How Medicare Advantage Works

Medicare is generally available for people age 65 or older, younger people with disabilities, and people with end-stage renal diseasepermanent kidney failure requiring dialysis or transplantor amyotrophic lateral sclerosi .

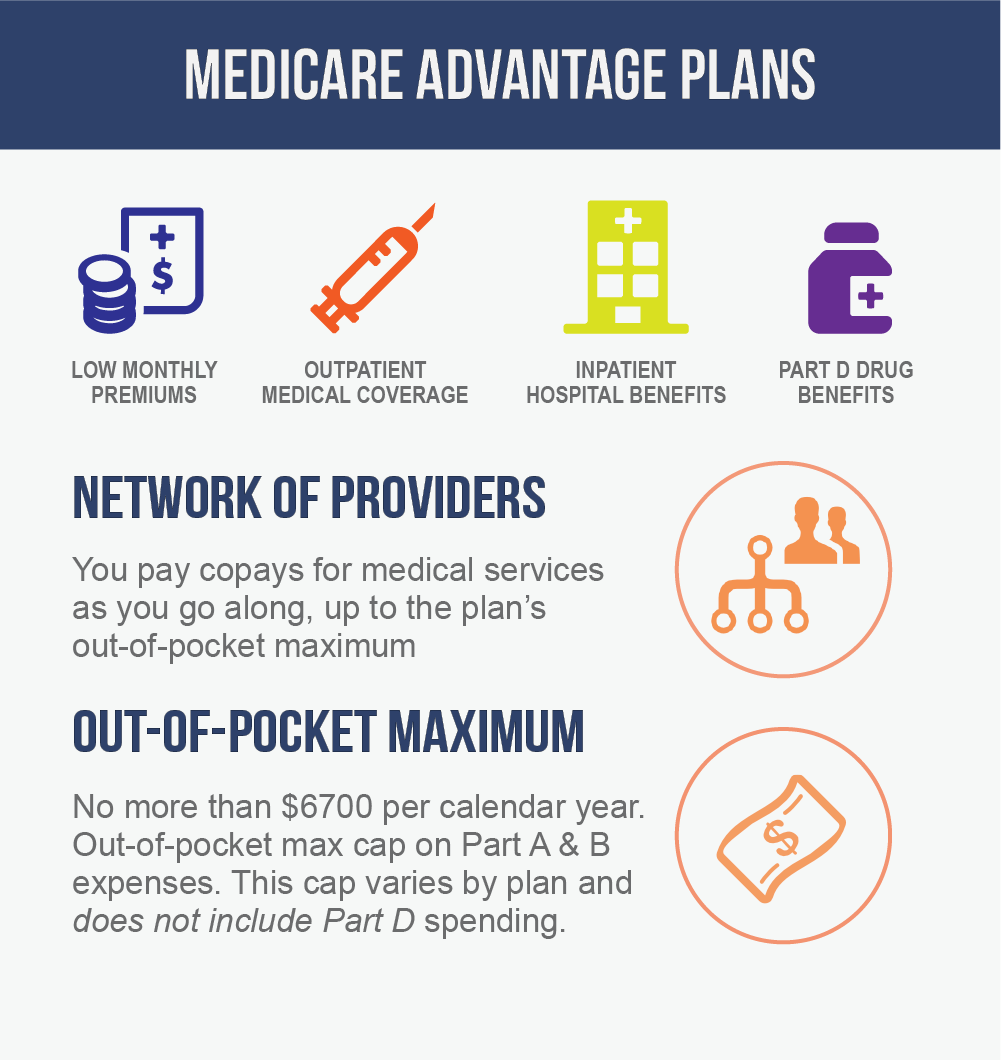

Medicare Advantage is a type of Medicare health plan offered by private companies that are Medicare-approved. They are considered an alternative to Original Medicare and cover all the expenses incurred under Medicare. They include the same Part A hospital and Part B medical coverage, but not hospice care. Most MA plans also include Part D prescription drug coverage.

Private companies receive a fixed amount each month for Medicare Advantage plan care. In turn, these companies can charge out-of-pocket costs to policyholders and are able to establish their own rules for service such as the need for referrals or provider networks for both non-urgent care and emergency services.

Some Medicare Advantage plans cover additional costs not paid for by Medicare including vision, dental, and hearing-related expenses. Medicare Advantage plans don’t work with Medigap, which is also called Medicare Supplement Insurance. Medicare pays the premiums for participants in Medicare Advantage plans.

The average monthly premium for a Medicare Advantage plan in 2022 is projected to be $19, versus $21.22 in 2021. In contrast, the 2021 monthly premium and annual deductible for Medicare Part B are $170.10 and $233 in 2022.

Best For Member Satisfaction: Kaiser Permanente

Average Medicare star rating: 5 out of 5.

Service area: Available in eight states and Washington, D.C.

Standout feature: Kaiser stands head-and-shoulders above other providers in terms of the companys Medicare star ratings, and the company tops a list of nine providers for member satisfaction.

Kaiser Permanente is the fifth-largest provider of Medicare Advantage plans, with more than 1.7 million members enrolled in 2021. Kaiser is also the largest not-for-profit health maintenance organization in the U.S., and the company uses an integrated care model, which means members can get all their care in one place and all their providers are connected. Kaiser plans are available in only eight states and Washington, D.C.

Pros:

-

Kaiser Permanente earned 846 points out of 1,000 in J.D. Powers latest U.S. Medicare Advantage Study, netting it the top spot for customer satisfaction out of nine providers measured.

-

Only seven Medicare health plans received a 5 out of 5 rating from the National Committee for Quality Assurance, and four of them are Kaiser Permanente plans.

Cons:

-

Kaiser Permanente plans are available only in eight states and Washington, D.C., so the majority of U.S. adults cant access them.

-

Kaiser offers only HMO plans, so members must work within Kaisers network of medical providers.

How Does Original Medicare Work

Original Medicare is a government-funded medical insurance option for people age 65 and older. Many older Americans use Medicare as their primary insurance since it covers:

- Inpatient hospital services. These benefits include coverage for hospital visits, hospice care, and limited skilled nursing facility care and at-home health care.

- Outpatient medical services . These benefits include coverage for preventive, diagnostic, and treatment services for health conditions.

Original Medicare generally doesnt cover prescription drugs, dental, vision or hearing services, or additional healthcare needs.

However, for people who have enrolled in original Medicare, there are add-ons such as Medicare Part D prescription drug coverage and Medicare supplement plans that can offer additional coverage.

Recommended Reading: Can I Have Medicare Part B Without Part A

Best Of The Blues: Highmark

Average Medicare star rating: 4.8 out of 5.

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

Standout feature: Highmark gets high Medicare star ratings from the CMS and high customer satisfaction scores from J.D. Power.

Highmark is a member of the Blue Cross Blue Shield family, which includes 35 independent companies that together form the third-largest provider of Medicare Advantage plans. As far as Blue companies go, Highmarks plans are highly rated and ranked for member satisfaction.

Pros:

-

Of nine Medicare Advantage providers , Highmark ranks second in J.D. Powers 2021 U.S. Medicare Advantage Study, scoring 834 out of 1,000 points. Its also the highest Blue on the list.

-

Highmarks Medicare Advantage contracts get an average Medicare star rating of 4.8 out of 5 from the CMS.

Cons:

-

Highmark offers Medicare Advantage plans in only four states: Delaware, New York, Pennsylvania and West Virginia.

-

Highmark Medicare Advantage offers only HMO and PPO plans. There are no special needs plans for people with certain diseases or chronic conditions.

Types Of Medicare Advantage Plans

There are different types of Medicare Advantage plans to choose from, including:

- Health Maintenance Organization .HMO plans utilize in-network doctors and require referrals for specialists.

- Preferred Provider Organization .PPO plans charge different rates based on in-network or out-of-network services.

- Private Fee-for-Service .PFFS plans are special payment plans that offer provider flexibility.

- Special Needs Plans .SNPs help with long-term medical costs for chronic conditions.

- Medical Savings Account .MSA plans are medical savings accounts paired with high deductible health plans.

Compared to original Medicare, there may be advantages if you choose a Medicare Advantage plan.

Don’t Miss: Does Medicare Cover Pill Pack

Medicare Advantage Plans Must Spend At Least 85% Of Premiums On Medical Costs

The ACA added new medical loss ratio requirements for commercial insurers offering plans in the individual, small group, and large group markets. It also added similar requirements for Medicare Advantage plans, although they took effect three years later, in January 2014.

Medicare Advantage plans must have MLRs of at least 85%, which is the same as the requirement for plans issued to employers in the large group market. That means 85% of their revenue must be used for patient care and quality improvements, and their administrative costs, including profits and salaries, cant exceed 15% of their revenue . The specifics of the calculations are laid out in this HHS regulation from 2013, with the calculation details starting on page 31288.

In the individual, small-group, and large-group health insurance markets, insurers that fail to meet the MLR requirements must send rebates to policyholders . But for Medicare Advantage plans, the rebates must be sent to the Centers for Medicare and Medicaid Services instead.

If a Medicare Advantage plan fails to meet the MLR requirement for three consecutive years, CMS will not allow that plan to continue to enroll new members. And if a plan fails to meet the MLR requirements for five consecutive years, the Medicare Advantage contract will be terminated altogether.

The federal government has ordered several plans to suspend enrollment in 2022 coverage due to a failure to meet the MRL requirements.

Can You Switch Between Original Medicare And Medicare Advantage

As a final note, no matter which option you decide is right for you, you can switch from Original Medicare to Medicare Advantage or vice versa. The two main times you can switch are the Medicare Annual Enrollment Period and the Medicare Special Enrollment Period for qualifying life events, if you qualify.

Read Also: How Do I Pay Medicare Premiums

Who Is Eligible To Join Advantage Plans

If you live in the designated service area of the specific plan, and already have Part A and Part B , you may join a Medicare Advantage plan instead of Original Medicare . If you have union- or employer-sponsored insurance, you may be able to add an Advantage plan, but be forewarned that in some cases you may lose your employer or union coverage when you enroll in an Advantage plan.

Individuals with End-Stage Renal Disease were generally not eligible to enroll in Advantage plans prior to 2021 with the exception of Medicare Advantage ESRD Special Needs Plans, although these are not widely available. But this changed as of the 2021 plans year, as a result of the 21st Century Cures Act. Medicare Advantage plans are guaranteed-issue for all Medicare beneficiaries as of 2021, including those with ESRD.

You should know that if you enroll in a Medicare Advantage Plan, you will not need to purchase Medigap coverage, nor will you be able to buy it. If you already have Medigap coverage, you can keep the coverage , although it wont pay for Medicare Advantage out-of-pocket expenses, such as copayments and deductibles.

Medicare Advantage Plans: Common Elements

- All plans have a contract with the Centers for Medicare and Medicaid Services .

- The plan must enroll anyone in the service area that has Part A and Part B, except for end-stage renal disease patients.

- Each plan must offer an annual enrollment period.

- You must pay your Medicare Part B premium.

- You pay any plan premium, deductibles, or copayments.

- All plans may provide additional benefits or services not covered by Medicare.

- There is usually less paperwork for you.

- The Centers for Medicare and Medicaid Services pays the plan a set amount for each month that a beneficiary is enrolled.

The Centers for Medicare and Medicaid Services monitors appeals and marketing plans. All plans, except for Private Fee-for-Service, must have a quality assurance program.

If you meet the following requirements, the Medicare Advantage plan must enroll you.

You may be under 65 and you cannot be denied coverage due to pre-existing conditions.

- You have Medicare Part A and Part B.

- You pay the Medicare Part B premium.

- You live in a county serviced by the plan.

- You pay the plan’s monthly premium.

- You are not receiving Medicare due to end-stage kidney disease.

Another type of Medicare Managed Health Maintenance Organization is a Cost Contract HMO. These plans have different requirements for enrollment.

Also Check: Who Pays For Medicare Part B Premiums

Why Are Some Medicare Advantage Plans Free

When a Medicare Advantage plan has a $0 premium, the company can offer that lower price by saving money on other costs, such as using in-network healthcare providers. It passes those savings on to you by offering a premium at no charge. A $0 premium is also a great way for providers to attract customers. You will, however, still have other monthly costs.

