Can You Get Help Paying For Hearing Aids Without Medicare Advantage

If youre paying for hearing aids out of pocket and looking for ways to save on cost outside of Medicare Advantage coverage, there are several options available.

Retirees may be able to receive coverage through the Federal Employee Health Benefits program. If you have a health savings account or flexible savings account through your insurance program, you may be able to dedicate pre-tax income toward your hearing aid cost as well. Purchasing hearing aids through Costco or other wholesale retailers can also help reduce your expenses, as these vendors typically sell hearing aids at a lower cost than audiology offices.

If you did purchase a hearing aid through an audiologists office, ask about unbundling their services from your payments to ensure youre only paying for the device. Choosing a basic hearing aid over one with special features, such as streaming capabilities, can also help keep costs low.

When To See An Audiologist

If youve answered yes to any of the questions above, you might want to schedule an appointment with an audiologist. During your first appointment, an audiologist will review your medical history, family history and evaluate your hearing and balance. Together, you and your doctor can determine if getting hearing aids is a good option for you.

What About House Bill 3503

In the news, you may have seen a mention of House Bill 3503, which requires insurance companies to offer optional coverage for hearing aids, with a reimbursement benefit of up to $2,500. This law went into effect in the state of Illinois on January 1, 2020.

However, if you read the bill, itâs pretty limited.

The insurance company can charge a higher premium for including this benefit, and they can make the hearing aid benefit optional. In addition, the insurance company doesnât have to provide the hearing aid coverage if theyâre unable to âmeet mandatory minimum participation requirements,â and the insurers set those requirements themselves.

We confirmed directly with the Centers for Medicare and Medicaid Services that Medicare and Medicare Supplements are not affected by this bill and are not required to provide hearing aid coverage.

Recommended Reading: Is Part B Of Medicare Mandatory

Does Medicare Cover Home Health

Medicare does help cover some

To be eligible, you must be under the care of a doctor and treated under a plan of care that is monitored and reviewed by your doctor. Also, your doctor will need to certify that you need certain eligible in-home services.

Medicare will not pay for 24-hour in-home care or meals delivered to you at home. It also doesnt cover help for whats called activities of daily living, like bathing, getting dressed, using the toilet, eating or moving from place to place within your home.9

Read Also: How Do U Say Please In Sign Language

Switch Your Plan Not Your Doctor

Though you have a new plan option, chances are you may be able to continue seeing your doctors. This is because this plan is the Aetna Medicare Plan with an extended service area . This is a type of Medicare Advantage plan. With this type of plan you pay the same cost for any doctor or hospital, according to the costs listed on the plan benefits summary. The provider must be eligible to receive Medicare payment and accept the Aetna plan.

- Instructions on how to use Aetna Medicare Advantage provider search »

-

- Step 1: After clicking on Find your provider, choose 2022 Medicare plans you through your employer

- Step 2: Enter your home zip code OR city, state then select from the drop-down

- Step 3: Choose select plan to find providers

- Step 4: Choose Medicare Advantage with Prescription Drug plan

- Step 5: Under PPO section Select Aetna Medicare Plan with Extended Service Area *

- Step 6: Then choose medical and click continue to find care at the bottom right of your screen to find providers

*As a member of the Aetna Medicare Plan with an Extended Service Area , you can receive services from any provider that is eligible to receive Medicare payment and is willing to treat you. Your cost share will be the same as in-network care. Out-of-network providers are under no obligation to treat Aetna members, except in emergency situations.

Read Also: When Do You Get Medicare Part B

Does Medicare Cover Elective Procedures

Services that are not considered medically necessary are generally not covered by Medicare Part A or Part B. For example, breast augmentation for cosmetic reasons isnt covered by Medicare, but reconstructive surgery after a mastectomy is covered.11

Medicare wont cover Lasik surgery just to avoid the need for glasses. But treatment for chronic eye conditions like cataracts or glaucoma may be covered if your doctor considers it to be medically necessary.12

Always err on the side of caution! Confirm your coverage before you commit to a procedure youre unsure about.

How Does Humana Medicare Advantage Work

According to a Humana customer service representative, its networks are regionally based. Each plan has its own set of providers, specialists and pharmacists.

Plan options vary based on location, but can include health maintenance organization plans, preferred provider organization plans, special needs plans and private fee-for-service plans.

Private fee-for-service plans essentially allow you to work with any provider who is Medicare-approved and agrees to the conditions of your plan.

Humana HMO plans allow you to choose a doctor from the Humana provider network. With Humana, youre also not locked into a provider and can switch as you see fit. Most Humana HMO plans include prescription coverage. They also offer hearing benefits, as well as vision and dental benefits, none of which are covered by traditional Medicare.

PPO plans are more flexible in terms of picking providers, so if you have several specialists or a preferred physician, a Humana PPO plan may be best for you.

Humana SNPs are designed for people who are:

- Living with a chronic health condition

- Dually eligible for Medicare and Medicaid

- Residents of a long-term care facility

There are two specific types of SNP plans with Humana: Chronic Condition Special Needs Plans and Dual-Eligible Special Needs Plans. Currently, these plans are available in just under 30 U.S. states.

Each Humana Medicare Advantage plan includes dental, vision and hearing benefits. Other benefits often offered by these plans include:

Don’t Miss: Does Medicare Cover Bladder Control Pads

What Medicare Advantage Plan Covers Hearing Aids

Only Medicare Advantage plans provide coverage for the cost of hearing aids. These plans are legally required to provide all the same coverage as Original Medicare and are free to offer additional benefits, says Worstell. Hearing aid coverage is a common extra benefit in these plans, along with coverage for dental, vision and prescription drugs, he adds.

How Do I Find A Humana Medicare Advantage Plan Near Me

Contact a licensed insurance agent to inquire about Humana Medicare Advantage plans available in your area. The agent will be able to confirm your eligibility, help you compare the costs and coverage of each plan and walk you through the enrollment process for a plan that covers hearing aids and meets your other coverage needs. You can also compare plans online for free, with no obligation to enroll.

Recommended Reading: What Is The Last Day To Sign Up For Medicare

How Do I Find Humana Hearing Aid Providers

Your Humana-covered hearing aid provider will be obtained through TruHearing. Heres how to find a hearing aid provider covered by your Humana plan:

What Is The Difference Between Ppo And Hmo Plans

Medicare PPOs are different from Medicare HMOs because they allow beneficiaries the opportunity to seek services from out-of-network providers.

When you visit out-of-network providers with a PPO plan, you are covered but will pay more for the services. When you use out-of-network providers with an HMO plan, you are generally not covered and will pay the full cost for those services.

Also Check: Your Pretty In Sign Language

Also Check: What Does Medicare Pay For Chiropractic Services

Does Insurance Cover Hearing Aids Information On Specific Plans:

Most insurance companies dont cover the cost of hearing aids. But some policies cover it. According to the care act, insurers must cover audiological exams costs because the law doesnt require providers to cater for hearing devices costs. You can check with your insurance if they have a plan covering hearing aids.

Oct 16, 2017 | Financial Services, Medicare & Insurance | 5 |

Medicare beneficiaries in 27 more states will soon have enhanced access to hearing examinations and more affordable hearing aids thanks toHumana Inc., the health insurance company announced. Humana is expanding its existing relationship with TruHearing, a hearing health care company, to include hearing care and hearing aid benefits within more of its Medicare Advantage plan offerings.

Humana is including this hearing benefit on certain 2018 Medicare Advantage plans offered in the following new states: Alabama, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Mexico, North Carolina, North Dakota, Oregon, Pennsylvania, South Carolina, South Dakota, Utah, Virginia, West Virginia, and Wisconsin. Humana and TruHearing teamed up in 2017 to introduce the benefit in select Medicare Advantage plans offered in Arizona, Arkansas, Nevada, Ohio, Oklahoma, Texas, and Washington state. In 2018, the benefit will be offered in a total of 34 states.

