Does Social Security Pay For Medicare

Social Security does not pay for Medicare, but if you receive Social Security payments, your Part B premiums can be deducted from your check. This means that instead of $1,500, for example, youll receive $1,386.40 and your Part B premium will be paid.

Now lets take a look at Medicare and Social Security to understand what these important benefit programs are, how you qualify, and what they mean for you.

Ways To Pay Your Medicare Bill:

If you pay by credit/debit card, enter the account information and expiration date as it appears on your card. Be sure to sign the coupon.

Mail your Medicare payment coupon and payment to:

Medicare Premium Collection Center

What Should You Do Once You Get Medicare

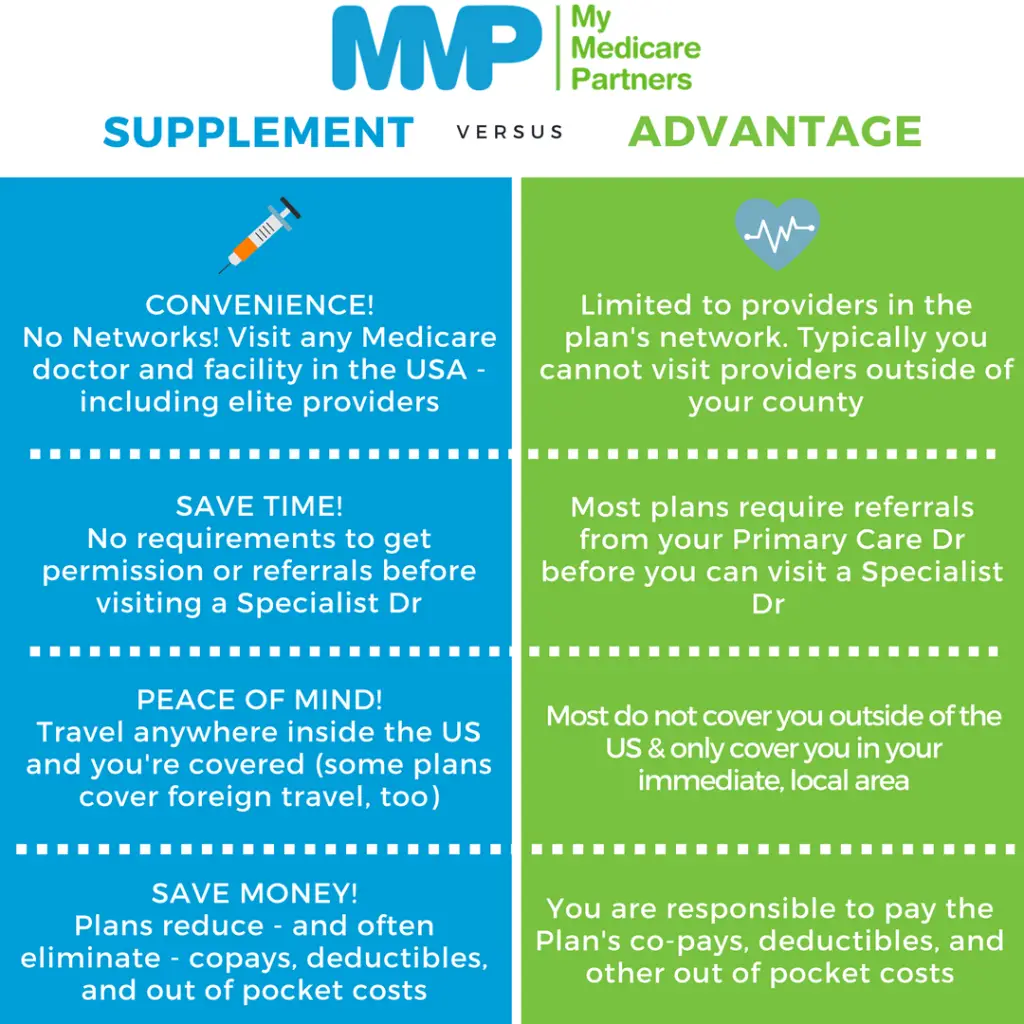

Although you can rely on Original Medicare alone, 86% of Medicare enrollees also have some type of additional coverage.2 It can be from an employer, a privately-purchased plan or from a government-run program like Medicaid. Original Medicare pays for a great deal of healthcare, but still leaves you with potentially costly gaps in healthcare coverage. Supplementary plans can cover these gaps including deductibles and copayments at a fraction of the out-of-pocket rate.

