the same system that other private insurance plans use. Plans may not advertise very clearly what type they are, so make sure to check the plan details for more information.

The table below lays out the major features for each type of Medicare Advantage, and then we go into more detail on each one.

| HMO |

|---|

| Yes |

Medicare Advantage Enrollment Dates

| Initial enrollment period | When you first become eligible for Medicare | Your initial Medicare enrollment period lasts for seven months, starting three months before you turn 65 and ending three months after the month you turn 65. |

| Medicare annual enrollment period | You can join, switch, or drop a plan. This includes Medicare Advantage and Medicare Part D plans. | |

| Medicare Advantage open enrollment period | If you’re enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or to Original Medicare . You can only switch once during each open enrollment period. | |

| Special enrollment periods | During certain special circumstances and changes in your life4 | Examples include moving to a skilled nursing facility or long-term care hospital.Rules about when you can make changes are different for each SEP. |

From the pros: Avoid costly late enrollment penalties by following our valuable Medicare enrollment guide!

Don’t Miss: What Does Part A Of Medicare Pay For

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Is Medicare Or Medicaid Primary

If you have both Medicare and Medicaid, Medicare is the primary insurer and will pay first. Medicaid will then pay second. Medicaid never pays first for services covered by Medicare. It will only pay after Medicare, employer group health plans, and/or Medicare Supplement insurance has paid.

However, there are some services Medicaid covers and Medicare does not, such as nursing home care. In this case, Medicaid would pay for the service and Medicare would only be primary payer for any Medicare-covered services received.

Medicaid will also help pay for other out-of-pocket expenses such as Medicare premiums, deductibles and copays.

Recommended Reading: Does Medicare Cover Dementia Care Facilities

What Happens If You Delay Medicare Part B Enrollment

At age 65, you face a lot of decisions: Should I retire soon? When should I start taking Social Security? Should I sign up for Original Medicare or Medicare Advantage? You also face an importantand often overlookeddeadline. If you dont sign up for Medicare Part B when you first become eligible for Medicare, your monthly

How Long Does Medicare Part D Penalty Last

Since the monthly penalty is always rounded to the nearest $0.10, she will pay $9.70 each month in addition to her plan’s monthly premium. Generally, once Medicare determines a person’s penalty amount, the person will continue to owe a penalty for as long as they’re enrolled in Medicare drug coverage.

Don’t Miss: Does Medicare Pay For Periodontal Surgery

What Is Medicare Part C Coverage For Extra Benefits

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the planâs formulary. Formularies may vary from plan to plan.

Other extra benefits that Medicare Part C may cover include:

- Routine dental care including cleanings, x-rays, and dentures

- Routine vision care including contacts and eyeglasses

- Routine hearing care including hearing aids

- Fitness benefits including exercise classes

Not all Medicare Part C plans cover extra benefits in the same way. For example, some Medicare Part C plans may only cover âMedicare-covered dental benefitsâ which generally only means dental care in the event of an accident or disease of the jaw. If your Medicare Part C covers dental benefits more extensively, you may have a higher monthly premium for that coverage.

What Is Medicare Part C Coverage For Inpatient Care

Under Original Medicare, inpatient care is generally covered by Medicare Part A. Medicare Part C covers the same benefits as Medicare Part A including:

- Inpatient care in a hospital

- Inpatient skilled nursing facility care

Medicare Part C also covers:

- Home health care

Medicare Part C may have different cost sharing amounts for inpatient care and home health care than Original Medicare has. With Medicare Advantage, your hospice care benefits will still be covered by Original Medicare.

Also Check: How Is Part B Medicare Premium Determined