How Much Does Fehb Cost After Retirement

FERS retirees must choose 50% or 25% survivors annuity for your spouse to qualify for FEHB coverage upon retirement after the annuitants death. The 50% election will cost you 10% of your full annuity and the 25% survivors annuity election will cost you 5% of your full annuity upon retirement.

What is the cost of FEHB for retirees? For retirees and non-postal workers in the largest FEHB plan, Blue Cross/Blue Shield standard, the biweekly self-only enrollment rates increase by $6.54 to $123.45, self-plus one by $13.66 to $280.81 and for family coverage with $13.38 to $300.12.

How Long Do Medicare Benefits Last For People With Disabilities

As long as youre receiving Social Security disability benefits, your Medicare coverage will continue. In some cases, your Medicare coverage can extend beyond your disability payments.

For example, if you return to work and become ineligible for SSDI, you could stay on Medicare for another eight and a half years93 monthsas long as your disability persists. However, you have to opt in to your employers health plan if they offer one.

In this case, your employer’s health plan would become the primary payer, and Medicare would pay secondary . Unfortunately, if your employer offers only an HSA plan, you wont be able to use Medicare since HSAs and Medicare dont mix.

How Do I Get Full Medicare Benefits

If youve worked at least 10 years while paying Medicare taxes, there is no monthly premium for your Medicare Part A benefits. But if you havent worked, or worked less than 10 years, you may qualify for premium-free Part A when your spouse turns 62, if she or he has worked at least 10 years while paying Medicare taxes. However, to be eligible for Medicare, you need to be 65 years old. You also need to be an American citizen or legal permanent resident of at least five continuous years.

So, to summarize with an example:

- Bob is 65 years old. Hes on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

Read Also: Are Motorized Wheelchairs Covered By Medicare

B Premium Reduction Give Back Plans

The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isnt available in all areas. Those with this plan may see a higher amount on their Social Security check, depending on their Part B premium payment method.

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Don’t Miss: How Soon Before Turning 65 Do You Apply For Medicare

Can I Stop My Medicare Part B

You can voluntarily terminate your Medicare Part B . Its a serious decision. You must have a face-to-face meeting with Social Security before you can terminate your Medicare Part B coverage. Call the SSA or your local Social Security office to schedule your interview.

What happens if you opt out of Medicare Part B?

Canceling Part B Because You Were Automatically Enrolled But Beware: If you opt out of Part B without proper coverage that is, employer-sponsored health insurance from your current job thats as good or better than Medicare you can you are late enrollment fines down the line.

Can you stop taking Medicare Part B?

You can voluntarily terminate your Medicare Part B . However, as this is a serious decision, you may need to have a face-to-face meeting. A Social Security representative will assist you in completing Form CMS 1763. You may also contact the nearest Social Security office.

What Is The Part B Premium Reduction Plan

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage, youll see a section that says Part B premium buy-down this is where you can see how much of a reduction youll get. Although, your agent or the customer service number on the back of your card can also tell you about the coverage.

Don’t Miss: What Does Medicare Part B Include

C Plans Are An Alternative To Original Medicare

Medicare Advantage plans provide Part A and Part B benefits. Most plans have built-in Part D prescription drug coverage. Some also offer other benefits, such as vision and dental coverage. You must continue to pay your Part B premium when you join Medicare Advantage.

There are specific times when you can enroll in Medicare Advantage. These include:

- Your Initial Enrollment Period , which starts three months before your 65th birthday and ends three months afterward.

- The annual Open Enrollment Period from October 15 to December 7, when you can switch between Original Medicare and Medicare Advantage.12

- The Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31 each year. If youre already enrolled in a Medicare Advantage plan, you can switch to a different one or drop your plan and return to Original Medicare.

Do You Have To Sign Up For Medicare When Youre 65

As long as you have creditable coverage, you dont have to enroll in Medicare when you are 65. Technically, you dont have to sign up for Medicare at all if you dont want to. Medicare is not mandatory, but it is important to be aware that if you choose to sign up later without creditable coverage, youll incur penalties that you may be stuck with for the rest of your life.

