When You Miss A Part C Or Part D Premium

If you miss a Part C or Part D premium, the consequences will depend on your specific plan. Either way, your coverage cant be dropped without warning.

All Part C and D plans must have a grace period thats at least two months in length, and some plans have a longer grace period. If you fail to make a premium payment, your plan must send you a written notice of non-payment and tell you when your grace period ends. Only once you fail to make your payment by the end of your grace period do you risk disenrollment from your plan. In some cases, youll be given the option to contact your plan administrator if youre behind on payments due to an underlying financial difficulty.

If youre disenrolled from your Part D plan, youll have the option to re-enroll during the Annual Election Period, which runs from October 15 to December 7 of every year. Keep in mind that if youre disenrolled due to a failure to pay your premiums, you may be required to make good on your outstanding premiums before getting back on the plan you once had. Furthermore, if you go without drug plan coverage for 63 days or more, you may be liable for a Part D late enrollment penalty once you sign up for a new plan.

If youre disenrolled from Medicare Advantage, youll be automatically enrolled in Original Medicare. During this time, you may lose drug coverage. You can then enroll in Medicare Advantage again during the Annual Election Period of October 15 through December 7.

Its Worth Asking Human Resources These Questions

If youre covered by a GHP and will be qualifying for Medicare soon, its worth your time to talk to Human Resources about transitioning to Medicare coverage. Heres what you should ask:

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He managed a Medicare technical assistance contract at the Medicare Rights Center in New York City and represented clients in Medicare claims and appeals. Josh also helped implement federal and state health insurance exchanges at the technology firm hCentive. He has also held consulting roles, including an associate at Sachs Policy Group, where he worked with insurers, hospital, and technology clients.

What Happens If We Dont Take Medicare Part B

Q. My husband turns 65 this month. We have chosen not to participate in Medicare Part B. We have full coverage insurance through his retirement program from the federal government. We are curious as to whether or not this was the right decision. I am not yet 65 so we have to keep this coverage until I receive Medicare. What are the consequences if we dont take Part B?

Confused

A. Were glad you asked.

Its very important to understand the consequences of not taking Part B, which you do not have to take.

The first thing that you need to find out is if Medicare is primary on your husbands retirement plan, said Jeanne Kane, a certified financial planner with JFL Total Wealth Management in Boonton.

If it is, he must sign up for Medicare Part B to avoid coverage gaps, she said.

In almost all circumstances, if you are Medicare eligible and participating in a retirement program, then Medicare becomes primary to the retirement plan, she said. This means Medicare is responsible for its portion before the retirement plan contributes towards any medical bills.

For example, she said, Medicare covers the first 80% of Medicare-approved medical expenses, such as doctors, other providers, tests, durable medical equipment, and more, so you have significant exposure, she said.

So if you dont have Medicare Part B and have a $10,000 medical event, you would be responsible for $8,000 before his retirement program kicked in, she said.

Don’t Miss: How To Find My Medicare Provider Id Number

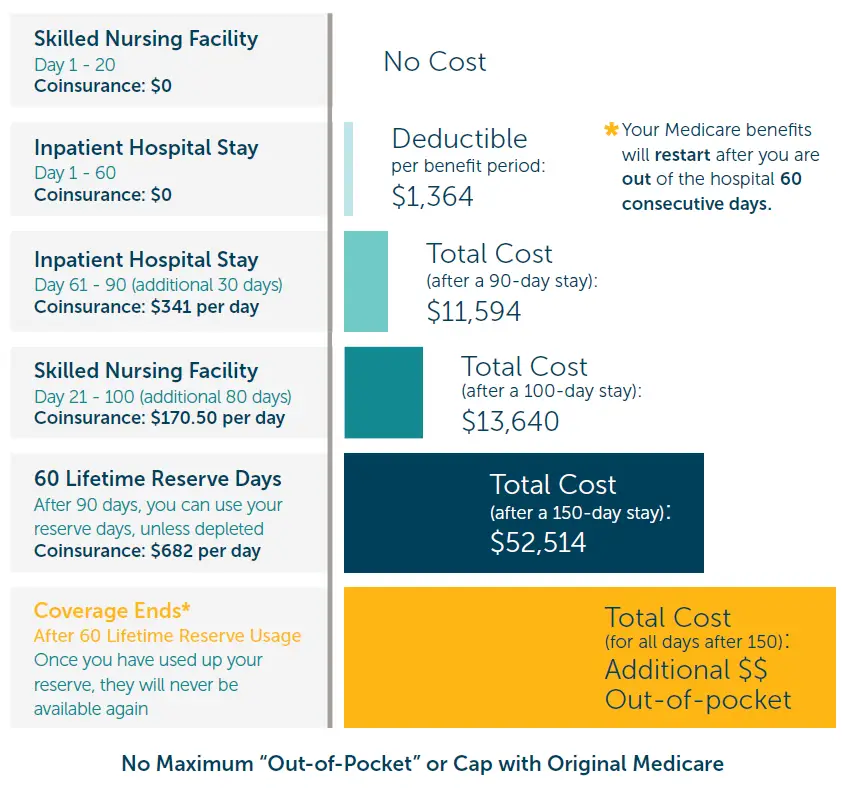

Medicare Part A Enrollees Are Getting Increases

While Medicare Part B is seeing a decrease in premiums next year, those who receive Medicare Part A will see increases in 2023. Here’s a breakdown of what’s going up.

Inpatient hospital deductible: $1,600 in 2023, an increase of $44 from $1,556 in 2022.

Daily coinsurance for the 61st through the 90th day: $400 in 2023, an increase of $11 from $389 in 2022.

Daily coinsurance for lifetime reserve days: $800 in 2023, an increase of $22 from $778 in 2022.

Skilled Nursing Facility coinsurance: $200 in 2023, an increase of $5.50 from $194.50 in 2022.

Apply For A Medicare Part B Plan

If youre ready to apply for a Medicare Part B health plan, HealthMarkets can help at no cost to you. Start reviewing your options online today, or call 439-6916 to speak with a licensed insurance agent.You can also locate a licensed insurance agent near you to schedule an in-person or virtual meeting.

48105-HM-1021

Read Also: Will Medicare Pay For A Transport Wheelchair

How Do You Sign Up For Medicare Part B

Signing up for Medicare Part B depends on your situation. In some cases, enrollment is automatic, and in others you must apply. If youre already receiving benefits from Social Security or the Railroad Retirement Board for at least four months before you turn 65, youll be automatically enrolled. If thats not the case, you can apply online at ssa.gov/medicare.6

That said, while most people should enroll in Medicare Part A, some people may choose to delay signing up for Part B. This typically depends on the kind of health coverage you have. For instance, if youre working and you still have health coverage through a job, or you have coverage through your spouse whos still working, you may be able to delay coverage without paying a late enrollment penalty.7 There are a lot of nuances find out about those and other situations here.

If you have Lou Gehrigs disease , end-stage renal disease , or youre under 65 and you are receiving Social Security Disability Insurance benefits, find out about enrollment here.

B Covers 2 Types Of Services

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive services: Health care to prevent illness or detect it at an early stage, when treatment is most likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts

You May Like: Is The Pneumonia Shot Covered By Medicare

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

The Basics Of Medicare And Fehb Coverage

Lets start with the basics. While working, you pay into the Medicare system. Part A, which covers basic hospitalization, is premium-free in retirement for nearly all working adults. Along with Part A, Medicare has additional separate parts:

-

Part B: Covers a majority of medical expenses

-

Part D: Offers prescription drug coverage through private insurance

You can also enroll in various Medicare Advantage plans, called Part C.

Most federal employees enjoying FEHB coverage can continue it into retirement if they are eligible for an immediate FERS pension AND have been enrolled in FEHB for the five years before retirement or when first eligible. For more information on eligibility requirements, please reference the OPM website.

FEHB is perhaps the most valuable benefit provided to federal employees and their families, which begs the question of whether enrollment in Medicare Part B is necessary. Before we dive into the ins and outs of FEHB vs. Medicare Part B, lets first look at who is eligible for Medicare. Most people who fit into one of the following categories can take advantage of Medicare:

-

People age 65 and older

-

People younger than 65 with specific disabilities

-

People of any age with end-stage renal disease, which includes renal failure requiring either a transplant or regular dialysis

Don’t Miss: How Much Does Medicare Cost The Average Person

What If I Need To Be In A Nursing Home

Medicare covers most of the costs associated with skilled nursing after an inpatient stays in the hospital. If you have both Medicare and Medicaid, a stay at a skilled nursing facility will cost very little.

After inpatient treatment, many patients need more outpatient care in the home setting. To learn how to get financial assistance for home health care, read How to Qualify for Home Health Care & Get Financial Assistance.

If you require assisted living because you are no longer able to live independently, read Does Medicare Cover Assisted Living Costs? What About Independent Living?

If you need long-term care and have limited resources, Medicaid can help, however, strict asset limits do apply. We have a complete guide to long-term care if you need it.

What Is Covered By Medicare Part B

Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive.

The medically necessary coverage encompasses a variety of tests, procedures, and care options. A medical service or supply must be a requirement for treating or diagnosing a medical condition for Medicare to consider them medically necessary. Each situation is different, so a medical supply or service that is medically necessary for one person may not be for another.

It is easy to keep up with your general health needs through Medicares outpatient insurance by utilizing annual wellness visits.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Part B covers the following preventive care services:

- Mental Health Counseling

You can receive many preventive services and more at your annual wellness visit.

Alongside preventive care services, Medicare Part B covers certain outpatient services you receive in the hospital. These include:

If you are administered drugs while at the hospital, Medicare Part B will also provide coverage for these services.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read Also: How Does Medicare Work In Texas

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

|

2 or 3 months after you turn 65 |

In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

Whats The Penalty If You Dont Sign Up For Medicare

Summary:

Some people donât realize that there may be penalties for not signing up for Medicare when theyâre first eligible. Most people donât pay a late-enrollment penalty for Medicare Part A. If you delay enrollment in Medicare Part B and/or Medicare Part D, you might face penalties. Donât worry â there are usually ways to avoid these penalties. Weâll take you through some common scenarios.

Recommended Reading: A Medicare Supplement Policy Must Not Contain Benefits Which

Are You Turning 65

You should sign-up for Medicare benefits a few months before you turn 65 to avoid a break in coverage. You’re eligible to enroll in Medicare Part B at age 65 even if you are not eligible for Medicare Part A.

- Sign up for Part B when first eligible to avoid a late enrollment penalty.

- If your sponsor is on active duty, you may delay Part B enrollment without penalty.

- Get started with Medicare

If you didn’t sign up for Medicare Part B when you first became eligible, or you dropped it, you can sign up during Medicare’s general enrollment period . You may have to pay a Medicare Part B Late Enrollment PenaltyYour monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B, but didn’t sign up for it..

Do I Have To Get Medicare Part B Before I Get Medicare Part D

Medicare Part D is optional you dont have to sign up for it. Part D is the prescription drug coverage part of Medicare. But you dont automatically get Part D, even if youre one of the many who get enrolled in Medicare Part A and Part B automatically. Original Medicare, Part A and Part B, doesnt include prescription drug coverage, except in certain cases.

Recommended Reading: How Do I Apply For Medicare In Missouri

Whos Eligible For Medicare Part B

Anyone whos eligible for Medicare is eligible for Part B, and thats anyone who is 65 or older, younger people with disabilities who have been receiving Social Security disability insurance benefits for 24 months and people with end-stage renal disease.3 Also, anyone who has Amyotrophic Lateral Sclerosis or Lou Gehrigs disease.

If youre not sure if youre eligible, try Medicares eligibility tool.

Medicare Part B: What It Covers What It Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Part B is the portion of Medicare that covers most doctor visits and other outpatient medical services. It also covers durable medical equipment and preventive services.

