Medicare Part C And Group Coverage

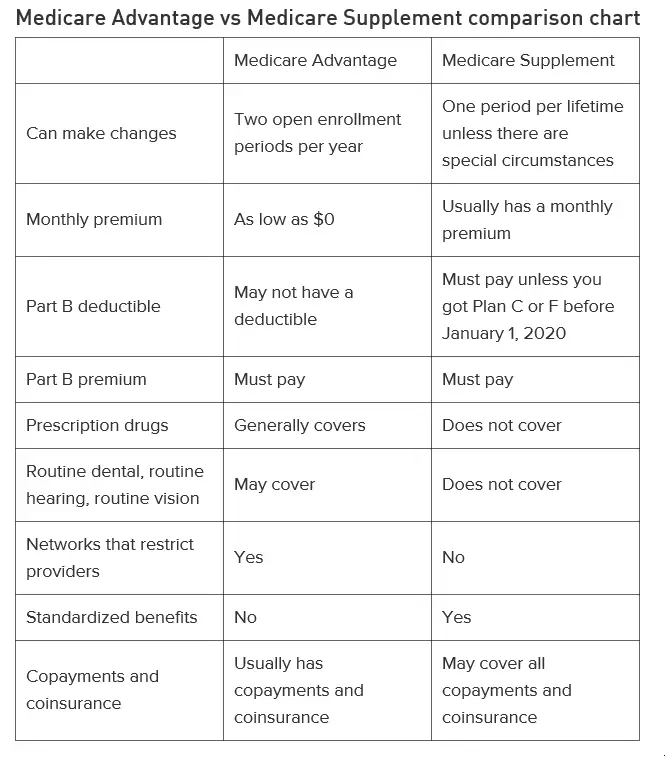

Medicare Part C is an alternative to Original Medicare that is available to most Medicare beneficiaries.

Medicare Advantage plans must provide at least the same benefits as Medicare Part A and Part B, and many provide additional benefits such as prescription drug, dental and vision coverage.

Before you can enroll in Medicare Advantage, you must enroll in Original Medicare .

If youre still receiving health insurance benefits through your employer, you can keep your Part A coverage, drop your Part B coverage while youre still insured by your employer, and then re-enroll in Part B once you retire.

If youre ready to explore your Medicare Advantage options now, a licensed insurance agent can help you find MA plans in your area and get you enrolled in one that works for you.

Compare Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Change In How You Report Earnings

The Social Security Administration bases its benefit calculations on earnings reported on W-2 forms and on self-employment tax payments. Most individuals are not required to send in an estimate of earnings.

However, the Social Security Administration does request earnings estimates from some recipients: those with substantial self-employment income or those whose reported earnings have varied widely from month to month, including people who work on commission. Toward the end of each year, Social Security sends those people a form asking for an earnings estimate for the following year. The agency uses the information to calculate benefits for the first months of the following year. It will then adjust the amounts, if necessary, after it receives actual W-2 or self-employment tax information in the current year.

Once a beneficiary reaches full retirement age, his or her income will no longer be checked. Because there is no Social Security limit on how much a person can earn after reaching full retirement age, there is nothing to report.

Are There Plans To Reduce The Medicare Enrollment Age

Some legislators have proposed measures to lower the Medicare eligibility age. Senator Bernie Sanders wrote a bill that would make all Americans eligible for Medicare in 2019. Representative Pramila Jayapal wrote a similar bill in 2021. Neither bill passed.

When this article was published, no changes had been made to the Medicare eligibility age.

Read Also: What Is Medicare Red White And Blue Card

Will I Be Enrolled In Medicare Automatically

You will generally be automatically enrolled in Medicare if:

- Youâre receiving Social Security retirement benefits when you turn 65.

- Youâre younger than 65 and youâve been getting Social Security disability benefits for 24 months. Youâll typically be enrolled in Medicare in the 25th month of getting these benefits.

- Youâre younger than 65 and have amyotrophic lateral sclerosis , also known as Lou Gehrigâs disease. Youâre automatically signed up for Medicare the same month your Social Security disability benefits start

You typically have to sign up for Medicare yourself if:

- Youâre not yet receiving Social Security retirement benefits when you turn 65.

- Youâre under 65 and have end-stage renal disease, a type of kidney failure. You might qualify for Medicare at any age, but you are not signed up automatically.

- You live in Puerto Rico. You may be automatically enrolled in Medicare Part A when you turn 65, but youâll need to sign up for Part B.

You might have to pay a late enrollment penalty if you donât sign up for Medicare when youâre first eligible. Learn more about the late enrollment penalties.

What Taxes Will You Owe In Retirement

The good news is that income from a retirement account is generally worth more than income from working. Once retired and living on unearned income, you will no longer be paying Social Security and Medicare payroll taxes. You will still be subject to income taxes at the federal state levels. That assumes you dont live in a state without an income tax.

Currently, federal income tax rates range from 10 to 37 percent, depending on your income level and marital status. Expect to get hit with taxes on your retirement income from things like a pension, annuity, IRA, 401, defined benefit plan, 457, or other pre-tax retirement accounts.

Tax-free income will help you keep your head above water when spending in retirement.

Getty

Tax-Free Income in Retirement

If you have money in a Roth, Roth 401, or the Rich Person Roth , you will have some tax-free retirement income. While that is a great piece of a well-rounded retirement plan, few people have all of their assets in Roth accounts. If they do, they have not accumulated enough assets to fully fund a comfortable retirement. Most people will still have some income in taxable accounts, or accounts like a 401, which will be taxed when funds are withdrawn.

Also Check: What Is Part B Excess Charges In Medicare

Working In Retirement: How Does It Affect Social Security And Medicare

Are you retired but considering going back to work?

Whether you’re in it for the extra income, or merely getting paid for something you enjoy doing anyway, it’s important to understand how bringing home a paycheck in retirement could affect your Social Security benefits and medical insurance coverage.

Here are a few things to consider before punching that timecard.

Do I Have To Sign Up For Medicare If I Have Private Insurance

It depends on the type of insurance you have and your place of employment. If you are self-employed or work at a small business with less than 20 employees, double check that you will still be covered past 65. If you have COBRA coverage, make sure to sign up for Medicare. If these do not apply to you, and you’re still covered by your health insurance, you can put off signing up for Medicare.

Also Check: What Is Cms Medicare Insurance

Medicare Coverage For High

Lets say you return to work after age 65 and keep your Medicare coverage.

If you land a lucrative second career or consulting position, you may enter a higher income bracket and face Medicare surcharges.

Thats because, by law, high-income earners pay more for Medicare Part B and Part D.

If youre single and earn more than $91,000 but less than or equal to $114,000 a year, you must pay an additional $68.00 a month for your Part B premium in 2022.

For a married couple filing jointly, extra charges start at incomes above $182,000.

A similar, smaller surcharge applies to Part D premiums.

In 2022, an individual who makes between $91,000 and $114,000 a year will owe a $12.40 income-related monthly adjustment amount in addition to their standard Part D premium.

Dont Miss: How Much Should You Have For Retirement

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Don’t Miss: Does Medicare Pay For Assisted Living In Ohio

If You Retire Before Age 65

In most cases, you cannot sign up for Medicare before you turn 65, even if you retire early.

If you have health insurance through your employers group health insurance plan, we recommend finding out whether you will lose those benefits when you retire.

Some companies allow employees to remain on their employer-provided health insurance plan after they retire, and some do not.

If you retire earlier than age 65 and lose your group health insurance coverage, you may consider enrolling in a private health insurance plan until you are eligible for Medicare.

Once you are enrolled in Medicare, you can drop your private insurance coverage.

What If I Had Job

Yes. Losing job-based coverage qualifies you for a Special Enrollment Period. This means you can enroll in a health plan outside of

The yearly period in the fall when people can enroll in a health insurance plan for the next calendar year. Open Enrollment for 2022 is over, but you may still be able to enroll in a Marketplace health insurance plan for 2022 if you qualify for a Special Enrollment Period.

. You can apply to the Marketplace with a Special Enrollment Period any time from 60 days before and 60 days after your separation date.

Also Check: Who Is Entitled To Medicare Benefits

Im Retiring In 2022 At Age 65 Or Before I Turn 65

If youre retiring before you turn 65 or right at age 65, its important to make sure you start learning about Medicare and to talk with your benefits administratorearly on. A great way to learn about Medicare is this helpful 7-part free email series that walks through the basics, Medicare enrollment, your coverage options and more.

Heres what else you need to know:

- Enroll during your Initial Enrollment Period to avoid late enrollment penalties. You can enroll as early as 3 months before your 65th birthday month.

- Enroll before you lose your employer coverage so you dont experience any gaps in health care coverage. A good recommendation is about three months in advance.

- You may be eligible for retiree coverage or COBRA. Ask your benefits administrator about your options and how either may work with Medicare.

- Ask about how your spouse/dependents will be impacted when you lose your employer coverage and if theyll qualify for either retiree coverage or COBRA.

- If you are not turning 65 for another year or two, you may need to get individual health insurance from an insurance provider if your employer doesnt offer retiree coverage, or to fill in any timing gaps between COBRA and Medicare.

Ways To Balance Social Securitys Budget

Even though Social Security isnt expected to run out of money for 15 years, several options for changes have already been floated to deal with the budget shortfall. These options include:

- Raising the payroll tax rate

- Increasing the wages subject to Social Security taxes

Recommended Reading: Fountain Of The Sun Retirement Community

Recommended Reading: What Is Troop In Medicare

What Taxes Will I Owe In Retirement

No one wants to worry about taxes in retirement. But ignoring them can undermine your retirement … security.

Getty

I recently spoke with a prospective client who was adamant that he would not have to pay taxes in retirement. He read and printed an online article which indicated, You will not owe these taxes in retirement. That myth was reinforced when his employers human resources associate person told him that he would not have to pay payroll taxes in retirement. Did you catch that? He was told he would not owe payroll taxes during his retirement years, which he misunderstood and thought he would not owe any taxes once he retired. Assuming you have income in retirement, you will be subject to at least some income taxes in your golden years.

