When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |

Didnt Sign Up For Medicare Part B When 65

Not everyone signs up for Medicare Part B when they turn 65. Some seniors forget to sign up during open enrollment and sign up late. Additionally, there is a very large contingent of people who are playing by the rules and not signing up for Medicare Part B because they dont need the coverage yet. They have chosen to stay with job-based insurance.

Tips For Choosing A Medicare Part D Plan

Remember, the plan you choose isnt set in stone. If your needs change year to year, you can switch to another plan in the next open enrollment period. Youll have to stay in the plan an entire year, so choose carefully.

When using the Medicare plan finder to choose a Part D plan, enter your medications and doses, then select your pharmacy options. Of the available drug plans, youll see the lowest monthly premium plan displayed first. Keep in mind, the lowest premium plan may not fit your needs.

Theres a drop-down selection to the right of the screen listing three options: lowest monthly premium, lowest yearly drug deductible, and lowest drug plus premium cost. Click through all the options and look at your choices before making a final decision.

Recommended Reading: Is Inogen One Covered By Medicare

When Is The Best Time For Medicare Part D Enrollment

There are different times when you might qualify for Medicare Part D enrollment:

Initial Enrollment Period for Medicare Part D Enrollment

Your Initial Enrollment Period occurs when you first become eligible for Medicare. For most people, eligibility happens when you turn 65. The IEP begins three months before the month you turn 65. It includes your birthday month and the three months following for a total of seven months. During that time, you can enroll in a Part D Prescription Drug plan or a Medicare Part C plan that includes prescription drug coverage.

Fall Open Enrollment Period for Medicare Part D Enrollment

Medicare also offers a Fall Open Enrollment Period every year that runs from October 15 to December 7. This period allows for Medicare Part D enrollment as well. You can also switch from one prescription drug plan to another during this time.

Special Enrollment Period for Medicare Part D Enrollment

Special Enrollment Periods or SEPs offer the chance for Medicare Part D enrollment when certain events happen in your life. Those events might include changing where you live or losing your current coverage. If your current plan changes its contract with Medicare or you have an opportunity to get other coverage, you might also qualify for an SEP.

How Long Do People On Disability Have To Wait To Become Eligible For Medicare

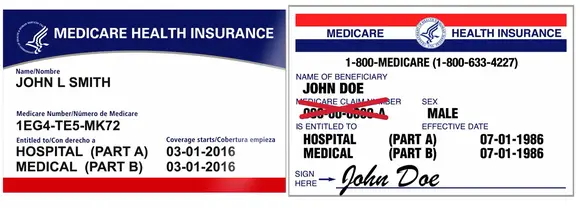

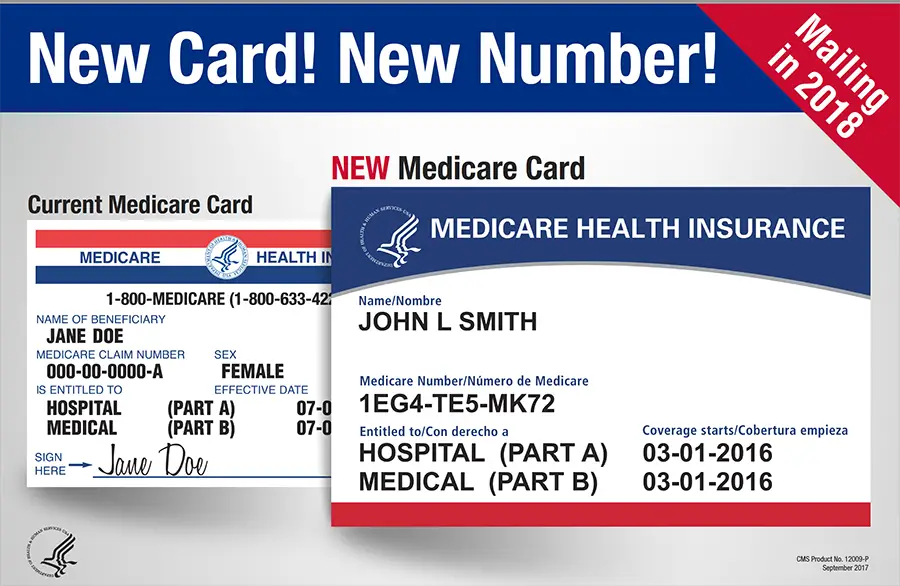

Once you have collected SSDI payments for two years, you will become eligible for Medicare. You wont even have to sign upMedicare will automatically enroll you in Part A and Part B and mail your Medicare card to you shortly before your coverage begins.

Thankfully, your 24-month waiting period doesnt have to be all at once. For example, if you qualify for SSDI, lose eligibility, then re-qualify for SSDI, each month you collect checks counts toward the total 24-month waiting period.

Similarly, if you apply for SSDI and are denied disability benefits, you can appeal the decision. If you appeal and the decision is reversed, your 24-month waiting period will be backdated to when your disability benefits should have started. The result: your wait for Medicare will be shorter than two years.

Read Also: Does Social Security Disability Include Medicare

I Want To Delay Part B

If you qualify and decide you want to delay enrolling in Medicare Part B, you should not face any late enrollment penalties for Part B. When you lose your employer coverage, you will get an 8-month Special Enrollment Period during which to enroll in Medicare Part B, and Part A if you havent done so already.

Youll also be able to enroll in a Medicare Advantage plan or Part D prescription drug plan in the first two months of this period. Note: if you enroll in Part C or Part D after the first two months of your Special Enrollment Period, you may face late enrollment penalties for Part D. Youll want to also ensure you provide proof of creditable coverage when you enroll in Part D.

You do not need to notify Medicare that you will be delaying Part B unless you are already receiving Social Security or Railroad Retirement Board benefits.

For Those Who Qualify There Are Multiple Ways To Have Your Medicare Part B Premium Paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

These Part B costs can add up quickly, which is why many beneficiaries search for a way to lower or be reimbursed for these expenses. The good news is they have options that can help maximize their savings while on Medicare.

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

Read on to learn about Part B savings options that you may be able to take advantage of.

Don’t Miss: What Is A Ppo Medicare Plan

Can You Enroll In Medicare Before You Turn 65

You may be eligible for Medicare before age 65 if:

- Youve received Social Security Disability Insurance for at least 24 months

- Youll get Medicare Part A and Part B automatically starting the first day of your 25th disability month. You should get your Medicare card in the mail three months before this date.

- You have Amyotrophic Lateral Sclerosis , or Lou Gehrigs disease

- Youll get Part A and Part B automatically in the month your SSDI benefits begin.

Note: Part B isnt automatic if you live in Puerto Rico.4 Youll have to contact Social Security to enroll.

- You have permanent kidney failure, or end-stage renal disease

- Youll need to sign up for Medicare yourself. Your coverage usually starts the first day of the fourth month of dialysis treatment or in the month youre admitted to a Medicare-certified hospital for a kidney transplant.5

A Word of Advice

If you dont have any other type of health insurance, you should enroll in Medicare Parts A and B when you turn 65.

Do I Have To Apply For Medicare Part B

If youre under age 65 and already receiving Social Security or Railroad Retirement Board disability benefits, youll be automatically enrolled in Medicare parts A and B when you turn 65. If you dont wish to have Medicare Part B, you can defer it at that time.

If youre not currently receiving these benefits, youll have to actively enroll in Medicare.

Important Medicare Deadlines

Its extremely important not to miss any Medicare deadlines, as this can cause you to face late penalties and gaps in your coverage. Here are the Medicare deadlines to pay close attention to:

- Original enrollment. You can enroll in Medicare Part B 3 months before, the month of, and 3 months after your 65th birthday.

- Medigap enrollment. You can enroll in a supplemental Medigap policy for up to 6 months after you turn 65 years old.

- Late enrollment. You can enroll in a Medicare plan or Medicare Advantage plan from January 1March 31 if you didnt sign up when you were first eligible.

- Medicare Part D enrollment. You can enroll in a Part D plan from April 1June 30 if you didnt sign up when you were first eligible.

- Plan change enrollment. You can enroll in, drop out of, or change your part C or Part D plan from October 15December 7, during the open enrollment period.

- Special enrollment. Under special circumstances, you may qualify for a special enrollment period of 8 months.

Read Also: How Long Does It Take To Get Medicare B

C Plans Are An Alternative To Original Medicare

Medicare Advantage plans provide Part A and Part B benefits. Most plans have built-in Part D prescription drug coverage. Some also offer other benefits, such as vision and dental coverage. You must continue to pay your Part B premium when you join Medicare Advantage.

There are specific times when you can enroll in Medicare Advantage. These include:

- Your Initial Enrollment Period , which starts three months before your 65th birthday and ends three months afterward.

- The annual Open Enrollment Period from October 15 to December 7, when you can switch between Original Medicare and Medicare Advantage.12

- The Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31 each year. If youre already enrolled in a Medicare Advantage plan, you can switch to a different one or drop your plan and return to Original Medicare.

How To Avoid The Medicare Part D Late Enrollment Penalty

You are not required to do your Medicare Part D enrollment during your IEP. However, if you go without Medicare Part D or other creditable prescription drug coverage for a continuous period of 63 days or longer after your IEP is over, you could be subject to a Part D late enrollment penalty. Coverage could come from a stand-alone prescription drug plan, a Medicare Advantage plan with prescription drug coverage , or another type of creditable prescription drug coverage.

The amount of the Part D late enrollment penalty depends on how long you went without prescription drug coverage. Medicare calculates the amount by multiplying the number of months you didnt have prescription drug coverage by 1% of the national base beneficiary premium. In 2021, the national base beneficiary premium is $33.06.

The penalty amount is added to your monthly premium and you will continue to pay the penalty as long as you are enrolled in Medicare Part D. You can avoid this penalty by ensuring you dont go without creditable prescription drug coverage for 63 days or longer. Creditable coverage pays at least as much as standard Medicare coverage for prescription drugs.

Medicare Part D enrollment is the first step in getting the coverage you need for your prescription medications. With multiple plans to choose from, it is helpful to compare plans carefully to find the right plan for you. You can start by entering your zip code on this page.

New To Medicare?

Recommended Reading: When Do I Apply For Medicare Benefits

Sign Up For Part B On Time

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month. If you dont sign up during that seven-month period, you can enroll during Medicares General Enrollment Period each year.

But for each 12-month period you go without Medicare coverage despite being eligible, youll be hit with a penalty that raises your Part B premium cost by 10 percent. Worse yet, that penalty will remain in effect for the rest of your life. The takeaway? If you want to save money, dont be late.

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Don’t Miss: How Does Medicare Part D Deductible Work

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Don’t Miss: Is A Psa Test Covered By Medicare

When You Must Enroll In Medicare Part B

You may be required to get Medicare Part B even when youre still working. There are two situations in which youmust get Part B when you turn 65.

In each of the above cases, you wont qualify for a Special Enrollment Period and cannot delay enrolling without incurring late enrollment penalties.

Additionally, some employer plans will automatically become secondary to Medicare when you become eligible. In this case, Medicare becomes your primary insurance and would pay first. If you do not have Medicare and need health care, you would essentially have almost no coverage from your employer plan. One such plan that operates like this is the militarys TriCare for Life.

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Are you eligible for cost-saving Medicare subsidies?

You May Like: Can I Buy Private Health Insurance Instead Of Medicare

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .