Medicare Eligibility For People Under 62

There are a few exceptions for Medicare age limits that can allow people younger than 65 and under age 62 to enroll in Medicare.

- If you have ALS , you are immediately eligible for Medicare regardless of your age as soon as your Social Security or Railroad Retirement Board disability benefits begin.

- You may also qualify for Medicare if you have kidney failure that requires dialysis or a kidney transplant, which is known as end-stage renal disease .

- You may also qualify for Medicare at age 62 or any age before 65 if you receive disability benefits from either Social Security or the Railroad Retirement Board for at least 24 months.

If you qualify for Medicare under the age of 65 because of a disability, you might also qualify for a Medicare Advantage Special Needs Plan.

Can I Get My Deceased Husbands Social Security

If My Spouse Dies, Can I Collect Their Social Security Benefits? A surviving spouse can collect 100 percent of the late spouses benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

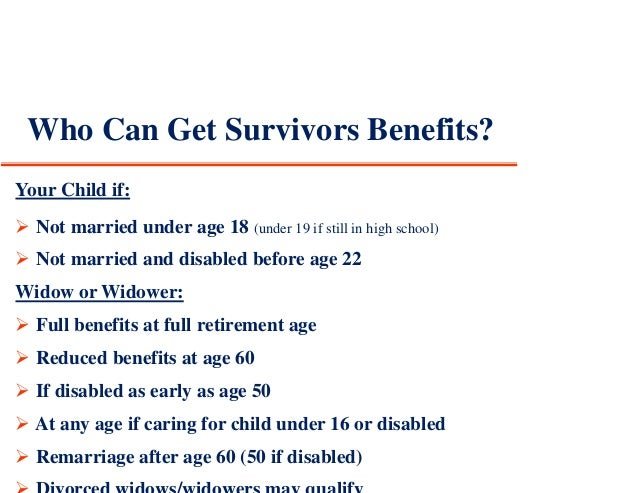

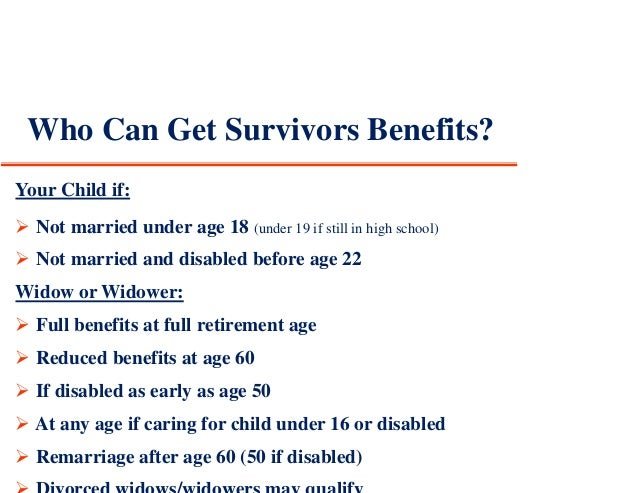

Who Qualifies For Social Security Survivor Benefits

Monthly survivor benefits are available to certain family members, including:

- A widow age 60 or older who has not remarried

- A widow of any age who is caring for the deceased’s child under age 16 or disabled

- An unmarried child of the deceased who is younger than age 18 , or 18 or older with a disability that began before age 22

- A stepchild, grandchild, step-grandchild, or adopted child, under certain circumstances

- Parents, age 62 or older, who were dependent on the deceased for at least half of their income and whose own Social Security benefit would not be larger than that of the deceased offspring

- A surviving divorced spouse, if they meet other eligibility requirements

First of all, you have to work a certain number of years and amass the requisite number of “credits” each year for your loved ones to be eligible for benefitswhich you have to do to be eligible yourself. For 2021, you receive one credit for every $1,470 you earn, up to $5,880, for a total of four credits a year. In 2022, it rises to every $1,510 you earn, up to $6,040.

Recommended Reading: How Do You Apply For Extra Help With Medicare

Review Your Medicare Choices Each Year

Whether you enroll in original Medicare or a Medicare Advantage plan, you generally do not need to renew coverage every year. That being said, plans are sometimes discontinued or their benefits and costs may change to the point that the plan no longer meets your needs. Its not unusual for pharmacy and provider networks to change, for costs to increase, or the list of covered prescription drugs to vary. Thats why its a good idea to review your plan each year and compare it against your current health care needs.

Your health insurer is required to send you an Annual Notice of Change by September 30 each year. The notice outlines any changes in coverage and costs expected to begin the following January. If you decide to change your health care plan after reviewing those updates, you can do so during Medicares open enrollment period. The period runs from October 15 to December 7. During this time, you can switch from original Medicare to Medicare Advantage or vice versa. You can switch from one Medicare Advantage plan to another or from one Medicare Part D plan to another. You can also enroll in Medicare Part D if you have not done so already, although late enrollment penalties may apply.

If you find that the new health care plan is not meeting your needs, you can reverse some plan decisions January 1 to March 31 of the following year. Guidance for the renewal process is offered through the U.S. governments phone line at 1-800-MEDICARE or through your local SHIP.

Got A Question Youd Like Answered

You can ask a question simply by hitting reply to our email newsletter, just as you would with any email in your inbox. If youre not subscribed, fix that right now by clicking here. Its free, only takes a few seconds, and will get you valuable information every day!

The questions were likeliest to answer are those that will interest other readers. So, its better not to ask for super-specific advice that applies only to you.

About me

I hold a doctorate in economics from the University of Wisconsin and taught economics at the University of Delaware for many years. In 2009, I co-founded SocialSecurityChoices.com, an internet company that provides advice on Social Security claiming decisions. You can learn more about that by clicking here.

Got any words of wisdom you can offer on todays question? Share your knowledge and experiences on our. And if you find this information useful, please share it!

Disclaimer: We strive to provide accurate information with regard to the subject matter covered. It is offered with the understanding that we are not offering legal, accounting, investment or other professional advice or services, and that the SSA alone makes all final determinations on your eligibility for benefits and the benefit amounts. Our advice on claiming strategies does not comprise a comprehensive financial plan. You should consult with your financial adviser regarding your individual situation.

Also Check: What Is Statement Of Understanding Medicare

Beware The Blackout Period

As noted earlier, a widow or widower generally doesn’t qualify for their benefits until age 60. However, that person can collect payouts as the caregiver for the deceased’s children until they turn 16.

Children qualify for benefits until they turn 18 . But between the child’s 18th birthday and the spouse’s 60th birthday , no one in the family is eligible to collect. That’s what’s known as a blackout period.

For example, a woman is left widowed at the age of 30 with a two-year-old son. As her son’s caregiver, she is entitled to collect Social Security benefits for 14 years, until his 16thbirthday. After that, her son continues to receive his survivor benefits for two more years, until he’s 18. His mom will be 48 at that point, leaving the family ineligible for any payments until her widow’s benefits become available when she’s 60. In this case, the Social Security blackout period lasts 12 years.

One possible solution is for families to make sure they have adequate life insurance to support a surviving spouse during any blackout period. Take, for instance, a couple, both 31 years old, who recently had a child. If either parent dies, the surviving spouse is eligible to collect benefits until they are 47 years old . If they both buy 30-year term life insurance policies and keep up with the premiums, they’ll be assured of coverage until age 61one year after Social Security eligibility is reinstatedin case one of them dies.

Related Faq For What Age Can A Widow Draw Social Security

Can a widow get Medicare at age 60?

If you are divorced, you must have been married to your ex-spouse for at least 10 years and currently be unmarried. As a widow: You must be at least 60 years old .

Can I retire at 57 and collect Social Security?

You can start your Social Security retirement benefits as early as age 62, but the benefit amount you receive will be less than your full retirement benefit amount.

Can I retire at 58 years old?

A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after normal retirement age may result in larger benefits. With delayed retirement credits, a person can receive his or her largest benefit by retiring at age 70.

Is Social Security based on the last 5 years of work?

Social Security benefits are based on your lifetime earnings. Your actual earnings are adjusted or indexed to account for changes in average wages since the year the earnings were received. Then Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most.

When can a spouse claim spousal benefits?

You can claim spousal benefits as early as age 62, but you won’t receive as much as if you wait until your own full retirement age. For example, if your full retirement age is 67 and you choose to claim spousal benefits at 62, you’d receive a benefit that’s equal to 32.5% of your spouse’s full benefit amount.

You May Like: Will Medicare Pay For A Bedside Commode

How Are Disabled Widows Benefits Calculated

Your survivors benefit amount is based on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be. The monthly amount you would get is a percentage of the deceaseds basic Social Security benefit . Two surviving parents 75 percent to each parent.

Medicare For Individuals Who Are Divorced Or Widowed

Many individuals who are divorced or widowed are concerned that the loss of their spouse will somehow affect their ability to qualify for Original Medicare .

Rest assured your marital status does not affect your ability to qualify for Medicare. You are eligible for Medicare if:

- You are a U.S citizen or legal resident for at least 5 consecutive years and

- You are:

- Age 65 or older or

- Younger than 65 with a qualifying disability or

- Any age if you have end-stage renal disease or amyotrophic lateral sclerosis .

Recommended Reading: Does Medicare Cover The Cost Of A Shingles Shot

Can A 62 Year Old Get Medicaid

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children.

Learn more about the difference between Medicare and Medicaid.

How Long Do You Receive Social Security Survivor Benefits

Social Security survivor benefits are payable to the surviving spouse for the remainder of their life. Restrictions apply for divorced spouses eligible to receive benefits.

Benefits for surviving children end at age 18 or age 19 and 2 months if still pursuing their elementary or secondary education. For surviving children who became disabled before age 22, their benefits continue for life.

Read Also: Is The Medicare Helpline Legit

B Enrollment May Be Impacted If You Lose Coverage Through Your Spouse

In most cases, individuals who do not enroll in Part B when they first become eligible may have to pay late enrollment penalties. However, if you were covered by a spouses employer or retiree coverage, you may be eligible for a Special Enrollment Period during which to get Part B.

The online blog doesnt take into account every situation, so its important that you ask questions and get answers for your specific situation. You may want to contact the Social Security Administration for more information by calling 1-800-772-1213 , Monday through Friday from 7 a.m. to 7 p.m.

When Will The Medicare Eligibility Age Lower

Now, with Democratic control of the Senate, its more likely that Medicare at 60 will go into effect in the coming years. Additionally, a majority of individuals on both sides of the political aisle support a Medicare buy-in plan for adults over 50.

Yet, there is opposition particularly from hospitals because of lower reimbursement rates. Thus, there could be pushback in the process.

Regardless of the outcome, the eligibility age for Medicare wont change overnight. Lowering the eligibility age is no longer part of the U.S. Governments budget for Fiscal Year 2022. So, the Medicare eligibility age will not see a reduction anytime in the next year.

In the meantime, its crucial for beneficiaries to stay up-to-date with the latest information about potential changes to Medicare, including a reduced eligibility age. We will be updating this content as more information is available.

- Was this article helpful ?

Don’t Miss: How To Apply For Medicare In Hawaii

Social Security: What Every Woman Needs To Know

When do I become eligible for benefits?

- As a worker: You must work and pay Social Security taxes for at least 10 years , and be at least 62 years old.

- As a spouse or divorced spouse: You must be at least 62 years old. If you are divorced, you must have been married to your ex-spouse for at least 10 years and currently be unmarried.

- As a widow: You must be at least 60 years old . If you are divorced, you can claim the survivors benefit if you were married at least 10 years and are currently unmarried .

If I qualify for more than one benefit, can I receive the total amount of both?

No. You will receive the benefit amount that provides you with the higher monthly benefit, but you do not receive both benefits added together.

When can I receive Social Security retirement benefits?You may receive full benefits at full retirement age. Full retirement age is increasing gradually until it reaches age 67 for those who were born 1960 or later. See the chart below.

| Year of Birth |

| 67 |

What happens to my benefit if I claim early?

If you start your benefits early, your benefits are reduced permanently. Your benefit is reduced about one-half of one percent for each month you start your Social Security before your full retirement age. For example, if your full retirement age is 67 and you sign up for Social Security when you are 62, you would only get 70% percent of your full benefit.

