Sign Up: Within 8 Months After The Active Duty Service Member Retires

- Most people dont have to pay a premium for Part A . So, you might want to sign up for Part A when you turn 65, even if the active duty service member is still working.

- Youll pay a monthly premium for Part B , so you might want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

When To Enroll In Medigap

You may only purchase Medicare Supplement Insurance during your open enrollment period. This is a six-month period immediately following your 65th birthday and only after you have enrolled in Medicare Part B.

The enrollment period cannot be changed or repeated. Once the enrollment period ends, you may no longer be able to enroll in a Medigap policy. If you are able, it may cost you more.

Medigap insurers are not allowed to charge you more for a policy if you have pre-existing conditions and cannot ask you about your family medical history.

Medicare Eligibility Before Age 65

If youre under 65 years old, you might be eligible for Medicare:

- If you receive disability benefits from Social Security or certain disability benefits from the Railroad Retirement Board for at least 24 months in a row

- If you have amyotrophic lateral sclerosis

- If you have end-stage renal disease . ESRD is permanent damage to the kidneys that requires regular dialysis or a kidney transplant

If youre eligible for Medicare because of any of these circumstances, you may receive health insurance through Medicare Part A and Medicare Part B , which make up Original Medicare. Your enrollment in Medicare may or may not be automatic, as explained below.

Don’t Miss: When To Sign Up For Medicare Part D

Medicare Eligibility By Disability

Most Medicare recipients under the age of 65 reach eligibility during their 25th month receiving Social Security disability benefits. If you qualify for Medicare because of a disability, your Initial Enrollment Period will begin during the 22nd month you receive these benefitsthree months before youre eligible for coverage.

Medicare Eligibility For Medicare Advantage Before 65

After youre enrolled in Original Medicare, you may choose to remain with Original Medicare or consider enrollment in a Medicare Advantage plan offered by a private, Medicare-approved insurance company.

Medicare eligibility for Medicare Part C works a little differently. Youre eligible for Medicare Advantage plans if you have Part A and Part B and live in the service area of a Medicare Advantage plan. If you have End Stage Renal Disease , you usually cant enroll in a Medicare Advantage plan, but there may be some exceptions, such as a Medicare Advantage plan offered by the same insurance company as your employer-based health plan, or a Medicare Special Needs Plan .

When you enroll in a Medicare Advantage plan, youre still in the Medicare program and need to pay your monthly Medicare Part B premium and any premium the plan charges. The Medicare Advantage program offers an alternative way of receiving Original Medicare coverage but may offer additional benefits. For example, Original Medicare doesnt include prescription drug coverage or routine dental/vision care, but a Medicare Advantage plan may include these benefits and more. Benefits, availability and plan costs vary among plans.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Also Check: Is My Spouse Covered Under My Medicare

What Does Part B Pay For Medicare Advantage

Initial Medicare Benefit Medicare For Part B benefits, you generally pay 20% of the Medicare-approved amount after you meet your deductible. This is called coinsurance. Refund rates vary packages may have lower refundable rates for some services. You pay the premium for part B. If you decide to take out health insurance.

What is the platinum planWhat is platinum health insurance plan? Platinum is a standardized type of health insurance that, on average, covers about 90 percent of members’ health care costs. The remaining 10% of the healthcare costs is covered by copays, coinsurance and deductibles.What is Obamacare Platinum Plan?The ObamaCare Platinum Plan is a type of cash plan for the health insurance market. Platinum pl

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Don’t Miss: Does Medicare Medicaid Cover Assisted Living

How Should I Prepare Prior To Reaching The Medicare Eligible Age

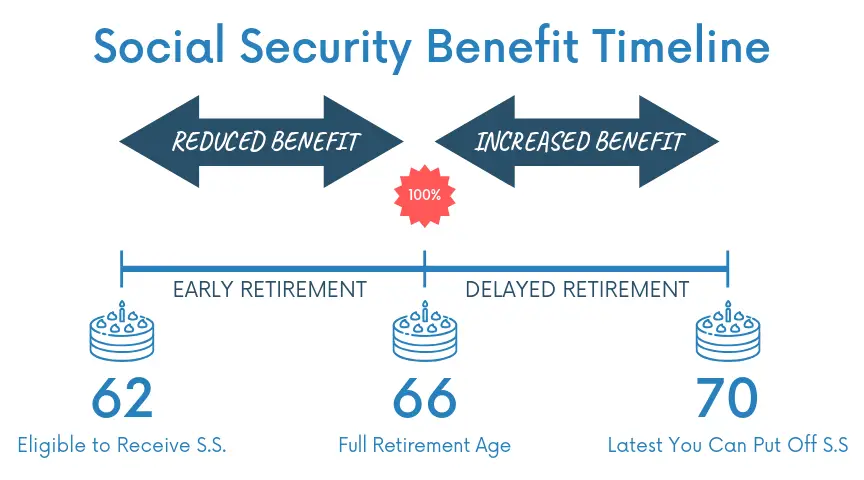

Now that you know when you are eligible for Medicare, you can start the retirement planning process. Be aware that by taking your retirement early, your monthly Social Security benefits will be reduced by a percentage for the rest of your life. This percentage can change, but currently, if you retire at age 62, your benefits will be 28.3 percent lower than if you waited until your full retirement age.

One benefit to receiving Social Security early is that you may be automatically signed up for Medicare when you reach 65. But either way, you should be aware at what age are you eligible for Medicare so that you can sign up on time. If you miss the deadline, your premiums for Medicare Part B will be higher. You can only sign up for Part B at certain times of the year.

When Can I Start Receiving Medicare Part A Benefits

You can start receiving Medicare Part A benefits with no premium once you are 65 or older if you or your spouse worked and paid Medicare taxes for at least 10 years. You can know you are eligible for premium-free Medicare A if one of the following applies to you:

- You currently receive or are eligible for Social Security.

- You currently receive or are eligible for Railroad Retirement Board benefits.

- You or your spouse served in a Medicare-covered government job.

If you received Social Security or RRB benefits at least four months prior to turning 65, you will receive Medicare Part A automatically. If not, you need to file an application with the Social Security Administration.

Recommended Reading: Is Eliquis Covered Under Medicare

Medicare Eligibility Requirements For 2020

Not sure if youre eligible for Medicare health insurance? The Social Security Administration enrolls some people automatically. But dont expect that or wait for your Medicare card to show up. Find out if youre eligible now so you can enroll at the right time and avoid any Late Enrollment Penalties .

Theres more than one way to qualify for Medicare, and enrolling in the different parts of Medicare differ as well. Plus, how you qualify may determine how you can receive coverage and what your premiums might be.

If youre looking for more of a crash course in the different parts of Medicare and how the program works as a whole, check out our Ultimate Medicare Guide. Otherwise, read on.

How Long Do Medicare Benefits Last For People With Disabilities

As long as youre receiving Social Security disability benefits, your Medicare coverage will continue. In some cases, your Medicare coverage can extend beyond your disability payments.

For example, if you return to work and become ineligible for SSDI, you could stay on Medicare for another eight and a half years93 monthsas long as your disability persists. However, you have to opt in to your employers health plan if they offer one.

In this case, your employer’s health plan would become the primary payer, and Medicare would pay secondary . Unfortunately, if your employer offers only an HSA plan, you wont be able to use Medicare since HSAs and Medicare dont mix.

Don’t Miss: Does Medicare Offer Home Health Care

What Are Medicare Parts C And D And How Many People Are Enrolled

Around a third of Medicare members are enrolled in an Advantage Plan. Since its inception, the number of members who purchase Part C plans has increased.

A survey conducted by the Center for Health Care Strategies found that costs were the highest barrier for low-income seniors in accessing dental coverage. To solve this problem, Progressive Democrats have included pushing to expand Medicare to cover dental, vision, and hearing needs. To appeal to voters, Senator Bernie Sanders took to social media saying: “Keeping your teeth in your mouth as you grow old should not be a luxury.”

Keeping teeth in your mouth as you grow old should not be a luxury in this country.

Bernie Sanders

With only around thirty percent of seniors having access to dental insurance, many seniors suffer from dental diseases that leave many toothless in their old age. The Centers for Disease Control and Prevention published data that shows that “nearly a fifth of those over sixty-five have lost all of their teeth.” Twice as many Black beneficiaries have lost all their teeth compared to the national average.

What To Look For In A Medicare Advantage Plan

- The costs will adapt to your budget and needs.

- a list of network providers with all the doctors you want to keep

- Coverage of the services and medicines you need

- Star rating from the Center for Medicare & Medicaid Services

Medicare for dummiesWhat do you need to qualify for Medicare? To qualify for Medicare, you must also be eligible for benefits from Social Security, a railroad retirement board, or have worked long enough for Social Security, a railroad retirement board, or a government official.How do I enroll in Medicare?How to Enroll in Medicare. To apply for Medicare Part A and/or Medicare Part B, do one of the following: O

Read Also: Does Humana Medicare Cover Tdap Vaccine

How Do I Get Full Medicare Benefits

If youve worked at least 10 years while paying Medicare taxes, there is no monthly premium for your Medicare Part A benefits. But if you havent worked, or worked less than 10 years, you may qualify for premium-free Part A when your spouse turns 62, if she or he has worked at least 10 years while paying Medicare taxes. However, to be eligible for Medicare, you need to be 65 years old. You also need to be an American citizen or legal permanent resident of at least five continuous years.

So, to summarize with an example:

- Bob is 65 years old. Hes on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

Can I Get Medicare If I Never Worked

Yes, you can get Medicare if you never worked, but youll need to pay a premium for Medicare Part A. If you are a U.S. citizen over 65 and you or your spouse did not pay Medicare taxes for at least 10 years, you may be eligible to purchase Medicare Part A health insurance. In 2020, seniors who did not receive premium-free Part A coverage paid $458 per month if they paid Medicare taxes for less than 30 quarters those who paid Medicare taxes for 30 to 39 quarters pay $252 per month.

You will not be enrolled automatically, so you need to file an application with the Social Security Administration. You can then enroll in Medicare Part A and Part B for a monthly premium during a valid Medicare enrollment period. You will not be able to purchase Part A alone.

Don’t Miss: Are Hearing Aids Covered By Medicare Part B

Do Your Medicare Benefits Cover Your Spouse

In the United States, as soon as you turn 65 you are eligible for Medicare benefits if you are citizen or have been a legal resident for five years or more and have worked for at least 40 quarters paying federal taxes. You may also be eligible for Medicare coverage if you are younger than 65 but have a qualifying disability or end-stage renal disease.

Your personal Medicare insurance policy does not cover anyone but you. Your spouse or family members cannot be included in your coverage. For your spouse to have Medicare coverage, he or she must have a separate, individual policy.

Your non-working spouse is eligible for premium-free Medicare Part A coverage at the age of 65 based on your work record and if you meet the necessary requirements for Medicare coverage mentioned above.

Medicare automatically enrolls you in Original Medicare. Most people get Part A premium-free at the age of 65 based on taxes paid while working. If you wish to sign up for Medicare Part B , and/or Part D , you must enroll separately during your initial enrollment period, Open Enrollment or during Special Enrollment Period to avoid paying late enrollment penalties. If you and your spouse are different ages, you will likely become eligible at different times.

What Happens if Your Spouse is Younger Than You?If your spouse is younger than you when you turn 65 and become Medicare eligible, he or she must wait until turning 65 to be automatically enrolled in premium-free Medicare Part A.

Related articles:

Medicare Eligibility: Key Takeaways

- Generally, youre eligible for Medicare Part A if youre 65 and have been a U.S. resident for at least five years.

- When youre notified youre eligible for Part A, youll be notified that youre eligible for Medicare Part B.

- You need to be eligible for both Medicare Part A and B in order to enroll in Medicare Advantage.

- To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both.

- If youre enrolled in both Medicare Part A and B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy.

For the vast majority of Americans who look forward to receiving Medicare health benefits, eligibility is as uncomplicated as celebrating your 65th birthday.

But your eligibility to receive Medicare coverage without having to pay a premium and your eligibility for other Medicare plans depends on such factors as your work history and your health status. Heres what you need to know:

Read Also: Is Inogen One Covered By Medicare

Who’s Eligible For Medigap

If youre enrolled in both Medicare Part A and Part B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy. These plans are standardized, and are designed to cover some or all of the out-of-pocket costs that are incurred when you have a Medicare-covered claim .

You have a federal right to buy a Medigap plan during the six months beginning when youre at least 65 years old and have enrolled in Part B. This is known as your Medigap open enrollment period. After this time runs out, you will have only limited chances to purchase one down the road.

Some states allow people of any age or health status to purchase Medigap coverage at any time without medical underwriting, but most dont. In many states, Medigap plans may not be available for people who have Medicare before age 65. There are 33 states that require Medigap plans to be guaranteed issue in at least some circumstances when an applicant is under age 65, but the rules vary from one state to another you can click on a state on this map to see details about state-based Medigap rules.

If youre enrolling in Medicare due to your age, the primary factor that will affect your ability to purchase a Medigap policy regardless of your health will be whether you enroll during your Medigap Open Enrollment Period.

Receiving Professional Home And Community Care Services

If you are receiving professional home and community care services arranged through your Local Health Integration Network, you are automatically covered by the Ontario Drug Benefit program. You pay up to $2 for each drug filled or refilled and you do not have to pay a deductible.

If you are aged 24 and under and have no private insurance or are receiving professional home and community care services, you do not have to pay the $2 for each drug filled or refilled.

Ask your care coordinator or pharmacist how it works.

Read Also: Does Medicare Offer Life Insurance

If A Nonworking Spouse Is Older Than You And You Meet The 40 Quarters Requirement

Now lets look at when your spouse is older than you and your spouse didnt meet the 40 quarters requirement, but you do.

When you turn age 62 and your spouse is age 65, your spouse can usually receive premium-free Medicare benefits.

Until youre age 62, your spouse can receive Medicare Part A, but will have to pay the premiums if they dont meet the 40 quarters of work requirement.

What Are The Best Medicare Advantage Plans

- Aetna Medicare Advantage Plans for 2021. Aetna Medicare Advantage Plans topped the list.

- Humana Medicare Advantage Plans for 2021. Humana provides Part C coverage for more than 20 years.

- Cigna Medicare Advantage Plans for 2021.

- Understanding Medicare Advantage plans.

- Understand the types of Medicare Advantage plans.

Read Also: When Do Medicare Benefits Start