What’s The Current Medicare Tax Rate

In 2021, the Medicare tax rate is 1.45%. This is the amount you’ll see come out of your paycheck, and it’s matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

| 2021 Medicare tax rate |

|---|

| Your employer pays | 1.45% |

For those who are self-employed, the full 2.9% must be paid by the individual, rather than splitting the tax with an employer. This tax toward Medicare is included in the self-employment tax that is paid quarterly through estimated tax payments.

The self-employment tax amount is based on net earnings calculated using IRS form Schedule SE. Even though the tax rate is higher for the self-employed, it’s being paid on a smaller portion of income because the taxable income is 92.38% of net profit.

For high-income self-employed earners, the Additional Medicare Tax of 0.9% also applies for any income above the annual threshold.

| 2021 Medicare tax for self-employed | |

|---|---|

| Rate you pay on 92% of net earnings | 2.9% |

| Additional amount you pay on income above the annual threshold | 0.9% |

How Does Medicare Calculate Income

The majority of Medicare beneficiaries qualify for Medicare Part A coverage at no cost, depending their contribution through taxes while working over a period of time. For those who have paid Medicare taxes for under 40 quarters, a monthly premium is charged. In 2020, the premium may be as low as $252 for those who paid Medicare taxes for 30 to 39 quarters or as high as $458 if taxes were paid for under 30 quarters. It is not tied to income level. Conversely, income is taken into account to assess each beneficiarys monthly premium for Part B.

Premiums for Medicare Part B insuranceAt the end of each calendar year, Medicare announces the Part B standard premium amount to be effective the first of the following year. For 2020, the rate is $144.60 per month. Medicare charges higher premiums to people across different income ranges. This is referred to as an Income Related Monthly Adjustment Amount . The basis for where you fall within these ranges is your tax return two years prior to the effective date of the new rate. As an example, the IRS provides Social Security with 2018 tax return data on which to evaluate individual premiums due for Medicare coverage in 2020. When you apply for Medicare, you are not required to provide copies of your tax return. As Medicare is a U.S. government program, the agency already has that information.

The 2020 standard rate applies if you fall into the following income ranges for the tax year 2018:

- Individual: $500,000 and above.

How To Calculate Fica Tax

The FICA tax tax is an employee payroll tax that funds Social Security benefits and Medicare health insurance. The tax is split between employers and employees. They both pay 7.65% of their income to FICA, the combined contribution totaling 15.3%. The maximum taxable earnings for employees as of 2020 is $137,700. There is no wage limit for Medicare.

Don’t Miss: How Do I Apply For Medicare In Missouri

Line : Wages And Tips And Other Compensation

The calculation for Line 2 is as follows:

|

The amount in the Gross Wages field in the Employee Summary window plus the amount in the Reported Tips field and the amount in the Charged Tips field in the Employee Tips Summary window. |

|

|

The amount in the Pension Wages field is subtracted, and then the amount in the Taxable Benefit field from the Employee Benefit Maintenance window is added. |

|

|

Finally, it reduces this net amount by any deductions that are sheltered from federal tax. |

What Are Employers Responsible For Regarding Medicare Taxes

Employers are responsible for withholding and reporting Medicare taxes taken from an employees wages. They must also deposit these wages into an authorized bank or financial institution.

An employer is also required to match 1.45% of an employees withholding for Medicare wages and tips. For example, if an employee makes $2,000 during their pay period, that employee would have $29 withheld from their paycheck, and their employer would match that contribution with an additional $29 paid toward Medicare.

The 0.9% Additional Medicare Tax is applied to employees only, so employers are not obligated to match that tax contribution.

Employers found to be non-compliant with these standards may face criminal or civil sanctions.

Recommended Reading: Does Medicare Cover Oxygen At Home

What Is The Additional Medicare Tax

The Additional Medicare Tax applies to people who make more than a set income level for the year.

As of 2013, the IRS requires higher-earning taxpayers to pay more into Medicare. The extra tax was announced as part of the Affordable Care Act and is known as the Additional Medicare Tax.

The tax rate for the Additional Medicare Tax is 0.9 percent. That means youll pay 2.35 percent if you receive employment wages. Self-employed taxpayers will pay 3.8 percent. Incomes from wages, self-employment, and other compensation, including Railroad Retirement compensation, all count toward the income the IRS measures.

If youre subject to this tax, your employer can withhold it from your paychecks, or you can make estimated payments to the IRS throughout the year.

What Is The Medicare Tax Rate

The 2020 rate for the Medicare tax is 1.45% for employers and 1.45% for employees. However, this rate varies depending on your annual income.

You can expect to be taxed at the 1.45% rate if you fall under the following categories:

-

For Single Taxpayers: The first $200,000 of your wages

-

For Married Taxpayers Filing Jointly: The first $250,000 of your wages

-

For Married Taxpayers Filing Separately: The first $125,00 of your wages

If your earnings exceed those amounts in your category, an additional 0.9% will be added to your Medicare tax for everything you earn above the threshold, totaling a 2.35% tax rate.

If you are self-employed, the 2020 Medicare tax rate is 2.9% on the first $137,700 of your yearly earnings. Dont forget to check the rates and income thresholds for your current tax year, as necessary.

Read Also: When Can You Start Collecting Medicare

What Deductions Are Taken From Social Security Paychecks

In 2010, more than 54 million people in the United States received $58 billion in Social Security benefits. Social Security checks are distributed from three benefit programs retirement, survivors and disability tax-free. However, benefit payments are decreased through deductions authorized by the federal government. If beneficiaries owe taxes, federal debt or have support orders, the amounts owed are deducted from their Social Security checks.

Determine Your Taxable Income

You can find the year to date totals on your most recent paycheck. For better accuracy, get this information from the last paycheck of the year. Also, make sure that you’re not using the number for the most recent pay period. You’ll want the total of all the wages that you’ve earned that year. This amount may need to be adjusted if you have any deductions that are excluded from taxable income.These types of deductions will include:

- 401 deductions

- Premiums for group life insurance

- Vision and dental insurance premiums

- Dependent care reimbursement accounts

You will subtract any of these items from your gross taxable wages. The number you come to should match the number you see in Box 1 on your W2 when you receive it. You’ll take these same steps when figuring out your state taxable income. Should this information be incorrect, you may need to reach out to your company’s payroll department for an explanation.

Calculate Medicare and Social Security Taxable Wages

Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income. However, there is a maximum amount of wages that is taxable for social security tax. For any wages earned during the year of 2017, this is capped at $127,200. You’ll start by looking at your most recent pay stub. Look at the gross taxable income for the year to date.

- Insurance premiums

- Life insurance premiums up to $50,000 in life insurance coverage

Also Check: Is Rollator Walker Covered By Medicare

Reasons Why The Gross Amount On Your End

APS receives many questions during tax season, and the one that comes up most often is, Why doesnt my W-2 match my pay stub? or Why doesnt my W-2 match my salary? It is typical for gross taxable wages on an employees final pay stub of the year to differ from the amount shown on their Form W-2. This difference is a result of the following reasons:

1. Year-End Pay Stubs Include Non-Taxable Income Items

Examples of non-taxable income items include reimbursements for mileage or other types of non-taxable expenses. These non-taxable items are paid back during payroll runs. As a result, the gross wages on an employees pay stub often differ from the Boxes 1, 3, 5, and 16 wages on the W-2 because these non-taxable items will lower gross taxable wages.

Example

2. Company-Sponsored Retirement Plan Participation

Company-sponsored retirement plans like a 401s reduce taxable federal and state wages only. They are reported in Boxes 1 and 16, respectively. If you contribute to a retirement plan, the compensation on your end-of-year pay stub vs your W-2 will be different.

Example

Sallys gross wages are $30,000 but over the course of the year, she contributed $3,000 towards her 401 retirement. Sallys federal and state W-2 wages will be $27,000. .

3. Company Health Insurance is a Pre-Tax Deduction

Example

Johns gross wages are $30,000 but over the course of the year, he contributed $2,000 to a pre-tax health insurance deduction. Johns taxable W-2 wages will be $28,000 .

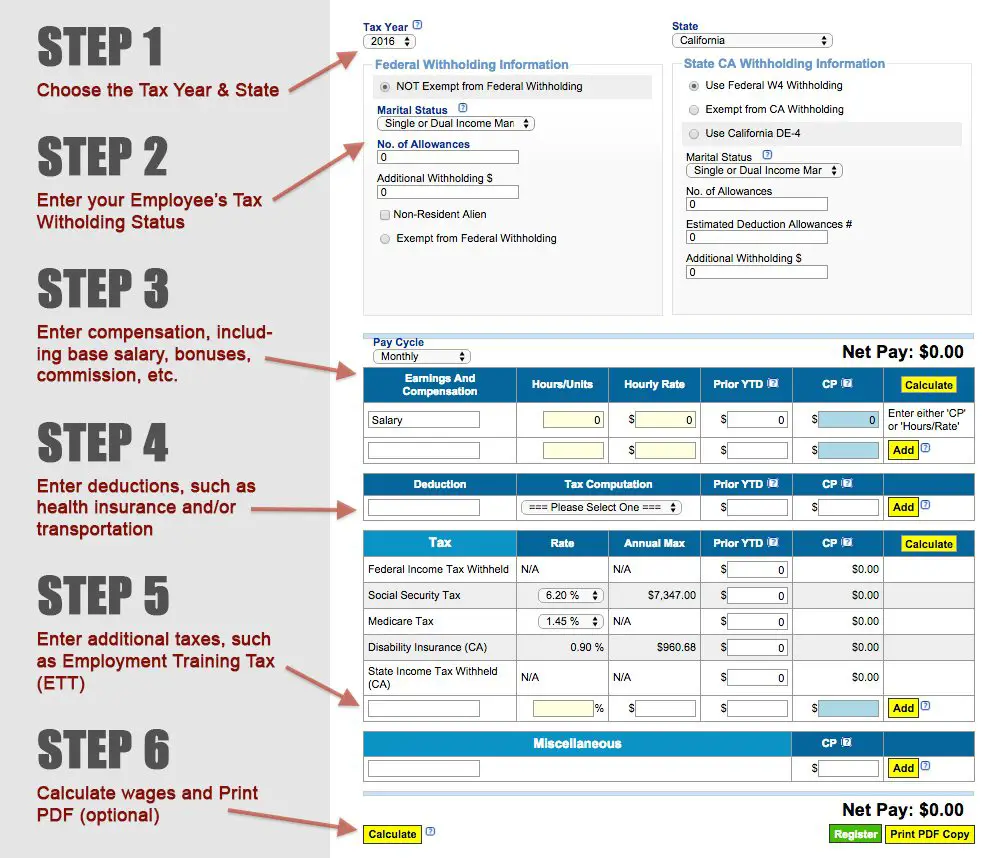

Before You Calculate Fica Tax Withholding

To calculate FICA taxes from an employee’s paycheck, you will need to know:

- The amount of gross pay for the employee for that pay period

- The total year-to-date gross pay for that employee

- The Social Security and Medicare withholding rates for that year

- Any amounts deducted from that employee’s pay for pre-tax retirement plans.

Employee pay subject to Social Security and Medicare taxes may be different from gross pay. This article on Social Security wages explains what’s included and what’s not.

In addition, you will need to know, for each year:

The Social Security Maximum. This is the maximum wages or salary amount for Social Security withholding for that year. Each year the Social Security Administration publishes a maximum Social Security amount no Social Security withholding is taken from employee pay above this amount. Go to this article on the “Social Security Maximum” to find this year’s maximum withholding amount.

The Additional Medicare Tax. The pay amount at which additional Medicare taxes must be withheld from higher-paid employees. The pay amount is different depending on the individual’s tax status At the specified level for the year, an additional 0.9% must be withheld from the employee’s pay for the remainder of the year. You must begin deducting the additional 0.9% when the employee’s wages reach $200,000 for the year, no matter what the employee’s marital status is.

