Can I Apply For Medicare At Age 62 Or Do I Have To Be 65

Although you may be able to begin withdrawing Social Security benefits for retirement at age 62, Medicare isn’t available to most people until they turn 65. But if you are under the age of 65, you could be eligible for Medicare if you meet any of the following criteria.

- You have been receiving Social Security disability benefits for at least 24 months.

- You receive a disability pension from the Railroad Retirement Board and meet certain criteria.

- You have Lou Gehrigs disease .

- You have ESRD requiring regular dialysis or a kidney transplant, and you or your spouse has paid Social Security taxes for a length of time that depends on your age.

If none of these situations apply to you, you’ll have to wait until age 65 to begin receiving your Medicare benefits. However, you can begin the sign-up process three months before the month you turn 65 during your IEP .

In General It’s 65 But You Might Be Eligible Sooner

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

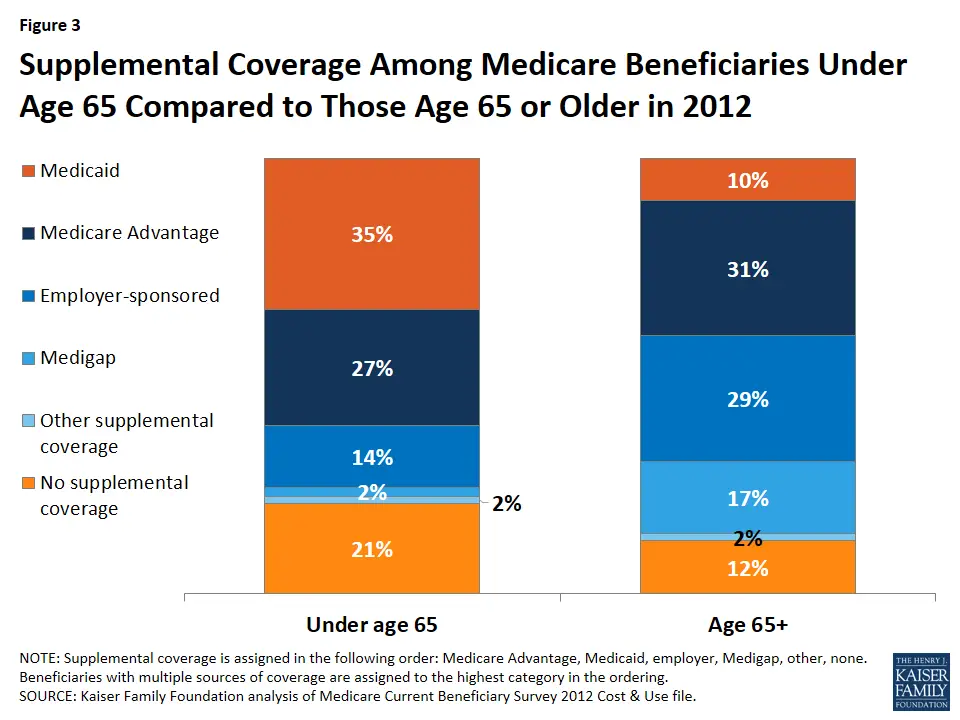

When you think of Medicare, you probably assume that its for people of retirement age. Thats true, but the program covers more than just those who have worked all their life. You might be eligible right now and not know it. Our research has found that while more than 80% of beneficiaries are people aged 65 or older, others receive services at a younger age due to a qualifying disability.

What Are The Differences Between Medicare And Medicaid

Medicare is a federal health insurance program open to Americans aged 65 and older, and those with specific disabilities who are under the age of 65. Medicaid, a combined state and federal program, is a state-specific health insurance program for low-income individuals with limited financial means, regardless of their age.

Medicare, generally speaking, offers the same benefits to all eligible participants. However, coverage is divided into Medicare Part A, Part B, and Part D. Medicare Part A is for hospice care, skilled nursing facility care, and inpatient hospital care. Medicare Part B is for outpatient care, durable medical equipment, and home health care. Part D is for prescription coverage. Not all persons will elect to have coverage in all three areas. In addition, some persons choose to get their Medicare benefits via Medicare Advantage plans, also called Medicare Part C. These plans are available via private insurance companies and include the same benefits as Medicare Part A and Part B, as well as some additional ones, such as dental, vision, and hearing. Many Medicare Advantage plans also include Medicare Part D.

Medicaid is more comprehensive in its coverage, but the benefits are specific to the age group. Children have different eligibility requirements and receive different benefits from low-income adults and from elderly or disabled persons.

Helpful Resources

Recommended Reading: What Is The Difference Between Medicare Advantage And Regular Medicare

Reaching Age 62 Can Affect Your Spouse’s Medicare Premiums

Although reaching age 62 does not qualify you for Medicare, it can carry some significance for your spouse if they receive Medicare benefits.

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they havent yet qualified based on their own work history.

- For example, Gerald is 65 years old, but he doesnt qualify for premium-free Part A because he did not work the minimum number of years required for eligibility. He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

- Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

In the above example, Jessica has not become eligible for Medicare by turning 62. Her husband Gerald, however, is now eligible to receive his Medicare Part A benefits without paying a monthly premium any longer.

How Do I Get Full Medicare Benefits

If youve worked at least 10 years while paying Medicare taxes, there is no monthly premium for your Medicare Part A benefits. But if you havent worked, or worked less than 10 years, you may qualify for premium-free Part A when your spouse turns 62, if she or he has worked at least 10 years while paying Medicare taxes. However, to be eligible for Medicare, you need to be 65 years old. You also need to be an American citizen or legal permanent resident of at least five continuous years.

So, to summarize with an example:

- Bob is 65 years old. Hes on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

Also Check: Is Unitedhealthcare Dual Complete A Medicare Plan

Your First Chance To Sign Up

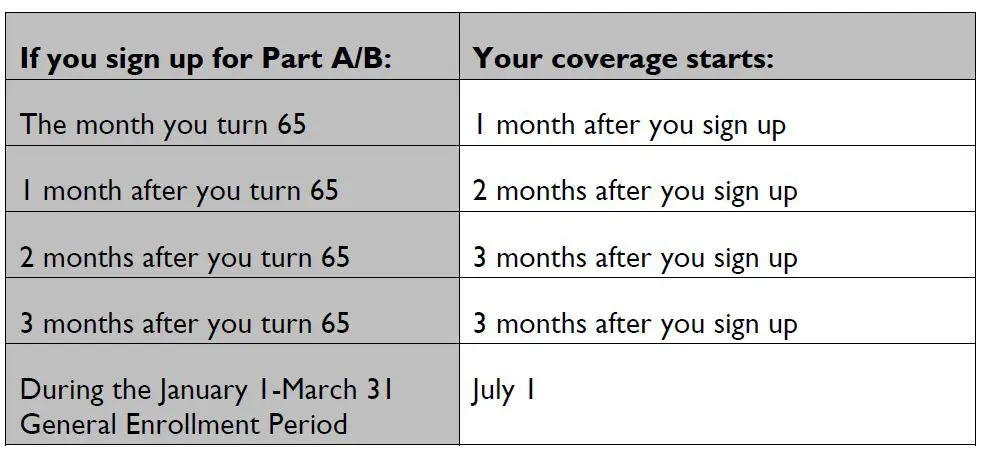

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Medicare Vs Medicaid Compare Benefits

In the context of long term care for the elderly, Medicares benefits are very limited. Medicare does not pay for personal care . Medicare will pay for a very limited number of days of skilled nursing . Medicare will also pay for some home health care, provided it is medical in nature. Starting in 2019, some Medicare Advantage plans started offering long term care benefits. These services and supports are plan specific. But they may include:

- Adult day care

Read Also: How To Apply For Medicare Insurance

Will I Get Medicare At 62 If I Retire Then

If you retire before the age of 65, you may be able to continue to get medical insurance coverage through your employer, or you can purchase coverage from a private insurance company until you turn 65. While waiting for Medicare enrollment eligibility, you may contact your State Health Insurance Assistance Program to discuss your options.

Here are other ways you may be eligible for Medicare at age 62:

- Or, you have been diagnosed with End-Stage Renal Disease

- You may qualify for Medicare due to a disability if you have been receiving SSDI checks for more than 24 months

- Are getting dialysis treatments or have had a kidney transplant

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Medicare For Individuals Who Are Divorced Or Widowed

Many individuals who are divorced or widowed are concerned that the loss of their spouse will somehow affect their ability to qualify for Original Medicare .

Rest assured your marital status does not affect your ability to qualify for Medicare. You are eligible for Medicare if:

- You are a U.S citizen or legal resident for at least 5 consecutive years and

- You are:

- Age 65 or older or

- Younger than 65 with a qualifying disability or

- Any age if you have end-stage renal disease or amyotrophic lateral sclerosis .

Also Check: Does Medicare Cover Laser Surgery

Medicare Part D Prescription Drug Coverage Eligibility

Like Medicare Advantage and Medicare Supplement, Part D prescription drug coverage is provided by Medicare-approved private insurance companies. These plans accompany Original Medicare. Generally, you cant have a standalone Part D plan if you have a Medicare Advantage plan.

To qualify for a Part D plan, you must meet the following requirements:

- You must have both Part A and B .

- You must live where plans are available.

- You must pay Part A, Part B, and Part D premiums, if applicable.

Full Retirement Age By Year

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

An easy way to think about full benefits and retirement age is this,

- Social Security will reduce your payments if you choose to receive your benefit before full retirement age. The percentage of reduced amount is highest at age 62 and decreases until you reach full retirement age.

- If you choose to receive Social Security payments when you reach full retirement, you will get the total amount.

- Suppose you choose not to receive Social Security payments when you reach full retirement and delay your benefit. In that case, you can increase the amount of your payment by earning delayed retirement credits.

If youre not sure when you reach full retirement age, our table provides the years and months you need to know for full retirement.

| The Year You Were Born | Age You Reach Full Retirement |

|---|---|

| Full Retirement Age 1954 |

If youre looking for the governments Medicare site, please navigate to www.medicare.gov.

Read Also: How Many Parts Medicare Has

Get Answers To Your Medicare Questions And Enroll In A Plan

If you have further questions about Medicare eligibility, contact a licensed insurance agent today. A licensed agent can help answer your questions and help you compare Medicare Advantage plans that are available where you live.

Compare Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

What If You Still Work

You can work and receive Medicare disability benefits for a transition period under Social Security’s work incentives and Ticket to Work programs.

There are three timeframes to understand. The first, the trial work period, is a nine-month period during which you can test your ability to work and still receive full benefits. The nine months don’t have to be consecutive. The trial period continues until you have worked for nine months within a 60-month period.

Once those nine months are used up, you move into the next time framethe extended period of eligibility. For the next 36 months, you can still receive benefits in any month you aren’t earning “substantial gainful activity.”

Finally, you can still receive free Medicare Part A benefits and pay the premium for Part B for at least 93 months after the nine-month trial periodif you still qualify as disabled. If you want to continue receiving Part B benefits, you have to request them in writing.

If you’re disabled, you may incur extra expenses that those without disabilities do not. Expenses such as paid transportation to work, mental health counseling, prescription drugs, and other qualified expenses might be deducted from your monthly income before the determination of benefits, which mayallow you to earn more and still qualify for benefits.

Recommended Reading: Does Medicare Cover Cosmetic Surgery

At What Age Does Medicare Start

- Asked May 3, 2013 in

Contact Bob Vineyard Contact Bob Vineyard by filling out the form below

Bob VineyardPROFounder, Georgia Medicare Plans, Atlanta,GAFor most people, Medicare starts when you turn age 65. It can start earlier if you are disabled under Social Security definitions and are receiving SSDI.It can also begin before age 65 if you have ALS or ESRD .Your Medicare Part B can begin later if you are covered under a group health insurance plan.Answered on May 3, 2013+2

Contact Bill Loughead Contact Bill Loughead by filling out the form below

Bill LougheadPROPresident, SummitMedigap.com, CO, FL, GA, MI, NC, SC & TXFor most people, Medicare starts the 1st day of the month you turn age 65. You can sign up for Medicare Part A & B which covers about 80% of the costs of care. You can also sign up for a Medicare Supplement plan to cover the difference. Medicare along with a Medicare Supplement is great health insurance. In addition, you can get a Medicare Part D plan to cover your prescription needs.Answered on May 26, 2014+2

How Much Does Medicare Cost At Age 65

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsurance. Known as hospital insurance, Part A doesnt require a monthly premium as long as you have paid Medicare taxes through employment for at least 10 years.

Part B, known as medical insurance, typically pays 80% of the covered cost while you pay the deductible and then 20%.

You May Like: Does Medicare Cover You When Out Of The Country

What Happens If You Dont Sign Up For Medicare

Its always your choice whether you sign up for Medicare, but you should understand the consequences of not signing up for this health insurance, including:

- Youll pay the full amount for all medical care unless you have private health insurance

- You may face delays getting Medicare coverage in future

- Youll face penalties if you change your mind and sign up for Medicare later

Automatic enrollment for Social Security beneficiaries makes getting Medicare easy. While you always have a choice about which Medicare plans you keep, consider their benefits now and in the future before making any decisions about your insurance-based coverage.

Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelors degree in science from the University of Leeds and a masters degree in public health from the University of Manchester. Her work has appeared in Netdoctor, Medical News Today, Healthline, Business Insider, Cosmopolitan, Yahoo, Harper’s Bazaar, Men’s Health and more.

When shes not typing madly, Zia enjoys traveling and chasing after her dogs.

Medicare Eligibility Due To Specific Illnesses

In addition to the above ways to qualify for Medicare health insurance, you may also be eligible if you have one of the following diseases:

- End-stage renal disease. To qualify, you must need regular dialysis or a kidney transplant, and your coverage can begin shortly after your first dialysis treatment. If you receive a transplant and no longer require dialysis, youll lose Medicare eligibility.

- Amyotrophic lateral sclerosis. Also known as Lou Gehrigs Disease, patients diagnosed with this terminal disease gain immediate Medicare eligibility.

You May Like: Which Medicare Plans Cover Silver Sneakers

Is It Mandatory To Sign Up For Medicare After Age 65

No, it isnt mandatory to join Medicare. People can opt to sign up, or not.

If you don’t qualify for Social Security retirement benefits yet, you may need to manually enroll in Medicare at your local Social Security office, online or over the phone when you turn 65. You can also apply online for your Medicare coverage at www.medicare.gov.

Enrolling in Medicare as soon as youre eligible ensures you get the subsidized health care you deserve without waiting periods or financial penalties.

If you continue to work for a company employing 20 or more people after you turn 65, you could delay your Medicare enrollment. Your employee group plan provides enough medical coverage while youre working, meaning you may be able to wait to sign up for Medicare once you retire without incurring any late penalties.

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Recommended Reading: Where Do I File For Medicare