Is It Mandatory To Sign Up For Medicare At Age 65

May 28, 2021 By Danielle Kunkle Roberts

Many people who are still working wonder whether it is mandatory to at age 65. Not knowing the proper answer could cost you, literally. So, is it mandatory to sign up for Medicare at age 65?

It is mandatory to sign up for Medicare Part A once you enroll in Social Security. The two are permanently linked. However, Medicare Parts B, C, and D are optional and you can delay enrollment if you have creditable coverage.

Sothe straightest answer I can give you is yes and no. Heres why:

Your specific circumstances affect the answer to the Medicare at 65 question. In order to discover a more precise answer for this question for YOU, you will need to answer some questions.

The answers to these questions will ultimately determine your personal answer for that frustrating question Is it mandatory to sign up for Medicare at age 65?

Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course

What Happens If You Don’t Sign Up For Medicare

If you do not sign up for Medicare Part A or Part B when you first become eligible, you may be subject to a late enrollment penalty if you choose to sign up later on.

- The Part A late enrollment penalty is only applicable to beneficiaries who do not qualify for premium-free Part A . The Part A late enrollment penalty is up to 10 percent of the monthly premium , and you must pay the penalty for twice the number of years that you could have had Part A but did not. For example, if you were eligible for Part A for two years before you finally signed up, you would have to pay the extra 10 percent penalty for four years.

- The Part B late enrollment penalty is up to 10 percent of the standard Part B premium for each 12-month period that you could have had Part B but did not. You have to pay this penalty for as long as you are enrolled in Part B.

Late enrollment penalties do not apply to everyone who delays coverage, however.

For example, if you delay enrollment because you have employer-provided health insurance coverage, you may be able to enroll in Medicare Part A and/or Part B at a later date without facing a late enrollment penalty.

How To Defer Medicare

In most cases, you or your spouse must be actively working for an employer that provides your current health insurance in order to delay Medicare enrollment and qualify for a special enrollment period later.

Keep in mind that COBRA and retiree benefits from a current or former employer do not count as active creditable coverage.

You can defer Medicare enrollment until your workplace health insurance ends or you leave your job whichever comes first.

When your workplace coverage stops, youll qualify for a special enrollment period of up to eight months when you can sign up for Medicare Part B without facing late enrollment penalties.

There are other times you can change your Medicare coverage, too, including during the general enrollment period and open enrollment period but you may face a penalty if you wait until one of these enrollment periods.

Its best to speak with your workplace benefits administrator if youre still working and want to delay Medicare until retirement.

Your workplace human resources department can help you determine whether your current health insurance qualifies as creditable coverage and if it makes sense to defer Medicare enrollment at 65.

There is another limited situation when you can delay signing up for Medicare Part A and/or Part B. If you live overseas when you turn 65 and dont qualify for premium-free Part A, youll have two months to sign up for Medicare once you return to the United States.

You May Like: How To Apply For Medicare Without Claiming Social Security

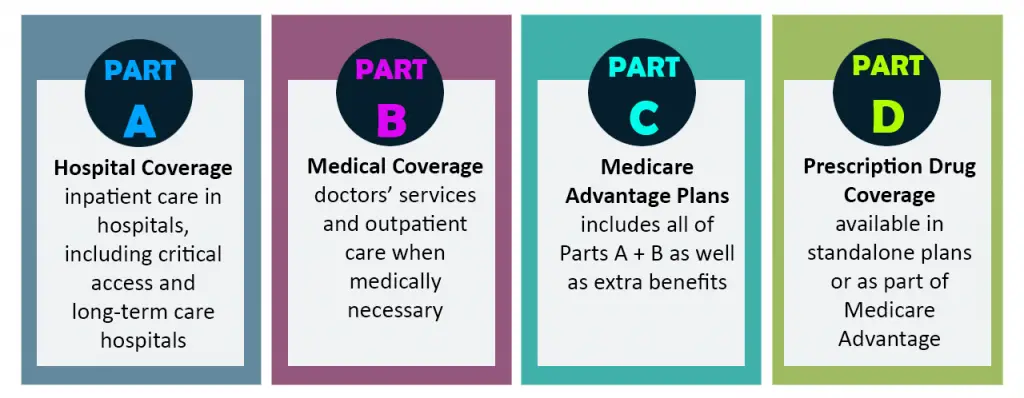

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

V Waiver Of Proposed Rulemaking

![[Deadline] Medicare Part D Disclosures [Deadline] Medicare Part D Disclosures](https://www.medicaretalk.net/wp-content/uploads/deadline-medicare-part-d-disclosures.jpeg)

The annual updated amounts for the Part B monthly actuarial rates for aged and disabled beneficiaries, the Part B premium, and Part B deductible set forth in this notice do not establish or change a substantive legal standard regarding the matters enumerated by the statute or constitute a substantive rule that would be subject to the notice requirements in section 553 of the APA. However, to the extent that an opportunity for public notice and comment could be construed as required for this notice, we find good cause to waive this requirement.

Recommended Reading: How To Get Dental With Medicare

A Word About Late Penalties

If you incur a late penalty, it will be tacked onto your Medicare monthly premium when you finally do enroll. The penalties stay in force for as long as you continue to be enrolled in Medicare.

With that said, if you were to never enroll in Medicare, you wouldnt end up paying those penalties. However, lasting your entire life without ever needing to sign up for Medicare is unlikely.

Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course

Does Part B Cover Prescription Drugs

Short answer: No, Part B doesnt typically cover prescription drugs.

Longer answer: Part B may cover some drugs in a specific situations, typically only those that are administered by a doctor in their offices or in a clinic.

To get Medicare coverage for most retail prescription drugs, you need a Medicare Part D prescription drug plan or a Medicare Advantage plan that includes prescription drug coverage.

Also Check: How Much Copay For Medicare

What Are Some Of The Reasons People Dont Enroll In Medicare

Two common reasons people may decide they dont want to become Medicare beneficiaries include:

- They have existing health insurancePeople who have other health care insurance may decide it provides adequate coverage without also having Medicare. However, Medicare can work with additional health insurance to save you money, so its usually worth enrolling anyway. Some retiree plans also wont cover costs for people eligible for Medicare who arent registered.

- They dont want to pay the premiumsWhile most people receive premium-free Medicare Part A , some people are required to pay a monthly Part A premium. Medicare Part B is optional but requires a monthly premium. Some people may decide theyd rather avoid these payments, though it could mean theyll pay extra for their Medicare coverage later when they eventually sign up.

Can I Drop Other Coverage To Enroll In Part B

Once youre eligible for Part B, youre eligible.

If one of the exceptions applies that qualifies you for a Special Enrollment Period, you can drop other coverage and enroll in Part B at any time, assuming you have enrolled for Part A.

You may be automatically enrolled in Medicare Part A.

Your retiree health plan may require you to enroll in Medicare. Whether or not this is the case, many health plans coordinate benefits with Medicare.

Medicare is the usually the primary payer. You may find that adding part B coverage can help lower your overall out-of-pocket health care expenses. In any case, having other coverage doesnt typically block you from enrolling in Part B if you are eligible.

You should consult your human resources office or benefits administrator to see how your employee or retiree plan coordinates with Medicare.

You May Like: Does Medicare Cover Accu Chek Test Strips

Choosing Part B: Understanding Enrollment Periods

Unlike other forms of medical insurance, you cant enroll in Medicare easily whenever you want. Instead, Medicare uses something called enrollment periods. These are periods of time during which you can enroll in or change your Medicare coverage without penalty. In some cases, you may not be able to enroll in a Medicare plan at all outside of an enrollment period. However, usually, you will have to pay a penalty.

There are many enrollment periods that all function differently, and its important to understand them all. Well cover the initial enrollment period first.

Can I Decline Medicare Altogether

Medicare isnt exactly mandatory, but it can be complicated to decline. Late enrollment comes with penalties, and some parts of the program are optional to add, like Medicare parts C and D. Medicare parts A and B are the foundation of Medicare, though, and to decline these comes with consequences.

The Social Security Administration oversees the Medicare program and recommends signing up for Medicare when you are initially eligible, even if you dont plan to retire or use your benefits right away. The exception is when you are still participating in an employer-based health plan, in which case you can sign up for Medicare late, usually without penalty.

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and wont cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits and must repay anything you have already received when you withdraw from the program.

Read Also: How To Apply For Medicare Card Replacement

Do I Need Medicare Part B If I Have Other Insurance

Many people ask if they should sign up for Medicare Part B when they have other insurance or private insurance. At a large employer with 20 or more employees, your employer plan is primary. Medicare is secondary, so you can delay Part B until you retired if you want to.

Keep in mind that both parts of Medicare can coordinate with large employer coverage to reduce your spending. Youll need to decide whether you want to enroll in Part B or delay it until later.

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $170.10/month for new enrollees in 2022. You can avoid that cost by simply delaying your Part B enrollment until you retire.

Medicare Part C: Medicare Advantage

Also known as Medicare Advantage, Part C is an alternative to traditional Medicare coverage. Coverage normally includes all of Parts A and B, a prescription drug plan , and, depending on your choice of a Medicare Advantage plan, other possible benefits.

Part C is administered by Medicare-approved private insurance companies that collect your Medicare payment from the federal government.

Depending on the plan, you may or may not need to pay an additional premium for Part C. You still need to pay your Medicare Part B premium. You don’t have to enroll in a Medicare Advantage plan, but for many people, these plans can be a better deal than paying separately for Parts A, B, and D. Beneficiaries will still pay separate premiums if they don’t choose to have the Part “C/D” premium taken out of their Social Security check.

If you’ve been pleased by the coverage of a Health Maintenance Organization , you might find similar services using a Medicare Advantage plan.

Don’t Miss: Is It Medicaid Or Medicare

What Parts Of Medicare Are Mandatory

Medicare is not mandatory for most people. However, its beneficial for eligible individuals to sign up as soon as possible in most cases to avoid penalties.

Enrolling in Part A is mandatory to keep your Social Security benefits. Part A inpatient coverage comes at no cost to most Americans. Its not mandatory to have Part A but if youve worked 40 or more quarters , youll get it premium-free. Those who qualify for free Part A should enroll once eligible.

But, if you want to contribute to a Health Savings Account after age 65, delaying Part A makes sense. Once Part A is active, you cant add to a Health Savings Account.

Part B and Part D are voluntary, and its not mandatory for you to enroll. Both involve monthly premiums. If you delay Part D, youll also face a Part D late-enrollment penalty.

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Don’t Miss: Is My Medicare Number My Social Security Number

When You Should Consider Enrolling In Medicare Part B

If you qualify to delay enrolling in Medicare, deciding to do so is a personal choice.

Some may choose to delay, and for others, it may still be a good fit for your health and lifestyle to enroll in Part B. Consider the following when trying to decide whether to enroll in Part B or delay while still working:

- Is Medicare less expensive than your current health insurance?

- Does Medicare offer better coverage than your current health insurance?

- Do you want to keep your current insurance but also take advantage of Medicare benefits

- Do you want to enroll in either a Medigap or Medicare Advantage plan?

- Is your prescription drug coverage considered creditable by Medicare?

Answering the above questions can help you decide whether or not to delay enrollment. Its important to carefully consider the last item regarding prescription drug coverage. While most employer coverage is considered creditable, you should still verify if it is or could end up facing a late enrollment penalty for Medicare Part D.

What Is Medicare Part B

Medicare Part B helps cover medical services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem.

Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

For more information about enrolling in Medicare, look in your copy of the “Medicare & You” handbook, call Social Security at 1-800-772-1213, or visit your local Social Security office. If you get benefits from the Railroad Retirement Board , call your local RRB office or 1-800-808-0772.Learn More:

You May Like: What Is Centers For Medicare And Medicaid Services

How Much Medicare Part B Will Pay

In addition to the monthly Part B premium, you may have to pay other costs for the services described above. Medicare has rules about how much it will pay for each of the Part B services.

Medicare will pay the entire costs of some services, like flu shots.

For other services, like mental health, Medicare will pay for 80% of the cost.

For most services, Medicare will pay for 80% while you pay the remaining 20% . This is called coinsurance.

For most Part B services, Medicare will help pay only after youve spent a certain amount of money for the year on medical services. This is the yearly deductible, and its $233 in 2022.

Medicare may help pay for occupational therapy to help you return to daily living activities.

Lets say that you havent received any medical services for the year and your doctor prescribes occupational therapy at a cost of $333 .

Since you havent paid your deductible yet, you would have to pay the first $233.

After that, theres still $100 left to pay . And since coinsurance applies, Medicare would pay for 80% of the remaining $100. So Medicare would pay $80 and youd pay another $20.

Lets say later in that same year, you are having balance problems and your doctor decides you need a balance exam. This is also covered by Medicare. But since you have already paid your $233 deductible for the year, you would only need to pay coinsurance for this exam.

What Does Medicare Part A Cost

Many are eligible for premium-free Part A, which is exactly what it sounds likequalified Medicare beneficiaries arent required to pay a premium for Medicare Part A coverage. To be eligible for Medicare Part A for free, you must be over age 65 and meet one of the following requirements:

- You or your spouse paid Medicare taxes while employed with the government.

- You are eligible for Social Security or Railroad Retirement Board benefits but havent started collecting them yet.

- You currently receive retirement benefits from Social Security or the Railroad Retirement Board.

If you are under age 65, you might still be eligible for premium-free benefits if you meet one of two requirements:

- You have received Social Security or Railroad Retirement Board benefits for two years.

- You have End-Stage Renal Disease .

If you dont meet any of the five requirements above, youll have to pay a premium for Part A. For 2020, the monthly premium is $458 .1 Additional costs with Part A include coinsurance in specific situations and a deductible of $1,408 in 2020 to cover hospital inpatient care.2

Read Also: Is Medicare Enrollment Required At Age 65