The most common reason a new beneficiary may delay enrolling in Medicare is that they have coverage through their employer. However, not all group coverage is creditable coverage. The size of your employer will determine if the coverage is creditable.

Also Check: Who To Talk To About Medicare

What Happens When You Turn 65

- If you already receive benefits from Social Security or the Railroad Retirement Board , youll be automatically enrolled in traditional Medicare, aka Original Medicare. This consists of Part A hospital insurance and Part B medical insurance. Your Medicare coverage usually starts the first day of the month you turn 65. You should expect to receive your Medicare card in the mail three months before your 65th birthday.

- If you dont receive Social Security or RRB benefits, youll need to enroll. You can sign up for Medicare with Social Security online, over the phone, or in person. You should enroll as soon as your Medicare eligibility period begins, even if youre not ready to receive Social Security retirement benefits.3

- If you dont have any other type of health insurance, you should enroll in Medicare Parts A and B when you turn 65. But if youre still working and you have health insurance through an employer or union, you may not have to enroll in Part B. We talk more about delaying Part B enrollment below.

How Long Can I Keep Fehb In Retirement

Most employees are aware of this five-year rule however, theyre not clear on what that five-year rule really means. It does not mean that the employee had to be in the same FEHB subscription for five years. Employees are allowed to change carrier, plan, and type of coverage within that five-year period.

How does FEHB work after retirement?

Once employees retire and have chosen to keep their FEHB coverage after retirement, they start paying the premium with after-tax cash. While they work, they pay the FEHB premium with pre-tax money, but when they retire, they pay it with after-tax money.

Do federal employees get medical benefits when they retire?

After retirement, federal employees enjoy a monthly annuity and medical coverage. To qualify for coverage, you must meet minimum service requirements, which include being covered as a federal employee for at least five years. Your spouse will receive coverage without the five-year plan.

You May Like: How Much Do Medicare Supplements Increase Each Year

When You Should Consider Enrolling In Medicare Part B

If you qualify to delay enrolling in Medicare, deciding to do so is a personal choice.

Some may choose to delay, and for others, it may still be a good fit for your health and lifestyle to enroll in Part B. Consider the following when trying to decide whether to enroll in Part B or delay while still working:

- Is Medicare less expensive than your current health insurance?

- Does Medicare offer better coverage than your current health insurance?

- Do you want to keep your current insurance but also take advantage of Medicare benefits

- Do you want to enroll in either a Medigap or Medicare Advantage plan?

- Is your prescription drug coverage considered creditable by Medicare?

Answering the above questions can help you decide whether or not to delay enrollment. Its important to carefully consider the last item regarding prescription drug coverage. While most employer coverage is considered creditable, you should still verify if it is or could end up facing a late enrollment penalty for Medicare Part D.

Medicare Part B Enrollment Options And Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you dont have to enroll in Part B, particularly if youre still working when you reach age 65.

However, if you dont qualify for a Special Enrollment Period , then you may incur penalty charges. These penalty charges are indefinite for as long as you keep Medicare Part B. When should you enroll in Medicare Part B? If youre not automatically enrolled because of the aforementioned conditions, then here are your enrollment options:

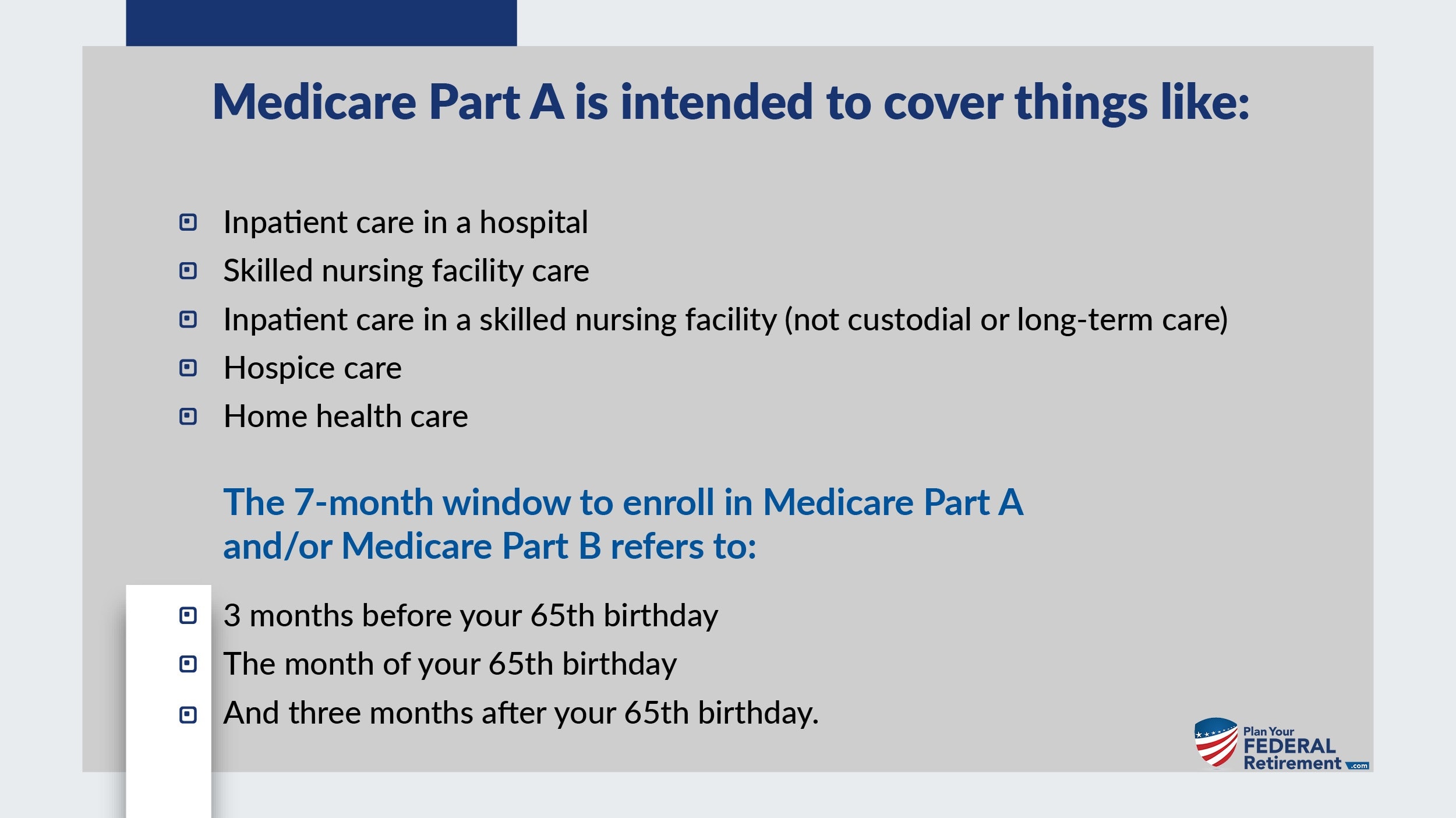

- You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

- If you delay enrollment, then you have to wait until the next general enrollment period begins. For Medicare Part B, you have from January 1 through March 31 to enroll. Coverage doesnt begin until July.

Read Also: How To Apply For Medicare By Phone

Who Is Eligible For Medicare Part A

You qualify for Medicare Part A if you:

- Meet the U.S. citizenship or permanent residency requirements and

- Youre 65 or older, or

- Youre under 65 and get

- Disability benefits from Social Security for at least 24 months, or

- Disability benefits because you have ALS , or

- Treatment as a kidney dialysis or kidney transplant patient.

How Much Does Fehb Cost Per Month

The monthly maximum government contribution is $530.53 for Self Only, $1,136.70 for Self Plus One, and $1,243.95 for Self and Family.

Why is FEHB so expensive?

There are a number of reasons why having FEHB is so rare and valuable. First, few employers offer comparable coverage. This means that if you pay $400 per month in FEHB premiums, the total premium cost will be approximately $1,400 per month. It would cost a lot more than that to find comparable coverage on your own.

Do you pay for FEHB?

You must pay both the government and the employee share of the costs. Premium conversion is a method of reducing your taxable income by the amount of your FEHB insurance premium.

Read Also: Does Medicare Cover Long Term Health Care

How To Apply For Medicare

Medicare enrollment is easier than ever. Once you meet eligibility requirements, you are ready to choose from a variety of plans in which to enroll. As we mentioned earlier, some beneficiaries can receive automatic enrollment, and some have to apply manually.

There are three ways to apply for Medicare Part A and Part B:

If you have previously been a railroad employee, you can enroll in Medicare by contacting the Railroad Retirement Board, Monday Friday, from 9:00 AM 3:30 PM at 1-877-772-5772.

Medicare applications generally take between 30-60 days to obtain approval.

Medicare Age: When Are You Eligible For Medicare

Your 65th birthday may feel like a special occasion. You might retire this year. You might also start qualifying for all the senior discounts when shopping or eating out.

Perhaps one of the most important benefits you now qualify for is Medicare. Medicare was established in 1965 to cover Americans age 65 and over. It has since expanded to cover people under age 65 with serious health problems.

According to the Kaiser Family Foundation, 16% of the Medicare population is made up of people with disabilities and 84% is made up of people age 65 or older. When someone with disabilities turns 65, their Medicare coverage continues.

NEW TO MEDICARE?

You May Like: Does Medicare Have Life Insurance

What Happens After I Register For Medicare Online

Once you have submitted your application, it will be reviewed by Medicare to ensure all the information is accurate and complete. You should double-check your contact information to make sure it is correct. This is important to ensure prompt delivery of your Identification Card, as well as in the event Medicare needs to contact you about your enrollment.

After your application is received and processed, a letter will be mailed to you with the decision. If you encounter any questions or problems during the process, you can always contact Social Security for assistance.

How Can Enrollment Periods Affect My Eligibility For Medicare Supplement Plans

The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Periodfor most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months. This is when you can get any Medicare Supplement plan thats available in your area, regardless of any health issues you may have. The insurance company cant charge you more if you have health problems or deny you coverage because of pre-existing conditions. Your special protections during this period are known as guaranteed-issue rights.

Keep in mind that even though a Medicare Supplement insurance company cannot reject your enrollment for health reasons, the company is allowed to make you wait up to six months before covering your pre-existing conditions. After this six-month waiting period is over, the plan will cover your pre-existing conditions. This pre-existing condition waiting period may apply even if you enroll in a Medicare Supplement plan during your Medicare Supplement Open Enrollment Period.

Don’t Miss: How To Avoid Medicare Part D Penalty

If I Retire At Age 62 Will I Be Eligible For Medicare At That Time

Fact checked Reviewed by: Leron Moore, Medicare consultant –

Medicare is federal health insurance for people 65 or older, some younger people with disabilities, and people with end-stage kidney disease. Most commonly, you are eligible for Medicare when you turn 65, but there are other health insurance options if you are younger and do not have coverage through you or your spouses employer.

What you should know

- 1The typical age requirement for Medicare is 65, unless you qualify because you have a disability.

- 2If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare.

- 3You have options for health insurance if you are too young for Medicare. You may obtain it through your employer, or you can purchase from private-sector insurance companies through the health insurance exchange. You may be eligible for Medicaid, which is based on income.

- 4If you retire before you are 65, you may be eligible for employer-provided group health insurance under the Consolidated Omnibus Budget Reconciliation Act .

Medicare was established in 1965 in order to provide health coverage for seniors who would otherwise not be covered by employer-sponsored health insurance plans. If you retire at the age of 62, you may be eligible for retirement benefits through social security, but early retirement will not make you eligible for Medicare.

When Do I Have To Sign Up For Medicare

If youre collecting Social Security, youll automatically be enrolled in both Part A and Part B. If youre not receiving Social Security, then youll want to sign up manually during your Initial Enrollment Period.

Three months before your 65th birthday, your Initial Enrollment Period window will start. Your IEP is a once-in-a-lifetime enrollment window that you dont want to miss.

If you do happen to miss it, youll have another opportunity to enroll during another enrollment period. However, you could get a penalty for not signing up when you first become eligible. The only way around the penalty is if you have creditable coverage.

Recommended Reading: How Do I Enroll In Medicare Part A And B