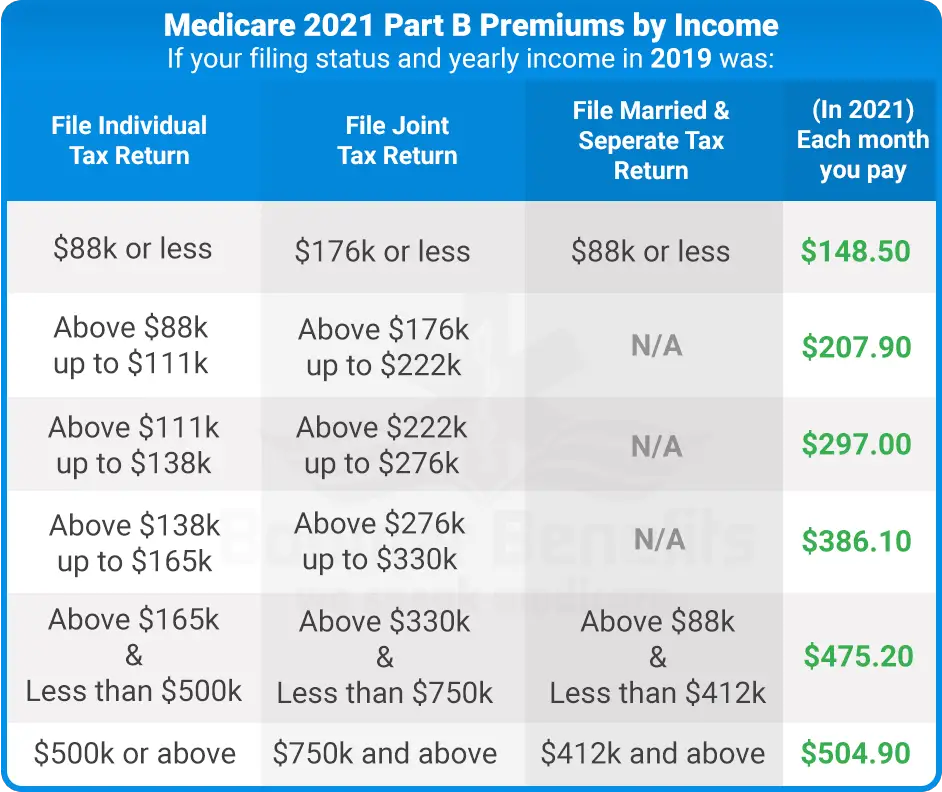

Most people pay a premium of $170.10 per month in 2022. You might pay more if your income exceeds certain thresholds.

Heres what you should know about Medicare Part B.

Also Check: Does Medicare Advantage Cover Hospice

What Happens If You Opt Out Of Part B

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. Youll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active. In my opinion, most Veterans should sign up for Part B.

Also Check: Does Medicare Pay For Vascepa

Do I Qualify For A Medicare Special Enrollment Period

Perhaps, if you or your spouse is still working and you have health insurance from that employer. The special enrollment period allows you to sign up for Medicare Part B throughout the time you have coverage from your or your spouses employer and for up to eight months after the job or insurance ends, whichever occurs first.

If you enroll at any point during this time, your Medicare coverage will begin the first day of the following month. And you will not be liable for late penalties, no matter how old you are when you finally sign up.

Your decision also depends on the size of your employer and whether the employers plan is first in line to pay your medical bills or second.

Larger companies. If you or your spouse work for a company with 20 or more employees, you can delay signing up for Medicare until the employment ends or the coverage stops, whichever happens first. These large employers must offer you and your spouse the same benefits they offer younger employees and their spouses, which means that the employers coverage can continue to be your primary coverage and pay your medical bills first.

Many people enroll in Medicare Part A at 65 even though they have employer coverage, because its free if they or their spouse has paid 40 or more quarters of Medicare taxes. But they often delay signing up for Part B while theyre still working so they dont have to pay premiums for both Medicare and the employer coverage.

Keep in mind

Also Check: Does Medicare Part A Or B Cover Prescriptions

Medicare Part B: Doctors And Tests

Medicare Part B covers a long list of medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatment.

You’re not required to enroll in Part B if you have “” from another source, such as an employer or spouse’s employer. If you don’t enroll and you don’t have creditable coverage from another source, you may have to pay a penalty if you enroll later.

You pay a monthly premium for Part B. In 2022, the standard cost is $170.10, up from $148.50 in 2021. If you’re on Social Security, this may be deducted from your monthly payment.

The annual deductible for Part B is $233 in 2022. Once you meet the deductible, you pay 20% of the Medicare-approved cost of the service, provided your healthcare provider accepts Medicare assignment. But beware: There is no cap on your 20% out-of-pocket expense.

For example, if your medical bills for a certain year were $100,000, you could be responsible for up to $20,000 of those charges, plus the charges incurred under Part A and D umbrellas. There is no lifetime maximum.

Kathryn B. Hauer, MBA, CFP®, EA, a financial advisor with Wilson David Investment Advisors in Aiken, S.C., and author of Financial Advice for Blue Collar America, explains:

On the other hand, you pay nothing for most preventive services, such as diabetes screenings and flu shots, if you receive those services from a provider who accepts Medicare assignment.