What happens to my benefit if I delay claiming it?

Can I work and still receive my Social Security benefit?

Can A 62 Year Old Widow Get Medicare

When can I receive Medicare benefits? Medicare is the federal health insurance program for people age 65 and older. Generally, individuals are automatically eligible for Medicare if they are 65 years old and have 40 quarters of work credit in Social Security covered employment, or their spouse is eligible for Medicare.

Recommended Reading: Can Medicare Take Your House

How Much Can You Earn While Collecting Widows Benefits In 2020

The Social Security earnings limits are established each year by the SSA. For 2020, those who are younger than full retirement age throughout the year can earn up to $18,240 per year without losing any of their benefits. After that, youll lose $1 of annual benefits for every $2 you make above the threshold.

What Is The Lowest Social Security Payment

Imagine that an individual who attained full retirement age at 67 had enough years of coverage to qualify for the full minimum Social Security benefit of $897. If they filed at 62, there would be a 30% reduction to benefits. This means that for 2020, the minimum Social Security benefit at 62 is $628.

Don’t Miss: How To Sign Up For Medicare Online

Can I Collect My Husbands Ss At 62

You can claim spousal benefits as early as age 62, but you wont receive as much as if you wait until your own full retirement age. For example, if your full retirement age is 67 and you choose to claim spousal benefits at 62, youd receive a benefit thats equal to 32.5% of your spouses full benefit amount.

Social Security Q& a: Can I Claim Widows Benefits At 60

Welcome to Social Security Q& A. You ask a Social Security question, our guest expert provides the answer.

You can learn how to ask a question of your own below. And if you would like a personalized report detailing your optimal Social Security claiming strategy, .

Check it out: It doesnt cost much and could result in you receiving thousands of dollars more in benefits over your lifetime.

Todays question comes from Debbie:

I am currently 60 years old and working full time. My husband died in 2013, and I am wondering if I can collect on his benefits now?

Read Also: What Does Medicare Supplement Plan N Cover

The Proposal For Medicare At 60

Besides a proposal to offer a public health insurance option similar to Medicare, President Biden hopes to lower the Medicare eligibility age to 60. During the presidential race, this was part of his health care platform. Currently, the age at which one becomes Medicare-eligible is 65. Individuals under 65 can obtain Medicare if they collect SSDI for 24 months or are diagnosed with ALS or ESRD.

Lowering the eligibility age five years aims to provide health care to those who retired early, are unemployed, or lack health benefits through their employer. Additionally, qualifying U.S. citizens over 60 would have an extra health care option. As the market is more difficult for older job seekers, the President says its necessary to provide this safety net.

Can I Claim My Deceased Husbands State Pension

You may be entitled to extra payments from your deceased spouses or civil partners State Pension. However, this depends on their National Insurance contributions, and the date they reached the State Pension age. If you havent reached State Pension age, you might also be eligible for Bereavement benefits.

Don’t Miss: Does Medicare Pay For Eyeglasses For Diabetics

Do You Automatically Get Medicare With Disability

5/5Disableddisabilityreceive Medicarereceivereceive Medicareread here

When Medicare StartsIn general, the two-year waiting period for Medicare is calculated from your date of SSDI entitlementwhen you are eligible to start receiving monthly benefits. This is usually the date your disability began, plus five months .

Likewise, do I have to pay for Medicare Part B if I am disabled? Most people who receive Social Security Disability do not have to pay for Medicare Part A. Most of the people who receive Social Security Disability benefits do have to pay a premium for Medicare Part B, but you may choose to opt out of this program if you already have medical insurance.

Correspondingly, what disability qualifies for Medicare?

Medicare is available for certain people with disabilities who are under age 65. These individuals must have received Social Security Disability benefits for 24 months or have End Stage Renal Disease or Amyotropic Lateral Sclerosis .

How much does Medicare cost on disability?

Premiums for Medicare Part A are $0 if you’re getting or are eligible for federal retirement benefits. It’s also premium-free if you’re under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease.