What Happens When You Turn 65

- If you already receive benefits from Social Security or the Railroad Retirement Board , youll be automatically enrolled in traditional Medicare, aka Original Medicare. This consists of Part A hospital insurance and Part B medical insurance. Your Medicare coverage usually starts the first day of the month you turn 65. You should expect to receive your Medicare card in the mail three months before your 65th birthday.

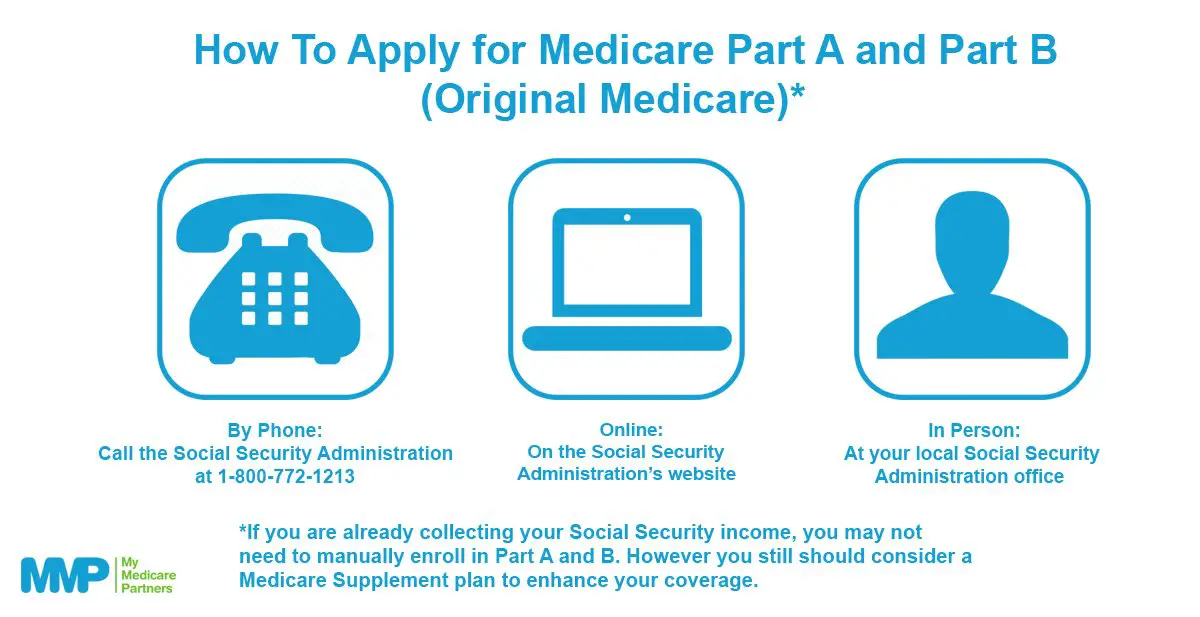

- If you dont receive Social Security or RRB benefits, youll need to enroll. You can sign up for Medicare with Social Security online, over the phone, or in person. You should enroll as soon as your Medicare eligibility period begins, even if youre not ready to receive Social Security retirement benefits.3

- If you dont have any other type of health insurance, you should enroll in Medicare Parts A and B when you turn 65. But if youre still working and you have health insurance through an employer or union, you may not have to enroll in Part B. We talk more about delaying Part B enrollment below.

Is Medicare Ever Free

By and large, Medicare is not considered free. Because you have been contributing to your Medicare services through taxes throughout your life, you will have contributed money to Medicare regardless of the current cost of your copayments or premiums.

However, it’s possible to receive assistance for your Medicare Part A and Part B premiums, copays, and other fees. This is called a Medicare Savings Program, which is state-funded help with paying your premiums.

In some situations, Part A and Part B deductibles, coinsurance, and copayments may be paid as well.

If you receive Social Security benefits, it may feel like Medicare is free because your Part B premiums can be automatically deducted from your benefit checks, but you are still paying for your coverage.

Though this doesnât necessarily make Medicare free, it’s definitely worthwhile to check out the Medicare Savings Program if you need financial assistance.

Read more: Is Medicare Coverage Free at Age 65?

Medicare Savings Programs: How It Works

Those with limited income and resources may qualify for premium assistance through Medicare Savings Programs . Each state manages MSP funds and decides who qualifies. Programs can pay for all, or just some, of your Medicare out-of-pocket expenses, which includes premiums. MSPs are primarily designed for Original Medicare plan enrollees, so all states must help eligible citizens with premium payments. However, states can decide whether to help pay Medicare Advantage premiums . When it comes to Medicare Part D, people who qualify for certain MSPs can receive help with premium payments through a separate program called Extra Help.

Recommended Reading: Does Medicare Have Silver Sneakers

Help Paying Original Medicare Premiums

Most MSPs provide help for Medicare Part A or Part B only. All programs require eligibility for Medicare Part A, but the main difference between each is the federal poverty level range that those seeking help must be within.

Parts A and B: The Qualified Medicare Beneficiary program is the only Medicare assistance program that pays premiums for both parts of Original Medicare. All states must provide Medicaid to QMB enrollees for Medicare cost-sharing, according to the Social Security Administration. Cost-sharing is the amount of money you would have to spend in premiums, deductibles, copayments and coinsurance. But if youre approved as a QMB, you are not responsible for paying any cost-sharing, according to the Center for Medicare Advocacy. This means that your Medicare costs, including your premiums, are 100% covered.

To qualify for the QMB program, your income must not exceed 100% of the FPL. You generally start receiving assistance the month following your approval. So, for example, if you were approved in June, you will start receiving assistance in July.

Part A Only: If you need help with just your Part A premiums, you may get assistance through the Qualified Disabled and Working Individual program. To get full or partial aid, you must:

Part B Only: Both the Specified Low-Income Medicare Beneficiary and Qualifying Individual programs will help pay for Medicare Part B premiums.

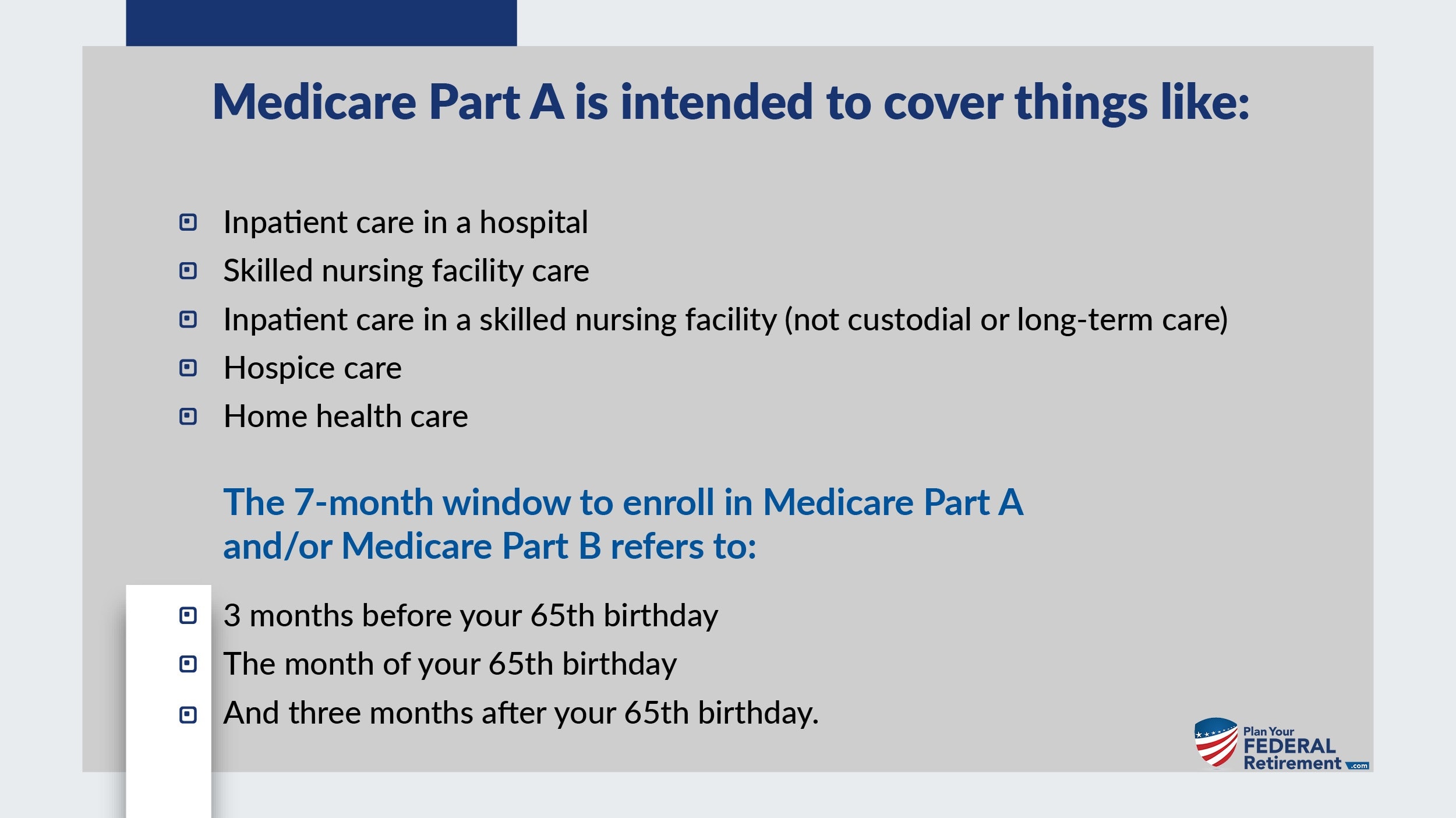

How Long Can You Stay In A Nursing Home With Medicare

Medicare covers up to 100 days of care in a skilled nursing facility each benefit period. If you need more than 100 days of SNF care in a benefit period, you will need to pay out of pocket. If your care is ending because you are running out of days, the facility is not required to provide written notice.

Read Also: Does Medicare Cover Home Health Care After Surgery

How Much Does Medicare Cost On Disability

If you qualify for SSDI, you’ll typically qualify for premium-free Medicare Part A based on your work record. Part B requires a monthly premium , automatically deducted from your Social Security check. You can technically opt out of Part B if you dont want to pay the premiums. Just know that without Part B, youll forego extensive medical coverage. Its usually not a good idea to opt out of Part B unless you have other health insurancelike from an employer.

How Do I Qualify For The Part B Premium Giveback Benefit

You may qualify for a premium reduction if you:

- Are enrolled in Medicare Part A and Part B

- Do not already receive government or other assistance for your Part B premium

- Live in the zip code service area of a plan that offers this program

- Enroll in an MA plan that provides a giveback benefit

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

You May Like: Does Medicare Pay For A Rollator

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2021, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

C Plans Are An Alternative To Original Medicare

Medicare Advantage plans provide Part A and Part B benefits. Most plans have built-in Part D prescription drug coverage. Some also offer other benefits, such as vision and dental coverage. You must continue to pay your Part B premium when you join Medicare Advantage.

There are specific times when you can enroll in Medicare Advantage. These include:

- Your Initial Enrollment Period , which starts three months before your 65th birthday and ends three months afterward.

- The annual Open Enrollment Period from October 15 to December 7, when you can switch between Original Medicare and Medicare Advantage.12

- The Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31 each year. If youre already enrolled in a Medicare Advantage plan, you can switch to a different one or drop your plan and return to Original Medicare.

Recommended Reading: What Does Medicare Cost Me

Help Paying Medicare Prescription Drug Premiums

You may be able to get help with Medicare premiums for your prescription drug coverage through the Part D Low-Income Subsidy program, also called Extra Help. You are automatically eligible for LIS if you qualify for the QMB, SLMB, or QI program. You will most likely receive 100% assistance in paying your Part D premiums if you qualify for Extra Help, according to My Medicare Matters. The LIS program offers three levels of help based on your income and resources. The fewer income and resources you have, the more assistance you can get. You may qualify if your income and resources are equal to or less than these limits.

Which Companies Offer Part B Premium Reduction

Humana Medicare Advantage options include the give-back feature on some plans. In some areas, Cigna may also have a Part B premium reduction plan. Even Aetna has a Part B give back in some areas. Further, there are likely more companies offering this type of policy than just the ones weve mentioned. Also, consider the plan ratings before you enroll.

Read Also: Do I Need To Keep Medicare Summary Notices

Medicare Part B Eligibility Requirements

Medicare Part B is a health insurance option that becomes available for people in the United States once they reach age 65. However, there are some special circumstances under which you may qualify to enroll in Medicare Part B before the age of 65.

Below, you will find the eligibility requirements for enrolling in Medicare Part B.

What Happens If You Enroll In Part D Late

If you dont enroll in Part D when youre first eligible and you didnt have other drug coverage for 63 consecutive days, Medicare may charge a penalty when you enroll, adding it to your monthly premium. Part D premiums vary by plan.

If youre concerned about drug coverage costs, Medicare has a program called Extra Help for people with limited incomes. There is no Part D penalty if you get Extra Help.13

You May Like: Does Medicare Cover Skin Removal

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the plan’s denial for a service to be provided.

The Right to Information About All Treatment Options

You have the right to know about all your health care treatment options from your health care provider. Medicare forbids its health plans from making any rules that would stop a doctor from telling you everything you need to know about your health care. If you think your Medicare health plan may have kept a provider from telling you everything you need to know about your health care options, then you have the right to appeal.

How Much Does Medicare Part B Cost

The out-of-pocket costs for Part B include a premium, deductible, and coinsurance. Part B will cover 80% of your medical expenses once youve met the annual deductible. You must pay the monthly premium for Part B. Most beneficiaries will pay the standard monthly premium. Those in a higher income bracket will pay more.

In 2021, the Part B premium is $148.50 a month. If you receive Social Security, Railroad Retirement Board, or Office of Personnel Management benefit payments, your Part B premium will be deducted from your monthly check. Part B has an annual deductible of $203. This deductible can slightly increase each year.

If you dont receive Social Security, you could get a monthly bill from Medicare. They have an online payment option called Easy Pay for those with a MyMedicare account.

You May Like: How Is Medicare Part B Penalty Calculated

Does My Medicare Cover Dental

Medicare doesnt cover most dental care, dental procedures, or supplies, like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices. Part A can pay for inpatient hospital care if you need to have emergency or complicated dental procedures, even though it doesnt cover dental care.

Can I Delay Enrolling In Medicare Part B

Some people may get Medicare Part A premium-free, but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B comes with a monthly premium, some people may choose not to sign up during their initial enrollment period if they are currently covered under an employer group plan .

If you are still working, you should check with your health benefits administrator to see how your insurance would work with Medicare. If you delay enrollment in Medicare Part B because you already have current employer health coverage, you can sign up later during a Special Enrollment Period without paying a late penalty. You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends , you have an eight-month special enrollment period to sign up for Part B without a late penalty.

Keep in mind that retiree coverage and COBRA are not considered health coverage based on current employment and would not qualify you for a special enrollment period. If you have COBRA after your employer coverage ends, you should not wait until your COBRA coverage ends to sign up for Medicare Part B. Your eight-month Part B special enrollment period begins immediately after your current employment or group plan ends . This is regardless of whether you get COBRA.

You May Like: How Old Before Eligible For Medicare

How Do I Qualify For Part D Prescription Drug Medicare Benefits

Anyone enrolled in any part of Original Medicare is eligible to sign up for a Medicare Part D Prescription Drug Plan.

Although enrollment in Part D is entirely voluntary, you must have creditable prescription drug coverage in order to avoid a late enrollment penalty if you decide to enroll after you first become eligible.

In other words, you can delay enrolling in Part D if you have prescription drug coverage through an employer or union health insurance plan. When your other coverage ends, you can enroll in Medicare coverage for prescription drugs without paying a monthly penalty.

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

You May Like: What Is A Medicare Special Needs Plan

How Much Does Medicare Cost

Original Medicare

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services.Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare.The amounts of deductibles and copayments change at the beginning of each year.

Part A – Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security “credits” as you work and pay taxes. For each year that you work, you earn 4 credits.

| $458 | $471 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease

How To Apply For Medicare Part B

If you’re nearing 65 and you’re not receiving Social Security or Railroad Retirement Board benefits, you’ll want to apply for Part B as soon as you can. Similar to Part A, you can apply doing any of the following:

- Call the Social Security Administration at

- Go to your local Social Security office

- Sign up online at ssa.gov

If you already receive Social Security or RRB benefits, you don’t need to do anything. You’ll receive a Medicare red-white-and-blue card about three months before your 65th birthday. If disabled, you’ll receive your card during your 25th month of disability. Even if you dont want Part B, you can follow the instructions on that same card and return it.

Also Check: How Do I Pay Medicare Premiums