Humana, TruHearing

Acadian Hearing Services Works With Major Insurance Carriers

Fortunately, you dont have to do the time-consuming and frustrating work of determining whether hearing aids are covered by your insurance because we include an insurance specialist as part of our Acadian Hearing Services team.

Our insurance specialists have experience working with insurance carriers in Texas and Louisiana in order to meet the needs of our patients who live in Southwest Louisiana and along the Eastern border of Texas. They know which questions to ask and how to make sure that you get all the insurance benefits youre entitled to from your policy from insurance companies like:

You May Like: Do Medicare Advantage Plans Have Dental Coverage

Humana Expands Affordable Hearing Aid Benefit In Medicare Advantage Plans

Benefit offered through TruHearing relationship should improve access to hearing tests and increase affordability for hearing aids in 34 states

LOUISVILLE, Ky.—-Medicare beneficiaries in 27 more states will soon have better access to hearing examinations and more affordable hearing aids thanks toHumana Inc.. Humana, a leading health and well-being company, is expanding its existing relationship with TruHearing, a hearing health care company, to include hearing care and hearing aid benefits within more of its Medicare Advantage plan offerings.

Humana is including this hearing benefit on certain 2018 Medicare Advantage plans offered in the following new states: Alabama, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Mexico, North Carolina, North Dakota, Oregon, Pennsylvania, South Carolina, South Dakota, Utah, Virginia, West Virginia and Wisconsin. Humana and TruHearing teamed up in 2017 to introduce the benefit in select Medicare Advantage plans offered in Arizona, Arkansas, Nevada, Ohio, Oklahoma, Texas and Washington state. In 2018, the benefit will be offered in a total of 34 states.

Traditionally, hearing aids have been unaffordable and out of reach for many Medicare beneficiaries. According to a National Academies of Sciences report on hearing aid affordability, the average retail price of two hearing aids in 2013 was approximately $4,700.

About TruHearing

About Humana

Why Doesn’t Original Medicare Cover Hearing Aids

Original Medicare doesnt cover hearing aids, hearing exams or hearing aid fittings when provided by an audiologist. Though hearing aids today can be a significant expense, sometimes costing upward of $6,000 for a pair, the devices were available at a lower cost when Medicare was first introduced in 1965. Medicare excluded hearing aids from coverage, claiming consumers could make the purchase themselves.

However, some Medicare Advantage plans may offer hearing aids coverage, depending on the insurance provider and specific plan selected. If you need help paying for your hearing aids, consider researching the various Medicare Advantage plans available to you and speaking to providers about potential hearing health benefits.

Don’t Miss: What Dental Care Is Covered By Medicare

Hearing Aids And Medicare Advantage

Many Medicare Advantage plans offer extra benefits like dental, vision, and hearing coverage.

The exact hearing benefits with a Medicare Advantage plan will vary widely depending on the plan. Weâll provide two examples of Medicare Advantage plans in Macon County to show how different the hearing benefits can be.

You May Like: Why Are My Ears Ringing All The Time

How Much Do Hearing Aids Typically Cost

According to the National Academies of Sciences, Engineering, and Medicine, about 30 million people in the United States live with hearing loss. However, an estimated 67â86% of individuals aged 50 years and older who could benefit from hearing aids do not use them.

Hearing aids may improve the quality of life for people who have different forms of hearing loss.

The cost of hearing aids varies. According to a 2015 report by the Presidentâs Council of Advisors on Science and Technology, the average cost of one hearing aid is about $2,400. However, some people may need two hearing aids, which would double this figure.

The high cost of hearing aids may create obstacles for some individuals to treat their hearing loss. However, these devices can considerably improve the quality of life for those with hearing conditions.

There are many early symptoms of hearing loss. A person might benefit from a hearing aid if they:

Hearing aids are an adaptation for deaf people and those with partial hearing loss, and they can make everyday life easier to manage. However, they are not a cure, as they do not address the underlying biological causes.

However, sensorineural hearing loss is treatable with hearing aids. According to the American Speech-Language-Hearing Association, SNHL involves damage to the inner ear and is the most common form of permanent hearing loss.

The specialist will perform additional hearing checks to determine the type and extent of any hearing problems.

Recommended Reading: Why Are There So Many Medicare Commercials

Signs You Might Need Hearing Aids

Cleveland Clinic3 shares a list of warning signs and changes in your behavior that might be related to hearing loss. Do you:

- Feel that people are mumbling or speaking too softly?

- Frequently ask people to repeat what they have said especially in noisy situations?

- Prefer the television or radio louder than other people?

- Have difficulty understanding on the telephone?

- Not understand all the dialogue at the movies or during live theater productions?

- Have difficulty understanding at your house of worship or group settings?

- Find yourself more impatient, irritable, frustrated or withdrawn than before?

- Have trouble understanding people when you cannot see their faces?

Benefit Offered Through Truhearing Relationship Should Improve Access To Hearing Tests And Increase Affordability For Hearing Aids

Medicare beneficiaries in select states will soon have better access to hearing examinations and affordable hearing aids thanks to Humana Inc. , a leading health and well-being company, teaming up with TruHearing, a hearing health care services and hearing aids company.

One in four Americans 70 years and over has a hearing impairment, according to the Centers for Disease Control and Prevention .

Traditionally, hearing aids have been unaffordable and out-of-reach for many Medicare beneficiaries. According to a National Academies of Sciences report on hearing aid affordability, the average retail price of two hearing aids in 2013 was approximately $4,700. Original Medicare covers diagnostic hearing exams if a patients health care provider orders the test to see if medical treatment is needed. Otherwise, original Medicare does not cover hearing exams, hearing aids, or exams to fit hearing aids.

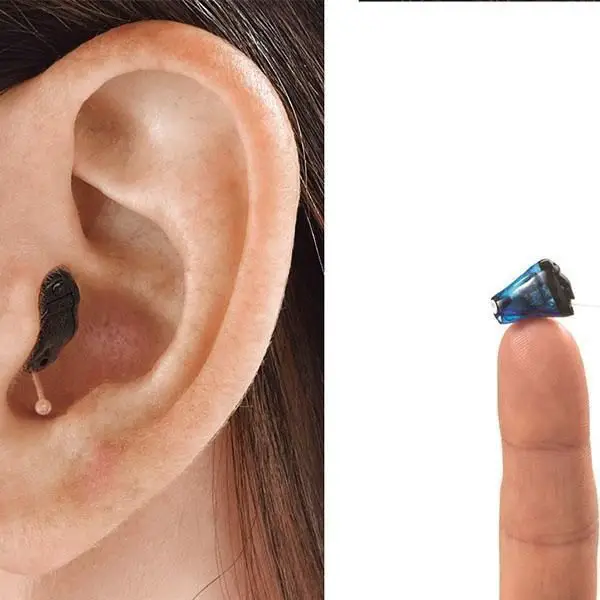

TruHearing hearing aids include three provider visits for fittings and evaluations within the first year of the hearing aid purchase, a 45-day trial period, a three-year extended warranty and 48 batteries per aid all at no extra cost to the member. The hearing aids offer wireless connectivity to your phone or tablet and come in a variety of sizes, colors, and styles.

Medicare beneficiaries who are interested in the hearing aid benefit should visit www.Humana-Medicare.com to research these plans and learn more about this and other plan benefits.

Categories

Don’t Miss: Are Shingles Shots Covered Under Medicare

How Do Part C Medicare Advantage Plans Cover Hearing Aids And Hearing Care

Private insurance companies sell Medicare Advantage plans. Medicare Advantage plans often include coverage for hearing, vision, and dental care, plus coverage for prescription drugs. Some comprehensive Part C plans cover hearing aids and their maintenance costs.

If you are considering enrolling in a Medicare Advantage plan, it’s essential to review the policy’s cost and coverage, as this can vary considerably by individual policies. In 2022, the average premium for a Medicare Advantage plan is $62.66 per month.

Some popular Medicare Advantage plan companies include: