Tivity Health Silversneakers Fitness Program

AARP Medicare Supplement Insurance members in some states can now take advantage of the SilverSneakers Fitness program as a value-added service at no additional cost. With SilverSneakers, members have free access to fitness center amenities such as treadmills, weights, heated pools and group exercise classes that are included with a basic membership. Members can take signature SilverSneakers classes designed specifically for older adults and taught by certified instructors. SilverSneakers members have access to more than 13,000 participating fitness center locations . Log on to silversneakers.com to find the nearest location. SilverSneakers Steps® is available to members living 15 miles or more from a participating SilverSneakers fitness center location. Members can select one of four fitness kits each year that they can use at home or on the go.

Steps kits can be ordered online at silversneakers.com or by calling SilverSneakers Customer Service at 1-888-423-4632 Monday through Friday, 8 a.m. to 8 p.m. EST. The SilverSneakers Fitness Program is currently available in the state of Illinois.

How Can I Purchase A Medicare Supplement Plan

To purchase a Medicare Supplement plan, you must be enrolled in Original Medicare. The best time to enroll is during your Medigap Open Enrollment Period. This six-month period begins when you enroll in Medicare Part B.

There are a total of 10 Medicare Supplement plans available on the market. Named AN, each of these plans offers a different set of benefits.

During this period, insurance companies cannot subject you to medical underwriting. This is a process that can be used to raise your premiums or deny you coverage. Outside of this period, you are not guaranteed the ability to enroll in a Medicare Supplement plan. Each plan of the same type must cover the same standard set of benefits. However, your costs can vary from carrier to carrier.

When Can I Enroll In Aarp/unitedhealthcare Plan F

Technically speaking, you can enroll in AARP/UnitedHealthcare Plan F at any time. However, the best time to do so is during your Medigap Open Enrollment Period.

This enrollment period begins when you are at least 65 years old and enrolled in both Medicare Part A and Part B. Your Medigap OEP only lasts for six months.

During your Medigap Open Enrollment Period, you have guaranteed issue rights, which protect you from medical underwriting that can increase your premiums if you are in poor health.

Recommended Reading: Does Medicare Offer Dental Plans

What Are The Advantages Of Having Aarp

At $16 a year, AARP provides access to hundreds of benefits that help you live your best life. From health and financial tools, volunteering opportunities, travel and restaurant discounts, to everything in between, if it has to do with enriching the lives of people 50-plus, this is what AARP is all about.

What Is The Difference Between Plan G Vs Plan N

One way to evaluate AARP/UnitedHealthcare Plan N is to compare it to a leading Medicare Supplement Insurance plan like Plan G.

Plan G offers the greatest amount of coverage to new Medicare beneficiaries, and the table below shows how it compares to Plan N.

| Benefit |

|---|

As you can see, Plan N coverage is comparable to that of Plan G.

- Neither plan covers the Part B deductible, so the only real difference is Plan G coverage of Medicare Part B excess charges and the certain copayments for office and emergency room visits under Plan N.

- As mentioned earlier, Part B excess charges can be avoided simply by seeing only health care providers who accept Medicare assignment.

Plan N typically costs less than Plan G. The lowest available premium for 2022 AARP/UnitedHealthcare Plan G in Atlanta, GA, is $116.80 per month, while the lowest Plan N premium in Atlanta is $104.25 per month.

Recommended Reading: Will Medicare Pay For In Home Caregivers

Does Aarp Offer Life Insurance For Seniors

Whole life insurance policies that have no medical exam required always require you to pay higher premiums. AARP whole life insurance is mainly for senior citizens looking for funds to cover funeral expenses and pay minor debts. AARP permanent life insurance coverage also builds cash value over time.

Does Aarp/unitedhealthcare Plan F Offer Any Extra Benefits

In many locations, AARP/UnitedHealthcare offers two versions of Plan F. In addition to the standard version, there may also be a wellness extras version that comes with a gym membership and discounts on dental, hearing and vision care.

The wellness extra plan versions come with slightly higher premiums than the standard version. Only the standard version of Plan F was used for the price quotes above.

Also Check: Do I Need Medicare If I Have Medicaid

What Is The Most Expensive Medicare Supplement Plan

Known as first-dollar coverage because people don’t have to worry about costs the moment they walk into a doctor’s office or hospital, or use a lab, Plan F is the most expensive of the Medicare supplemental plans. Nearly everything except vision, dental, drugs, and equipment such as hearing aids is covered.

Expert Advice Right At Your Fingertips

If you have questions about the different plan options, are curious about plan benefits or just dont know where to start, thats OK. UnitedHealthcare is here and ready to help.

Call UnitedHealthcare today.

Our licensed insurance agents/producers are standing by to answer your questions or to help you set up an in-person appointment.

Also Check: How Does An Indemnity Plan Work With Medicare

What Does Aarp Medicare Supplement Plan G Cover

There are nine Medicare costs that can be covered by Medicare Supplement Insurance, and Plan G covers the following eight Medicare expenses :

The only thing Plan G does not cover is the Medicare Part B deductible, which was $203 for the year in 2021.

How Much Are The Copays For Medicare Supplement Plan N

In exchange for lower monthly premiums, you are responsible for a copay of $50 when visiting the emergency room and a $20 copay at the doctors office. Yet, there is no copay if you visit an urgent care center.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Thus, if you cannot get an appointment with your primary care physician, instead of going to the emergency room over something minor, you can go to urgent care and avoid copays. Remember that these copays will not count towards the Medicare Part B deductible.

Also Check: Will Medicare Cover Lasik Surgery

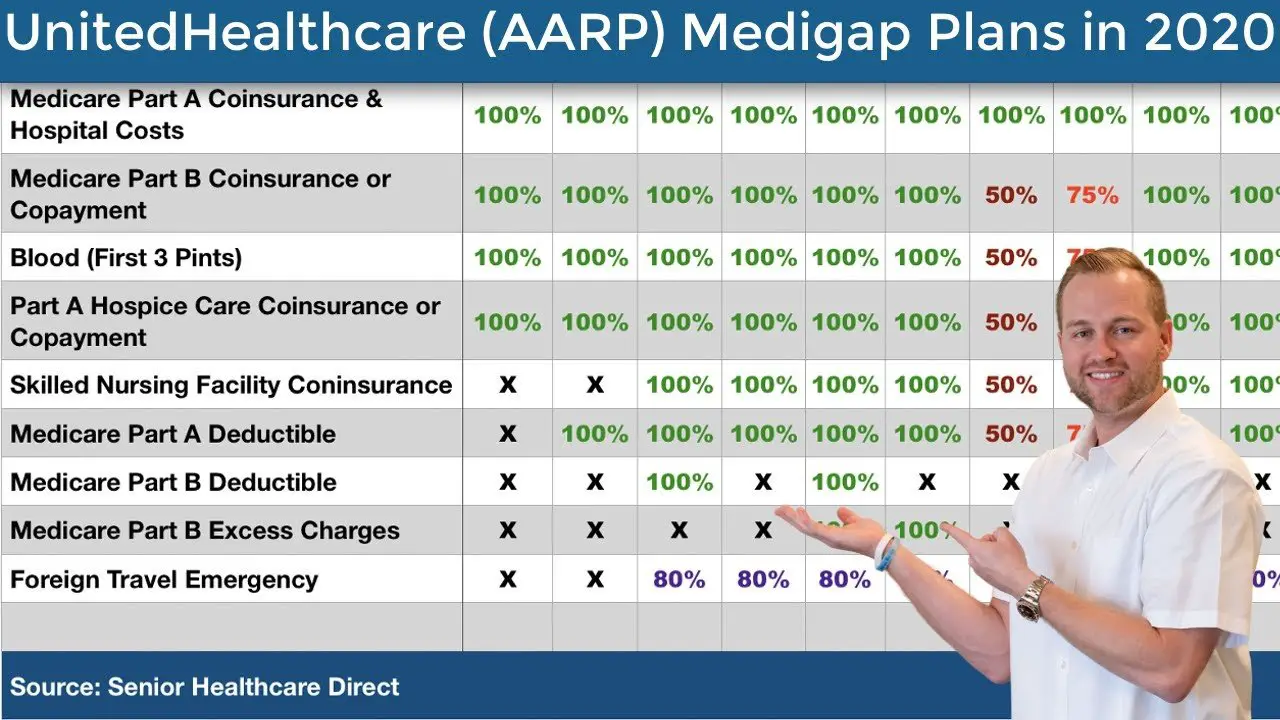

Overview Of Aarp By Unitedhealthcare Medicare Supplement Plans

AARP by UnitedHealthcare, like all Medicare Supplement insurance providers, can only offer certain standardized plans. Its main plan offerings are A, B, G, K, L and N, though it also offers plans C and F to some seniors. According to new Medicare regulations, plans C, F, and variants thereof can only be offered to those who were eligible for a Medigap policy prior to January 1, 2020. There are additional plans offered by other companies, including plans D and M, which AARP by United Healthcare has chosen not to provide.

