How To Sign Up For Medicare In Georgia

Last updated on:

Retirement is a time when many of the hard-earned benefits of a lifetime of hard work can become available so retirees can more fully enjoy their golden years. As that fateful day approaches you may be wondering exactly how to sign up for Medicare in Georgia.

Thankfully, signing up for Medicare happens almost always automatically if you enroll for retirement or disability benefits. Still, knowing the right time and the right steps ahead of time will help keep you fully covered and avoid any penalties, epecially in Georgia.

If youre approaching sixty-five years old and wondering just when and how to sign up for Medicare benefits, this should help you decide the best way to approach that. Heres what you need to know:

When To Sign Up For Medicare In Georgia

Most people should sign up for Medicare when theyre first eligible, which is usually upon turning sixty-five years old.

Part A is the only part required to enroll in, but depending on your individual needs in terms of increased coverage, the additional benefits from coverage of the other parts might outweigh the costs.

In addition to part A and part B, which refers to hospital and medical insurance respectively, there are options for the enhanced part C or part D .

Signing up for medicare later carries potential risks, such as a gap in coverage or paying a penalty. In some situations, for example, if you are working past the age of sixty-five and have health insurance through your employer in Georgia, it may make sense to sign up later.

Most of the time, the initial enrollment period begins three months before the month of your sixty-fifth birthday and three months after.

Medicare part A benefits typically start the month of your sixty-fifth birthday if you enroll before then, or within a month of enrollment after that. During that same initial enrollment period, you can add any of the other parts you might be interested in.

However, if you try to switch outside of this initial period, there may be a gap in coverage where costs wouldnt be covered by the plan.

How Medicare Sign Up Works in Georgia

Oftentimes, Medicare sign-up is as simple as contacting the Social Security Administration to make sure that you qualify for benefits in GA.

Who Qualifies For Medicare In Georgia

To qualify for Medicare, you must meet certain eligibility requirements. First, you must be a U.S. citizen or permanent resident. You must also be at least 65 years old or have a disability and receive Social Security Disability Insurance benefits for at least 24 months. You may qualify for Medicare at a younger age if you have end-stage renal disease or amyotrophic lateral sclerosis .

Read Also: When Can I Get Medicare

How Does Georgia Medicare Enrollment Work

If you start receiving your Social Security or Railroad Retirement Board benefits at least four months before you turn 65, youll be enrolled in Medicare automatically. Otherwise, you must fill out an application online or contact your local Social Security office. You can enroll in Medicare during the following periods:

- Initial enrollment: Your Initial Enrollment Period starts three months before your 65th birthday and ends three months after your 65th birthday. If youve never had Medicare, you can enroll during this period. If you started receiving Medicare when you were younger, you can also make changes to your plan.

- General enrollment: Choose this enrollment period if you missed your IEP. The Medicare General Enrollment Period is January 1 to March 31. You can choose Original Medicare, Medicare Advantage, Medigap, or Part D.

- Medicare Advantage open enrollment: You can make changes to your Medicare Part C, also known as Medicare Advantage, from January 1 to March 31.

- Open enrollment: You can join, switch plans, or drop your coverage from October 15 to December 7 each year.

- Special Enrollment Periods : You may qualify for a SEP if you lose your coverage or have changes to your eligibility outside the regular enrollment periods.

Can I Sign Up For Medicare At A Social Security Office

You can apply online for Medicare even if you are not ready to retire. Use our online application to sign up for Medicare. It takes less than 10 minutes. In most cases, once your application is submitted electronically, youre done. There are no forms to sign and usually no documentation is required. Social Security will process your application and contact you if we need more information. Otherwise, youll receive your Medicare card in the mail. Learn more about your Medicare card.

Don’t Miss: How To Find A Medicare Doctor

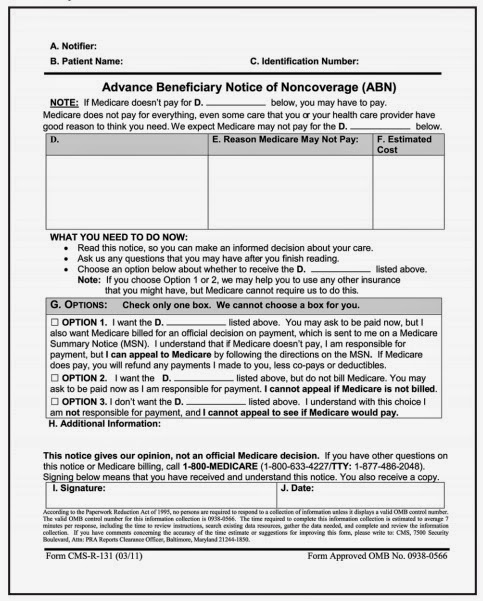

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

How Do I Apply For Medicare In Ga

You can apply for Original Medicare in Georgia by contacting Social Security, either by phone or online.