MedicareGuide.coms plan selector is designed to intelligently bring you the best Medicare Supplement plans. These plans, also known as Medigap policies, fill the gaps in coverage that you would otherwise be charged by Original Medicare.

Recommended Reading: How To Compare Medicare Supplement Plans

Do I Receive A Notice About Medicare When I Turn 65

If you are already receiving Social Security benefits, you will get information about Medicare in the mail three months before you turn 65. If you do not receive Social Security benefits, you must actively enroll in Medicare yourself by contacting your local Social Security office. You will not receive a notification in the mail informing you that you qualify for Medicare

Read More:

Also Check: How Can I Get My Medicare Card Number

Who Is Eligible For Medicare

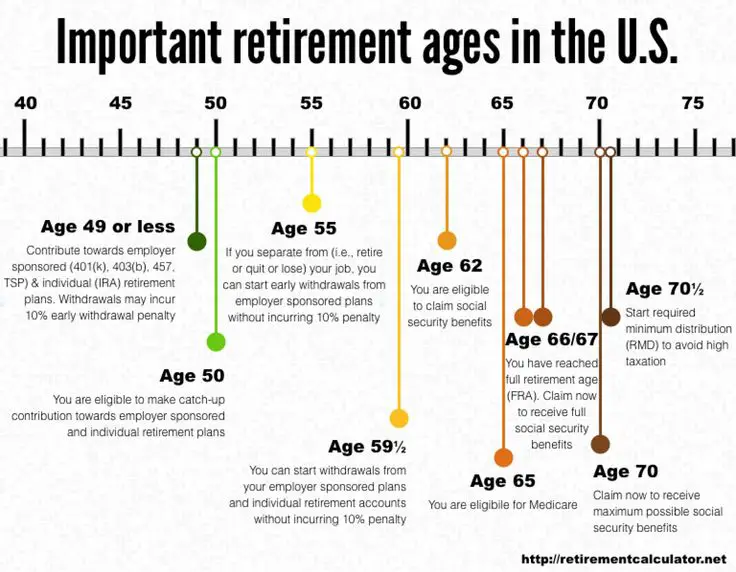

Most people enroll in Medicare when they turn 65. You can enroll as early as three months before your 65th birthday or as late as three months after. Youll need to be a United States citizen or have been a permanent legal resident for at least five years. In order to get full coverage, you or your spouse need to meet a work requirement. Meeting the work requirement verifies that youve paid into the system.

You May Like: How Soon Before Turning 65 Do You Apply For Medicare

When Does Medicare Open Enrollment Start

For most people, its best to enroll during your seven-month Initial Enrollment Period. Begin three months before you turn 65. It includes your birth month, and it ends three months after your birth month.

If you want your benefits to start at the beginning of the month, you turn 65, be sure to sign up at least a month before your birthday. You can also enroll in Part D prescription coverage or a Medicare Advantage plan at this time.

Those that dont sign up for Part B during the Initial Enrollment Period may pay a late enrollment penalty. Youll pay the penalty every month for the rest of your life for as long as you have coverage.

Examples of Creditable Coverage

For example, you work for a large employer, and the health plan is creditable coverage. In this scenario, delaying enrollment would make sense, especially if the coverage is better than Medicare.

Although, group coverage better than Medicare isnt the typical scenario. Many people work for small employers when this is your situation, Medicare is primary. So, if you dont have Medicare, and you only have the group plan, the employer plan wont pay until your Medicare is active.

Further, COBRA is NOT creditable coverage for Medicare. When you delay Part B without creditable coverage, a late enrollment penalty could be coming your way.

Even those with TRICARE need to enroll in Medicare to keep their benefits. However, if you have TRICARE, its unlikely youll benefit from extra Medicare coverage.

Medicare Eligibility By Disability

Most Medicare recipients under the age of 65 reach eligibility during their 25th month receiving Social Security disability benefits. If you qualify for Medicare because of a disability, your Initial Enrollment Period will begin during the 22nd month you receive these benefitsthree months before youre eligible for coverage.

Recommended Reading: How To Qualify For Extra Help With Medicare Part D

Turning 65 What You Need To Know About Signing Up For Medicare

The first of the 78 million baby boomers turned 65 on January 1, 2011, and some 10,000 boomers a day will reportedly reach that milestone between now and 2030. If you are about to turn 65, then it is time to think about Medicare. You become eligible for Medicare at age 65, and delaying your enrollment can result in penalties, so it is important to act right away.

There are a number of different options to consider when signing up for Medicare. Medicare consists of four major programs: Part A covers hospital stays, Part B covers physician fees, Part C permits Medicare beneficiaries to receive their medical care from among a number of delivery options, and Part D covers prescription medications. In addition, Medigap policies offer additional coverage to individuals enrolled in Parts A and B.

Local Elder Law Attorneys in Your City

City, State

Medicare enrollment begins three months before your 65th birthday and continues for 7 months. If you are currently receiving Social Security benefits, you don’t need to do anything. You will be automatically enrolled in Medicare Parts A and B effective the month you turn 65. If you do not receive Social Security benefits, then you will need to sign up for Medicare by calling the Social Security Administration at 800-772-1213 or online at . It is best to do it as early as possible so your coverage begins as soon as you turn 65.

Making Changes To Medicare: Open Enrollment Period

If you already have Medicare Parts A and B, you have an Open Enrollment Period every year between October 15 and December 7. During open enrollment, you can switch from one Medicare Advantage plan to another. You can also switch from traditional Medicare to a Medicare Advantage plan during this time. If you want to switch from a Medicare Advantage Plan back to traditional Medicare, you can do so during open enrollment or during the special Medicare Advantage Disenrollment Period that runs from January 1 through February 14 each year. Once you select a new plan to enroll in, you’ll be disenrolled automatically from your old plan when your new plan’s coverage begins.

When coverage begins. When you switch coverage during the Open Enrollment Period, your new coverage starts January 1. When you switch back to traditional Medicare during the Medicare Advantage Disenrollment Period, your coverage will start on the first day of the month after the month in which you disenroll.

Special trial period for first year you join a Medicare Advantage plan. If you first join a Medicare Advantage plan during your Initial Enrollment Period, you can drop the plan anytime during the first 12 months. But you can only switch to a new Medicare Advantage plan during an Open Enrollment Period .

Recommended Reading: Which Medicare Plan Covers Hearing Aids

How Does Working After Retirement Affect Your Benefits

Working after retirement is becoming more and more common. The average recipient of Social Security retirement benefits is only receiving $1,543 per month. One can quickly see why it often becomes necessary to continue working even when receiving benefits. Some people might continue to work their normal job when they choose to start receiving benefits. Others might decide to return to work at a part-time job. So, how does working affect the benefits that you will receive?

The main thing to understand here is that your benefits can be affected by earning additional income, particularly if you have not reached full retirement age. Those who choose to start their benefits early might not receive their full benefits if they are still working. In 2021, the Social Security earnings limit is $18,960 to still receive full benefits. This means that if you earn more than this amount from another source like a part-time job, then your benefits will be reduced. Your benefits will be reduced by $1 for every $2 that you earn above the limit.

What Happens With Medicare After I Retire

Once your employment or non-retiree employee group coverage ends , youâll enter a Special Enrollment Period . During this SEP, which starts the month after the qualifying event and lasts for the eight months afterwards, you can usually enroll in a Medicare plan without incurring a penalty.

If you donât enroll in Parts A and/or B during the SEP, youâll start to accrue a penalty thatâll take effect if and when you enroll in them.

â â â

With so many retirees counting on Medicare for coverage, we often donât think about working while on Medicare, but working and Medicare can go hand in hand. Whether you choose to have Medicare while employed or rely on coverage through your work, you should look at your options to make sure itâs right for you. The same goes for remaining on your partnerâs employee health plan after age 65. While it may seem like a good choice, thatâs not always the case. Knowing your options can keep you covered when you need it most and avoid a potential financial penalty. Whether youâre remaining on an employee health plan and doubling up with a Medicare plan or going right to Medicare, you can explore your options with the Medicareful Plan Finder. With this tool, you can search for Medicare plans in your area, directly compare costs and coverages, and connect with a licensed insurance agent if you have questions!

Don’t Miss: Should I Get Medicare Part C

What If You Worked 10 Years Or Less

Most people will qualify for coverage by paying Medicare and Social Security taxes for 10 years through any combination of employers. Youll need to have spent 10 years doing taxable work to enroll in Medicare Part A for free. If youve worked for less than 10 years in the US, youll need to pay monthly premiums for Medicare Part A.

However, if your spouse who is 62 or older has enough quarterly credits or receives Social Security benefits, then youll still qualify. You may also be able to qualify based on your spouses work record if youre widowed or divorced.

