What Is Medicare Part B

Medicare Part B is one of the two parts that make up Original Medicare. While Part A covers hospital care, Part B covers medical care.

Medicare Part B, one of the two parts of Original Medicare, generally covers medical expenses and care, including medically necessary services and preventative services that may not be covered by Part A. On the other hand, Medicare Part A covers hospital-related health services and care, including inpatient hospital care, nursing care, and home health care.

Part A and Part B are designed to work together. While Part A provides coverage for services in hospital and hospice care, Part B handles the doctors visits and tests that help streamline patient treatments. Enrolling in Part B is optional, and you could choose to enroll only in Part B and not Part A. However, Part B is required if you want to buy Part A, but not if you are eligible for premium-free Part A.

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

B Premium Can Be Limited By Social Security Cola But That Hasnt Been An Issue For Most Beneficiaries Since 2019

In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 , in 2020 , and in 2019 . Some enrollees pay more than the standard premium, if theyre subject to a high-income surcharge .

But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees. The COLA for 2022 was the largest it had been in 30 years, and more than adequate to cover even the substantial increase in Part B premiums.

Read Also: When Can You Start Medicare

How Much Does Medicare Part B Cost

Medicare consists of several different parts, including Part B. Medicare Part B is medical insurance and covers medically necessary outpatient care and some preventative care. Together with Medicare Part A , it makes up whats called original Medicare.

If youre enrolled in Part B, youll pay a monthly premium as well as other costs like deductibles and coinsurance. Continue reading to take a deeper dive into Part B, its costs, and more.

How Much Does Medicare Part C Cost In 2022

The premium for Medicare Part C â also called Medicare Advantage â depends on your plan and the insurer, since these health plans are provided by private insurance companies.

Deductibles, copays and coinsurance for Medicare Part C vary by plan. However, there is a limit to how much you can spend on out-of-pocket expenses. After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage canât exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

The average out-of-pocket limit for Medicare Advantage enrollees was $5,059 in 2019, according to the Kaiser Family Foundation.

Learn more about Medicare Part C.

You May Like: Can You Get A Medicare Card Online

Other Medicare Charges Also Rising

The annual Part B deductible will rise $30 next year to $233, up from this year’s $203.

For Medicare Part A, which covers hospitalization and some nursing home and home health care services, the inpatient deductible that patients must pay for each hospital admission will increase by $72 in 2022 to $1,556, up from $1,484 this year. Almost all Medicare beneficiaries pay no Part A premium. Only people who have not worked long enough to pay their share of Medicare taxes are liable for Part A premiums.

Open enrollment for Medicare began Oct. 15 and continues through Dec. 7. During this period, beneficiaries can review their coverage and decide whether to make changes.

Dena Bunis covers Medicare, health care, health policy and Congress. She also writes the Medicare Made Easy column for the AARP Bulletin. An award-winning journalist, Bunis spent decades working for metropolitan daily newspapers, including as Washington bureau chief for the Orange County Register and as a health policy and workplace writer for Newsday.

Editor’s note: This story has been updated to include additional information.

More on Medicare

Medicare Part A Premiums

Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as youre eligible for Social Security or Railroad Retirement Board benefits.

You can also get premium-free Part A coverage even if youre not ready to receive Social Security retirement benefits yet. So, if youre 65 years old and not ready to retire, you can still take advantage of Medicare coverage.

Part A does have a yearly deductible. In 2022, the deductible is $1,556. Youll need to spend this amount before your Part A coverage takes over.

You May Like: What Does Medicare Extra Help Pay For

Summary Of Medicare Benefits And Cost

The chart below is a comprehensive list of Medicare Part A and B costs, including premiums, deductibles and coinsurance. Medicare supplemental insurance, known as Medigap, can help cover some of the gaps in coverage and pay for part or all of Medicares coinsurance and deductibles, depending on the policy. Some Medicare Advantage plans may also help cover these costs. See Medigap: Medicare Supplemental Insurance and Medicare Advantage for more information.

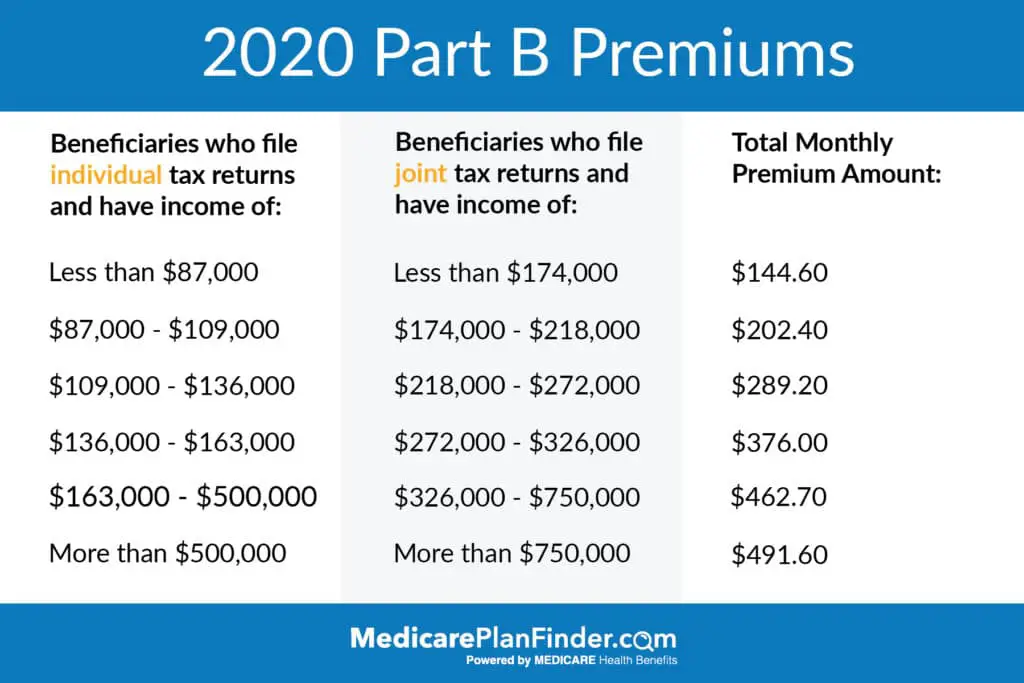

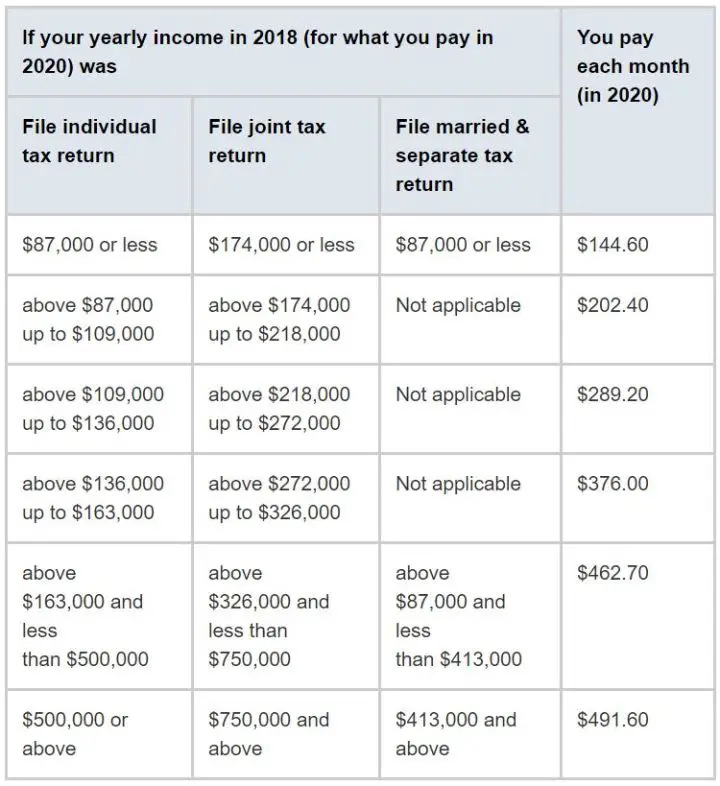

Medicare Part B Premiums Rise 7% In 2020 With Premiums For Highest

Getty

The Centers for Medicare & Medicaid Services has announced Medicare Part B premiums for 2020, and the base premium increases nearly 7% from $135.50 a month to $144.60 a month. That $9.10 monthly increase compares to a modest $1.50 monthly increase last year. Meanwhile high earners are still getting used to income-related surcharges that kicked into higher gear in 2018, and those have been bumped up again too. The wealthiest senior couples will be paying nearly $12,000 a year in Medicare Part B premiums. Part B covers doctors and outpatient services.

The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. Whats to blame for the bigger increases this year? Rising spending on physician-administered drugs, according to CMS.

The CMS announcement comes after last months Social Security Administrations COLA announcement: a 1.6% cost of living adjustment for 2020. The average Social Security benefit for a retired worker will rise by $24 a month to $1,503 in 2020. The higher Medicare Part B premium cuts into retirees monthly Social Security payments. Part B premiums typically are deducted from monthly Social Security checks.

By comparison, the wealthiest retireessingles with $500,000 of income or more and couples with $750,000 of income or morewill face total premiums of $491.60 a monthper person, including a $347surcharge, in 2020. The 2019 numbers are here.

You May Like: What Is Medicare Dual Complete

Does My Health Play Any Role In My Costs

No. If youre enrolled in Original Medicare , your health wont play a role in how much you pay for your Medicare coverage. Part A is determined by how long you paid Medicare taxes. For Part B, all enrollees pay the same deductible while premiums are calculated using income and whether you signed up on time.

B Premiums And Social Security

You cannot be expected to pay more for Medicare if there is not also a proportionate rise in Social Security benefits. The holds harmless provision of the Social Security Act protects recipients from paying higher Medicare Part B premiums if those premiums will cause their Social Security benefits to be lower than they were the year before.

Simply put, increases in Part B premiums cannot exceed the annual cost-of-living adjustment for Social Security.

In those cases, the Medicare Part B premium will be decreased to maintain the same Social Security benefit amount. However, keep in mind that the holds harmless provision does not apply to Medicare Part D. If the Medicare Part D Income-Related Monthly Adjustment Amount increases, a beneficiary may still see a decrease in their overall Social Security benefits.

Not everyone is eligible for the holds harmless provision. Only people in the lowest income category who have already been on Medicare Part B and have had their premiums directly deducted from their Social Security checks for at least two months in the past year are considered. Beneficiaries new to Medicare and people on Medicaid will be subjected to the current premium rate.

The Social Security cost-of-living adjustment for 2022 is 5.9%. This is estimated to be an additional $92 per month for the average recipient. This amount would be able to cover the rise in Medicare premiums in the new year.

For those who are dual eligible, Medicaid will pay their Medicare premiums.

You May Like: Does Medicare Cover Long Term Nursing Home Care

So Much For That Generous Social Security Raise

In 2022, seniors on Social Security are in line for a 5.9% cost-of-living adjustment , their largest in decades. All told, the average benefit will rise from $1,565 a month to $1,657 a month, representing a $92 increase.

But now, about one-third of that raise will be wiped out by the higher cost of Medicare Part B. And while it’s easy to argue that seniors will still come out ahead financially, let’s also remember that the whole reason Social Security benefits are rising so much in 2022 is that inflation has driven the cost of living up substantially. And so while Medicare Part B hikes won’t take seniors’ entire Social Security raise, the remainder of that increase will no doubt be eaten up by higher gas, grocery, and utility costs.

For years, Medicare premiums costs have risen at a much faster rate than Social Security COLAs, leaving seniors struggling to keep up. In addition to higher monthly premiums, seniors on Medicare will face an annual Part B deductible of $233 in 2022. That’s a $30 increase from 2021, and while it may not seem like a huge jump on its own, combined with premium increases, it certainly leaves many beneficiaries in a tough spot.

Medicare Part A Deductible

Most Part A costs come from the inpatientInpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facilitySkilled nursing facilities provide in-patient extended care with trained medical professionals to recover from injury or illness and activities of daily living. These facilities provide physical and occupational therapists, speech pathologists and medical professionals assist with medications, tube feedings and wound care. Skilled nursing stays are usually covered under Medicare Part A. will require you to pay the annual deductible.

For the year 2021, the Plan A deductible increased from 2020:

- Medicare Part A deductible 2020: $1,408

- Medicare Part A deductible 2021: $1,484

Also Check: Does Medicare Cover Acupuncture Services

How Much Will I Pay For Premiums In 2022

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if:

A Coinsurance For Skilled Nursing Facility Care

Medicare Part A covers skilled nursing care provided in a skilled nursing facility under certain circumstances. The 2022 Part A coinsurance amounts are as follows:

- Days 1-20: $0 coinsurance per benefit period

- Days 21-100: $194.50 coinsurance per day of each benefit period

- Days 101 and beyond: You are responsible for all costs

You May Like: What Is The Most Expensive Medicare Supplement Plan

Medicare Part D Costs

Original Medicare does not generally cover prescription drugs, with the exception of limited outpatient prescription drugs.

If you want Medicare prescription drug coverage, you can enroll in a Medicare Advantage plan that includes drug coverage, or you can enroll in a stand-alone Part D plan.

Compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.3

Pay Your Premiums Directly From Your Social Security Benefits

Seniors who are enrolled in Medicare and Social Security simultaneously have their Part B premiums deducted directly from their Social Security benefits. Doing so isnt just a convenience, though in some cases, it can save you from rising premium costs thanks to Medicares hold-harmless provision.

This provision protects you from losing out on Social Security income when Part B premium increases surpass the cost-of-living adjustments that are applied to benefits each year. This means that if Part B increases by $30 a month in a given year, but your cost-of-living adjustment only raises your monthly benefits by $24, you save yourself the extra $6 by not having to pay it.

Also Check: How To Submit A Medical Claim To Medicare

Recommended Reading: What Is The Cost Of Medicare Supplement Plan F

Medicare Part B Premiums

Premiums for Medicare Part B are paid every month. The standard Part B premium in 2022 is $170.10, but the amount you actually pay is determined by the modified adjusted gross income reported on your 2020 IRS tax return. For example, if your individual tax return in 2020 was $91,000 or less, you would pay $170.10 every month in 2022 for your Part B deductible. If your individual tax return in 2020 was between $91,001 and $114,000, you would pay $238.10 every month.

If you receive benefits from the Railroad Retirement Board, the Office of Personnel Management , or through Social Security, your premium is automatically deducted from this amount.

How To Delay Part B Enrollment

Enrollment in Medicare Part B is optional. If you choose to delay your application, you could face a permanent penalty based on the number of consecutive 12-month periods where you were eligible for Part B but did not enroll.

However, if you currently have a job that provides coverage or are covered by similar insurance through your spouses job, you may be able to delay without facing enrollment penalties later due to the SEP that kicks in after employer-sponsored coverage ends.

You May Like: Does Medicare Pay For Tummy Tuck

How Can I Avoid Paying For Medicare

Delaying enrollment in Medicare when youre eligible for it could result in a penalty that will remain in effect for the rest of your life.