For Those Who Qualify There Are Multiple Ways To Have Your Medicare Part B Premium Paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

These Part B costs can add up quickly, which is why many beneficiaries search for a way to lower or be reimbursed for these expenses. The good news is they have options that can help maximize their savings while on Medicare.

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

Read on to learn about Part B savings options that you may be able to take advantage of.

What To Know About Medicare Part B Premiums

With proper planning, you can avoid unnecessary surprises, and hopefully save money on Medicare B premiums

There are many things to look forward to as you contemplate the next chapter of your life the chapter after full-time work comprised of travel, family, leisure and more purposeful work. However, in all of my years offering advice and guidance, I have never heard of planning for Medicare as one of them. But with proper planning, you can avoid unnecessary surprises, and hopefully save money on Medicare B premiums.

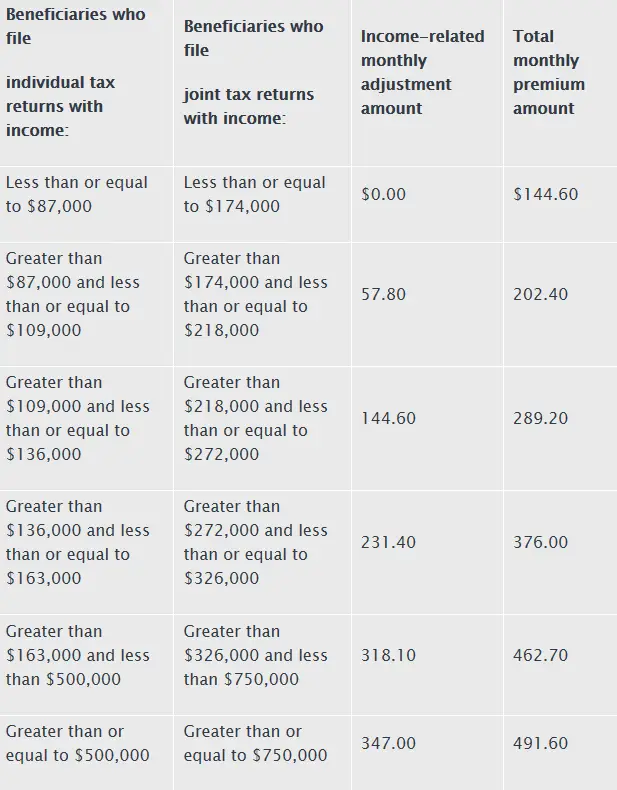

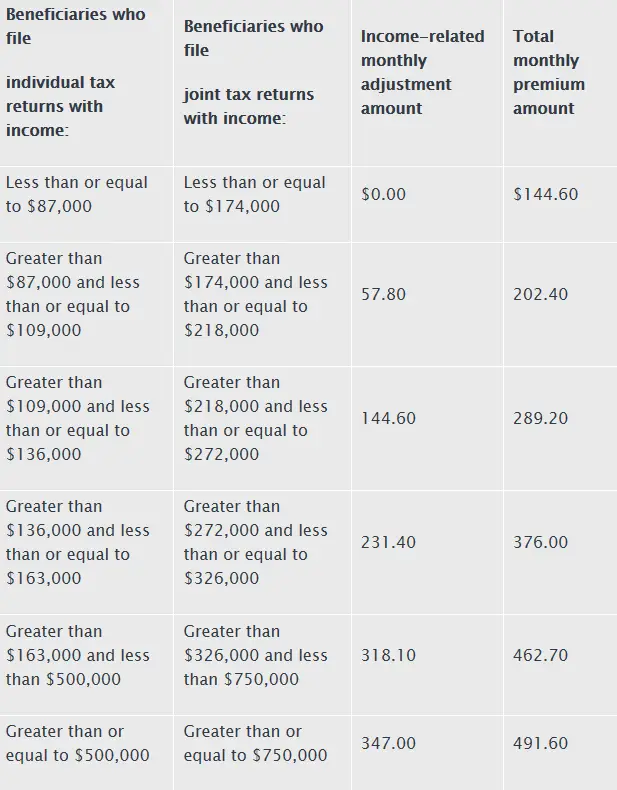

The amount of your Medicare Part B premium is based on your modified adjusted gross income . The higher your MAGI, the higher your potential premium. One thing to note about MAGI is that it is not universally applied. However, adjusted gross income is. AGI is a line item on your tax return, and everyone computes it using the same formula. The starting point for MAGI is generally AGI then adjustments are made specific to the particular provision in question. In the case of your Medicare premium, MAGI is your AGI plus tax-exempt interest. To make things a bit more complicated, your MAGI from two years prior is used. For example, to determine your 2019 premiums, your MAGI reported on your 2017 tax return is used. This is repeated each subsequent year. The premiums for Medicare Part B generally range from $135 to $460, per-month. The increase in the premium is an income-related monthly adjustment amount .

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or you may contact your local Social Security office to file your appeal. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services at 1-800-MEDICARE to make a correction. Social Security receives the information about your prescription drug coverage from CMS.

Don’t Miss: How Much Is Medicare Copay For A Doctor’s Visit

What Is The Medicare Part B Premium

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

- Medicare Part A is hospital insurance. It is available primarily to U.S. citizens and permanent residents age 65 and older. Most pay no premium for it.

- Medicare Part B covers other medically necessary services and preventative care like doctor’s services, lab tests, and outpatient care. Most pay a flat monthly premium for it, which is adjusted annually.

There is also a Medicare Part D, which covers prescription costs. It is available from insurance companies that are approved to offer it.

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

You May Like: Can You Draw Medicare At 62

The Daily Journal Of The United States Government

Legal Status

This site displays a prototype of a Web 2.0 version of the daily Federal Register. It is not an official legal edition of the Federal Register, and does not replace the official print version or the official electronic version on GPOs govinfo.gov.

The documents posted on this site are XML renditions of published Federal Register documents. Each document posted on the site includes a link to the corresponding official PDF file on govinfo.gov. This prototype edition of the daily Federal Register on FederalRegister.gov will remain an unofficial informational resource until the Administrative Committee of the Federal Register issues a regulation granting it official legal status. For complete information about, and access to, our official publications and services, go to About the Federal Register on NARA’s archives.gov.

Legal Status

Medicare Program Medicare Part B Monthly Actuarial Rates Premium Rates And Annual Deductible Beginning January 1 2022

A Notice by the Centers for Medicare & Medicaid Services on

Document Details

Information about this document as published in the Federal Register.

- Printed version:

- The premium and related amounts announced in this notice are effective on January 1, 2022.

- Effective Date:

Document Details

Document Statistics

- Page views:

- as of 01/02/2022 at 12:15 am EST

Document Statistics

Enhanced Content

Relevant information about this document from Regulations.gov provides additional context. This information is not part of the official Federal Register document.

- Docket Number:

- Medicare Part B Monthly Actuarial Rates, Premium Rates, and Annual Deductible Beginning January 1, 2021

- Docket RIN

Enhanced Content

This document has been published in the Federal Register. Use the PDF linked in the document sidebar for the official electronic format.

-

Enhanced Content – Table of Contents

This table of contents is a navigational tool, processed from the headings within the legal text of Federal Register documents. This repetition of headings to form internal navigation links has no substantive legal effect.

Enhanced Content – Table of Contents

Enhanced Content – Submit Public Comment

Enhanced Content – Submit Public Comment

Enhanced Content – Read Public Comments

Enhanced Content – Read Public Comments

Enhanced Content – Sharing

Enhanced Content – Document Print View

Enhanced Content – Developer Tools

Recommended Reading: Can I Submit A Claim Directly To Medicare

How Much Are Part D Irmaa Surcharges

For Part D, the IRMAA amounts are added to the regular premium for the enrollees plan .

Note that if you are a Medicare Advantage policy member and that plan includes prescription drug benefits then both Part B and Part D IRMAAs are added to the plan premium .

The following income levels trigger the associated IRMAA surcharges in 2022:

| Table 2. Part D 2021 IRMAA |

|---|

| Individual |

Source: CMS

Medicaid Part B Reimbursement Options

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.

Also Check: How To Win A Medicare Appeal

How Is A Beneficiarys Premium Determined

The Social Security Administration reviews a beneficiarys most recent federal tax information in order to determine what their premium will be. Based on the image below, the distribution of income among Medicare beneficiaries is represented by 50% with incomes below $23,500. And for those with incomes over $93,900, the beneficiary is required to pay a high premium. This adjustment is based on a sliding scale which is based upon the Modified Adjusted Gross Income and is the beneficiarys total adjusted gross income and tax-exempt interest income.

Chart source – KFF

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $170.10 a month for Part B premiums in 2022. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2022 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2022 is $233.

You May Like: How Much Do Medicare Plans Cost

E Regulatory Flexibility Act

The RFA requires agencies to analyze options for regulatory relief of small businesses, if a rule or other regulatory document has a significant impact on a substantial number of small entities. For purposes of the RFA, small entities include small businesses, nonprofit organizations, and small governmental jurisdictions. Individuals and States are not included in the definition of a small entity. This notice announces the monthly actuarial rates for aged and disabled beneficiaries enrolled in Part B of the Medicare SMI program beginning January 1, 2022. Also, this notice announces the monthly premium for aged and disabled beneficiaries as well as the income-related monthly adjustment amounts to be paid by beneficiaries with modified adjusted gross income above certain threshold amounts. As a result, we are not preparing an analysis for the RFA because the Secretary has determined that this notice will not have a significant economic impact on a substantial number of small entities.

establishes certain requirements that an agency must meet when it publishes a proposed rule or other regulatory document that imposes substantial direct compliance costs on State and local governments, preempts State law, or otherwise has federalism implications. We have determined that this notice does not significantly affect the rights, roles, and responsibilities of States. Accordingly, the requirements of do not apply to this notice.

How Much Are My Premiums

The Social Security Administration determines whether an Income-Related Monthly Adjustment Amount applies to your Medicare Part B and D premiums based on your Modified Adjusted Gross Income from two years prior.

For example, if you will be paying Medicare premiums in 2021, the SSA will determine if an IRMAA surcharge applies by reviewing your 2019 tax return. Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income . If that total for 2019 exceeds $88,000 or $176,000 , expect to pay more for your Medicare coverage.

The SSA has established five income tiers that determine the surcharge applicable to your base premiums amounts. For 2021, the monthly premium for Part B can range from $148.50 to a maximum amount of $504.90.

You can view the income thresholds and premium amounts on Medicare’s website. An important point to note is that these tiers are cliff-like, meaning that even one dollar over the top end of any tier will bump your premium surcharge up to the next level.

You might be asking what you can do if the income you reported two years ago is considerably different from your income today.

Read Also: What Weight Loss Programs Are Covered By Medicare

B Premium Can Be Limited By Social Security Cola But That Hasnt Been An Issue For Most Beneficiaries Since 2019

In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 , in 2020 , and in 2019 . Some enrollees pay more than the standard premium, if theyre subject to a high-income surcharge .

But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees. The COLA for 2022 was the largest it had been in 30 years, and more than adequate to cover even the substantial increase in Part B premiums.

How Much You Pay

Paying extra is something you might be able to avoid, but theres good news hidden in these extra charges.

First, heres how the charges break down as of 2022:

- Youll pay an extra $68 monthly for Part B and $12.40 extra for Part D if youre married and make $182,000 to $228,000 jointly, or $91,000 to $114,000 as an individual.

- Youll pay an extra $170.10 monthly for Part B and $32.10 extra for Part D if youre married and make $228,000 to $284,000 jointly, or $114,000 to $142,000 as an individual.

- Youll pay an extra $272.20 monthly for Part B and $51.70 extra for Part D if youre married and make $284,000 to $340,000 jointly, or $142,000 to $170,000 as an individual.

- Youll pay an extra $374.20 monthly for Part B and $71.30 extra for Part D if youre married and make more than $340,000 to $750,000 jointly or more than $170,000 to $500,000 as an individual.

- Youll pay an extra $408.20 monthly for Part B and $77.90 extra for Part D if youre married and make more than $750,000 jointly or more than $500,000 as an individual.

Each of the tiers is an all-or-nothing charge. You only have to be $1 into the next tier to pay the higher amount. There is no prorating within the tiers.

You can expect these figures and income thresholds to change somewhat annually due to inflation adjustments. And keep in mind that Medicare is always a hot political topic. Medicare law often changes as well.

Read Also: Does Medicare Cover End Of Life Care

Medicare Part B Premium

If you have Part B, youll need to pay a monthly premium. The standard monthly premium for 2022 is $170.10.

However, the amount of this premium can increase based on your income. People with a higher income typically pay whats known as an income-related monthly adjustment amount . For 2022, your income amount is calculated from your 2020 tax return.

The following individuals can enroll in original Medicare :

- people age 65 and older

- individuals with a qualifying disability

Eligibility for Part B depends on whether or not youre eligible for premium-free Part A. Most people get premium-free Part A because theyve paid Medicare taxes while working.

How Medicare Surcharges Are Determined

According to the Social Security Administration , your modified adjusted gross income from two years ago is what counts. This means that benefits for the current period are based on calculations from income you earned two years earlier. Most people’s MAGIs and adjusted gross incomes will be the same, but your MAGI may be different if youre paying student loan interest, alimony payments, moving expenses, or some other types of payments.

The SSA will look at your 2020 tax return to determine whether you owe surcharges in 2022. It’s done this way because the levels are normally set the year before, while the Social Security Administration only has access to returns from the prior tax year.

Also Check: Is Mutual Of Omaha A Good Medicare Supplement Company