Medicare Part D Special Enrollment Period Rules Are Different

Medicare offers qualified individuals who work past age 65 an 8-month Special Enrollment Period for Part B and for Part A if not already enrolled but Part D has its own rule.

With Part D, you only have about thefirst two months after losing employer coverage to get Part D coverage without penalty. The short timeframe is due to a Medicare rule that says you cant go more than 63 days without Part D or creditable drug coverage after you are enrolled in Part A and/or Part B. This means, that if you want to get a Part D plan or a Medicare Advantage plan with drug coverage, you have to enroll within two months of your Special Enrollment Period beginning. See a helpful visual below.

This is an important detail that often catches people off guard.

So with this rule in mind, lets look at Mikes situation again.

- Mikes employer plan satisfied the creditable coverage requirement.

- Mike enrolled in Part B immediately.

- He waited 5 months to get Part D.

So why is Mike having to pay the Part D late enrollment penalty? Mike is faced with the penalty because he did not enroll in Part D coverage within the 63-day timeframe required by the unique Medicare Part D rule. He should have shopped for a plan earlier.

Do I Need To Enroll In The Same Medicare Plan As My Spouse

There is no need to join the same Medicare Part D plan as your spouse. Medicare is an individual health plan, there are no joint plans. When choosing a Part D plan it is important to consider your individual health needs. While one plan may work well for you, it may not work for your spouse.

Do I have to enroll in Medicare Part D to keep Original Medicare ?

No. Enrollment in a Medicare Part D plan is optional. However, to enroll in a prescription drug plan you must first enroll in Original Medicare or a Medicare Advantage Plan.

Where can I get help with choosing a Part D drug plan?

Before enrolling in a Medicare Part D drug plan, it is important you feel comfortable with your decision. There are various resources you can utilize to gather more information, like Medicare.gov and The Medicare Rights Center to name a few. Another way to get help choosing a Part D drug plan is by consulting with an independent licensed insurance agent. Medicare Concierge can help connect you with an licensed insurance agent or direct you to online resources to enroll online. Independent licensed insurance agents represent multiple plans which allow them to give an unbiased opinion on your health plan choices. Because they represent many carriers, they have a better understanding of how each plan compares to the next. Most independent licensed insurance agent services are free, so there is really no downside to using their services.

Am I Eligible For Part D

Medicare prescription drug coverage is an optional benefit offered to people who have Medicare. If youre enrolled in Original Medicare Part A and/or Part B, you can get Part D regardless of income. You dont need to have a physical exam and you cannot be denied for health reasons. Part D is also a part of some Medicare Advantage plans.

You May Like: How Much Is Medicare B Cost

When Can I Join A Medicare Part D Drug Plan

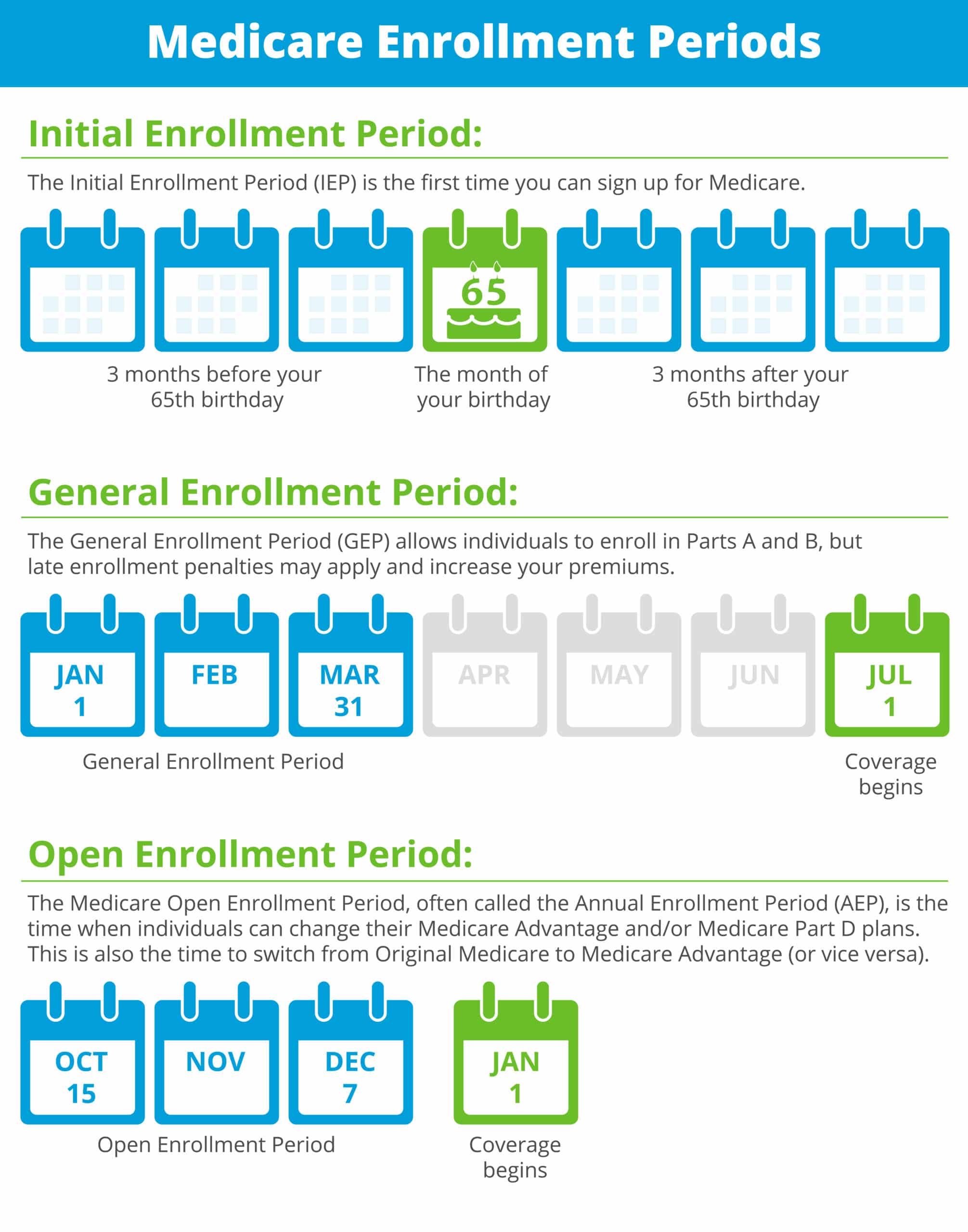

If you are eligible for Medicare benefits because you are 65 or have a disability, you can enroll in a Medicare Part D drug plan. You can enroll the month you turn 65, or in the three months before or three months after you turn 65 . If you do not enroll during that seven-month period, you may have to pay a late enrollment penalty in the form of a higher premium.

If you have Medicare, you can enroll in a Part D drug plan during the open enrollment period, which begins on October 15 and lasts until December 7 each year, with plan selections effective on January 1. If you have a Part D drug plan already, you can change to a different plan during this enrollment period.

You can enroll in the Part D drug plan at any time without paying a penalty if you have both Medicaid and Medicare, or if your income makes you eligible for extra help .

Medicare Annual Open Enrollment Period

Medicares annual open enrollment period is October 15 through December 7. During this time, you can select a new Medicare Advantage or Prescription Drug Plan with coverage that will begin January 1. It is also a chance to review and compare your coverage with other available plans and enroll in a new plan.

During the open enrollment period you can:

- Buy a new Medicare Advantage plan if you are enrolled in Original Medicare .

- Switch back to Original Medicare if you currently have a Medicare Advantage plan.

- Change to a new Medicare Advantage or Part D plan if you currently have a Medicare Advantage or Part D plan.

- Buy or cancel a Part D plan if you have, or are signing up for, Original Medicare.

This open enrollment period cannot be used to enroll in Part A and/or Part B for the first time. For information about enrolling in Part A and/or Part B for the first time visit www.medicare.gov or call 800-633-4227.

Note: Each year, insurance companies can make changes to Medicare plans, including changes to the prescription drugs they cover. It is a good idea to review your current Medicare plan every year to make sure it still meets your needs.

For more information about Medicares annual open enrollment period, or assistance with your review and plan comparison, contact the Michigan Medicare/Medicaid Assistance Program at 800-803-7174 or visit their website at mmapinc.org.

Recommended Reading: Is Shingrix Vaccine Covered By Medicare

Prescription Drugs Not Covered By Medicare Part D

Over-the-counter medications generally arent covered by Part D plans, which includes:

- vitamins

- cosmetic and weight loss medications

Prescription drugs not covered by Medicare Part D include:

- your plan doesnt offer Part D services

- you want to switch to a plan with a higher star rating

You can also change plans during open enrollment each year.

There Are Two Paths To Medicare Part D

When you first enroll in Medicare you must choose between original Medicare or Medicare Advantage. That decision impacts how you can get prescription drug coverage through a Part D plan.

If you enroll in original Medicare, you need to purchase a separate Medicare Part D plan from a private insurer. If you choose to enroll in a Medicare Advantage plan, your Part D coverage is typically included. In cases where its not included in Medicare Advantage plans, you can purchase a separate Medicare Part D plan.

Regardless of which Medicare program you opt fororiginal or Advantageyou typically have at least two dozen different Medicare Part D plans to choose from.

Don’t Miss: What Do You Need To Sign Up For Medicare

Who Can Enroll In A Medicare Part D

In general, individuals who have Original Medicare, Part A and/or Part B, or a Medicare Advantage plan are eligible to enroll into a Medicare Part D Prescription Drug Plan.

In order to be eligible for Medicare Part D enrollment, you must:

- Have Medicare Part A and/or Part B.

- Live in the service area of a plan that provides prescription drug coverage.

Medicare prescription drug coverage is voluntary, and you will need to enroll. You can receive this coverage through private insurance companies in two ways:

- Medicare Prescription Drug Plan : These stand-alone Prescription Drug Plans can be added on to your Original Medicare coverage, as well as certain Medicare Cost Plans, Medicare Medical Savings Account plans, and Medicare Private Fee-for-Service plans.

- Medicare Advantage Prescription Drug plan: Some Medicare Advantage plans include prescription drug coverage, in addition to providing Medicare Part A and Part B coverage.

Keep in mind that you cannot be enrolled in both types of plans. If you are currently enrolled in a Medicare Advantage plan that includes drug coverage and enroll into a Medicare Prescription Drug Plan, you will be automatically disenrolled from the Medicare Advantage plan and reverted back to Original Medicare.

Consider All Your Drug Coverage Choices

Before you make a decision, learn how prescription drug coverage works with your other drug coverage. For example, you may have drug coverage from an employer or union, TRICARE, the Department of Veterans Affairs , the Indian Health Service, or a Medicare Supplement Insurance policy. Compare your current coverage to Medicare drug coverage. The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options.

If you have other types of drug coverage, read all the materials you get from your insurer or plan provider. Talk to your benefits administrator, insurer, or plan provider before you make any changes to your current coverage.

Don’t Miss: What Is The Difference Between Medicare Supplemental And Advantage Plans

D Income Adjusted Monthly Rates For 2021 Based On Your 2019 Income

| File individual tax return |

|---|

For example, if you filed a tax return in 2019 of between $88,000.00 and $111,000.00 you would have to pay your quoted monthly premium plus a $12.30 income adjustment fee. This would bring your total to $77.30 per month.

But if you filed a tax return of $500,000 dollars in the same period youd have to pay a $77.10 income adjustment fee, bringing your total to $142.10 per month.

If youre unsure about choosing a Part D provider, shop around and compare the different plans on offer in your state. PolicyScout has put together a list of the best Medicare providers in the country and would be happy to walk you through your different healthcare options.

Key Point – Medicare Part D Plan Coverage Costs

Part D plan costs consist of:

For example, if you choose a mid-tier plan and filed a tax return above $111,000.00 for the previous year you would pay $777.60 plus an annual deductible of $445.00, bringing the total cost of Medicare Part D coverage for that year to $1,222.60.

Penalty If You Dont Sign Up For Medicare Part D

Even if you dont take medications now, if youre at risk for health problems as you get older, you might need medications later. If you delay enrollment in Medicare Part D at the Medicare age of 65, you might have to pay a Part D late enrollment penalty.

If you go for 63 days or more without prescription drug coverage after your Initial Enrollment Period , thats when you could face a Part D late enrollment penalty. Your penalty is added to your monthly premium amount.

Also Check: Is Prolia Covered By Medicare Part B Or Part D

Medicare Part D Enrollment Periods

There are a few specific enrollment periods to be aware of when signing up for a Medicare Part D plan:

Initial Enrollment Period

The Initial Enrollment Period is your first opportunity to enroll in a Medicare Part D plan. This enrollment period runs for 7 months which includes:

- 3 months before your 65th birthday

- Your birth month

- 3 months after your 65th birthday

For example, if you turn 65 in June, you can enroll in a prescription drug plan as early as March and as late as September.

Annual Enrollment Period

If you missed your Initial Enrollment Period and you wish to enroll in a Medicare Part D plan, you will need to do so during the Annual Enrollment Period. The Annual Enrollment Period runs every year from October 15 December 7. Coverage for plans chosen during this time will begin on January 1. During AEP, you can:

- Enroll in a Medicare drug plan

- Disenroll in a Medicare drug plan

- Change a Medicare drug plan

- Switch from a Medicare Advantage plan that includes prescription drug coverage to a Medicare Advantage plan that doesnt

Special Enrollment Period

The Special Enrollment Period allows enrollment for Medicare Part D under specific individual circumstances. The most common reason for enrolling in a Medicare Part D plan during a Special Enrollment Period is loss of employer coverage. You may also qualify for a SEP if:

Medicare Part Ds Inescapable Cost Sharing Structure

There is currently no annual maximum out-of-pocket limit on what you can owe in a given year. Theres a four-step maze that determines your share of the costs of medication.

- Deductible period. Some plans charge an annual deductible before coverage kicks in. The maximum deductible allowed in 2021 is $445.

- Initial coverage period. Once your insurance kicks in, you will owe whatever coinsurance or copay your plan imposes. But once the combined total of individual payments and insurer payments reaches $4,130 in 2021 , you officially enter the Medicare Part D donut hole.

- Coverage gap. Otherwise known as the Medicare Part D donut hole, during this stretch you owe 25% of your medication costs. In 2021, enrollees stay in the donut hole until their out-of-pocket spending plus discounts they received for brand name drugs reaches at least $6,550. Then its on to the final cost-sharing stage.

- Catastrophic coverage. After your out-of-pocket spending hits the maximum for the coverage gap, you leave the donut hole and your cost sharing drops to 5% for the rest of the year.

The non-profit Kaiser Family Foundation estimates that since 2010, the annual number of Medicare Part D enrollees whose spending lands them in the catastrophic coverage stage has grown from 400,000 to nearly 1.5 million. It also found that between 2010 and 2019, enrollees cumulatively spent nearly $10 billion when in the catastrophic stage.

Recommended Reading: Does Medicare Pay For Air Evac

Medicare Part D Plans With Prescription Drug Coverage

Wondering about Medicare Part D plans? Medicare beneficiaries across the nation have the option of enrolling in Medicare Part D to get help with their prescription drug costs.

Plans offered under Medicare Part D are available in two ways. If you have Original Medicare , Medicare Part D isnt automatically included. Instead, you can get this coverage by enrolling in a stand-alone Medicare Prescription Drug Plan that works alongside your Original Medicare benefits.

If you have Medicare Part C, you can get prescription drug benefits by enrolling in a Medicare Advantage plan that includes this coverage. Also known as Medicare Advantage Prescription Drug plans, these plans give you the option to get your Medicare health and prescription drug benefits covered under a single plan.

Medicare Part D coverage is available through private insurance companies that are contracted by Medicare, so costs and availability may differ between Medicare plans, insurance companies, and location.

After You Apply For Medicare Part D

Once youve applied, the plan has 10 calendar days to reply in one of three ways:

- Confirming theyve received your application

- Requesting more information

- Denying your application with an explanation why.

If you merely receive confirmation, you’ll soon get a card in the mail with important documents about your plan details. If they need more information from you, send it to them ASAP. If they’ve denied you, it’s either because you’re not in the plan’s service area or you’re not currently in an enrollment periodget more information about these reasons and try again for another plan.

Read Also: When Does My Medicare Coverage Start

When And How Do I Enroll In Medicare Part D

The first opportunity for Medicare Part D enrollment is when youre initially eligible for Medicare during the seven-month period beginning three months before the month you turn 65.

If you enroll prior to the month you turn 65, your prescription drug coverage will begin the first of the month you turn 65. If you enroll during the month you turn 65 or one of the three following months, your prescription coverage effective date will be delayed it will not be retroactive to the month you turned 65.

If you enrolled in Medicare due to a disability, you may enroll during a seven-month window beginning three months prior to your 25th month of disability. If you enroll in the three months prior to your 25th month of disability, your coverage will begin the first day of the 25th month. If you enroll during the 25th, 26th, 27th, or 28th month of disability, your coverage will begin the first of the month after you enroll .

Heres more information on how to pick a prescription drug plan.

In both of these cases whether youre turning 65 or are eligible for Medicare because of a disability you have the option of selecting a Medicare Advantage plan that includes prescription drug coverage, and using that in place of Medicare A, B, and D. The enrollment periods and rules are the same as those described above for stand-alone Medicare Part D plans.

After youve chosen from the various PDP offerings, you can enroll by:

Medicare Prescription Drug Eligibility And Enrollment

This page contains enrollment and disenrollment guidance for current and future contracting Part D plan sponsors and other parties interested in the operational and regulatory aspects of Part D plan enrollment and disenrollment.

New! Revisions to the Prescription Drug Plan Enrollment and Disenrollment Guidance and Individual Enrollment Request Form to Enroll in a Part D plan for CY 2021

On August 11, 2020, CMS released the Enrollment Guidance Policy Changes and Updates and Model Medicare Advantage and Prescription Drug Plan Individual Enrollment Request Form for Contract Year 2021 memorandum via our Health Plan Management System to provide guidance and the new PDP model enrollment request form updates. The policy and technical changes reflect the recently published regulation changes in CMS-4190-F to include:

- The removal of enrollment prohibitions on beneficiaries with End-Stage Renal Disease who choose to join a Medicare Advantage plan

- The establishment of two new Special Enrollment Periods for exceptional circumstances and the codification of previously adopted SEPs for exceptional conditions implemented through sub regulatory guidance in addition, to,

- The new Model Individual Enrollment Request Form to enroll in a Part D plan, OMB No. 0938-1378 and

- Changes to the Electronic enrollment process to include new flexibility for Electronic Signatures.

Good Cause Flow Process and Frequently Asked Questions

- Frequently Asked Questions

- Good Cause Triage Process Flow Chart

Also Check: When Do Medicare Benefits Kick In