The table below provides coverage details for all six of the standardized plans that AARP by UnitedHealthcare offers to those newly eligible for Medicare. All of these plans also include Part A hospital costs and coinsurance plus coverage for 365 days after Medicare benefits end.

| AARP by UnitedHealthcare Medicare Supplement Options |

|

Supplement |

|

$3,310 |

*Copays apply

The above six plans are all available in most locations, but there are a few exceptions. If you live in Massachusetts, Minnesota or Wisconsin, youll be offered a different variety of plans specific to your state. This is simply due to the fact that these states have decided to abide by different regulations. You can learn more about these plan styles by reading How to Compare Medigap Policies and following the included links to information on these states unique regulations.

Helpful Resources

Other Types Of Medicare Advantage Plans

If you want more freedom in health care providers or payment options, there are two other types of Medicare Advantage plans to consider.

Private Fee-For-Service plans

PFFS plans may or may not have a doctor/provider network, but cover any doctor or provider who accepts Medicare. If the plan doesnt include prescription drug coverage, you can also enroll in a stand-alone Part D plan separately.

Medical Savings Account plans

MSA plans combine a high-deductible health plan with a special savings account. Medicare deposits funds that are withdrawn tax free to pay for qualified health care services. You can see any doctor or provider you choose. MSA plans dont cover prescription drugs, but you can enroll in a stand-alone Part D plan separately.

Not all plans are available in all areas.

Dont Miss: Does Medicare Coverage Vary By State

Read Also: How Long Does It Take To Get Medicare After Applying

Is Aarp Good For Seniors

Besides travel perks and shopping discounts, an AARP membership provides discounts, services and resources that can help you maximize your retirement benefits: Financial planning resources and free tax and financial advice. Special rates on banking and investment services. Discounts on prescriptions.

Coverage Including Exclusions Or Limits

For an individual to qualify for a Medigap plan with the AARP, they must become a member. AARP membership $12 the first year, and then $16 annually.

When someone has an AARP Medigap plan, they can use any Medicare-approved doctor or healthcare provider across the U.S.

Medicare standardizes the coverage for each Medigap plan. The table below shows some of the benefits covered through the AARP Medigap plans. A person can check the complete coverage details for all AARP plans online.

| Benefit |

|---|

| 50%Plan K |

Plans K and L have annual limits that a person must reach before the insurer begins to pay. In 2021, Plan Kâs out-of-pocket limit is $6,220, and the out-of-pocket limit for Plan L is $3,110.

Read Also: Does Medicare Pay For Oral Surgery

Aarp Medicare Supplement Plan N

Plan N is the final Medicare Supplement plan available from AARP. It covers the following benefits:

- 100% of your coinsurance payments for inpatient hospital care

- 100% of your coinsurance or copayments for hospice care

- 100% of your Medicare Part A deductible

- 100% of your Medicare Part B coinsurance or copayments*

- 100% of up to 3 pints of blood to be used in a medical procedure

- 100% of your coinsurance for care provided in a skilled nursing facility

- 100% of approved foreign travel emergency costs

* Certain Part B copays do not qualify for coverage under Plan N. This includes:

- A copayment of up to $20 for some office visits

- A copayment of up to $50 for emergency room visits that do not result in an inpatient admission

Why Aarp Medicare Supplement Insurance Plans From Unitedhealthcare

UnitedHealthcare has been providing coverage and building personal relationships for more than 30 years and offers the only Medicare Supplement plans endorsed by AARP.** The basic benefits provided by Medicare Supplement plans are the same no matter which insurer you choose. But an AARP Medicare Supplement Insurance Plan from UnitedHealthcare has many features that stand out.

Don’t Miss: How Much Does A Married Couple Pay For Medicare

What It Will Cost You

Nationwide, the average monthly premium for Medigap Plan G is $173 for a 65-year-old man and $156 for a 65-year-old woman, according to Weiss Ratings. High-deductible Plan G has a $2,490 deductible in 2022, and that premium averages about $54 a month for a 65-year-old man, and $49 a month for a 65-year-old woman. Premiums are based on three pricing systems and vary widely based on where you live.

- Attained-age rated. This premium is initially based on your current age but can rise as you get older.

- Community rated. The same monthly premium is charged to everyone who has this policy, regardless of age.

- Issue-age rated. This premium is based on your age when you first buy the policy. The younger you are, the lower the initial premium. Any premium increases in the future will not be based on your age.

Experts suggest that you ask a potential insurer which pricing system it uses before buying a Medigap policy. That way youll know whether to expect increases as you age.

