When To Choose A Medicare Advantage Plan

You can enroll, switch, or cancel a Medicare health plan during the following times:

- Initial Enrollment Period: March, April, or May

- Open EnrollmentIn health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions…. Period: October 15 December 7

- Medicare Advantage Open Enrollment Period: January 1 March 31

During the Medicare Advantage Open Enrollment Period, you can switch to another health insurance plan or go back to your Original Medicare health insurance. If you switch Medicare Advantage plans or go back to Original Medicare , your new coverage will begin on the first day of the month after your new plan gets your request for coverage.

Keep in mind, if you go back to Original Medicare you may not be able to buy a Medicare Supplement policy. Once you cancel a Medigap plan, the insurer has the right to deny coverage based on preexisting conditions. You only have a guaranteed issue rightGuaranteed-issue is a right granted to Medicare beneficiaries and applies to Medicare Supplement insurance . All states and the federal government enforce this essential right, which protects Medicare beneficiaries from medical underwriting…. when you first qualify for Medicare.

Special Case: People Surviving Through Als And Esrd

The medicare eligibility rules for people surviving through ALS or end-stage renal disease are different from the regular ones. They do not have to wait for 2 year-long periods for their medicare benefits to start.

- For the people surviving through ALS, the medicare benefits start the day they meet the disability.

- Whereas, for the people with ESRD, medicare coverage will begin on the very first day of the fourth month of dialysis therapy.

To learn more about different kinds of disabilities, their eligibility criteria, and the elimination period by visiting our site NJDDC.ORG today!

Do You Automatically Get Medicare With Social Security

Medicare and Social Security are two benefits programs managed by the United States government. Medicare currently has over 61 million beneficiaries.

Both federal initiatives are linked, meaning that many individuals receiving Social Security payments may automatically receive Medicare benefits once they qualify for Medicare based on age or disability.

In this article we review how people can receive Medicare health insurance coverage alongside their Social Security benefits.

You May Like: Can I Get Glasses With Medicare

Making Changes To Medicare: Open Enrollment Period

If you already have Medicare Parts A and B, you have an Open Enrollment Period every year between October 15 and December 7. During open enrollment, you can switch from one Medicare Advantage plan to another. You can also switch from traditional Medicare to a Medicare Advantage plan during this time. If you want to switch from a Medicare Advantage Plan back to traditional Medicare, you can do so during open enrollment or during the special Medicare Advantage Disenrollment Period that runs from January 1 through February 14 each year. Once you select a new plan to enroll in, you’ll be disenrolled automatically from your old plan when your new plan’s coverage begins.

When coverage begins. When you switch coverage during the Open Enrollment Period, your new coverage starts January 1. When you switch back to traditional Medicare during the Medicare Advantage Disenrollment Period, your coverage will start on the first day of the month after the month in which you disenroll.

Special trial period for first year you join a Medicare Advantage plan. If you first join a Medicare Advantage plan during your Initial Enrollment Period, you can drop the plan anytime during the first 12 months. But you can only switch to a new Medicare Advantage plan during an Open Enrollment Period .

What Insurance Do You Get With Social Security Disability

In most cases, people receiving Social Security Disability Income are automatically enrolled in Original Medicare after serving a 24-month waiting period.

The CMS waives this waiting period for people with ALS or end-stage renal disease. People with these conditions receive Medicare coverage as soon as they collect SSDI.

Read Also: Is Silver Sneakers Part Of Medicare

Medicare Supplement Insurance Enrollment

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan , the best time to sign up is during your six-month Medigap Open Enrollment Period.

- Your Medigap Open Enrollment Period starts as soon as you are age 65 or older and are enrolled in Medicare Part B.

- Insurance companies cannot deny you Medigap coverage or charge you a higher fee for pre-existing health conditions if you apply for Medicare Supplement Insurance during your Medigap Open Enrollment Period.

If you dont sign up for a Medigap plan during your Medigap Open Enrollment Period, you may still be able to buy one at any time.

Insurance companies can take your health into consideration when setting your premiums or deciding whether or not to offer you coverage, however.

You must be enrolled in Medicare Part A and Part B in order to buy a Medigap plan.