There are some key differences between Original Medicare and Medicare Advantage. HealthMarkets can help you understand the plans, explain which one would work best for your situation, and assist with applying.

More than 61% of Medicare-eligible Georgia residents who applied were eligible for Extra Help with Medicare prescription drug plan costs in 2020.5 Find out if you also qualify.

Shop online with HealthMarkets now to get your free FitScore, compare Medicare plans, and discover the options that are available to you.

46982-HM-0121

References:1. Total Number of Medicare Beneficiaries, KFF. 2020. Retrieved from https://www.kff.org/medicare/state-indicator/total-medicare-beneficiaries/ | 2. Original Medicare Eligibility and Enrollment, CMS. 2020. Retrieved from https://www.cms.gov/Medicare/Eligibility-and-Enrollment/OrigMedicarePartABEligEnrol | 3. What Medicare Part D drug plans cover, Medicare. 2020. Retrieved from https://www.medicare.gov/drug-coverage-part-d/what-medicare-part-d-drug-plans-cover | 4. Understanding Medicare Advantage Plans, Medicare. 2020. Retrieved from https://www.medicare.gov/Pubs/pdf/12026-Understanding-Medicare-Advantage-Plans.pdf | 5. Extra Help with Medicare Prescription Drug Plan Cost , Social Security. 2020. Retrieved from https://www.ssa.gov/open/data/fy16-onwards-MPD-Plan-Cost-Yrly.csv

Recommended Reading: How To Sign Up For Medicare Part D

You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

How Does Medicaid Provide Financial Assistance To Medicare Beneficiaries In Georgia

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums, prescription drug expenses, and services not covered by Medicare such as long-term care.

Our guide to financial assistance for Medicare enrollees in Georgia includes overviews of these programs, including Extra Help, long-term care coverage, and eligibility guidelines for assistance.

Read Also: Does Medicare Cover Outside Usa

Contact Social Security To Sign Up For Medicare

You can either:

Know when to sign up for Part BYou can only sign up for Part B at certain times. If you dont sign up for Part B when you turn 65, you might have to wait to sign up and pay a monthly late enrollment penalty. Find out when you can sign up. How much is the Part B late enrollment penalty?

How Social Security Determines You Have A Higher Premium

We use the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $182,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, youll pay higher premiums. See the chart below, Modified Adjusted Gross Income , for an idea of what you can expect to pay.

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, well apply an adjustment automatically to the other program when you enroll. You must already be paying an income-related monthly adjustment amount. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Recommended Reading: How Do I Print My Medicare Card

Average Costs Of Medicare Advantage In Georgia

2023 Georgia Medicare Advantage plans with prescription drug coverage have an average premium of $13.34 per month, though you may be able to find $0 premium plans where you live.1 Deductibles for plans in Georgia average $0 per year.1

The premiums, deductibles and out-of-pocket costs of individual plans may vary greatly depending on where you live and the plan you have.

You can view the average 2023 Georgia Medicare Advantage plan monthly premiums by county listed below in this guide.

A licensed insurance agent can help you compare Medicare Advantage plan costs in your area.

Compare Georgia Medicare Advantage plan costs

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

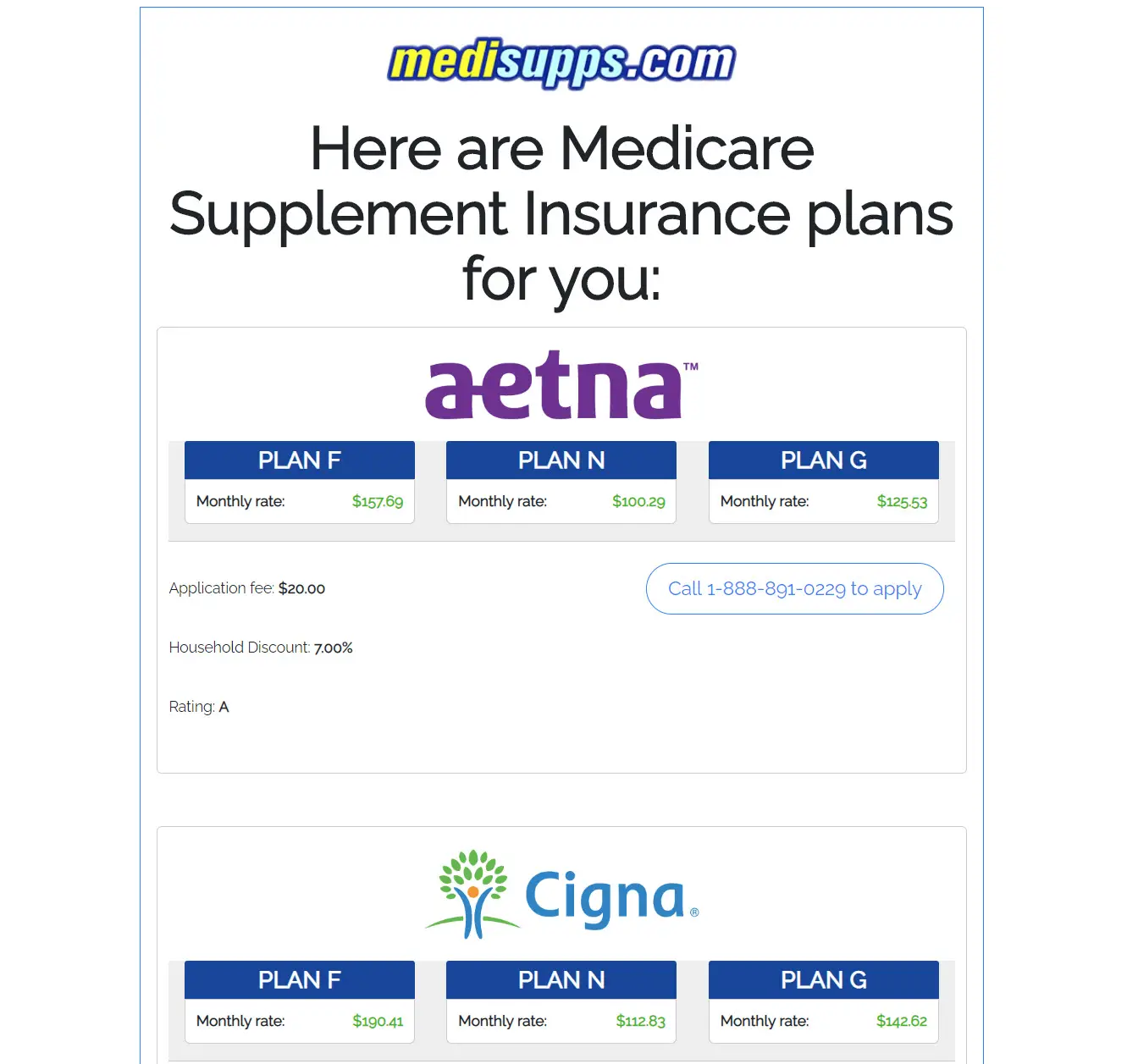

Quick Facts About Medicare Supplement Insurance Plans

Medicare Supplement insurance plans help pay your out-of-pocket Original Medicare costs, like copays and coinsurance. Some plans may pay your Medicare Part A deductible. All Medicare Supplement insurance plans typically pay your Part A hospital costs for up to a year after your Part A coverage runs out.

These plans are standardized across most states, including Georgia. Theyâre named with letters, like Medicare Supplement Plan G. If you buy Plan G in Georgia from one company, and your cousin in Florida buys Plan G from a different company, the basic plan benefits are the same. You might pay different premiums, however.

If you want a Medicare Supplement insurance plan, the best time to buy one is generally during your Medigap Open Enrollment Period . Your OEP starts the first month that youâre both age 65 or older, and enrolled in Medicare Part B. The OEP runs for 6 months. After six months, you can still apply for a plan anytime, but an insurance company can charge you more, delay your coverage, or even reject your application.

Also Check: Does Medicare Pay For Skilled Nursing Home Care

Planning For Healthy Babies

P4HB members need to renew each year. You will get a renewal notice in the mail before the deadline.

To renew:

TTY:

P4HB members renew every 12 months. Youll get a renewal note in the mail before the deadline.

To renew call . Youll need to confirm your income when you renew. You can use pay stubs within 90 days of your renewal deadline.

Need help or your renewal date? Call .

Ways To Apply For Disability Benefits:

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Once your disability benefits start, well mail you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up for Part B and pay a monthly late enrollment penalty.

Read Also: What Is Aarp Medicare Supplement

Medicare Enrollment Guide For Providers & Suppliers

Use this guide if any of the following apply:

- Youre a health care provider who wants to bill Medicare for your services and also have the ability to order and certify.

- You dont want to bill Medicare for your services, but you do want enroll in Medicare solely to order and certify.

- You wish to provide services to beneficiaries but do not want to bill Medicare for your services.

- You want to enroll as a supplier who does not dispense or furnish durable medical equipment, prosthetics, orthotics and supplies .

What You Need To Know About Medicaid Medicare And Paying For Health Care In Georgia

Feeling stuck with healthcare costs and dont know what insurance options are right for you?

We all have healthcare costs at some point in our lives, and these costs are likely to rise as we age or have a disability. Many things bring health insurance top of mindmaybe you are on the verge of retirement, or have recently received a new diagnosis, or are experiencing a change in employment, or are seeing your medical bills start to pile up. Whatever the reason, you might be looking at some alternative options to private insurance and trying to find opportunities to access public funds to help pay for your healthcare.

If you dont have much income, you might be wondering how to access Medicaid. If you turned 65 recently, you are probably thinking about Medicare. If you already have Medicare and you are wondering how you can get additional help, you may qualify for Medicare Supplement Insurance, sometimes called Medigap Insurance. If you were or are a uniformed U.S. service member, you may be interested in TRICARE, or perhaps you qualify for veterans benefits.

Together, we can understand your payment options, identify the best approach to managing your care, and access resources to confidently navigate the healthcare system informed and educated.

You May Like: Does Medicare Cover Psychological Services

Quick Facts About Medicare Advantage Plans

- Most Medicare Advantage plans cover prescription drugs. Original Medicare includes limited prescription drug coverage and doesnât generally cover medications you take at home.

- Medicare Advantage plans often have provider networks. You might not be able to see just any doctor who takes Medicare assignment, or you might have to pay more if that doctor is out of network.

- Medicare Advantage plans often include benefits beyond Medicare Part A & Part B, like routine dental, vision, and hearing care. These extra benefits vary among plans, so compare plans before you sign up.

- Medicare Advantage plans place a cap on your possible spending on covered services, to protect you from very high medical costs. Itâs actually the government that sets this annual maximum outÂ-of-pocket limit, but plans can set the limit to lower than the government limit if they want to.

- Medicare Advantage plans have out-of-pocket costs that might include a monthly premium, annual deductible, coinsurance, and/or copays. Costs vary among plans.

- To qualify for Medicare Advantage, you need to live in the planâs service area. You also need to stay enrolled in Medicare Part A and Part B, and continue paying your Medicare Part B premium.

Applying For Medicare Is Easy

It is easy to sign up for Medicare as long as you know the rules and follow them. Otherwise it can be complicated.

Hardly a week goes by when someone doesnt call to ask questions about how to sign up for Medicare.

Dont just assume you can apply anytime without penalty or delay. It doesnt work that way.

This is a government program. The process isnt logical nor intuitive. Sign up for Medicare and get it right the first time.

Ask an expert.

A Georgia Medicare expert. Call or email.

Don’t Miss: What Are Medicare Part Abcd

Get Started With Medicare

Medicare is health insurance for people 65 or older. Youre first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease , or ALS .

Follow these steps to learn about Medicare, how to sign up, and your coverage options. Learn about it at your own pace.

Additional Information And Resources

Need help with your Medicare coverage enrollment, or understanding your Medicare eligibility in Georgia? You can contact GeorgiaCares, the State Health Insurance Assistance Program, with questions related to Medicare enrollment in Georgia.

Regardless of whether youre about to submit your Medicare application in Georgia or have been a Medicare beneficiary for many years, youre likely to have questions from time to time. The Medicare Rights Center website is a nationwide resource for information, with helpful content geared to Medicare beneficiaries, caregivers, and professionals.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

About our health insurance quote forms and phone lines

We do not sell insurance products, but this form will connect you with partners of healthinsurance.org who do sell insurance products. You may submit your information through this form, or call to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

If you have questions or comments on this service, please contact us.

Recommended Reading: How Much Does Medicare Plan D Cost