Is There A Premium For Part B

Yes, and it tends to increase from year to year. For most enrollees, the Part B premium is $148.50/month in 2021. There were concerns that it could have been higher than that, but the short-term government spending bill that was enacted in October 2020 limited the Medicare Part B premiums for 2021.

New: Our Guide to 2022 Medicare Open Enrollment

Hold harmless provision limits Part B premium increases when Social Security COLA is small

Medicare Part B premiums for most enrollees are deducted from their Social Security checks. But theres a hold harmless rule that prevents net Social Security checks from declining from one year to the next, unless the person has an income of $88,000 or more .

So if the Part B premium increases by more than an enrollees Social Security cost of living adjustment , the persons Part B premium will be adjusted, and will end up being less than the standard amount.

For most enrollees, the COLA for 2020 and 2021 were more than sufficient to cover the Part B increases. So most enrollees are paying $148.50/month for Part B in 2021. And the COLA for 2022 is expected to be historically large, and more than adequate to cover the full increase in the standard premium for Part B.

As described below, however, that has not always been the case in recent years.

Small COLA in 2017 meant most enrollees paid less than the standard Part B premium

In 2018, most enrollees were still paying slightly less than the standard Part B premium

Can I Delay Enrolling In Medicare Part B

Some people may get Medicare Part A premium-free, but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B comes with a monthly premium, some people may choose not to sign up during their initial enrollment period if they are currently covered under an employer group plan .

If you are still working, you should check with your health benefits administrator to see how your insurance would work with Medicare. If you delay enrollment in Medicare Part B because you already have current employer health coverage, you can sign up later during a Special Enrollment Period without paying a late penalty. You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends , you have an eight-month special enrollment period to sign up for Part B without a late penalty.

Keep in mind that retiree coverage and COBRA are not considered health coverage based on current employment and would not qualify you for a special enrollment period. If you have COBRA after your employer coverage ends, you should not wait until your COBRA coverage ends to sign up for Medicare Part B. Your eight-month Part B special enrollment period begins immediately after your current employment or group plan ends . This is regardless of whether you get COBRA.

When Can You Sign Up

Like Medicare Part A, typical Medicare Part B enrollment comes with a seven-month Initial Enrollment Period for signup. This includes the three months before and after the month you turn 65, plus the month of your birthday. Hence, if you turn 65 in April, your Initial Enrollment Period stretches from January through July.8

If you arent automatically enrolled, you can sign up for Part B any time during your Initial Enrollment Period. But if you wait until the month you turn 65 , your Part B coverage will be delayed.

If you miss your initial signup and you arent eligible for a Special Enrollment Period , you can enroll in Part B during the General Enrollment Period, between January 1 and March 31 each year. There are a variety of reasons you might get a SEP, including losing employer health coverage or moving back to the U.S. after living in another country.

You May Like: Does Medicare Pay For Mens Diapers

Medicare Advantage Plans May Cover More Vaccines Than Original Medicare

Medicare Advantage plans are sold by private insurance companies as an alternative to Original Medicare.

Every Medicare Advantage plan must provide the same hospital and medical benefits as Medicare Part A and Part B, and most plans include Medicare prescription drug coverage.

MAPDs must help cover a number of commercially available vaccines that arent covered by Original Medicare when reasonably and medically necessary to prevent illness. However, specific rules of administration and costs will vary depending on the Medicare Advantage plan you enroll in.

A licensed insurance agent can help you compare Medicare Advantage plans in your area, including what vaccinations may be covered.

Find Medicare plans that cover your vaccinations

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Chiropractic Care And Medicare Supplement Plans

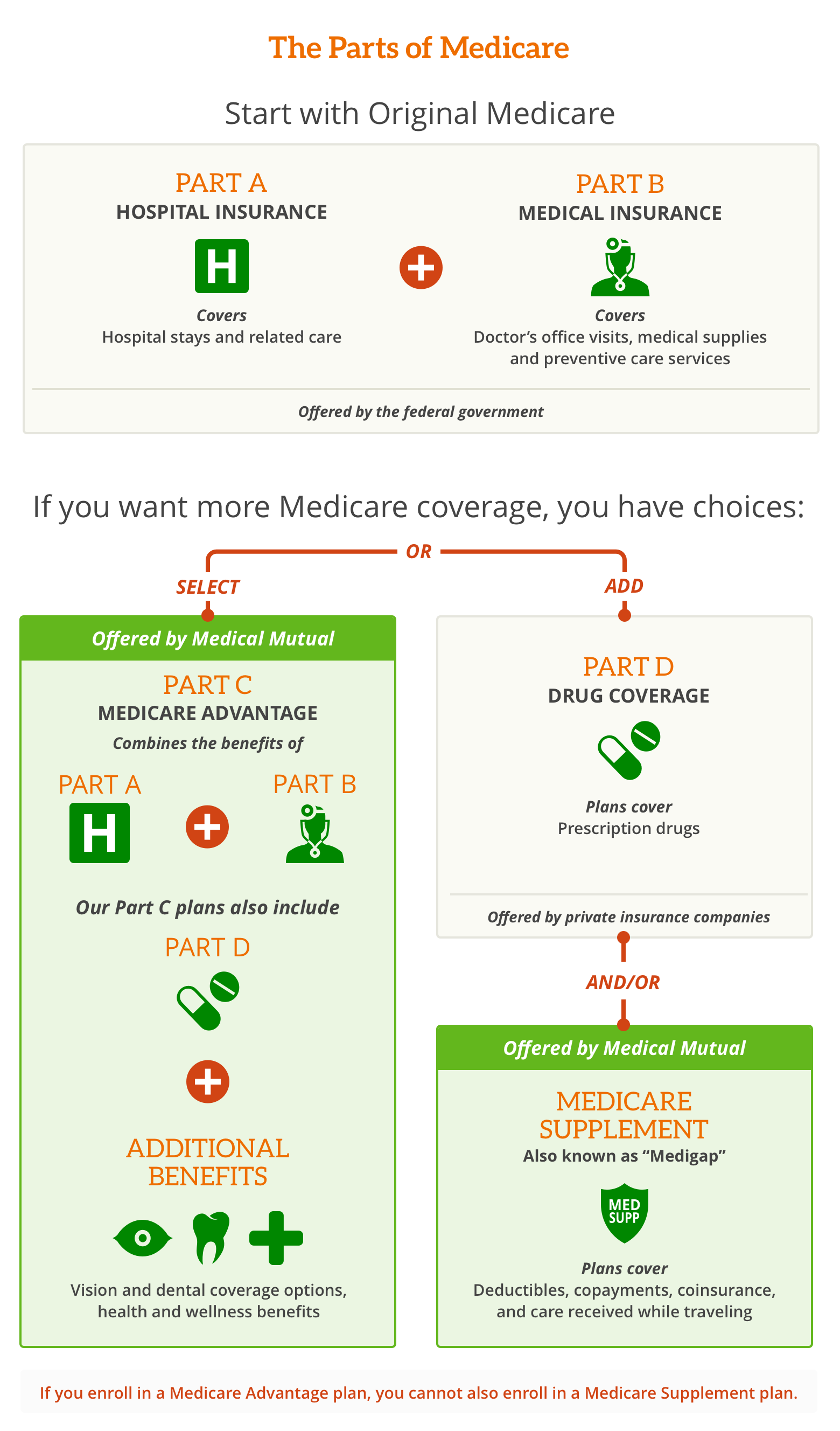

Medicare Supplement plans are insurance plans offered by private insurance companies that cover fees that Original Medicare does not. Like Medicare Advantage plans, Medicare Supplement plans can vary widely according to price. However, unlike Medicare Advantage, the coverage that Medicare Supplement plans offer doesnt vary at all.

For example, Supplement Plan A may cost more in New York than in Kansas, but the coverage offered will be exactly the same. This is because it is regulated at the federal level.

For now, Medicare Supplement plans do not cover any chiropractic services. However, many Medicare Supplement plans do cover your Part B deductible and the 20% of the Medicare-approved amount that you have to pay out of pocket for chiropractic care.

MORE ADVICE

As many people who seek chiropractic care are suffering from chronic pain issues, chiropractors may partner with local physicians to handle pain management care together.

Also Check: What Does Medicare Cost Me

Is Medicare Part B Right For Me

Medicare Part B coverage is right for you if you are currently not working and do not want to enroll in a Medicare Advantage plan.

In order to decide if you should enroll in Medicare Part B, you must first look at your health insurance situation before you turn 65 years old. This will help you determine if Medicare Part B makes sense for your health care situation. However, in most cases an individual will automatically or manually enroll in both Medicare Part A and B during their initial enrollment period. Then, they may select Medicare supplement policies, which would fill in the coverage gaps.

One situation in which you may decide to delay your enrollment is if you are still working. In this case, you can opt to continue on your employer group health insurance plan and not enroll in Medicare Part B.

In this case, you can avoid paying the late enrollment fee if that employer policy is a qualified health insurance plan as defined by the IRS. You should, however, confirm with your company’s benefits manager that the health plan does qualify before you decide to push your Original Medicare enrollment.

How Much Do Medicare Beneficiaries Pay Out Of Pocket

While Medicare is designed to cover the bulk of your medical expenses, the system was designed with high cost sharing and no out-of-pocket limits in original Medicare. The more medical services you need, the more youll pay in Medicare costs.

The idea is that this will help drive responsible use of medical services. It also means that you could pay a lot out of pocket after Medicare has paid its share.

Also Check: Does Medicare Pay For Inogen Oxygen Concentrator

Do You Automatically Get Medicare With Social Security

Medicare and Social Security are two benefits programs managed by the United States government. Medicare currently has over 61 million beneficiaries.

Both federal initiatives are linked, meaning that many individuals receiving Social Security payments may automatically receive Medicare benefits once they qualify for Medicare based on age or disability.

In this article we review how people can receive Medicare health insurance coverage alongside their Social Security benefits.

When And How To Apply Directly

An individual only needs to complete a Medicare Part B application if they refused Medicare Part B during their Initial Enrollment Period but wish to enroll during general enrollment, or if they are still in the Initial Enrollment Period but did not enroll in Part B and Part A at the same time

The application process involves completing form CMS 40B, which applicants can find on the Centers for Medicare & Medicaid Services website.

You May Like: Does Medicare Cover Skin Removal

What Are Medicare Part B Premiums

Medicare Part B premiums are monthly fees that Medicare beneficiaries pay for insurance that covers medically necessary services and preventive services that aren’t covered by Medicare Part A. Part B covers things like ambulance services, doctor visits, lab work, and medical equipment. By contrast, most people don’t have to pay a premium for Medicare Part A.

Does Medicare Cover The Hepatitis B Vaccine

Medicare Part B and Medicare Advantage plans will cover injection of the Hepatitis B vaccine if you are considered at medium or high risk for Hepatitis B.

You may have an increased risk if:

- You have hemophilia

- You live with another person who has Hepatitis B

- You work in health care and have frequent contact with blood and other bodily fluids

Your doctor can help you determine if youre at increased risk for contracting Hepatitis B.

Read Also: How Do Zero Premium Medicare Plans Work

What Is Medicare Part B

To better understand what Part B is, you need an understanding of Medicare in general. Medicare is essentially health insurance coverage that is managed by the Federal government. Medicare was started and signed into law in 1965 as a way to provide health coverage to older Americans. It is managed by the Centers for Medicare & Medicaid Services .

Since the health insurance market is made up largely of employer-based health plans, retired people were left without many good options for coverage. In addition, people unable to work due to disabilities often had trouble finding health coverage as well. This put these older people and people with disabilities without coverage of any kind and set them up for financial hardships should any health issues arise. This differs from the Medicaid program which is jointly funded by state and Federal governments to offer coverage to low-income families.

You may also hear about Medicare Advantage plans. You may hear these called Part C or MA Plans. These plans are maintained by private insurance carriers who contract with the Federal government to administer the plan. These plans typically include Part A, Part B, and optional prescription drug coverage. Think of the Advantage plans as an all-in-one alternative to Original Medicare. You should be aware, however, that these companies can charge different out of pocket expenses, and they have different rules regarding referrals to specialists and other items.

What Does Part B Of Medicare Cover

Medicare Part B helps cover medically-necessary services like doctors services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

The basic medically-necessary services covered include:

- Abdominal Aortic Aneurysm Screening

- Bone Mass Measurement

- Cardiac Rehabilitation

- Durable Medical Equipment

- EKG Screening

- Foot Exams and Treatment

- Glaucoma Tests

- Kidney Dialysis Services and Supplies

- Kidney Disease Education Services

- Outpatient Medical and Surgical Services and Supplies

- Pap Tests and Pelvic Exams

- Physical Exams

- Smoking Cessation

- Speech-Language Pathology Services

- Tests

- Transplants and Immunosuppressive Drugs

To find out if Medicare covers a service not on this list, visit www.medicare.gov/coverage, or call 1-800-MEDICARE . TTY users should call 1-877-486-2048.

You May Like: How Can I Sign Up For Medicare

Who Is Automatically Enrolled

Groups that are automatically enrolled in original Medicare are:

- those who are turning age 65 and already getting retirement benefits from the Social Security Administration or the Railroad Retirement Board

- people under age 65 with a disability who have been receiving disability benefits from the SSA or RRB for 24 months

- individuals with amyotrophic lateral sclerosis who are getting disability benefits

Its important to note thateven though youll be automatically enrolled, Part B is voluntary. You canchoose to delay Part B if you wish. One situation where this may occur is ifyoure already covered by another plan through work or a spouse.

Medicare Part B: Limited Chiropractic Service Coverage

Medicare covers only a very limited selection of chiropractic services, of which are covered by Part B. As Part B is the part of Medicare that covers outpatient medical services, it makes sense that this coverage would apply to chiropractors. However, chiropractic services dont qualify as medical care in the ordinary sense, so Part B wont cover chiropractic services the same way it covers an ordinary doctors visit.

Don’t Miss: When Can Medicare Plans Be Changed

What Happens If You Dont Sign Up For Medicare

Its always your choice whether you sign up for Medicare, but you should understand the consequences of not signing up for this health insurance, including:

- Youll pay the full amount for all medical care unless you have private health insurance

- You may face delays getting Medicare coverage in future

- Youll face penalties if you change your mind and sign up for Medicare later

Automatic enrollment for Social Security beneficiaries makes getting Medicare easy. While you always have a choice about which Medicare plans you keep, consider their benefits now and in the future before making any decisions about your insurance-based coverage.

Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelors degree in science from the University of Leeds and a masters degree in public health from the University of Manchester. Her work has appeared in Netdoctor, Medical News Today, Healthline, Business Insider, Cosmopolitan, Yahoo, Harper’s Bazaar, Men’s Health and more.

When shes not typing madly, Zia enjoys traveling and chasing after her dogs.

How Parts B And D Work Together

Medicare Parts B and D pay for medications you receive in the ambulatory setting but they won’t pay towards the same prescription. You can only turn to one part of Medicare or the other. However, you may be able to use them both for drugs you receive in a hospital setting.

Medications you receive in the hospital when you are admitted as an inpatient will be covered by your Part A deductible. It is important to understand what happens when you are evaluated in the emergency room and sent home or are placed under observation, even if you stay overnight in the hospital. In this case, you can turn to Parts B and D to pay for your drugs.

When you are placed under observation, Part B will still pay for the medications reviewed above. If you receive IV medications, these will generally be covered. However, you may also receive oral medications during your observation stay that are not on the Part B list of approved medications. In this case, you will be billed for each pill administered by the hospital.

Send copies of your hospital bills to your Part D plan for reimbursement. Unfortunately, if you receive a medication that is on your Part D formulary, your plan may not pay for it.

Read Also: Can You Get Medicare Advantage Without Part B

Can I Reject Part B Altogether

Medicare Part B is optional. You can choose to skip it altogether and avoid the premiums. But that means youre on the hook for the full cost of any services that would otherwise be covered under Part B. For healthy enrollees, that might amount to the occasional office visit and nothing more. But if you end up needing extensive outpatient care such as kidney dialysis, chemotherapy, radiation, physical therapy, etc. your bills could add up quickly.

As noted above in the discussion about late enrollments, you will have a chance to sign up for Part B each year, regardless of how long youve delayed your enrollment. But the late enrollment penalty could become substantial, depending on how long youve been without Part B coverage. And if and when you do decide to enroll, youll have to wait until the January-March general enrollment period, with your coverage taking effect in July. So going without Part B when you dont have other coverage from an employers plan is an option, but its a fairly risky option.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

What Vaccines Are Covered By Medicare

The following chart shows how some common vaccines are covered by Medicare.

| Vaccine | ||

|---|---|---|

| Coronavirus 2019 | – Part B | You pay nothing for the vaccine, whether you receive 2 shots or only a single dose. |

| Influenza | -Part B | You pay nothing for 1 flu shot per flu season if your doctor accepts Medicare assignment. |

| Pneumococcal | -Part B | You pay nothing for 2 shots if your doctor accepts Medicare assignment. |

| Hepatitis B | -Part B | You pay nothing if youre at medium or high risk for Hepatitis B and your doctor accepts Medicare assignment. |

| -Medicare Advantage plans with drug coverage-Part D | Coverage rules and costs vary by plan. | |

| Tetanus | -Medicare Advantage plans with drug coverage-Part D | Coverage rules and costs vary by plan. |

These are only a few of the most commonly recommended vaccines. Check with your doctor or health care provider if you have questions about a specific immunization or vaccine that is not listed here.

Medicare Part B also typically covers vaccines after youve potentially been exposed to a dangerous disease or virus. For example, your rabies shot may be covered by Medicare Part B if you are bitten by a dog.

Recommended Reading: Does Medicare Cover Rides To The Doctor