What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

Also Check: Does Medicare Cover Counseling For Depression

How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

How Do I Enroll In A Medicare Advantage Plan

Once youve enrolled in original Medicare, you can begin searching for Medicare Advantage plan options in your area.

Unlike with original Medicare, you must live in the service area of the Medicare Advantage plans youre shopping for companies dont offer nationwide coverage. This means that even if you find better Medicare Advantage plan options elsewhere, you can only enroll in a plan in your state.

If youre ready to shop for Medicare Advantage plans in your area, you can use Medicares plan finder tool to look for an Advantage plan that meets both your healthcare and financial needs.

Recommended Reading: What Age Can You Receive Medicare Benefits

Best For Simplicity And Clarity: Blue Cross Blue Shield

Blue Cross Blue Shield

Shopping for Medicare Advantage coverage can feel like youâre going through a maze. Blue Cross Blue Shield breaks down the steps in the process and does a good job providing information about what its affiliated companies have to offer.

-

Low premiums, with optional add-ons for extra cost

-

Websiteâs educational information on many different kinds of plans

-

Coverage offered in Puerto Rico

-

No estimates available on the main page

-

Must go to individual plan websites for local details

-

No Medicare Advantage coverage in Mississippi and Wyoming

If you want clear, straightforward Medicare information, Blue Cross Blue Shield is the best company to go through for Medicare Advantage. We chose it primarily for features such as its Medicare Advantage Plans document, available for anyone to view on its website without entering any personal information.

It gives a detailed look into the company’s plan offerings, explaining state-specific plans and who to contact if you want to enroll. Each organization may offer different plans, and the plans can differ by ZIP code, so it’s important to gather information about the plans in your specific area.

BCBS is an association of 34 independent insurance companies, not a single insurer. To get the details of your specific options, you’ll have to track down the BCBS affiliate in your market. Note: BCBS affiliation may not be obvious from its name or how it’s commonly referred to, such as Anthem or Highmark.

How Many Americans Have Medicare Advantage Coverage

As of September 2021, there were nearly 28 million Americans enrolled in Medicare Advantage plans more than 43% of all Medicare beneficiaries.

Enrollment in Medicare Advantage has been steadily growing since 2004, when only about 13% of Medicare beneficiaries were enrolled in Advantage plans. Managed care programs administered by private health insurers have been available to Medicare beneficiaries since the 1970s, but these programs have grown significantly since the Balanced Budget Act signed into law by President Bill Clinton in 1997 created the Medicare+Choice program.

Don’t Miss: How Much Will Medicare Part B Cost Me

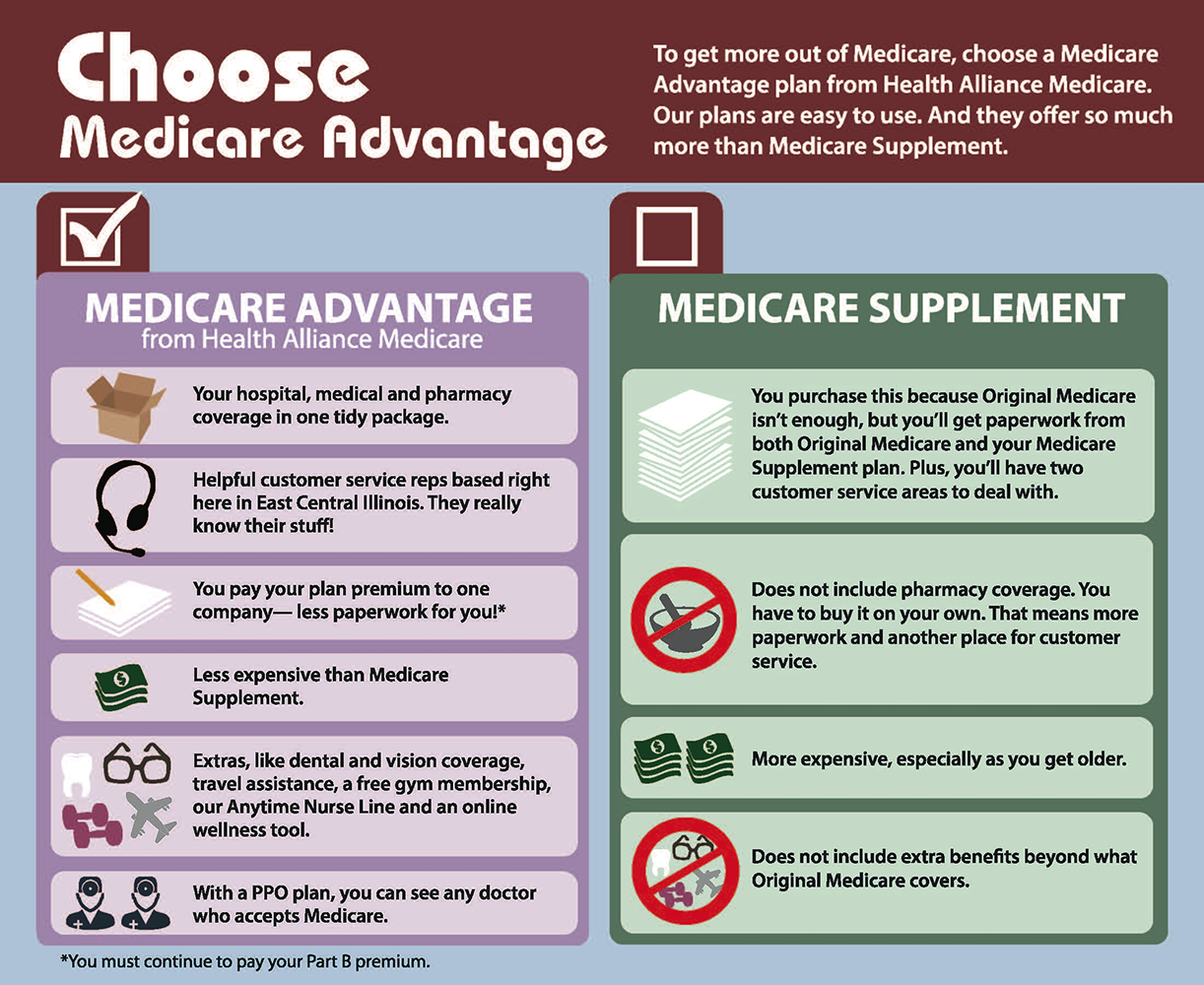

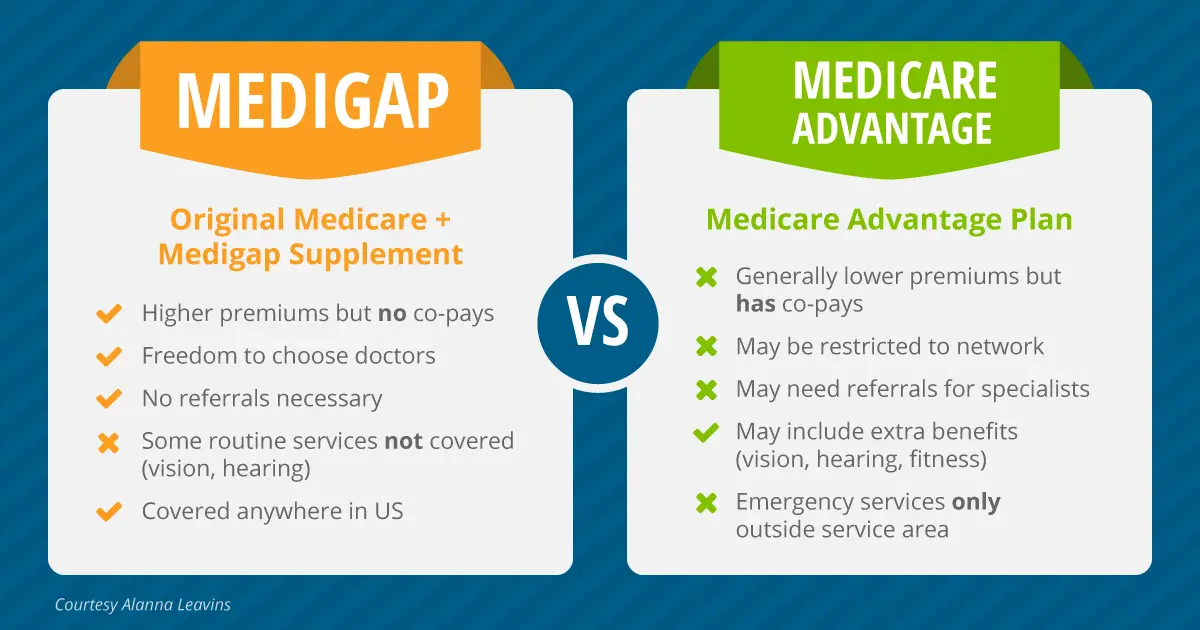

What Is The Difference Between A Medigap Plan And Medicare Advantage

The difference between a Medigap plan and a Medicare Advantage plan boils down to two main factors: cost and coverage. The Medicare Advantage plan can be cheaper, but the Medigap plan offers the ability to pick and choose the coverage you want, whereas in most cases, the Medicare Advantage plan has a set coverage scope.

Medicare Advantage is still a Medicare plan it just offers a bit more all at once than Original Medicare does, as it includes prescription coverage, and in most cases, coverage for vision, dental, or hearing. Medigap coverage has more individual options, but the prices can rack up for each type of supplemental coverage.

What Plan Is More Affordable

Medicare Advantage plans will have lower out-of-pocket expenses because they manage the resources that you use. The cost of prescription drugs is usually included in the plan. Some plans offer other benefits tooâsuch as vision, dental, and fitness programs. What you give up is the ability to see out-of-network providers at the same low cost.

With Medicare Supplement plans, you pay a premium to a private insurer to bridge your gaps in Original Medicare coverage. There are 10 standardized levels of Medicare Supplement, Plans A-N, each with their own level of coverage. However, the pricing and specific private insurers offering these plans will vary according to your region.

Additionally, with Medicare Supplement plans, the more gap coverage you want, the higher monthly premium you pay. Some expenses not typically covered by Medicare Supplement include vision, dental, and long-term care. If you want prescription drug coverage, you must join Medicare Part D.

Read Also: What Does Original Medicare Mean

Drug Coverage In Medicare Advantage Plans

Most Medicare Advantage Plans include prescription drug coverage . You can join a separate Medicare Prescription Drug Plan with certain types of plans that:

- Cant offer drug coverage

- Choose not to offer drug coverage

Youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply:

- Youre in a Medicare Advantage HMO or PPO.

- You join a separate Medicare Prescription Drug Plan.

Note:

Coverage Choices For Medicare

If you’re older than 65 and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn’t happen automatically. However, if you already get Social Security benefits, you’ll get Medicare Part A and Part B automatically when you first become eligible .

There are two main ways to get Medicare coverage:

You May Like: Is Medicare Medicaid The Same

Premiums Paid By Medicare Advantage Enrollees Have Slowly Declined Since 2015

Figure 7: Average Monthly Medicare Advantage Prescription Drug Plan Premiums, Weighted by Plan Enrollment, 2010-2020

Nationwide, average Medicare Advantage Prescription Drug premiums declined by $4 per month between 2019 and 2020, much of which was due to the relatively sharp decline in premiums for local PPOs this past year. Average premiums for HMOs also declined $3 per month, while premiums for regional PPOs increased $3 per month between 2019 and 2020.

Average MA-PD premiums vary by plan type, ranging from $20 per month for HMOs to $32 per month for local PPOs and $47 per month for regional PPOs. Nearly two-thirds of Medicare Advantage enrollees are in HMOs, 33% are in local PPOs, and 5% are in regional PPOs in 2020.

How Medicare Advantage Plans Work

Medicare Advantage plans also known as Medicare Part C are required to provide the same benefits as Medicare Part A, which covers hospitalization, and Medicare Part B, which covers doctors visits. Medicare Advantage plans also typically include Medicare Part D prescription drug coverage and may include benefits not covered by Medicare, providing some savings on routine dental care, eye exams and glasses, and hearing aids.

Recommended Reading: Who Pays For Assisted Living Facilities Does Medicare