Medicare Costs And Medicare Supplement

Original Medicare doesn’t pay for everything. When you have a Medigap plan to work with Original Medicare it can help with some of the following costs that you would have to pay on your own:

- About 20% in out-of-pocket expenses not paid by Medicare Part B for doctor and outpatient medical expenses .

- Part A coinsurance, and most plans include a benefit for the Part A deductible

- Hospital coverage up to an additional 365 days after Medicare benefits are used up.

- Part A hospice/respite care coinsurance or copayment.

Are Medicare Plan F Premiums Tax

When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out-of-pocket can also be deducted on your taxes. You would need to itemize these medical expenses, but the tax deductions could provide valuable additional returns. During the itemizing process, you would only be able to deduct expenses that exceed 10% of your adjusted gross income.

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

Read Also: What Is The Best Medicare Part D Plan For 2020

Why You Need A Medigap Plan F Policy

Most people know a little about Medicare Part A and B, often called Original Medicare, but not much about the other options available to them. Medicare Supplement Plan F is also referred to as Medigap Plan F. It is a supplemental policy that you can buy from a private insurance company. It is only available to Original Medicare beneficiaries who want the additional insurance coverage needed to help pay for their share of the costs.

Original Medicare pays for about 80 percent of your major medical costs. A Medigap plan can be used to cover various parts of your 20 percent share . Medicare Supplement Plan F covers all the gaps in Original Medicare.

NOTE: The correct terminology is Medicare Supplement Plan F, not Part F. Here is an easy way to remember. Only Medicare uses Parts . Private insurance companies sell Plans.

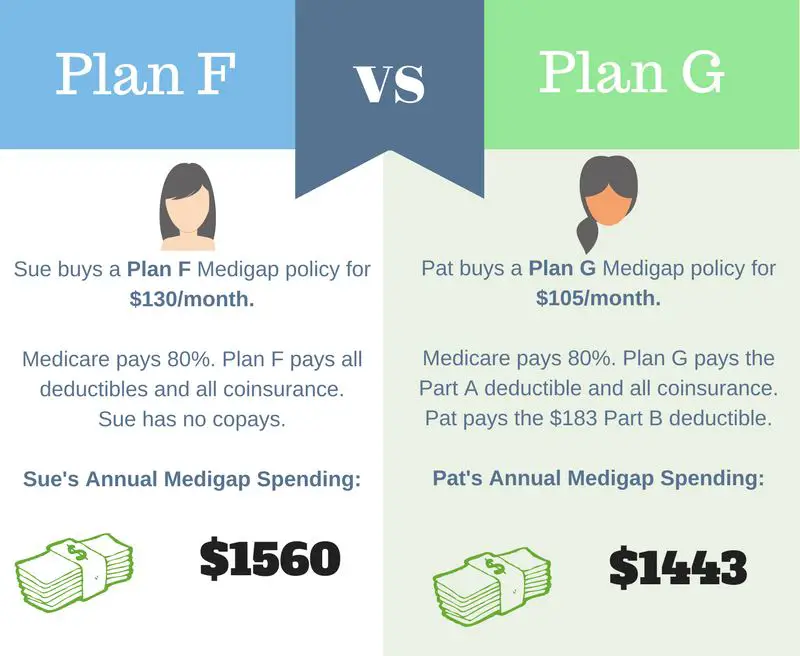

How Do I Decide Between Medicare Supplement Plan F And Plan G

Our clients often ask us for help comparing Medicare Plan F vs. Plan G. We understand it can be a tough decision to make. Well help you compare the plans so that you can feel confident in your choice. First, lets take a look at what benefits the two plans cover.

| Medigap Plan Benefits | ||

|---|---|---|

| Part A coinsurance & hospital costs | Yes | |

| Part B coinsurance or copayment | Yes | |

| Part A hospice care coinsurance | Yes | |

| Skilled nursing facility care coinsurance | Yes | |

| Part B deductible | Yes | |

| Foreign travel emergency | Yes | Yes |

You May Like: Why Is Medicare Advantage Free

How Much Should I Expect To Pay For Medicare Plan F

The following summary reviews Plan F costs across four regions of the United States. Based on cost summaries from Medicares Medigap Find a Plan database, Part F ranges from $97 to $990 per month.

- East Coast : $242$414

- Midwest : $115$946

- South : $97$903

- West Coast : $144$990

Keep in mind this is only a sampling of data. Costs could be higher or lower where you live, depending on your age, gender, and when you first sign up for Medigap.

What Does Plan N Cover

Like all Medicare supplement insurance, this supplement policy covers your Medicare Part A coinsurance and your hospital costs for up to an additional 365 days after Medicare stops paying. The federal government website Medicare.gov also lists the following benefits for Medigap Plan N:

- 100% of your Medicare Part B coinsurance or co-payment, except for a co-payment of up to $20 for certain office visits and up to $50 for emergency room visits that don’t result in inpatient hospital admission.

- The first three pints of blood for a transfusion.

- Part A hospice care coinsurance or co-payment.

- Skilled nursing facility care coinsurance.

- Part A deductible what you must pay out of pocket before your Medicare coverage begins.

- 80% of health emergencies when you travel internationally .

The hospice benefit, offered at varying levels in every Medigap plan, first became available the year Plan N debuted on the market.

Also Check: Who Pays For Part A Medicare

Plan F Coverage For Other Medicare

This plan coverage also includes 80% of approved costs associated with foreign travel emergencies, which is vital for the many seniors who enjoy taking cruises or other trips outside the United States. There are plan limits, but this coverage can help offset charges associated with becoming sick or injured while traveling outside of the U.S.

Plan F also includes Medicare-approved skilled nursing facility coinsurance costs. This coverage is essential as hospitalization can lead to the need to stay for an extended period in a skilled nursing facility for recuperation. Medicare limits this benefit to the first 100 days of a stay in a skilled nursing facility. Because of this, If you need extended coverage beyond 100 days, individuals should consider a long-term care plan.

Compare These Plans Side

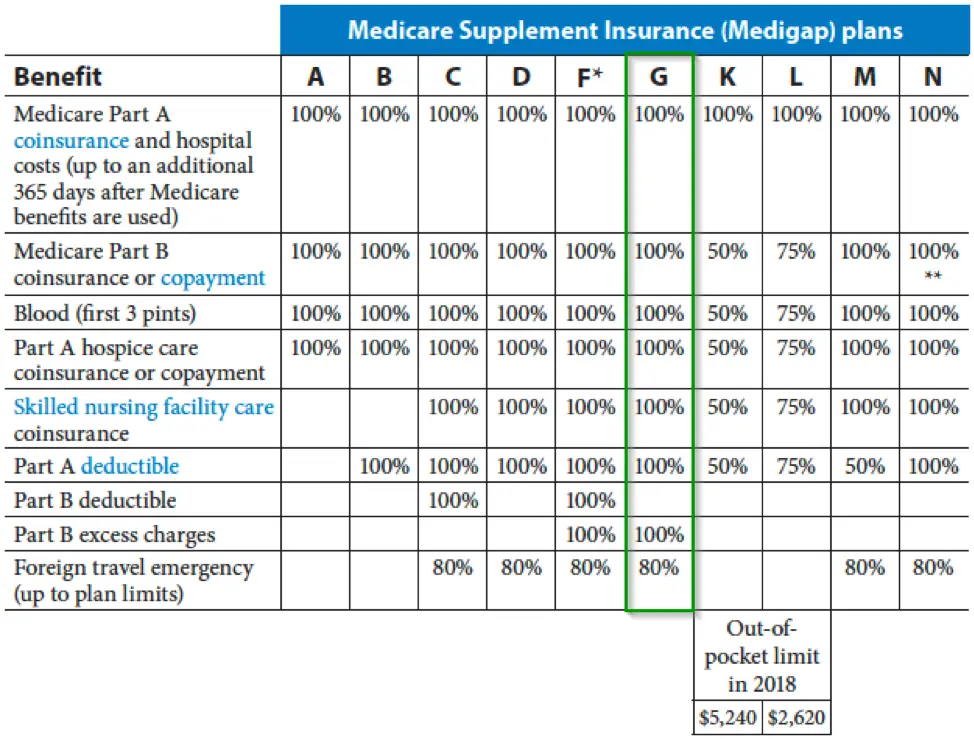

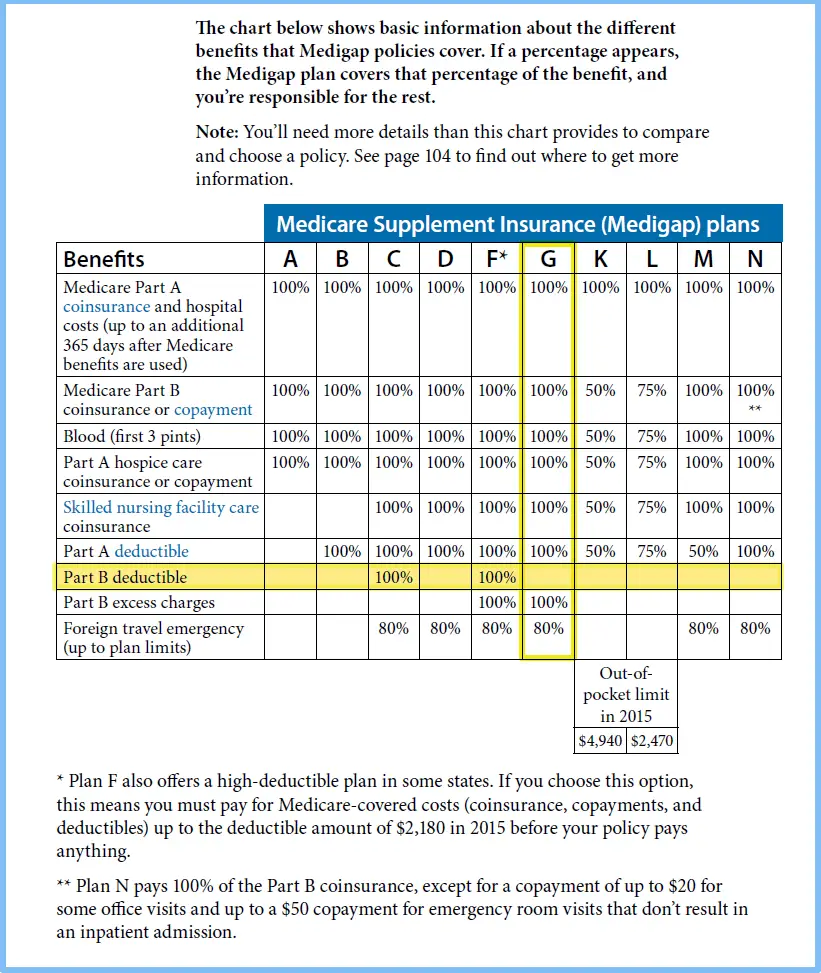

If a “yes” appears, the plan covers the described benefit 100%. If a row lists a percentage, the policy covers that percentage of the described benefit. If a “no” appears, the policy doesn’t cover that benefit.

| Medigap Benefits | ||

|---|---|---|

| Part A: inpatient hospital deductible | No | |

| Part A: skilled nursing facility coinsurance | Yes | Yes |

| Part B: deductible** | ||

| Coverage while in a foreign country | No | |

| State-mandated benefits | Yes |

* The plan pays 100% after you spend $1,000 in out-of-pocket costs for a calendar year.

**Coverage of the Part B deductible will no longer be available to people who are new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to get this benefit

You May Like: What Income Is Used To Calculate Medicare Premiums

How Much Does Medicare Plan F Cost

Costs vary from person to person. The price of a Medicare Plan F policy is determined based on your age, location, gender, and use of tobacco. National averages are around $300 per month, but in many areas, rates start as low as $125 per month. For the high deductible version, you may pay as little as $68. Health insurance companies will be able to help you determine eligibility and costs for the different Medigap policies.

IMPORTANT: Many people try to compare the cost of Medicare supplement insurance plans with a Medicare Advantage plan . The two types of insurance are as different as apples and oranges. With a Medigap plan, you pay for most of your medical services in advance through your monthly premiumsA premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. …. With a Part C plan, you pay most of your costs through copays and coinsurance when you use healthcare services. Both offer comprehensive coverage, but a Medicare supplement gives you peace of mind and helps you plan for your healthcare expenses. If you still have questions about how these plans differ, your insurance agent can walk you through the costs and covered services.

Medicare Supplement Plan G Coverage

Like other plans, Plan G fills in the gaps that Original Medicare leaves uncovered. Plan G covers everything listed on the benefits chart, with the exception of the Part B deductible. With Plan G, youll only be responsible for the annual Part B deductible of $203 outside your monthly premium. Whether you visit your doctor, the hospital, or a specialist, you wont have to worry about getting hit with an unexpected medical bill.

Plan G covers:

- Foreign travel emergency costs

- Part B excess charges

For a full summary of what Plan G covers in contrast to other plans, see the chart below.

You May Like: How Much Does Medicare Cover For Home Health Care

Why Get Medicare Supplement Insurance

Original Medicare includes Part A for hospitalization and Part B for regular medical insurance. Youre eligible to enroll in both Part A and Part B starting three months before your 65th birthday. But even if you sign up for Original Medicare, this federal health insurance program doesnt cover all medical expenses.

With Original Medicare, youre still responsible for copayments, deductibles, and coinsurance. And depending on how often you see a doctor or receive inpatient hospital care, your out-of-pocket costs can skyrocket. This is where a Medicare Supplement insurance plan, also called Medigap, can help.

Medigap plans cover costs that Original Medicare doesnt. In 47 states, most people can choose from up to 10 Medicare Supplement insurance plans.

The Cares Act Of 2020

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increased flexibility for Medicare to cover telehealth services.

- Increased Medicare payments for COVID-19-related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarified that non-expansion states can use the Medicaid program to cover COVID-19-related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Do not pay a Medicare broker directly for their assistance. They are paid by the insurance company to sell their insurance. If you suspect Medicare Advantage fraud, please call the Medicare Drug Integrity Contractor at 1-877-772-3379.

Also Check: When Can I Change My Medicare Prescription Drug Plan

Do All Medicare Supplement Insurance Plans Pay The Same

The cost of a Medicare Supplement Insurance plan can vary from one carrier or location to the next.

However, the standardized benefits that each type of Medigap plan covers stays the same, no matter where you live or who your plan carrier may be .

That means the benefits of Ohio Medigap Plan A will be exactly the same as Texas Medigap Plan A.

The 9 standardized benefits that may be offered by a Medicare Supplement Insurance plan include the following:

Why Should I Enroll In A High

High-deductible Plan F policies usually have lower premiums than standard Plan F policies. As a result, if you need or want to keep your monthly payments to a minimum, this might be your best option as far as Medicare Supplement policies are concerned.

Just know that youll have to deal with higher out-of-pocket costs if you get sick or otherwise need medical care. Given that, people who are fairly healthy are the best candidates for high-deductible Medigap Plan F coverage.

Recommended Reading: Do You Have To Take Medicare

What Does Medicare Supplement Plan G Cover

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible. However, the premiums for Plan G tend to be considerably less than that of Plan F. Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option.

Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F. This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

Consider Talking To A Broker Or Consultant

A Medicare broker or independent consultant can be an excellent resource. Not only is a broker’s service completely free to you, but they must follow very specific rules, so they are prohibited from selling you on a plan you haven’t specifically asked to hear about. Brokers have a wealth of knowledgeand in some cases, better access to plans and programsso they may be able to get you a better price.

Don’t Miss: Why Is My First Medicare Bill So High

Medigap Plan K And Plan L Have Annual Out

Plan K and Plan L each have an annual out-of-pocket spending limit.

Once you reach this limit within a calendar year, the plan will pay 100 percent of the costs for your covered Medicare services for the remainder of the year.

The Plan K out-of-pocket maximum is $6,620 in 2022. The 2022 Plan L out-of-pocket spending limit is $3,310.

When Should You Enroll In A Medigap Policy

The best time to purchase your Medicare Supplement plan is during the Medigap Open Enrollment Period, the six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B. During those six months, private insurers cannot deny you an available policy for any reason, and you have more options and lower pricing. You may also have other options for purchasing a Medigap policy later, depending on your situation. For example, a canceled policy, a loss of insurance, an insurance carrier bankruptcy, and other circumstances may qualify.

But outside of open enrollment, insurers can use medical underwriting things like your age, gender, area of the country, and previous health conditions when deciding to sell a policy. That means you may be denied a policy or have to wait for preexisting condition coverage, often for six months after your policy is in effect, pay higher premiums, or have fewer options than when enrolling during the open enrollment period.5

Your state may have additional rules regarding open enrollment so check to be sure.

Recommended Reading: Does Medicare Pay For Private Duty Nursing

The Best Medicare Plan For You: Plan F +rx

The recommended plan is the best fit based on a few questions. There are other personal circumstances that may change this recommendation, including receiving employer sponsored retiree benefits or having specific medical circumstances to consider. Please note that CMS will impose a penalty if you do not have prescription drug coverage . We strongly encourage you review all options with an agent before applying.

What Does Medicare Plan F Cover

Youll need to investigate the different Medigap plans to determine the right one for you. The comparison chart below will help.

Medicare Plan F provides the same healthcare coverage from state to state. In general, you can use it to cover the copayment for all medical costs and even the Medicare Part B deductible.

Another benefit covered by Plan F is Medicare Part B Excess ChargesA Medicare Part B excess charge is the difference between a health care providers actual charge and Medicares approved amount for payment….. These occur when your doctor or specialist does not accept the standard Medicare payment for a service. Medicare allows healthcare providers that do not accept Medicare assignmentAn agreement by your doctor to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance…. to charge up to 15 percent more. Without Plan F, you will pay these costs out-of-pocket.

Plan F also covers your big costs if you are admitted as an inpatient in the hospital or a skilled nursing facility. Your Medicare benefits cover these costs under Part A, but most people are taken by surprise when they see the per-benefit-period deductible. Plan F is one of these insurance plans that protect enrollees from these high out-of-pocket expenses.

Heres a side-by-side Medigap comparison chart:

Also Check: How To Order Another Medicare Card

Does It Matter Which Company I Select

Medicare Supplement plans are completely standardized, so the benefits will be the same from company to company. All Medicare Supplement plans, including Plan G, are standardized in the following ways:

- Benefits You dont have to worry about which company offers the best or most benefits. The benefits of a Plan G will be the same regardless of the company you select.

- Doctors Network Medicare Supplement insurance companies dont have their own doctors networks. Their plans are only supplements to your primary Medicare Parts A & B coverage. Your network is the nationwide Medicare network, so, you dont have to worry about whether one company has a better doctors network than another.

- Claims-Paying Process The Medicare Supplement claims process is highly automated. It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicares instructions. Due to the automation and standardization in this area, every company is equal in its claims-paying history.

To make it simple, Medicare is your primary coverage. The plans that each Medicare Supplement insurance carrier offers are identical from company to company, because they are standardized by the government.

Which Of These Medicare Supplement Plans Is Right For Me

Medicare Supplement Plan F has the most comprehensive benefits of the three your out-of-pocket Medicare costs with this plan are generally minimal. However, Plan F premiums may also be higher compared to Medicare Supplement Plan G or Plan N. Premiums may vary from one company to the next, even for the same plan.

Medicare Supplement Plan G might be a good choice if youre someone who uses a lot of health-care services each year, but you dont want to pay a high premium. Once you pay your Part B deductible, most of your Medicare out-of-pocket costs may be covered.

Medicare Supplement Plan N has fairly comprehensive benefits, as well, and if youre someone who doesnt visit the doctor a lot, your Medicare out-of-pocket costs will be very low. This plan may also have the lowest monthly premium of the three, depending on the insurance company you choose.

Whatever plan you choose, its usually best to buy it during your Medicare Supplement Open Enrollment Period . Your six-month OEP starts the month youre both 65 or older, and enrolled in Medicare Part B. During this time, you can buy any Medicare Supplement plan sold in your state, and you cant be charged more due to your health status. If you wait until after the OEP, you may be charged more or turned down for coverage if you have a health condition.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

You May Like: How Do You Qualify For Medicare Part A And B