In Which Statesis Medicaid Enrollment Automatic

The Social Security Administration handles Medicaid enrollmentfor the many states in which Medicaid eligibility is automatic for SSIrecipients. Your state will contact you with information after you receive yourSSI award letter from Social Security. These states are:

|

Alabama |

|

|

North Carolina |

Wyoming |

Note that SSI recipients in Indiana will be automatically enrolled in Medicaid starting on June 1, 2014. At that point, Indiana switches from being a 209 state to an automatic enrollment state.

Does Social Security Count As Income For Medicaid

Applying for Medicaid services involves an evaluation of your income and assets. These limits are determined by each state, but federal policy establishes what types of income and assets are counted or exempt for retirees.

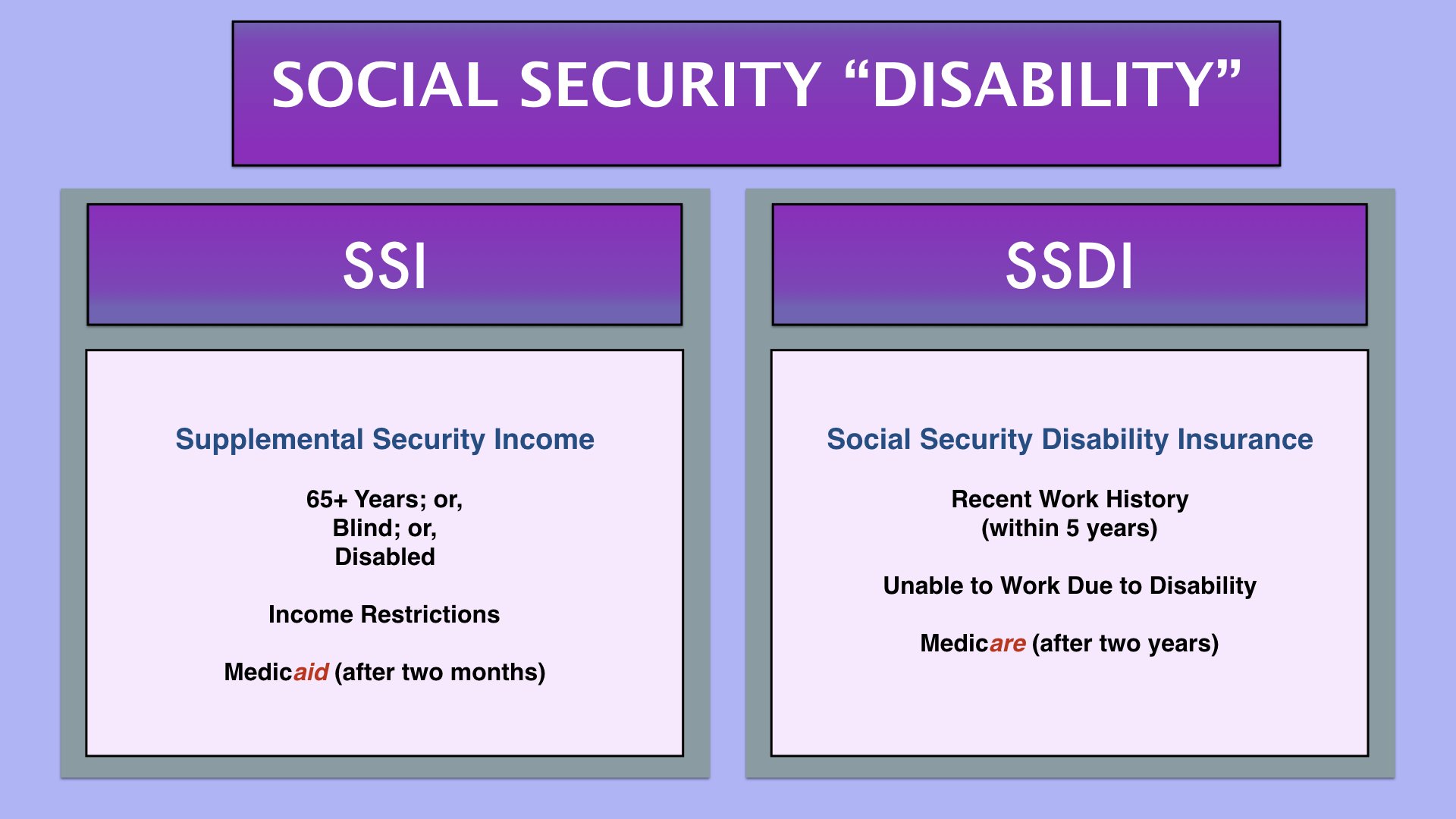

Common Types of Social Security Benefits

The Social Security Administration manages various benefits programs that pay cash allotments to beneficiaries and, in some cases, their dependents. Although these programs are all managed by the SSA, its important to understand how they differ and under which circumstances they might overlap. This can help you determine which type of Social Security income might be counted under Medicaids rules.

