Why Change From Ma To Medigap

Other than the qualifying scenarios listed previously, there are a few other reasons you may want to change from MA coverage to a Medigap plan.

- Youre looking for a larger provider network. Medigap covers the same network as Original Medicare, while MA plans typically have a smaller list of covered providers.

- You want assistance with deductibles, copays or coinsurance. While some MA plans offer $0 premiums and lower out-of-pocket costs, some Medigap plans cover all deductibles and most out-of-pocket costs, which could result in greater cost savings.

- You dont use the extra MA coverage. One of the primary benefits to a MA plan is the extra benefits offered, such as hearing, vision and dental. If you dont use those benefits, you may not need MA coverage.

- You dont want to have to get a referral. Often with MA plans, you need a referral or prior authorization to see a specialist or for certain services/procedures. Medigap plans do not require this.

Recommended Reading: Do I Need To Apply For Medicare Every Year

How To Cancel Medicare Part B

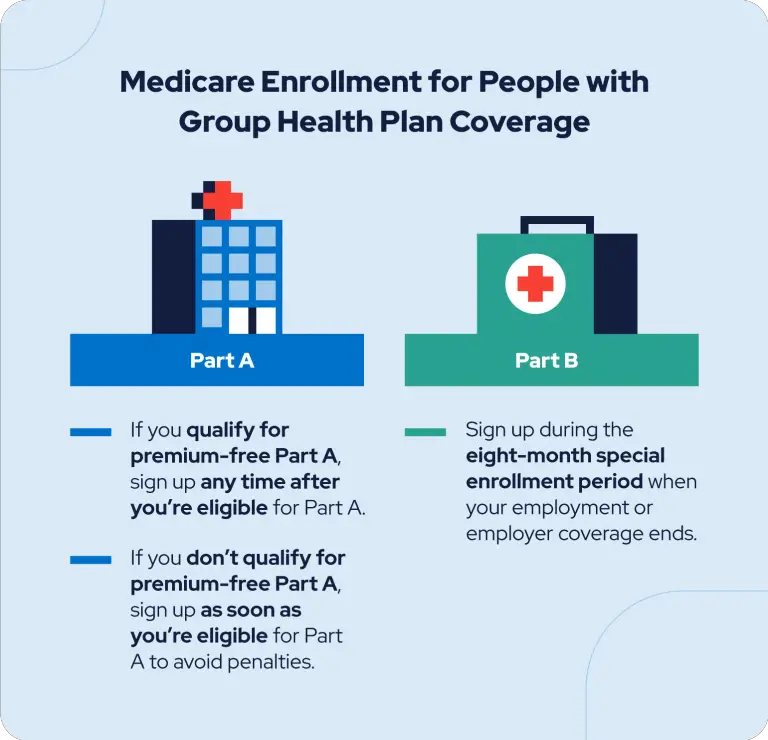

Part B of Medicare is optional, but you may be automatically enrolled if youre already receiving Social Security or Railroad Retirement Board retirement benefits when you turn 65.

Because there is a monthly premium for Part B, you will be automatically charged for that premium the month your coverage begins.

When you receive your Medicare card and welcome packet in the mail, the back of your Medicare card will include instructions for disenrolling from Part B.

If you do not initially disenroll in Part B, you will have to do so by contacting your local Social Security office or calling 1-800-772-1213 .

You may not disenroll from Part B online. You will have to speak directly to a Social Security agent to complete the process.

You are required to fill out the form while speaking to a representative to ensure you understand the consequences of disenrollment, such as late-enrollment penalties that you may incur later on if you wish to re-enroll in Part B.

How Do I Order Free Covid

You only need to provide the US Postal Service with a few bits of information to get your free test kits. You won’t be asked to provide any credit or debit card details, as both the tests and the shipping are free. Here’s how to get your free test kits.

1. Visit special.USPS.com/testkits. You can also get there via covidtests.gov.

2. Enter your contact details and shipping information.

3. Click Check Out Now.

4. Verify that your information is correct and select Place My Order.

All orders will be shipped via First Class Package Service.

People who can’t access the website or who have trouble ordering online can call 800-232-0233 to order their free tests.

Read Also: Do I Have To Join Medicare At Age 65

Pros And Cons Of Medicare Advantage Plans Vs Original Medicare

Determining the best route for your needs means comparing the benefits of each coverage. Healthcare is different for everyone. Here is a breakdown comparison of Medicare Advantage vs. Medicare Part A and Part B.

Pros of Medicare Part A and Part B

Every senior that enrolls in Medicare Part A and Part B receives identical benefits. There are no networks, no copays, no waiting periods, and no pre-existing condition limitations. You can see any doctor that accepts Medicare, and any out-of-pocket costs remain the same, regardless of the provider from whom you receive care.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Additionally, your coverage will travel with you across the United States. So, if you live in California, your coverage remains the same if you travel to Ohio, New Jersey, or even Florida. Regardless of the state you are in, Original Medicare benefits do not change.

Cons of Medicare Part A and Part B

When you enroll in Medicare Part A and Part B, you are responsible for the Part B premium, Part A deductible, Part B deductible, and Part A and Part B coinsurances. With these costs, there is no out-of-pocket maximum for Original Medicare.

Alongside the out-of-pocket costs, another con is that Original Medicare does not provide additional benefits. These include dental, vision, hearing, and drug coverage. If you require this coverage, you will have to seek additional policies.

Pros of Medicare Advantage

How To Switch Medicare Plans And Why You Might Want To

Medicare open enrollment starts soon, but 7 in 10 Medicare beneficiaries say they don’t compare Medicare plans during this period, according to a 2021 analysis by KFF, a health policy nonprofit.

That’s not great, since Medicare Advantage plans which operate much like the private insurance you may have had through an employer change from year to year. One of your doctors may have fallen out of network or your prescription drug prices may have gone up. And people with Original Medicare should compare their Part D prescription drug coverage.

Here’s how to approach switching Medicare plans.

Read Also: How Much Income Before Medicare Goes Up

How To Choose The Right Medicare Coverage For You

There are a lot of factors to consider when choosing a Medicare plan, and your needs or finances might change down the road. Weigh your options carefully at the beginning, keeping your current and future healthcare needs and your budget in mind.

Medicare Advantage plans offer optional additional services but will cost more than original Medicare. Some of the costs you pay upfront with Medicare Advantage may save you money in the long run, especially on extra services like prescription coverage, vision, and dental.

If you go with a Medicare Advantage plan, you should also review the plans quality rating and whether your existing or preferred doctors and facilities are in-network. Compare plans carefully to find one that fits your specific needs.

You should also review your prescription drug plan options, considering which plans cover your medications. Each plan should outline cost ranges for various drugs. Make sure what you need is covered at a price you can afford.

Medicare Advantage Trial Rights And Special Enrollment Period

If you decide to switch back to Original Medicare, you can do so without penalty. But only if disenrollment occurs during your Medicare Advantage trial period.

Usually, beneficiaries must wait for an Open Enrollment Period. But, if you qualify for a Special Enrollment Period, you can enroll outside of Open Enrollment. Eligibility for a Special Enrollment Period includes the following events:

-

Youve moved to an area that makes new plan options available to you or is outside of the service area of your plan.

-

Youve moved into or out of an institution such as a skilled nursing facility.

-

Youve been released from jail or prison.

-

Youve returned to the United States after living abroad.

-

Youve lost Medicaid coverage, employer coverage, union coverage, or COBRA.

-

Youre now eligible for Medicaid, Extra Help, or other government assistance programs.

-

New plan options are made available to you through an employer.

-

Youve voluntarily or involuntarily lost your Part D prescription drug coverage.

-

Your plan provider has lost its ability to contract with Medicare.

-

You are now eligible for a Special Needs Plan or are no longer eligible for a Special Needs Plan.

As a note: sometimes the Special Enrollment Period is called the Special Election Period.

Read Also: Is Medicare Only For Us Citizens

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

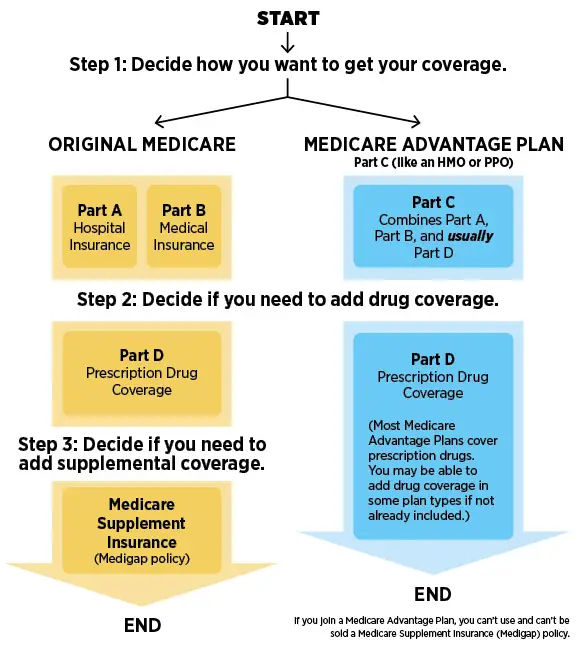

Whats The Difference Between Original Medicare And Medicare Advantage

Original Medicare is a health plan administered by the federal government. Its also known as Medicare Part A and Medicare Part B,. With Original Medicare, you work with any doctor or healthcare provider accepting Medicare. And you dont need referrals to see a specialist, so long as that specialist accepts Medicare.

You can also add a Medigap policy to your health plan. Medigap is also known as Medicare Supplement Insurance.

Medicare Part C, or Medicare Advantage, works in a different way. With Medicare Advantage, you get health insurance through a private health insurance company. That health plan must follow guidelines from the Centers for Medicare & Medicaid Services . It must offer at least the same coverage as Original Medicare.

With Medicare Advantage, you work with doctors and providers within your healthcare network. You may need a Primary Care Physician to recommend you to see a specialist. And you may need to follow other network guidelines.

However, most Medicare Advantage plans offer additional benefits. That means coverage and services not available to Original Medicare beneficiaries.

You cant have both Medicare Advantage and Medigap. With either plan, you can add Medicare Part D so long as you dont already have prescription coverage.

Can You Switch Back To Medicare From Medicare Advantage?

Yes. You can switch back during the Fall annual election period . You can switch back sooner if you qualify for a special enrollment period .

Recommended Reading: How Much Money Is Deducted From Social Security For Medicare

Can I Get Out Of My Medicare Advantage Plan

You can drop out of the plan and return to original Medicare, with the right to buy Medigap supplemental insurance, at any time during those first 12 months if you joined the plan straight away when you enrolled in Medicare at age 65, or if you dropped a Medigap policy to join the Advantage plan and this is the first …

The First Year Exception

There is a 12 month exception on underwriting if the Medicare Advantage plan you are in is the first one you have ever tried. If you leave that Medicare Advantage plan in the first 12 months, you can return to your Medigap plan without underwriting. In that first year ONLY, you will be guaranteed to reinstate your former Medigap plan.

Be aware of this window if you try Medicare Advantage and decide you dont like it.

Moral of the story: It has been my experience that people like their Medicare Advantage plan until they get sick. Once they develop a chronic or serious health condition, they often desperately want to go back to their Medigap plan for the fuller coverage.

However, because of that health condition, you may not be able to get back into a Medigap plan. Ask yourself if that is a risk you are willing to take in order to lower your health insurance costs now. The old motto that you get what you pay for definitely applies here.

Read Also: Is Medicare Solutions A Legitimate Company

Recommended Reading: Which Medicare Advantage Plans Cover Massage Therapy

How To Cancel Medicare Part C

If you wish to cancel your Medicare Part C plan, you may be able to do so during certain enrollment periods that include:

- Medicare Advantage Open Enrollment Period

- Fall Open Enrollment Period for Medicare Advantage and Prescription Drug Plans, also called Annual Enrollment Period

- Special Enrollment Period

What Is The Difference Between Medicare Advantage And Medicare Supplement Insurance Plans

Medicare Advantage plans and Medicare Supplement insurance plans are two entirely different types of coverage.

A Medicare Advantage plan is an alternate way to get your Original Medicare benefits from a private insurance company. Medicare Advantage plans cover everything that Original Medicare covers, at a minimum, and some may even offer extra benefits for things like routine vision, dental, and hearing care. Most also include Part D coverage for prescription drugs.

Medicare Supplement insurance plans, on the other hand, cover some or all of your out-of-pocket expenses from Original Medicare, such as copayments, coinsurance and deductibles. They do not cover any costs associated with prescription drugs under Part D, and they canât be used for out-of-pocket costs under Medicare Advantage. If you have a Medicare Advantage plan, it is against the law for a company to sell you a Medicare Supplement insurance plan, unless you are planning to switch to Original Medicare.

Don’t Miss: What Does Medicare Part D Do

Can I Switch Policies

In most cases, you wont have a right under federal law to switch Medigap policies, unless one of these applies:

- Youre eligible under a specific circumstance or guaranteed issue rights

- Youre within your 6-month Medigap open enrollment period

You dont have to wait a certain length of time after buying your first Medigap policy before you can switch to a different Medigap policy.

What Is An Annual Notice Of Change

Your Medicare plan provider is required to send you a Plan Annual Notice of Change each fall. The ANOC includes any changes in coverage, costs and more that will be effective the following January. Its important to review any changes to your plan to make sure the plan still meets your needs. If you dont receive an ANOC by October, or youd like to cancel your plan, contact your plan carrier.

Also Check: Does Medicare Cover Iovera Treatment

So What Should You Do

Because of the variety of options and potential costs you might incur, it is a good idea to regularly review your coverage. This is especially true if you have had your plan for several years.

After a thorough review, you may discover you are exactly where you need to be.

Our agents have years of experience with the wide varieties of plans in the marketplace throughout the United States. We can review your coverages and present multiple options that meet your health and financial needs.

We may find you should stay right where you are and we will tell you that as well.

Whatever you do, dont let the amount of information out there overwhelm you. You could be putting your retirement savings as well as your health at risk.

Prefer to chat by phone? Give us a call at

Can You Go Back To Original Medicare From An Advantage Plan

Changing from Medicare Advantage to Original Medicare is very simple, however, this also changes the coverage options. You are eligible to switch plans twice each year, i.e., Oct. 15 Dec. 7 & Jan. 1 March. 31 . This time frame helps you switch plans with no questions asked, and the changes will take effect on the 1st day of the month after the month in which the changes occurred. The process is easy, call Medicare at 1-800-633-4227/your local Social Security Office/contact your Medicare Advantage insurer and process your disenrollment.

The second way to switch to Original Medicare, if you are entitled to a trial right. The dependable first year in the Medicare Advantage program where you can drop and return to Original Medicare without penalty. You have the right to purchase a supplemental Medigap policy during the Medigap Open Enrollment Period to cover the remaining costs after what is paid by Medicare Part B.

Don’t Miss: How Do I Find My Medicare Number As A Provider

Occurs: Jan 1 Through March 31 Each Year

If you’re enrolled in a Medicare Advantage plan on Jan. 1, you can:

- Change to a different Medicare Advantage plan.

- Leave your Medicare Advantage plan to join Original Medicare.

- Add or drop Medicare Part D when switching plans.

However, you cannot switch from one stand-alone prescription drug plan to another stand-alone prescription drug plan.

Any changes you make, take effect the first day of the month after your request.

Switching To A Medicare Advantage Plan

Summary:

Medicare Advantage plans can be full of extra benefits like prescription drug coverage, dental, hearing, and vision coverage. Another advantage of a Medicare Advantage plan is a mandatory out-of-pocket maximum. A possible disadvantage of a Medicare Advantage plan is you canât have a Medicare Supplement plan with it. You may be limited to provider networks.

The Medicare Advantage program, also known as Medicare Part C, provides a way you can get your Original Medicare benefits through a private, Medicare-approved insurance company instead of directly from the government. If youâre thinking of switching to a Medicare Advantage plan, you may find this article useful.

Read Also: When Do I Sign Up For Medicare Benefits

Certain Circumstances For Changing Medicare Plans

There are other disenrollment circumstances to help you switch to another type of coverage to suit you.

- If you move out of your plans service area, in that case, you can switch to Original Medicare for two months after the month you move without penalty.

- You can move from Medicare Advantage to Original Medicare if you enter or leave institutional care. Such as skilled nursing facilities, long-term hospitals, psychiatric hospitals, rehabilitation

- hospitals and units, swing bed hospitals, and care facilities for the intellectually disabled.

- If you lose your Medicaid coverage, you can drop from Medicare Advantage Plan to Original Medicare once a quarter from the date of notification or lose, whichever is earlier.

- You can switch from Medicare Advantage to any private plan without penance if you find it more credible as and when the PACE plan allows for it.

- Extra help or Medicare Part D prescription drug benefits give you the right to switch plans limited by the plans rules to provide you with comprehensive drug benefits.

- Consider this disenrollment option to automatically enroll you in Original Medicare, an error made by a federal employee while assisting you in selecting a plan.

Changing Medicare Advantage Plans After Open Enrollment

In certain situations, you may be able to change Medicare Advantage plans after these open enrollment periods.

Your first year in a Medicare Advantage plan. This counts as a trial period in two circumstances. You can drop out of the plan and return to original Medicare with the right to buy Medigap supplemental insurance during the first 12 months 1) if you joined the plan when you enrolled in Medicare at age 65, or 2) if you dropped a Medigap policy to join the Advantage plan and this is the first Advantage plan you have been enrolled in.

If a five-star Medicare Advantage plan is available in your area. If a Medicare Advantage plan that covers your area earned an overall five-star rating from the Centers for Medicare & Medicaid Services, you can join that plan any time of year except the first week in December. You can use this five-star special enrollment period once a year. Coverage begins the first day of the month after the plan receives your enrollment request.

To find out whether a five-star plan is available in your area, visit the Medicare Plan Finder and filter results for your zip code based on star ratings. Plans with a five-star rating have a five-star icon. You can also call 800-MEDICARE or your State Health Insurance Assistance Program to find out if five-star plans are available.

Don’t Miss: Is Cigna A Good Medicare Supplement