How Much Money Can I Make Before Social Security Will Reduce My Benefits

It depends on your age. If you have not yet reached full retirement age, then you can only earn $18,960. If you make more than that, then your benefits will be reduced. That limit increases to $50,520 the year in which you reach full retirement age. Suppose you reach normal retirement age in September. Then from January to September, the higher limit will apply. Upon actually reaching normal retirement age, the limit is removed altogether. This means that you can earn an unlimited income with no effect on your benefits. This age is anywhere from 65 to 67 depending on the year in which you were born.

Read Also: Does Medicare Cover Disposable Briefs

Income Limits For Social Security Retirement Benefits

Many people ask, How much can you earn in 2021 and draw Social Security? The annual limit for 2021 is $18,960 for those who have not reached full retirement age. So, suppose that you begin receiving benefit payments at age 62. This special rule states that you can have no more than $18,960 in annual earnings or else your benefits will be reduced. Keep in mind that the earnings limit only applies to money earned from work. It does not include earnings from investments like an IRA or capital gains. However, if a spouse or child receives benefits based on your work record, their benefits will be reduced as a result of your earnings as well.

If you claim benefits and have been working for the entire year, then it might be a good idea to check out the SSAs earnings test calculator. You should know that it is your responsibility to notify the Social Security Administration of your earnings. Failure to notify SSA might mean that your benefits do not get appropriately reduced, especially in your first year of working. You might continue receiving your full monthly checks, and then you will be forced to repay those extra benefits when you file your income taxes. You might even owe some additional fines and penalties as well. Be sure that you are aware of these rules when it comes to allowable monthly income so that you do not find yourself in this situation.

Medicare Other Insurance And How We Can Help

Did you know you can enroll in Medicare even if you have other kinds of insurance such as Medicaid, VA benefits, and employer-sponsored health insurance? That said, some of these types of insurance work better with Medicare than others. In some cases, they may affect your ability to enroll in Medicare.

To find out how to choose the right Medicare coverage and understand how it will interact with health insurance you may already have, call the number below. A licensed Medicare expert can answer your Medicare eligibility questionsand help you enroll.

Also Check: How To Know If I Have Medicare

Healthmarkets Can Answer Your Medicare Eligibility Questions

If you are eligible for Medicare and are ready to shop for a plan, HealthMarkets can help. We make it easy to compare plans, get free Medicare quotes, and enroll. Answer a few short questions and to see what kind of Medicare plan might work best for your lifestyle, and which plans make the best fit. Get started now.

46253-HM-0920

How To Use This Information

Each survivor’s situation is different. Talk to a Social Security representative before you decide to take benefits.

You cannot use the Retirement Estimator to determine benefit amounts for a surviving spouse. However, if you know what the worker’s yearly lifetime earnings were, you can use our Online Calculator to get a rough estimate of what the benefits would be for the surviving spouse at full retirement age.

If you know what the widow or widowers benefit is at full retirement age, you can use the information for the survivor’s year of birth to find out how much the widows or widowers benefit would be at various ages.

You May Like: Can I Enroll In Medicare Online

Medicare Vs Medicaid Compare Benefits

In the context of long term care for the elderly, Medicares benefits are very limited. Medicare does not pay for personal care . Medicare will pay for a very limited number of days of skilled nursing . Medicare will also pay for some home health care, provided it is medical in nature. Starting in 2019, some Medicare Advantage plans started offering long term care benefits. These services and supports are plan specific. But they may include:

- Adult day care

Also Check: How Much Is Medicare B Deductible

Will I Get Medicare At 62 If I Retire Then

If you retire before the age of 65, you may be able to continue to get medical insurance coverage through your employer, or you can purchase coverage from a private insurance company until you turn 65. While waiting for Medicare enrollment eligibility, you may contact your State Health Insurance Assistance Program to discuss your options.

Here are other ways you may be eligible for Medicare at age 62:

- Or, you have been diagnosed with End-Stage Renal Disease

- You may qualify for Medicare due to a disability if you have been receiving SSDI checks for more than 24 months

- Are getting dialysis treatments or have had a kidney transplant

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Also Check: Does Medicare Cover Private Home Care

When Does Medicare Advantage Coverage Start

The date your Medicare Advantage plan starts depends on the enrollment period and your eligibility. Those turning 65 and enrolling in Medicare, can select an advantage plan 3-month before the effective date.

When you pre-enroll in your plan, you save yourself from scrambling. Medicare is one thing you dont want to procrastinate on. Many people change plans during the Annual Enrollment Period if you make a change during this period, your policy will begin on January 1st of the following year.