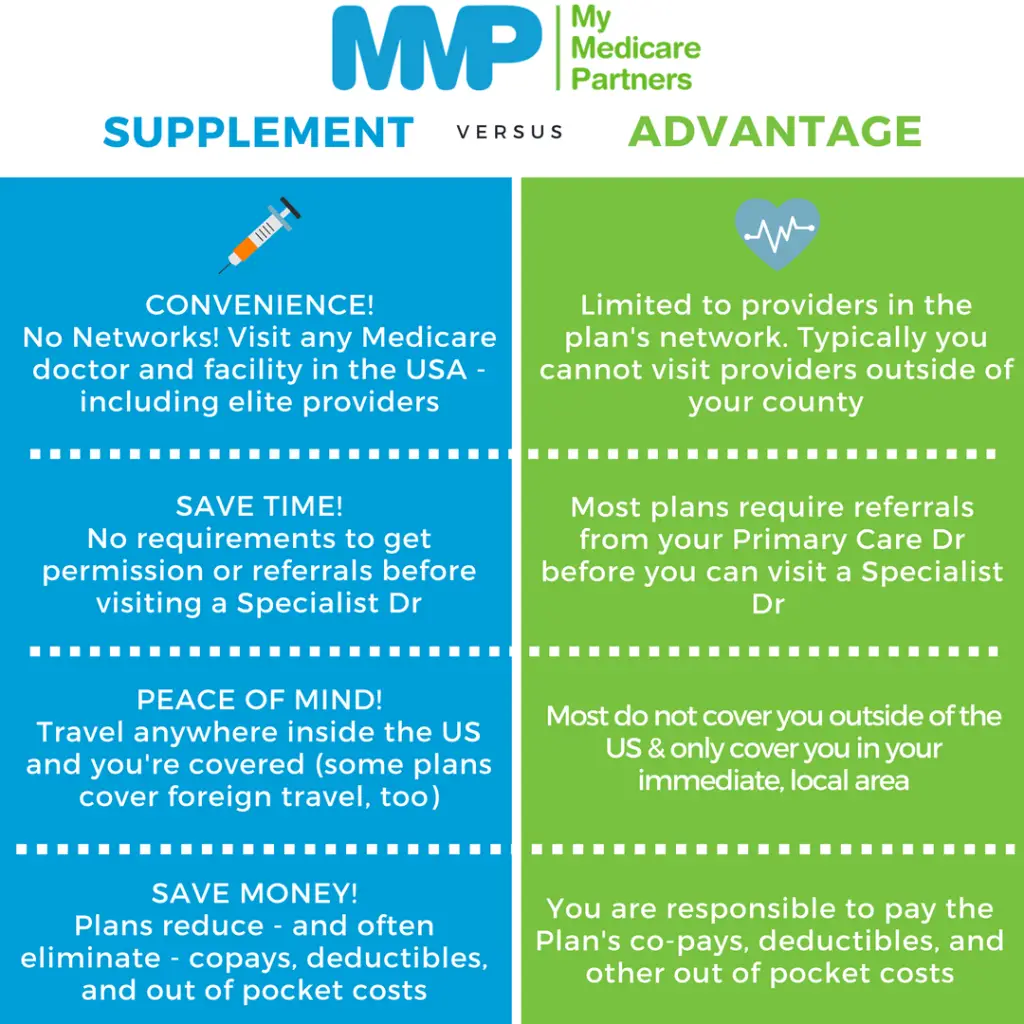

Medigap and Medicare Advantage plans are very different, and you cannot be enrolled in a Medigap plan and a Medicare Advantage plan at the same time.

Learn more about the differences between Medicare Advantage vs. Medicare Supplement Insurance.

Request a free, no-obligation Medicare Supplement Insurance quote today by visiting MedicareSupplement.com.

Be Smart About When To Start Medicare

The rules governing when Medicare starts can seem complicated but again, the vast majority of people can focus on getting their benefits when they reach the Medicare age of 65. By being aware of the exceptions, though, you can coordinate your Medicare benefits with other healthcare options, to make sure that you get as much financial support as you can to help you cover the costs of staying healthy.

Read Also: Is Dexcom G6 Cgm Covered By Medicare

Signing Up Late: General Enrollment Period

Part A. If you didn’t sign up for Medicare Part A when you were first eligible, you can sign up for Part A anytime, without penalty.

When coverage begins. Your Part A coverage will go back to six months before the date you signed up .

Part B, C and D. If you didn’t sign up for Medicare Part B when you were first eligible, you can sign up for Part B during a General Enrollment Period, which happens between January 1 through March 31 each year. You will also have from April 1 through June 30 of that year to add a Medicare Advantage plan or Medicare Part D plan.

When coverage begins. When you sign up for Part B, C, or D during a General Enrollment Period, your coverage will start July 1.

Late sign-up penalty. Individuals who did not sign up for Medicare Part B when they turned 65 might face a penalty of higher lifetime premiums when they do sign up. However, most individuals who were covered by a group health plan through an employer are not subject to the penalty. If you didn’t sign up for Part B because you had group health benefits through work, you should be able to sign up during your Special Enrollment Period.

How Do You Know If You Are Adequately Covered By Medicare Part B

If you are unsure whether you are carrying Part B Medicare coverage, check your Medicare card. If you have the coverage, it will be listed. If you do not have it, you can get it, although the costs may be higher if your initial enrollment period has ended. Premiums for Part B Medicare depend on your income.

Coverage for Medicare is based on:

- Federal and state laws

Recommended Reading: How To Qualify For Medicare Disability

Medicare Special Enrollment Period

Depending on your circumstances, you may also qualify for a Special Enrollment Period .

Medicare Special Enrollment Periods can happen at any time during the year. You may qualify for a Special Enrollment Period for a number of reasons, which can include:

- You moved to a new area that is outside of your current Medicare Advantage plan’s service area

- You left your employer coverage

- Medicare ended your current Medicare Advantage plan’s contract

A licensed insurance agent can help you find out if you qualify for a Medicare Special Enrollment Period.

When Does Medicare Coverage Start If You Sign Up For A Medicare Advantage Plan

If you sign up during your Medicare Initial Enrollment Period, your Medicare Advantage coverage usually starts at the same time your Original Medicare coverage would start, as described above. For example, if you enroll in Medicare Advantage during the three-month period before you turn 65, your plan would start coverage the first day of your birthday month.

If you sign up for a Medicare Advantage plan during the Annual Election Period , your plan coverage usually starts January 1 of the next year. The same is true if you change plans.

If you switch from one Medicare Advantage plan to another during the Medicare Advantage Open Enrollment Period , generally your new coverage starts the first of the month after the plan gets your request.

Also Check: What Is The Average Premium For Medicare Advantage Plans

Do You Want Part C Part D Or A Medicare Supplement

If you want to purchase Medicare Part C , Medicare Part D , the best time to sign up is during your Initial Enrollment Period. If you enroll:

- During the three months before your birthday month, coverage begins the first day of your birthday month

- During your birthday month or the next three months, your coverage begins the first day after the month you enroll

While enrolling during your IEP has its advantages, see below for the other times you can enroll.

But First A Quick Intro To Medicare

Medicare is basic health insurance provided by the Federal government for people 65 and older and people under 65 who meet certain criteria. When you sign up for Medicare, you are signing up for Part A and Part B. This is the first step to completing your Medicare coverage.

Medicare consists of 4 separate parts:

- Part A

- Part B

- Part C

- Part D

Read Also: Does Medicare Cover Chronic Pain Management

How Long Do People On Disability Have To Wait To Become Eligible For Medicare

Once you have collected SSDI payments for two years, you will become eligible for Medicare. You wont even have to sign upMedicare will automatically enroll you in Part A and Part B and mail your Medicare card to you shortly before your coverage begins.

Thankfully, your 24-month waiting period doesnt have to be all at once. For example, if you qualify for SSDI, lose eligibility, then re-qualify for SSDI, each month you collect checks counts toward the total 24-month waiting period.

Similarly, if you apply for SSDI and are denied disability benefits, you can appeal the decision. If you appeal and the decision is reversed, your 24-month waiting period will be backdated to when your disability benefits should have started. The result: your wait for Medicare will be shorter than two years.

I Turn 65 In A Few Months When Should I Sign Up For Medicare

En español | If you already receive Social Security benefits, Social Security will automatically sign you up for Medicare Part A and Part B though you can decline Part B enrollment if you want to. Otherwise, you need to apply for Medicare. The best time to do that depends entirely on your own situation. Broadly, there are two options:

Also Check: How To Get Medicare Insurance License

When To Start A Medicare Supplement Plan

Medigap is extra insurance that fills in the gaps in Medicare. Medigap plans can pay for more extended hospital stays. Your one-time Medigap Open Enrollment Period starts on the 1st day of the month youre 65 years old and have Part B.

Signing up for Medigap during Open Enrollment means the insurance company CANT charge you more or deny you coverage. If you wait and sign up, you can be turned down or charged more because of your health.

Decide On Medicare Advantage

Now that youve enrolled in Medicare Part A and Part B, you need to decide whether you want to stay with Original Medicare, Parts A and B, or sign up for Medicare Part C, also called Medicare Advantage.

With a Medicare Advantage plan, you continue to pay a premium for Part B while a private insurance carrier delivers your services. That company contracts with Medicare to deliver both Part A and Part B benefits. Policies vary, but most include prescription drug coverage and other benefits that arent covered by Original Medicare. You enroll with a private insurer to get your Part C/Advantage plan. You can compare plans at medicare.gov.

Also Check: What Are All The Medicare Parts

Consider Whether You Need Medicare Supplement Insurance

You might already know that Medicare doesnt pay 100% of approved charges. For example, Medicare Part B coverage pays 80% of covered medical costs after you meet the annual deductible. That means youre responsible for the remaining 20% and for paying your deductible.

Thats why many people who choose Original Medicare also buy Medicare Supplement Insurance, often called a Medigap policy, to help pay for some or all of these gaps in benefits. Private insurance companies sell these policies. They help pay for other costs, including coinsurance and copays.

How To Change Medicare Plans

Once youre enrolled in Medicare, youll have various opportunities to change certain aspects of your coverage. Heres an overview:

- During the annual open enrollment period , you can make a variety of changes, none of which involve medical underwriting:

- Switch from Medicare Advantage to Original Medicare or vice versa.

- Switch from one Medicare Advantage plan to another.

- Switch from one Part D prescription plan to another. Its highly recommended that all beneficiaries use Medicares plan finder tool each year to compare the available Part D plans, as opposed to simply letting an existing drug plan auto-renew.

- Join a Medicare Part D plan.

- Drop your Part D coverage altogether.

Also Check: What Is The Difference In Medicare And Medicare Advantage

When Does The Medicare Deductible Reset

Your Medicare deductible resets on January 1 of each year. The Medicare deductible is based on each calendar year, meaning that it lasts from January 1-December 31, and then it resets for the new year.

If youâre signing up for Medicare for the first time, and your coverage starts sometime during the middle or later-part of the year, your deductible will still reset on January 1.

This year, the Medicare Part A deductible is $1,408, and the Medicare Part B deductible is $198.

So, if youâre on Medicare, you would need to meet these deductibles before Medicare starts covering your medical bills.

There is a way to avoid paying Medicare deductibles, which is to have a Medicare Supplement â also called a Medigap plan.

There are 11 total Medicare Supplement plans, and each one varies in terms of price and benefits.

The 3 most popular plans are Plan F, Plan G, and Plan N, because they provide the most coverage.

Is It Mandatory To Sign Up For Medicare After Age 65

No, it isnt mandatory to join Medicare. People can opt to sign up, or not.

If you don’t qualify for Social Security retirement benefits yet, you may need to manually enroll in Medicare at your local Social Security office, online or over the phone when you turn 65. You can also apply online for your Medicare coverage at www.medicare.gov.

Enrolling in Medicare as soon as youre eligible ensures you get the subsidized health care you deserve without waiting periods or financial penalties.

If you continue to work for a company employing 20 or more people after you turn 65, you could delay your Medicare enrollment. Your employee group plan provides enough medical coverage while youre working, meaning you may be able to wait to sign up for Medicare once you retire without incurring any late penalties.

Read Also: Can You Get Medicare Advantage Without Part B

At What Age Should You Start Looking Into And Applying For Medicare

You should start looking into and applying for Medicare for up to 6 months before you become eligible.

- Was this article helpful ?

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

If You Do Medicare Sign

- Read in app

Tony Farrell turned 65 four years ago the age when most people shift their health coverage to Medicare. But he was still employed and covered by his companys group insurance.

When his birthday came around, he began researching whether he needed to move to Medicare, and determined he could stick with his employers plan, said Mr. Farrell, a marketing and merchandising executive for specialty retailers. At the time, he was working for a company that makes infomercials in San Francisco.

Four months later, Mr. Farrell was laid off, but he kept the companys health insurance for himself and his family under the Consolidated Omnibus Budget Reconciliation Act , the federal law that allows employees to pay for coverage as long as 36 months after a worker leaves a job.

I just thought, this is great the coverage wont change, he recalled. I was just relying on my own logic and experience, and felt that if I didnt need a government service, I wouldnt sign up for it.

But Mr. Farrell unknowingly ran afoul of one of the complex rules that govern the transition to Medicare and now he is paying the price.

Recommended Reading: How Old To Be Covered By Medicare