Recommended Reading: Is Obamacare Medicaid Or Medicare

Social Security Tax Limit For 2017 Is $788640

One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes. Once you hit that limit, you will no longer be taxed for Social Security in 2017.

Related blog post: How are Payroll Taxes Calculated? Federal Income Tax Withholding

The Cares Act Of 2020

On March 27, 2020, former President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19-related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

The CARES Act changes to Medicare will likely continue until the pandemic ends.

Don’t Miss: How To Sign Up For Medicare Part B Online

How Will Changing Employers Affect My Limit

In general, when you change employers, your prior Social Security wages will not be considered with your new employer. You will start all over again for Social Security limits. This is because employers match Social Security taxes , and your new employer is expected to match up to $7,886.40 in taxes. While you may have Social Security taxes taken in excess of your limit, you can claim a refund of Social Security taxes paid over $7,886.40 in 2017 on your personal income tax return.

How To Determine Gross Pay

For salaried employees, start with the person’s annual amount divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees if no overtime is included for that pay period:

A salaried employee is paid an annual salary. Let’s say the annual salary is $30,000. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

Then include any overtime pay. Next, you will need to calculate overtime for hourly workers and some salaried workers. Overtime pay must be added to regular pay to get gross pay.

Read Also: Does Medicare Cover Chronic Pain Management

Do Medicare Advantage Premiums Come Out Of My Social Security Check

About half of Medicare Advantage plans have $0 premiums, but if you do have a premium, you can deduct it right from your Social Security check. This is your choice, as it is not required to come from the Social Security check.

Please note: If you choose a Medicare Advantage plan, you still must pay the Medicare Part B premium. So, youd have two premiums coming out of your Social Security check.

Read More: 10 Things Medicare Advantage Plans May Cover That Original Medicare Doesnât

Who Is Eligible For Social Security Retirement Benefits

As mentioned, youll need to meet a few requirements to be eligible for Social Security retirement benefits. Just like with Medicare, youll need to be a United States citizen or permanent resident. You might also need to have worked and earned credits. The amount of credits you need depends on your circumstances and the type of benefit youre applying for.

Youll need at least 40 credits in order to apply for retirement benefits. Since you can earn up to four credits a year, youll earn 40 credits after 10 years of work. This rule applies to anyone born after 1929.

The amount youll receive per month will depend on your income throughout your working life. You can use the calculator on the Social Security website to estimate your retirement benefits.

Don’t Miss: How To Avoid Medicare Part D Penalty

Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $142,800 is subject to the Social Security tax for 2021. Since $142,800 divided by $6,885 is 20.7, this threshold is reached after the 21st paycheck.

For the first 20 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining four pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,537.40 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employees take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,074.80 to Social Security and $4,791.96 to Medicare.

Fica Taxes: The Basics

Every payday, a portion of your check is withheld by your employer. That money goes to the government in the form of payroll taxes. There are several different types of payroll taxes, including unemployment taxes, income taxes and FICA taxes. Two types of taxes fall under the category of FICA taxes: Medicare taxes and Social Security taxes.

Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act of 1935. The funds are used to pay for both Social Security and Medicare.

If you own a business, youre responsible for paying Social Security and Medicare taxes, too. For self-employed workers, theyre referred to as SECA taxes based on regulations included in the Self-Employed Contributions Act.

You May Like: How Does Medicare Supplement Plan G Work

Additional 09% Medicare Tax On Earned Income

Editor: Albert B. Ellentuck, Esq.

Under the 2010 Patient Protection and Affordable Care Act, P.L. 111-148, beginning in 2013, individuals must pay an additional 0.9% Medicare tax on earned income above certain thresholds. This tax applies to both wage income and self-employment income. The IRS has issued proposed regulations regarding the additional 0.9% Medicare tax that can be relied on until final regulations are published. It has also issued a set of frequently asked questions that are not authoritative guidance but do provide insight into how the IRS plans to administer the new tax.