In some circumstances, a beneficiary may receive more than one type of Social Security income. For example, if a retiree is disabled, they may receive their retirement income in addition to SSDI or SSI payments.

Defining Modified Adjusted Gross Income

Gross income is the total amount of all earned and unearned income an individual or their household receives before any deductions or disregards are applied. Adjusted gross income is the total taxable amount of earned and unearned income for a tax-filing individual or group, minus qualifying deductions.

Income counted in MAGI:

- Funds from loans .

- Alimony income finalized on or after January 1, 2019.

- Child support.

Medicaid Income Eligibility Standards

Related article:

Which Statesuse Their Own Criteria For Granting Medicaid

Theremaining states do not automatically grant Medicaid to persons withdisabilities who qualify for SSI because they use their own criteria fordetermining whether someone is eligible for Medicaid. These states may haveincome limits that are higher or lower than SSI’s, different asset limits, ordifferent requirements for what makes someone disabled.

Inmost of these states, however, the income limitsfor Medicaid aren’t too different from the income limit for SSI . And many of them use thesame resource limit as SSI program, although several have a lower assetlimit than SSI , and a couple states have a higher asset limit .

These states are called “209 states,” named after a sectionof the legislation that created the SSI program in 1972. This legislationprohibited states from making their Medicaid eligibility criteria stricter thanthe criteria the states were using in 1972. In these states, you must apply forMedicaid with your state’s Medicaid agency or health and human services department.

The 209 states are:

|

Virginia |

Note that Indiana ceased being a 209 state in 2014.

Even though some 209 states have lower income limits than theSSI program, these states have to let Medicaid applicants deduct their medicalexpenses from their income when their eligibility for Medicaid is beingdetermined. This is called “spending-down.” This means that SSIrecipients with high medical bills will qualify for Medicaid in these states.

Recommended Reading: How Much Medicare Is Taken Out Of Social Security Check

Enrolling In Medicare With A Disability

Just like when you become eligible for Medicare at age 65, when you are eligible with disability, you have an Initial Enrollment Period of 7 months.

Your Initial Enrollment Period will begin after you have received either disability benefits from Social Security for 24 months or certain disability benefits from the Rail Road Retirement Board for 24 months.1 In other words, your IEP starts on the 25th month of disability benefits.

You will be automatically enrolled in Medicare Part A and Part B, but if you decide you want to get a Medicare Advantage or Part D prescription drug plan, you will need to enroll yourself directly with the private plan provider. You will need to enroll during your IEP to avoid late enrollment penalties.

NOTE: If you become eligible for Medicare because of ALS or ESRD, your situation is different. See the below special sections for eligibility and enrollment for ALS and ESRD.

What Insurance Do You Get With Social Security Disability

In most cases, people receiving Social Security Disability Income are automatically enrolled in Original Medicare after serving a 24-month waiting period.

The CMS waives this waiting period for people with ALS or end-stage renal disease. People with these conditions receive Medicare coverage as soon as they collect SSDI.

Read Also: Does Medicare Cover Any Weight Loss Programs

How Does Medicare Get Confused With Social Security

But some of the confusion stems from the fact that the Social Security Administration is responsible for determining eligibility for Medicare and handling many of the programs administrative functions, including enrollment. The SSA also handles the administration of Social Security benefits.

Since eligibility for both Medicare and Social Security benefits are managed by the SSA, people who begin receiving Social Security retiree benefits prior to age 65 will be automatically enrolled in Medicare once they turn 65.

Calculating The Waiting Period For Medicare Benefits

Typically, the Social Security Administration will count each month you receive SSDI payments as a month towards your 24-month waiting period. Since there is a five-month waiting period to begin receiving SSDI benefits after your disability onset date, this means most people will not receive Medicare until the 30th month of disability.

Previous periods of disability can be counted towards the 24-month qualifying period if your new disability begins within 60 months after the termination of the previous disability benefits, within 84 months after the termination of your disabled widows` or widowers` benefits or your childhood disability benefits, or if the current disabling impairment is either identical or directly related to your previous SSDI qualifying disability.

During the qualifying period, you will need to obtain your health insurance coverage from another source. You can:

- Apply for Medicaid coverage for low-income adults

- Purchase coverage from the open market

- Obtain coverage from a former employer

- Be added to a spouses plan

Please note that there are two exceptions to the 24-month qualifying period. SSDI recipients with End Stage Renal Disease or Amyotrophic Lateral Sclerosis do not have to wait to receive Medicare benefits.

Read Also: Does Medicare Pay For Dtap Shots

Spouses And Social Security Retirement Benefits

Your spouse can also claim up to 50 percent of your benefit amount if they dont have enough work credits, or if youre the higher earner. This doesnt take away from your benefit amount. For example, say you have a retirement benefit amount of $1,500 and your spouse has never worked. You can receive your monthly $1,500 and your spouse can receive up to $750. This means your household will get $2,250 each month.

Guide To Medicare For People With Disabilities: A Step

Individuals under 65 with certain disabilities may qualify for Medicare. If you have end-stage renal disease , you are eligible for Medicare at any age. Youre automatically enrolled in Medicare if you have amyotrophic lateral sclerosis and receive disability benefits, or if you have received disability benefits for at least two years.

On This Page

Medicare coverage isnt only limited to people 65 and older. While senior citizens have increased medical needs, there are also many younger individuals who need health care services due to their disabilities.

To serve the health care needs of the population, Medicare also offers plans to people with certain disabilities.

As of 2019, Medicare covered more than 8 million Americans under age 65 with disabilities.

You can qualify for Medicare under age 65 if you have end-stage renal disease , amyotrophic lateral sclerosis or if youve received disability benefits for at least 24 months.

This guide covers Medicare eligibility requirements for people with disabilities, the coverage for different types of disabilities and a checklist on how to sign up for Medicare.

Also Check: Can You Sign Up For Medicare Part B Anytime

Your Health Care Rights

The Americans with Disabilities Act of 1990 , federal legislation and California state law all prohibit discrimination on the basis of a disability. However, these laws are limited in a number of ways, and they dont require insurance companies to sell you policies.

Medical providers cannot refuse to treat you because you have a disability. But they can refuse to accept you as a new patient if they are refusing other Medicare patients, or if they dont treat anyone with Medicare. Medical providers are also permitted to refer you to another provider if the care you need is not within the scope of their practice.

If you think a physician or health care plan is denying your disability rights, file a complaint with your medical group, your plan and the U.S. Department of Justice . If you need help, contact your local Health Insurance Counseling & Advocacy Program office for free counseling and information.

Ssdi And Other Disability Benefit Programs

Many people who are on SSDI benefits are also eligible for other disability benefits programs like Medicare or Medi-Cal. Its important to understand how these different programs interact as benefits from one program may impact eligibility for another program.

If you have questions about how programs interact with each other, talk to a benefits planner. You can also use the DB101 Benefits and Work Estimator for estimates on how working may impact your SSDI benefits and other benefits.

Recommended Reading: How To Renew Medicare Benefits

What Is Social Security

Social Security is a program that pays benefits to Americans who have retired or who have a disability. The program is managed by the Social Security Administration . You pay into Social Security when you work. Money is deducted from your paycheck each pay period.

Youll receive benefits from Social Security once youre no longer able to work due to disability or once youve reached a qualifying age and stopped working. Youll receive your benefits in the form of a monthly check or bank deposit. The amount youre eligible for will depend on how much youve earned while working.

You can apply for Social Security benefits if one of these situations apply to you:

- Youre 62 or older.

- You have a chronic disability.

- Your spouse who was working or receiving Social Security benefits has died.

Social Security retirement benefits are designed to replace a portion of the monthly income you earned before you retired.

What Happens If You Dont Sign Up For Medicare

Its always your choice whether you sign up for Medicare, but you should understand the consequences of not signing up for this health insurance, including:

- Youll pay the full amount for all medical care unless you have private health insurance

- You may face delays getting Medicare coverage in future

- Youll face penalties if you change your mind and sign up for Medicare later

Automatic enrollment for Social Security beneficiaries makes getting Medicare easy. While you always have a choice about which Medicare plans you keep, consider their benefits now and in the future before making any decisions about your insurance-based coverage.

Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelors degree in science from the University of Leeds and a masters degree in public health from the University of Manchester. Her work has appeared in Netdoctor, Medical News Today, Healthline, Business Insider, Cosmopolitan, Yahoo, Harper’s Bazaar, Men’s Health and more.

When shes not typing madly, Zia enjoys traveling and chasing after her dogs.

Also Check: What Age Am I Medicare Eligible

How Much Is The Disability Benefit

The disability benefit is linked through a formula to a worker’s earnings before he or she became disabled. The following figures show how the disability insurance benefits compare to prior earnings for a worker who became eligible for benefits in 2014 at age 55.

| Earnings Before Disability | Annual DI Benefit |

|---|---|

| 26% |

*Average indexed earnings

The average benefit paid to disabled workers in June 2017 was $1,172 a month or about $14,064 a year.

Social Security Annual Cost

Social Security beneficiaries’ monthly benefit amount is adjusted annually to maintain purchasing power over time. In October each year, the Social Security Administration announces the cost-of-living adjustment payable in January of the following year.19 The Social Security COLA is a reflection of inflation measured by the Consumer Price Index-Urban Wage Earners and Clerical Workers ,20 calculated by the Bureau of Labor Statistics. The CPI-W, representing 29% of the population, is an estimate of the average change in prices of the goods and services purchased by households whose income is earned primarily from a clerical or wage occupation. The CPI-W gathers prices on thousands of items and services across the United States, including food, beverages, clothing, transportation, medical care, education, housing, recreation, and energy.21 An average CPI-W is calculated from these prices each quarter. The Social Security COLA equals the percentage increase in the average CPI-W from the third quarter of the base year to the third quarter of the current year. If the CPI-W indicates deflation, the Social Security COLA will equal 0.0% and Social Security benefits will not decrease.

Also Check: Is Keystone 65 A Medicare Advantage Plan

Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

Medicaid And Ssi Benefits

Medicaid is a state-administered program, not a federal program. Like SSI, Medicaid is subject to income and asset restrictions. If you qualify for SSI, you are automatically approved for Medicaid benefits in North Carolina. There is no waiting period for these benefits to kick in, although processing times vary by Social Security office and by state.

Medicaid provides for a certain amount of doctors visits and prescriptions per month, as well as a certain amount of nursing home care. Onceindividuals receiving SSI benefits reach the age of 65, they can file an uninsured Medicare claim for Medicare and enroll in the federal Medicare program which provides more coverage than Medicaid programs.

You May Like: What Age Qualifies You For Medicare

Returning To Work With Medicare Disability Enrollment

You are allowed to keep your Medicare coverage for as long as a medical professional deems you medically disabled.

If you under age 65 and return to work, you wont have to pay a premium for Part A for the next 8.5 years.

If youre still younger than age 65 once that 8.5-year time period as passed, youll begin paying the Part A premium. In 2021, the standard Part A premium is $259.

Your Medicare costswill depend on your specific circumstances. Its important to know that unlikestandard insurance plans, each Medicare part has its own costs and rules.

What Is The Highest Income To Qualify For Medicaid

Each state sets its own eligibility requirements for Medicaid, including income limits.

Medicaid uses the Federal Poverty Level as a benchmark to determine ones eligibility. In most states that grant Medicaid to low-income adults, individuals are eligible for Medicaid if they have an income that is at or below 150% of the FPL. The state in which you live and the type of Medicaid you are applying for may dictate a different income amount.

Read Also: Does Medicare Part C Cover Dentures

How Long Do I Have To Be On Ssdi Before I Get Medicare

SSDI and Medicare often go hand in hand, but unfortunately there is a waiting period before you can start receiving both Medicare and SSDI benefits. Once you begin receiving monthly SSDI benefits, you must wait 24 months before qualifying for Medicare. Considering how long it often takes just to qualify for and begin receiving disability benefits, this can leave some disabled workers with no healthcare and little to no income.

Although the Social Security Administration does not automatically offer any interim financial aid while waiting for disability, other resources may be available to help you stay afloat until your SSDI and Medicare benefits go into effect.

Contact your local Department of Social Services or Department of Health and Social Services to find out what kind of interim assistance may be available to you, including programs like Medicaid, Temporary Assistance for Needy Families , and the Supplemental Nutrition Assistance Program .

In some cases during your Medicare waiting period, you may be eligible for healthcare coverage through a former employer. If you are able to work in some capacity, you can also qualify for a trial work period which wont affect your benefits as long as you earn less than what is considered Substantial Gainful Activity .

Do I Get Prescription Drug Coverage With Disability Ssdi

You don’t directly get prescription drugcoverage with Social Security Disability Insurance. Social Security will mainlypay disability benefits when you have sufficiently proved that you are indeeddisabled, based on the eligibility criteria they have.

However, if you have been receivingdisability benefit payments for 24 months, you may become eligible underMedicare and receive medical benefits, including prescription drug coverage. Youneed to sign up for this coverage. You are required to sign up within theperiod covered by three months prior to your 25th month receivingSocial Security disability benefits up to the three months after your 25thmonth. Confusing? This just means that you can sign up between the 22ndmonth to the 28th month that you are receiving Social Securitybenefits. You need to do this. Otherwise, you may also need to pay a penalty.

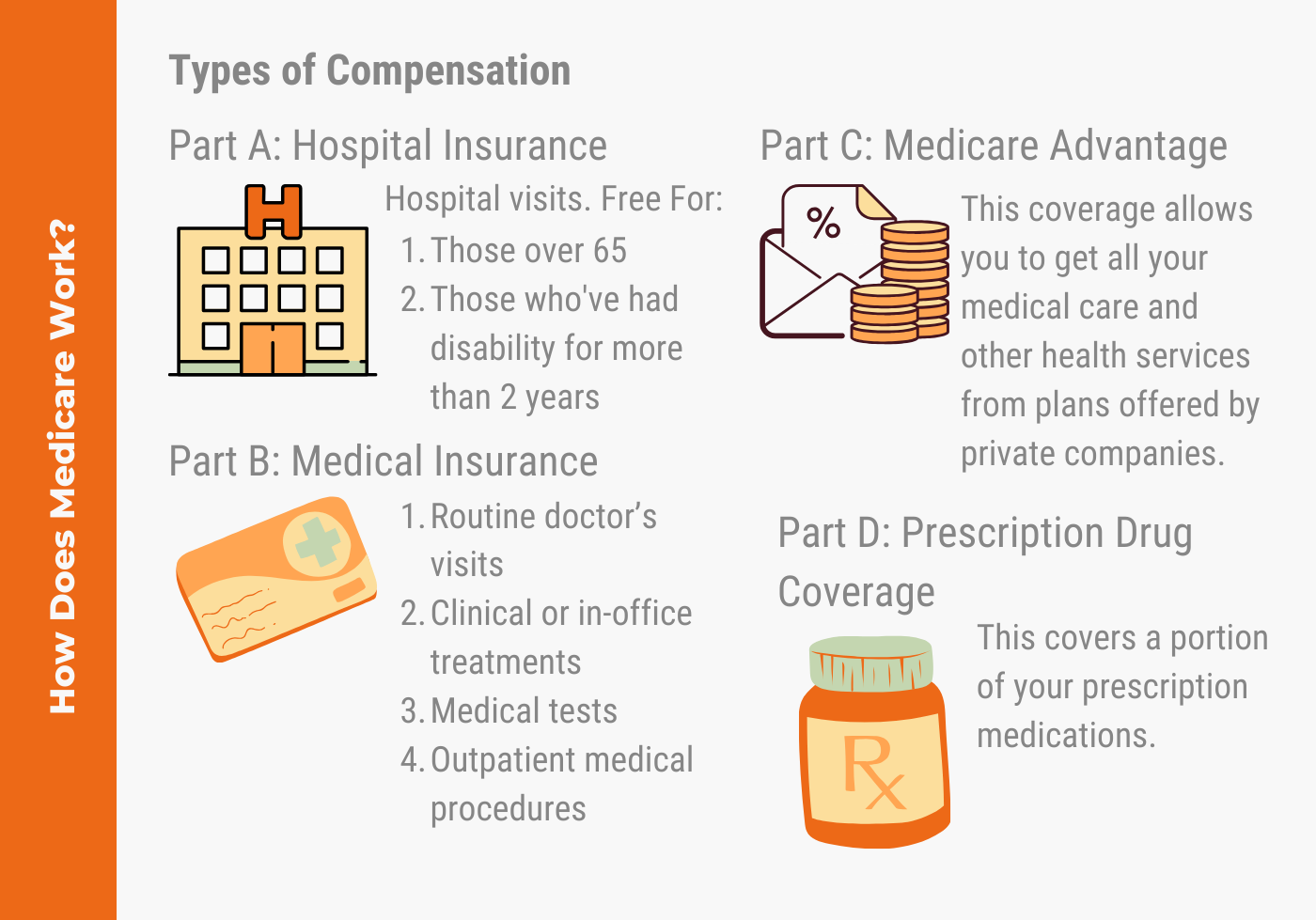

The Medicare benefits provided include:

- Medicare Part A benefits

- Medicare Part B (covering mainly outpatient services and other expensesnot covered by Medicare Part A

- Medicare Part D

- Other optional plans such as Medicaid

This is not just for the disabled beneficiary,but also for his dependents. Also, the prescription drug coverage covers notjust generic prescription drugs but also brand-name medications.

In 2010, the beneficiary will receive arebate of $250 when his medication expenses exceed $2,700. Come 2011, discountsof up to 50% will be given for medicines, particularly brand-name drugs.

| Not a bit |

Don’t Miss: Does Medicare Pay For Bunion Surgery