Your Monthly Social Security Benefits Increase The Longer You Wait To Claim

You can collect Social Security benefits as soon as you turn 62, but taking benefits before your full retirement age means a permanent reduction in your payments of as much as 25% to 30%, depending on your full retirement age.

If you wait until you hit full retirement age to claim Social Security benefits, youll receive 100% of your earned benefits. But you can also get a big bonus by waiting to claim your Social Security benefits at age 70 your monthly Social Security benefit will grow by 8% a year until then. Any cost-of-living adjustments will be included, too, so you dont forgo those by waiting.

Waiting to claim your Social Security benefits can help your heirs as well. By waiting to take her benefit, a high-earning wife, for example, can ensure that her low-earning husband will receive a much higher survivor benefit in the event she dies before him. That extra income of up to 32% could make a big difference.

You May Like: Is Eecp Covered By Medicare

Medicare Part B And Group Coverage

Unlike premium-free Part A, Medicare Part B requires you to pay a monthly premium for your Part B benefits .

If youre still receiving health insurance benefits through your employer and are automatically enrolled in Medicare Part B, you may have the option to opt out of Part B until you retire or lose your group health insurance coverage.

Opting out of Part B will prevent you from having to pay monthly premiums for coverage you arent using. Once you retire, you should qualify for a Medicare Special Enrollment Period, which allows you to enroll in Part B later without facing a late enrollment penalty in most cases.

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Read Also: What Is Oep In Medicare

General Tips For Working Members Age 65 And Older

Four months before your 65th birth month you will receive a letter from CalPERS titled Important Information Concerning Health Coverage at Age 65. This notice contains information regarding the CalPERS Medicare enrollment requirements. We encourage you to carefully review and save this letter for future reference.

We recommend you also review and save all mail received from the Social Security Administration , as it will contain valuable information regarding your Medicare enrollment. You may remain enrolled in a CalPERS Basic health benefits plan until retirement. When you retire, you’ll no longer be eligible to remain in a CalPERS Basic health plan if you are eligible for Medicare Part A at no cost.

Do You Pay For Medicare After Retirement

Budgeting for Medicare after retirementYou’ll need to pay monthly premiums, copayments, coinsurance, and deductibles. You can pay for premiums and other Medicare costs in several ways. While you could budget and save for healthcare throughout your life, other programs can help: Paying with Social Security.

Don’t Miss: How Can You Have Both Medicare And Medicaid

Investment Income And Medicare Taxes

After retirement, the majority of Americans rely on income from retirement savings, Social Security benefits, and pension benefits. While Social Security benefits are subject to income taxes after retirement, pension payments, annuities, and the interest or dividends you receive from your savings or investments are not subject to Medicare or FICA taxes.

For contributions that youve made to traditional retirement accounts, such as an IRA or 401, FICA taxes were paid when the money was earned and dont have to be paid again when you begin making withdrawals. If your employer matches your contributions to your 401, the match is not subject to Medicare taxes.

You Can Pay Back Benefits You’ve Already Receivedand Boost Your Future Benefit

If you’ve taken Social Security benefits early at a reduced rate, you have the option of paying back to the government what you’ve already received and restarting benefits at a later date with a higher payout. Keep in mind that you will need to repay the gross amount of your benefitwhich includes any withholdings for Medicare premiums and/or income tax.

For example, say you chose to receive benefits at 62 and nine months later decided you wanted to return to work. You could stop receiving Social Security by withdrawing your application for benefits, pay back the benefits received, return to work, and then defer your benefit up to age 70, when you could restart your benefits at a higher level. The option to pay back Social Security is limited to the first 11 months’ worth of benefits, and the SSA allows repayment only in the first year after you start to receive benefits.

Once you reach full retirement age, another option is to voluntarily stop benefits at any point in time before age 70 to receive delayed retirement credits . Benefits will automatically restart at age 70 at a higher amount, unless you choose an earlier date.

Take note that when you withdraw your application or stop your benefits after full retirement age, you must specify if your Medicare coverageif you have itshould be included in the withdrawal.

You May Like: How To Get Medicare To Pay For Wheelchair

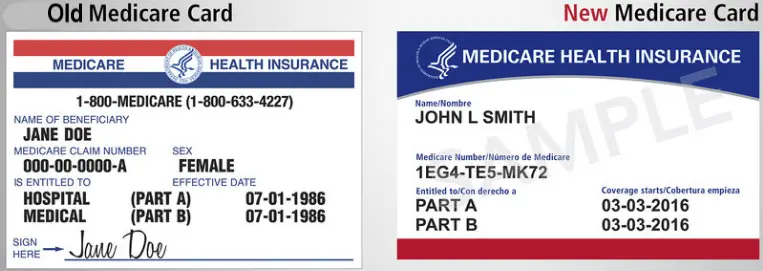

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .