The Five Star Special Enrollment Period

Medicare Part D plans, along with Medicare Advantage plans and Medicare Cost plans, are rated on a scale of 1 to 5 stars based on quality and performance. A 5-star rating is the highest. If you want to switch to a 5-star plan, you can do so one time between December 8 and November 30 of the following year.

Does Medicare Cover Insulin

How Medicare covers insulin depends upon the type you use. For example, if you use injectable insulin, Medicare Part D covers the insulin as well as supplies you may need to inject the insulin, such as alcohol swabs and syringes.

However, if you use insulin administered via an insulin pump, Medicare Part B will usually pay for the insulin. Medicare may cover only certain insulin pump types and insulin, so its important to check for covered pump types before purchasing.

When Can I Join Switch Or Drop A Medicare Drug Plan

- When you first become eligible for Medicare, you can join during your Initial Enrollment Period.

- If you get Part B for the first time during the General Enrollment Period, you can also join a Medicare drug plan from April 1 through June 30 and your coverage will start on July 1.

- You can join, switch, or drop a Medicare drug plan between October 15 through December 7 each year and your changes will take effect on January 1 of the following year, as long as the plan gets your request before December 7.

- If you’re enrolled in a Medicare Advantage Plan, you can join, switch, or drop a plan during the Medicare Advantage Open Enrollment Period between January 1 through March 31 each year.

- If you qualify for a Special Enrollment Period.

You May Like: How To Sign Up For Aetna Medicare Advantage

Who Is Eligible For Medicare Part D

If youre wondering whether you are eligible for a Medicare prescription drug plan, this is the criteria you need to meet:

- Be aged 65 years or over

- Have Original Medicare

- Aged younger but have a qualifying disability or condition

- Have end-stage renal disease that requires dialysis or a kidney transplant

If you signed up for Social Security before turning 65, you would have been enrolled in Medicare automatically, though benefits will begin once you turn 65. There can be penalties for not enrolling at age 65, so signing up on time will help you avoid this.

If you have employer sponsored coverage, you might be able to delay Medicare while your EIS is still active. That said, the size of your employer/company will determine whether or not youll pay a penalty for not enrolling by age 65. We suggest looking into this in advance of your 65th birthday to avoid paying a possible penalty.

Top 5 Rated Medicare Prescription Drug Plans For 2022

Home / FAQs / Medicare Part D/ Top 5 Part D Plans

When choosing Part D coverage, its important to know which is the best Medicare prescription drug plan for 2022. Also, by knowing what to expect, you can stay ahead of the game.

Drugs can be costly, and new brand-name drugs can be the most expensive. With age, youre more likely to require medications.

Medicares standalone Part D plan can cover you. Part D plans have a monthly premium that insurance companies determine.

There may be several plans as well as companies to choose from in your state. Policies vary by county, so moving may warrant a plan change.

Read Also: Is Unitedhealthcare Dual Complete A Medicare Plan

Are You Eligible For A Part D Special Enrollment Period

Aside from the two main enrollment periods, certain circumstances may entitle you to a special enrollment period when you can change your Part D plan. These circumstances include:

- If You Move to an Area Where Your Current Part D Plan Isnt Available If you notify your current plan before you move, your SEP begins the month before you move and ends two full months after you move. If you notify the plan after you move, your SEP begins the month you notify your plan and ends a full two months after that notification.

- If You Move to a New Area Where Your Current Plan Is Still Available But Now Have Additional Part D Options That You Didnt Have Before Your SEP period will remain the same if you move to an area where your current plan isnt available.

- If You Currently Live in a Skilled Nursing or Long-Term Care Facility, or You Move Into or Out of One Your special enrollment period lasts as long as you live in the facility and for two full months after you move out.

- If Your Plan Changes Its Contract With Medicare Medicare will determine your special enrollment period on a case-by-case basis.

There are several other circumstances that could qualify you for a special enrollment period. The full list is on Medicare.gov.

Medicare Plans Offering Prescription Coverage

Medicare prescription drug coverage is an optional benefit that is offered to everyone with Medicare. Even if you donât use prescription drugs now, you should consider joining a 2020 Medicare Part-D Plan. If you decide not to join a Medicare drug plan when youâre first eligible, and you donât have other creditable prescription drug coverage or get Extra Help, youâll likely pay a late enrollment penalty if you join a plan later. Generally, youâll pay this penalty for as long as you have Medicare Part-D coverage.To get Medicare prescription drug coverage, you must join a plan approved by Medicare that offers additional Medicare drug coverage. Each plan can vary in cost and specific drugs covered.

Select Your State to Browse Plans

| Puerto Rico |

If you are looking for extra Medicare coverage in 2020 you can use this guide to help compare Medicare Advantage plan and premium information for Medicare plans offering part D coverage. Previous Medicare enrolled seniors cant start signing up until October 15 2018. Open enrollment runs through December 7 2019.

Read Also: How Much Is Premium For Medicare

D Spending And Financing

Part D Spending

The Congressional Budget Office estimates that spending on Part D benefits will total $111 billion in 2022, representing 15% of net Medicare outlays . Part D spending depends on several factors, including the total number of Part D enrollees, their health status and drug use, the number of high-cost enrollees , the number of enrollees receiving the Low-Income Subsidy, and plansâ ability to negotiate discounts with drug companies and preferred pricing arrangements with pharmacies, and manage use . Federal law currently prohibits the Secretary of Health and Human Services from interfering in drug price negotiations between Part D plan sponsors and drug manufacturers.

Part D Financing

Financing for Part D comes from general revenues , beneficiary premiums , and state contributions . The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments. Higher-income Part D enrollees pay a larger share of standard Part D costs, ranging from 35% to 85%, depending on income.

Payments to Plans

When Is The Medicare Part D Plan Annual Election Period

If you missed your IEP, or if you have a Part D Plan and want to change it, mark the Annual Election Period on your calendar. Commonly called the Medicare Open Enrollment, AEP is the time of year when all Medicare beneficiaries can join, drop, or switch plans.

AEP is the same time each year. It starts on 15 October and ends promptly on 7 December. Be aware that coverage does not start immediately. Regardless of the day you join, your coverage begins on 1 January and continues for the entire year.

There are some rare cases where you may be eligible to enroll during a Special Enrollment Period . If you are eligible for a SEP, Medicare will send information to you in the mail with details and instructions.

There is one additional enrollment period that may apply to you. Each year from 1 January through 14 February 14, anyone enrolled in Medicare Advantage Plans with prescription drug coverage , Part A, and Part B benefits in one plan…. plan) can join a Part D plan if they first cancel their MA-PD and return to Original Medicare. This is the Medicare Advantage Disenrollment Period.

Recommended Reading: Which Insulin Pumps Are Covered By Medicare

Tips For Choosing Medicare Drug Coverage

If youre wondering how to choose a Medicare drug plan that works for you, the best way is to start by looking at your priorities. See if any of these apply to you:

- I take specific drugs.

-

Look at drug plans that include your prescription drugs on their

formulary

. Then, compare costs.

- I want extra protection from high prescription drug costs.

-

Look at drug plans offering coverage in the

coverage gap

, and then check with those plans to make sure they cover your drugs in the gap.

- I want my drug expenses to be balanced throughout the year.

-

Look at drug plans with no or a low

deductible

, or with additional coverage in the

coverage gap

- I take a lot of generic prescriptions.

-

Look at Medicare drug plans with

tiers

that charge you nothing or low copayments for generic prescriptions.

- I don’t have many drug costs now, but I want coverage for peace of mind and to avoid future penalties.

-

Look at Medicare drug plans with a low monthly

premium

for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

- I like the extra benefits and lower costs available by getting my health care and prescription drug coverage from one plan, and Im willing to pick a drug plan with restrictions on what doctors, hospitals, and other health care providers I can use.

-

Look for a

Unitedhealthcare Medicare Part D Plans

The three options available with UnitedHealthcare include the Walgreens plan, Preferred, and Saver Plus plans. Those looking for a lower premium option with UHC need to look into the Walgreens policy.

But, those that have an extensive list of medications should consider a more comprehensive policy like the Saver Plus.

United Healthcare Preferred Pharmacy

The Walgreens policy is the pharmacy that is the most cost-efficient. But, mail-order is generally the best pharmacy to use if youre trying to save the most money.

With the Saver Plus, you can go to Publix, Walmart, or Walgreens. There are network pharmacies that offer you coverage, just at a slightly higher price.

UnitedHealthcare Part D Reviews

UnitedHealthcare has a wide range of insurance products, and theyve been around for a long time. The company does more than Medicare.

You may have UHC through an employer, if not now, maybe at some point. They offer plans throughout the nation, which makes it easy for anyone to sign up with them.

The cost of their plans is generally a bit higher than most others. But, if you have specific drugs that only they cover, this plan could be your best option.

Also Check: How To Get New Medicare Card Without Social Security Number

More Drugs See Restrictions

Plans are able to add restrictions to certain drugs, meaning that there are limits on patients obtaining a drug at the pharmacy counter. A single drug can have multiple restrictions. Specific restrictions include:

- Prior authorization: You must get approval from the plan before they will cover the medication.

- Step therapy: You must try another, less expensive medication before you fill for a more expensive one.

- Quantity limits: The plan limits how much of the medication it will cover in a given time period.

So how have restrictions for Medicare Part D plans changed over time? For the average plan, the share of drugs with any restriction grew from 26% in 2010 to 45% in 2020. The share of drugs with quantity limits and prior authorization restrictions steadily increased over time.

This means that Medicare beneficiaries are being forced to jump through increasingly more hoops to get their medications.

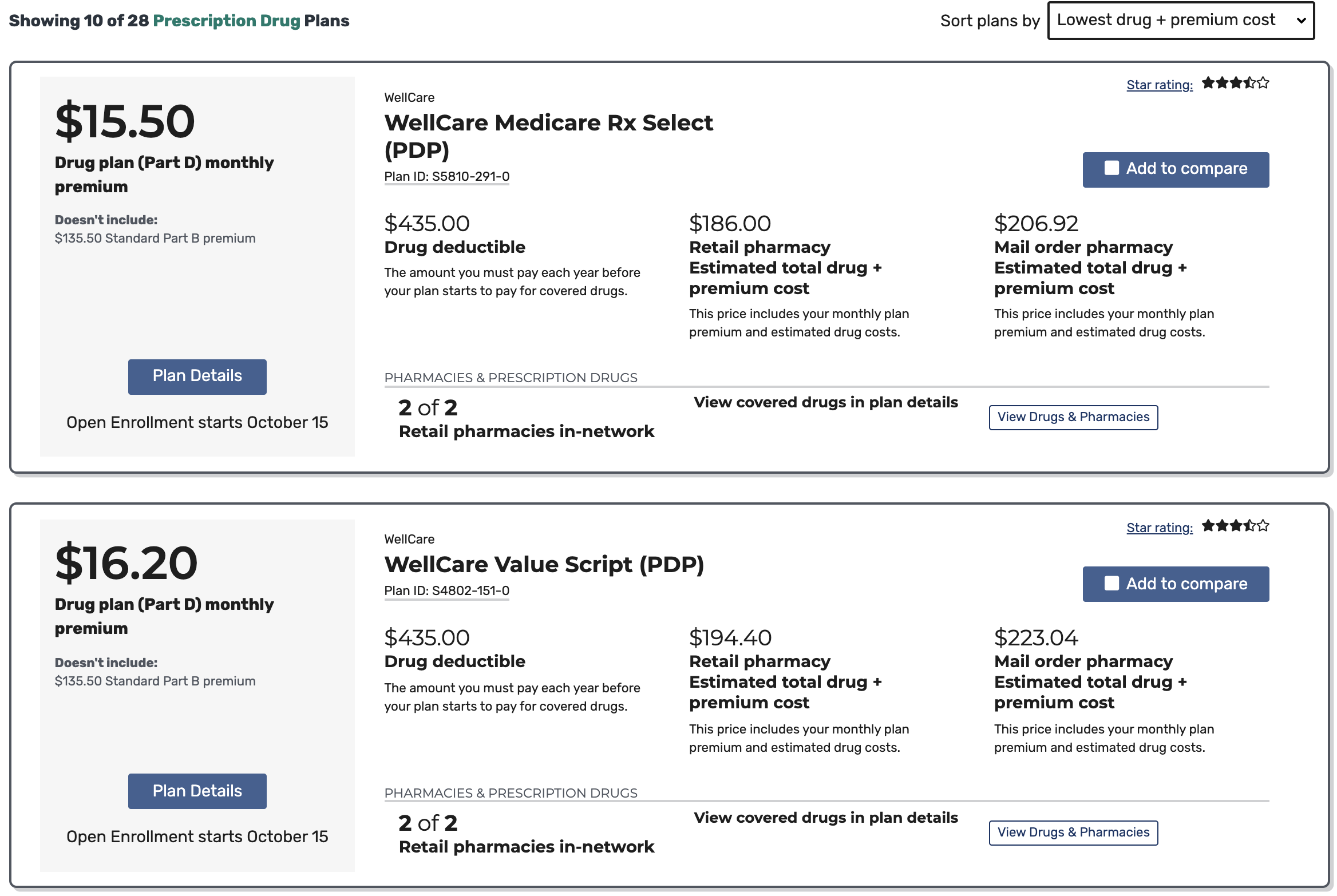

Medicares Part D Benefit Is Complex But Simple Shopping Strategies Can Potentially Save Enrollees Thousands Of Dollars Each Year

Medicare enrollees have from October 15 through December 7 to shop around for a new Part D plan for the following year.

As a Medicare beneficiary, you have a multitude of choices to make. From my experience dealing with frustrated Medicare enrollees, I can tell you that selecting the right prescription drug plan is one of the most important. If you make the right choices, they can save you huge sums of of money and headache, while ensuring you have access to the medications you need.

My family is a perfect example: When I sat down with a great uncle a few years ago to take a look at his Part D coverage, it was very quickly obvious that he was overpaying about $2,000 too much for coverage for prescription drugs he needed. Even with my immediate family, my father had the right drugs covered but was paying too much by hundreds of dollars each year.

My family members are just two examples out of the millions of Americans more than 46 million as of late 2019 who are enrolled in Part D coverage, including those with stand-alone Part D plans and those with Part D coverage integrated with a Medicare Advantage plan about three-quarters of all Medicare beneficiaries have Part D coverage.

You May Like: What Age Is For Medicare

When Should I Get Medicare Part D

Most people join a Medicare Part D Plan during their Initial Enrollment Period . IEP is a 7-month period that occurs when you first become eligible for Medicare. It starts three months before the month of your 65th birthday and ends three months after the month of your 65th birthday.

If you have Medicare due to a disability, your IEP for Medicare Part D starts 3 months before the 25th month of your disability and ends 3 months after your 25th month of disability.

For most people, their IEP is the best time to get Part D coverage. The one exception is if you have “creditable coverage” through an employer’s health plan or retirement benefit. It’s best to call Medicare to make sure the coverage you have is credible.

If you don’t enroll in Part D when you are first eligible, and you don’t have credible coverage, Medicare will assess a late penalty on top of your Part D premium. It’s not a one-time penalty, either. You pay it for as long as you have coverage.

Compare Medicare Part D Plans 2020

Most insurers release new plans and change-of-coverage notices in the fall for the upcoming plan year. The 2020 plans are generally listed in Part D plan finder tools by October, so you should already have access to the most current information for this year when youre ready to shop.

Its helpful to connect with a professional to narrow down your Part D plan options to find the one that works best for your needs. That way youll know youre getting a complete picture of the Medicare plans in your area before you buy.

Also Check: How Do I Get Dental And Vision Coverage With Medicare

How Do I Get Enrolled

You must affirmatively enroll in a Part D plan to participate Its not automatic. If you are eligible and don’t enroll during the open enrollment periodDuring the Medicare Open Enrollment Period, Medicare Advantage and Part D plan members can change, switch, or drop a plan they chose during the Annual Election Period. OEP starts on January 1 and ends on… you will have to pay a late enrollment penalty to use the benefit. The penalty is about 1% of the average premium times the number of months that you were eligible but not enrolled.

Aetna: Cheapest Medicare Part D Plan

If youre on a limited income and youre concerned about deductibles and copays, Aetna might be the right Plan D provider for you. Aetna offers 3 tiers of Part D plans, and plans are available with $0 deductibles so you start saving right away.

Aetnas most affordable plan, Aetna Medicare Rx Select, has an average monthly deductible of just $17. The Rx Select plan also features a $0 deductible for all Tier 1 and 2 drugs, which encompass most generic prescriptions. And Aetna provide assistance if you receive income supplement support.

Recommended Reading: Does Costco Pharmacy Accept Medicare

Yes You Can Switch Plans As Your Needs Change

If your Part D plan isn’t working for you, there’s hope. Each September, plans send out an Annual Notice of Change letter. This letter lets you know about plan changes for the upcoming year, such as cost increases or drugs being added or removed from the plan . Read the Annual Notice of Change letter carefully to see if it makes sense to keep or switch your plan. You can change plans during open enrollment.

When Can You Change Part D Plans

You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want. Your final choice will take effect on January 1.

If you have a Medicare Advantage plan that doesnt include drug coverage and you also have a Part D plan, you can change it during the Medicare Advantage open enrollment period, which runs from January 1 to March 31 each year. If you choose this route, you must do one of the following:

- Change your Medicare Advantage plan to one that includes drug coverage .

- Switch from Medicare Advantage back to Original Medicare, then purchase a standalone Part D plan.

If youre enrolled in a Medicare Advantage plan that you like and want to change only your Part D plan, it is best to wait until the general enrollment period, in the fall.

You May Like: When Can Medicare Plans Be Changed