Aarp Medicare Supplement Plan L

Similar to Plan K, Medicare Supplement Plan L offers less comprehensive coverage for a lower price. Plan L offers coverage for all basic benefits included with all Medicare Supplement plans. However, for some of these benefits, the coverage provided is partial rather than full.

Here are the benefits and coverage levels you can expect from Plan L:

- 100% of your coinsurance payments for inpatient hospital care

- 75% of your Medicare Part A hospice care coinsurance or copayment

- 75% of your Medicare Part A deductible

- 75% of your Medicare Part B coinsurance or copayment

- 75% of up to 3 pints of blood for use in a medical procedure

- 75% of your coinsurance for care provided in a skilled nursing facility

An Additional Benefit Of Plan L

Plan L is one of two Medicare Supplement plans that includes an annual out-of-pocket maximum. In 2020, that limit is set to $2,940. Once youve spent this much, your plan will cover up to 100% of your Medicare costs for the remainder of the year.

Read Also: How To Work For Medicare

Medicare Plan N: Coverage Cost And How It Works

Find Cheap Medicare Plans in Your Area

Medicare Supplement Plan N reduces how much Original Medicare enrollees have to pay out of pocket for health care. For example, Plan N pays 100% of the coinsurance for hospitalization and medical care .

Plan N, one of 10 Medicare Supplement or Medigap policies, provides greater coverage than most of the other supplemental plans on the market. This includes Plans A, B, D, K, L and M.

It isnt the most comprehensive plan available. However, Plan N is best for those who want a good value with most medical expenses covered for an average cost of $152 per month.

Aarp Medicare Supplement Plans Quick Comparison Table

| Plans | |

|---|---|

| $3,310 | $0 |

*Plan F has a Med-Select plan option that offer you the same solid benefits as the standard plans, but cost less. You save on premiums simply by agreeing to use any of the Med-Select participating hospitals for non-emergency elective admissions. If you do not use one of these hospitals for your non-emergency admissions, you pay the $1,556 Part A deductible. Med-Select is not an HMO. With Med-Select, you are fully covered for emergency care at any hospital, and you can choose your own doctors and specialists.

**Plans K and L provide for different cost-sharing than plans A-F. Once you reach the annual limit, the plan pays 100% of the Medicare copayments, coinsurance and deductibles for the rest of the calendar year. The out-of-pocket annual limit does NOT include charges from your provider that exceed Medicare-approved amounts, called excess charges. You will be responsible for paying excess charges.

Read Also: Is Fehb Better Than Medicare

Plans K And L: Lower Premium Cost Sharing

Plans K and L are cost-sharing plans offering lower monthly premiums. The premiums are typically lower because, for some services, they pay a percentage of the coinsurance instead of the full coinsurance amount. Once the out-of-pocket limit is reached, these plans pay 100% of covered services for the rest of the calendar year.

Add Part D Coverage During Medicare Open Enrollment

Since Medicare Supplement plans help you cover the out-of-pocket costs of Medicare Parts A and B, your supplement plan wont cover prescription drugs. To do that, you must purchase a Medicare Part D prescription drug plan. If you didnt purchase a Part D plan during your Initial Enrollment Period, you can purchase one during the upcoming Medicare Open Enrollment Period from October 15 through December 7 each year.

If you are already enrolled in a Part D plan but want to switch to a different one, you can do that during your Open Enrollment Period as well.

If you want to compare AARP Medicare Supplement to other carriers plans, read about the best Medicare options to choose from. Call 844-927-3188 to speak to a licensed Medicare expert about your healthcare options.

Read Also: How To Get A Scooter With Medicare

What Is Aarp Plan N

Medicare Supplement plans are insurance plans you can use in conjunction with Original Medicare to fill coverage gaps in certain areas. Medigap plans help pay for your Medicare Part A and Part B coinsurance and copays, deductibles and more.

Medigap Plan N is one of 10 Medigap plans available in most states, each of which include a set of benefits that are standardized across every state and carrier. That means AARP Plan N in Florida would cover the same Medicare costs as AARP Plan N in Texas, though plan availability and premiums may vary.

Medicare Supplement Insurance Plans 2022

| Medicare Supplement Benefits | |

| 80% | 80% |

| 1. Plans C and F are not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.2. Plans F and G also offer a high deductible plan which has an annual deductible of $2,490 in 2022. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.3. Plan K has an out-of-pocket yearly limit of $6,620 in 2022. Plan L has an out-of-pocket yearly limit of $3,310 in 2022.4. Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 for emergency room visits that dont result in an inpatient admission.View an image version of this table. |